Share

Read Next

Polyacrylonitrile (PAN), shown here on creels, is produced from acrylonitrile (ACN) and is the most commonly used precursor for carbon fiber manufacturing. ACN is typically sourced from petroleum-based feedstocks, which makes carbon fiber’s carbon footprint relatively large. Evolving to a bio-based ACN would substantially improve ACN’s sustainability profile. Photo Credit (including image in line with title): CW

Carbon fiber composite materials, for all of their virtues — light weight, high strength, durability — have a couple of significant downsides that do not play well in a world that is pivoting quickly to emphasize CO2 footprint, sustainability and decarbonization. One downside is the great deal of energy required which, depending on its source, can produce up to 30 tons of CO2 per ton of carbon fiber manufactured. The second is acrylonitrile, the primary feedstock used to produce the carbon fiber precursor polyacrylonitrile (PAN), which has been traditionally sourced from petroleum-based chemistries.

A vast majority of the energy used in carbon fiber manufacturing is consumed by a series of furnaces and ovens through which the PAN fibers pass as they are oxidized and carbonized to become carbon fibers. (Click here for more on how carbon fiber is made.)

Reducing energy consumption, as would be expected, revolves around sourcing energy from renewable resources, including hydro, solar and wind. This is the relatively low-hanging fruit of carbon fiber decarbonization. There are also technologies aimed at reducing the process time, such as rapid oxidation developed by Deakin University (Geelong, Australia), licensed by LeMond Carbon (Knoxville, Tenn., U.S.) and audited by Bureau Veritas (BV, Paris, France) in 2019, that have demonstrated a 70% reduction in energy required per kilogram of output fiber. However, such technologies have yet to be commercialized.

Reducing the carbon footprint of the precursor is much more challenging and generally follows one of two paths. The first path is to develop a new class of precursor from a non-PAN, bio-based source. Lignin, a cellulose byproduct of papermaking, has been the primary focus of this effort, but to date has not been able to produce carbon fibers with mechanical properties on par with those derived from PAN.

The second path is to develop PAN itself from bio-based sources — that is, a bio-based PAN chemically identical to petroleum-based PAN and thus a potential drop-in replacement in the carbon fiber manufacturing process. From a materials property perspective, this path is preferable for obvious reasons, but the challenge is one of cost. Is it possible for a bio-based PAN to be cost-competitive with petroleum based PAN?

The genesis of bio-based PAN

In 2019, CW reported on a research program at Southern Research (Birmingham, Ala., U.S.), to develop a cost-effective process for the manufacture of ACN from non-food carbohydrates. The program revolved around the use of xylose and glucose (aka C5, C6 sugars) harvested from wood-based biomass and refined via hydrolysis. The process involves passing the sugar feedstock through a series of three catalysts, with each catalyst producing an intermediate material and, in the process, generating a chemical byproduct:

- Hydrocracking (with H2) to produce intermediate glycerol; byproducts are glycols, sorbitol, lower alcohols, water.

- Dehydration to produce intermediate acrolein; byproducts are hydroxyacetone and water.

- Ammoxidation (with air, NH3) to produce ACN; byproducts are acetonitrile and water.

As part of its research with bio-based ACN, Southern Research conducted a life cycle assessment (LCA), comparing biomass-to-ACN manufacture to petroleum-to-ACN manufacture. Results said bio-based ACN manufacture offers a carbon footprint of -1.57 pounds equivalent CO2 per pound of finished product, compared to 3.5 pounds equivalent CO2 per pound of finished product for petroleum-based ACN manufacture. In short, the bio-based feedstock allows for a process that conserves carbon emissions.

Regarding cost, Southern Research’s process is sensitive to the purity of the sugars feedstock, and the higher the feedstock quality, the more expensive it is. When CW last spoke to Southern Research, it was getting ready to commission a small-scale production plant and looking for carbon fiber manufacturers willing to assess the quality of its ACN.

Bio-based ACN goes commercial

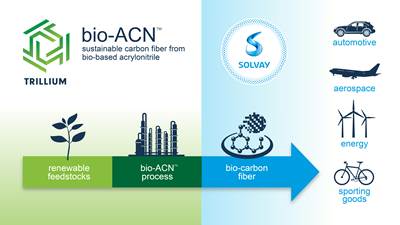

A lot has happened in three years. Notably, the ACN production process Southern Research developed has been licensed by Trillium Renewable Chemicals (Knoxville, Tenn., U.S.), which is commercializing it for production of ACN and acetonitrile.

Corey Tyree, CEO of Trillium, says the company, still in startup mode, completed its seed raise ($3 million) in early 2021 and then constructed a glycerol-to-ACN pilot plant in Charleston, W.V., U.S. This facility applies the core technology — dehydration and ammoxidation — established at Southern Research, with feedstock primarily from plant-based glycerol derived from soybean oil. Tyree notes that Trillium’s process also accepts glycerol from rapeseed oil, which is common in Europe, or palm oil, which is common in Asia.

