Zebra Technologies survey reveals expectations for transparency in automotive manufacturing

Study reveals high demand for knowing the origin and sustainability level of materials and automotive parts as well as receiving an end-to-end view of the manufacturing process.

Zebra Technologies Corp. (Lincolnshire, Ill., U.S.), an innovator in digital solutions, hardware and software, has released the findings of its Automotive Ecosystem Vision Study, which confirmed automotive manufacturers are under pressure to accommodate growing consumer demands for sustainability and transparency throughout the manufacturing process, and fleet managers’ need for the digitization of operations and supply chain. Despite a fluctuating economy, automotive manufacturers are ready to invest in technology innovation as seven in 10 expect to increase their tech spend and six in 10 plan to increase their manufacturing infrastructure spend in 2023.

Spanning multiple generations, the study emphasizes consumers as the driving force behind automotive manufacturers’ acceleration to technology innovation — eight in 10 says sustainability and eco-friendliness are key priorities in their vehicle purchase and lease decisions. Moreover, 87% of Millennials prioritize sustainability in their vehicles, followed closely by 78% of Gen Xers and 76% of Baby Boomers.

Consumers are also driving the growing emphasis on personalization — the ability to customize a vehicle to their liking. Nearly four in five consumers say personalization options factor into their decision to purchase a vehicle, and eight in 10 fleet managers share these same requirements for sustainability and personalization. While nearly 80% of automotive industry decision-makers recognize consumers expect more sustainable and personalized vehicle options today, seven in 10 concede it’s difficult to keep up with increasing customization demands. As a result, three-fourths of automotive manufacturers say a top priority is to build strategic partnerships with tech companies for their next generation of production.

“There’s no doubt the automotive manufacturing ecosystem is undergoing a seismic shift with huge hurdles to cross. This includes essentially running two distinct manufacturing processes — one for traditional gasoline/diesel vehicles and the other for next generation electric, hybrid and autonomous self-driving vehicles,” Stephan Pottel, automotive industry lead, Zebra Technologies, says. “The pressure to meet regulations, demands for sustainability as well as do more faster and provide real-time visibility throughout the supply chain is daunting. With the right strategic investments in technology, the automotive industry can meet and even surpass these expectations and better serve their customers.”

The survey results also reveal stronger preference to purchase electric vehicles (EV) in the future with more than half of consumers indicating their future preference is for a hybrid electric vehicle (HEV). However, navigating this increasing demand for EVs comes with challenges, as 68% of automotive industry decision-makers say they are under high pressure to produce next-generation (i.e., electric) vehicles, and 75% of them are under high pressure to deliver products that are more eco-friendly, sustainable and safer for the environment.

Trust and transparency in automotive manufacturing

According to Zebra Technologies, data and information transparency is highly important to consumers and fleet managers alike, and they’re seeking more visibility into the automotive ecosystem. When considering a vehicle for purchase or lease, 81% of consumers and 86% of fleet managers indicate they want to understand the origin and source of materials and parts on their vehicle. Millennials lead the way for more transparency in automotive manufacturing, with eight in 10 saying it’s important to have access to the origin of materials and parts, knowing if source materials and parts are sustainable and understanding how the vehicle is manufactured from end-to-end.

Beyond gaining greater visibility into the automotive manufacturing process, once they have their vehicles, 88% of consumers and 86% of fleet managers want to understand how the data from their vehicles will be used by the automotive ecosystem. After a vehicle purchase, 83% of consumers and 84% of fleet managers expect ownership and control of the data their vehicle generates.

Automotive supply chain visibility

A majority of consumers and fleet managers (80%) want end-to-end visibility during the manufacturing process. However, only about one-third of automotive industry decision-makers say they will prioritize connecting real-time data systems to enable a holistic view of operations and increase visibility across production and throughout the supply chain over the next five years.

About one-third of OEMs said autonomous mobile robots (AMRs), RFID, rugged handheld mobile computers and scanners as well as industrial machine vision will improve supply chain management while about one-third of suppliers cite mobile barcode label/thermal printers, wearable computers and location technology as the technologies to do so.

Overall, seven in 10 automotive industry decision-makers agree digital transformation is a strategic priority for their organization. In the next five years, they anticipate expanding their use of technology across the board with 47% focused on additive manufacturing (AM)/3D printing and 45% on supply chain planning solutions.

Zebra conducted the Automotive Ecosystem Vision Study among a global audience of 1,336 respondents including automotive industry decision-makers — including OEMs and suppliers — fleet managers and consumers. The study aimed to gauge industry views, priorities and expectations the industry faces and the challenges and opportunities resulting from rapid digital transformation. All data was collected and tabulated by third-party research firm Azure Knowledge Corp.

Related Content

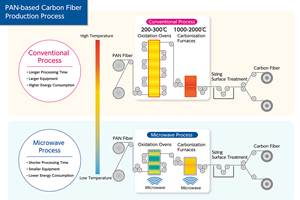

Microwave heating for more sustainable carbon fiber

Skeptics say it won’t work — Osaka-based Microwave Chemical Co. says it already has — and continues to advance its simulation-based technology to slash energy use and emissions in manufacturing.

Read MoreBio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreNatural fiber composites: Growing to fit sustainability needs

Led by global and industry-wide sustainability goals, commercial interest in flax and hemp fiber-reinforced composites grows into higher-performance, higher-volume applications.

Read MoreRead Next

Future Materials Group publishes market update report for advanced materials sector

Half-year review examines the advanced material sector’s response to macroeconomic headwinds, supply chain challenges and geopolitical concerns.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.jpg;maxWidth=300;quality=90)