The pilot plant provided a platform to help Trillium optimize its ACN manufacturing process in anticipation of the company’s next evolutionary step: Construction of a market-scale demonstration plant somewhere in the U.S. This facility, says Tyree, could break ground before the end of 2023 and begin production by mid-2024. Its capacity will be 25 kilograms/week, with funding provided by a $10.6 million Series A financing round in late 2022.

Ultimately, Tyree says, once its ACN manufacturing process is fully derisked, Trillium expects to construct multiple full-scale production plants around the world.

Carbon fiber supply chain interest

Although Trillium’s ACN, marketed as Bio-ACN, can be targeted to a variety of industries and applications, Tyree says customer and market signals will determine the direction the company follows. And so far, the strongest signals are coming from the carbon fiber manufacturing industry.

In early 2022, Trillium and carbon fiber manufacturer Solvay Composite Materials (Alpharetta, Ga., U.S.) signed a letter of intent (LOI) to develop a supply chain for Bio-ACN. Under this agreement, Solvay, in 2023, will conduct an analysis of Trillium’s Bio-ACN to verify its chemistry and composition. This will be followed, in 2024, by Solvay conducting an LCA of the Bio-ACN.

Employees of Trillium Renewable Chemicals are shown here working on the company’s pilot line in Charleston, W.V., U.S., which produces Bio-ACN sourced from soybean oil feedstocks. Trillium has received Series A financing and will soon build a demonstrator production plant somewhere in the U.S. The company is working with Solvay to assess Bio-ACN as a drop-in replacement for petroleum-based ACN. Photo Credit: Trillium Renewable Chemicals

Another strong signal from the carbon fiber supply chain came in December 2022 as part of Trillium’s $10.6 million Series A financing. Carbon fiber manufacturer Hyosung Advanced Materials Corp. (Seoul, South Korea) provided a $3.0 million investment in that round. Young Joon Lee, VP of Hyosung, says the company was drawn to Trillium’s Bio-ACN because of the product’s strong sustainability profile.

“Sustainability is at the heart of Hyosung’s future growth strategy,” he says, “and we firmly believe that our strong partnership will take us to the next level of industry leadership in [the] renewable chemicals space.”

Says Tyree of investment from the carbon fiber industry: “That’s where much of the interest is coming from, and it’s serious. This is the market segment that frequently travels through the [investment] pipeline to a strategic partnership or an investment. That is telling.”

The sustainability story that Trillium ultimately tells with Bio-ACN is a strong one. “Unlike some other segments,” Tyree notes, “ACN is the only monomer used to produce PAN, and the sustainability impact of a green drop-in ACN product is not diluted by other petroleum-based products.”

Thus the decarbonization advantages conveyed by the company’s technology are maintained in the final product. The result, he says, is a 70% reduction of the carbon footprint of ACN. And what about the carbon fiber itself? “We have a general idea,” Tyree says, “but the LCA work that Solvay is doing will be the ultimate measure. It’s not hard to see, however, that a 70% reduction in the ACN footprint will result in a substantial reduction in the carbon fiber footprint.”

Beyond decarbonization, Tyree says Trillium is discovering that different regions see different benefits of Bio-ACN through different lenses. “The people we talk to ask a lot of questions because they need to understand how to sell this to their customers,” Tyree says. “Is it the bio feature they’re selling? Is it the lower carbon footprint green aspect that they’re selling? Is it both?”

For example, he says potential customers in the EU are sensitive to use of GMOs in feedstocks. They are also concerned about the use of palm oil — derived from the oil palm tree which has displaced forests in some regions to expand crop production. “Our view is that done responsibly, palm oil is actually quite a good crop,” Tyree says. “But we have to be sensitive to some customers’ concerns about this crop.”

Assuming Trillium’s Bio-ACN proves chemically identical to petroleum-based ACN — and there is no reason to think that it will not — the next question will be about cost. Tyree would not divulge specific cost data but did note that he expects Bio-ACN will have cost parity with conventional ACN by the time it enters the market. And that could be soon, given the technology, market, and funding hurdles that Trillium has cleared.

Ultimately, Tyree says, Bio-ACN’s position in the market will come down to its ability to help carbon fiber manufacturers meet sustainability goals. “The one thing that cuts across all customers and geographies is the carbon footprint,” he says. “ACN represents the chemistry where you can have the most impact.”

Keep an eye on more reporting in the next few months from CW about other bio-based precursors for carbon fiber manufacturing.

Related Content

TU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreWelding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreRead Next

Thermoplastic tapes reinforced with textile-based PAN carbon fiber

IACMI project trials inline production of thermoplastic tapes reinforced with textile-based PAN carbon fiber.

Read MoreSolvay collaborates with Trillium on bio-based acrylonitrile for carbon fiber applications

New agreement with Trillium Renewable Chemicals will enable Solvay's development of sustainable, bio-carbon fiber for use in various applications.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More