Auto composites quest: One-minute cycle time?

Faced with high fuel prices and ever-more stringent restrictions on tailpipe emissions, automakers are taking composites into their own hands.

Regulation of tail-pipe emissions.

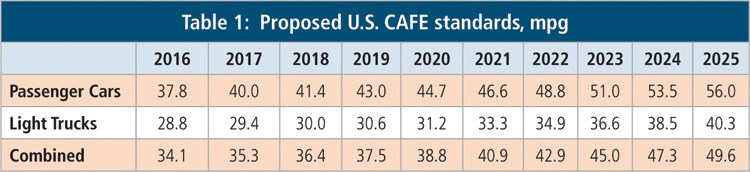

As the world’s automakers emerged from the recent recession, shaken to the core and, in some cases, recapitalized with public funds, almost everything had changed but this. In the U.S., the National Highway Traffic Safety Admin. (NHTSA) and the Environmental Protection Agency (EPA) are in the midst of updating Corporate Average Fuel Economy (CAFE) standards for the 2017 to 2025 time frame. CAFE standards are used by the U.S. government to establish vehicle fuel efficiency standards for all cars and trucks sold into the U.S. The proposed 2017-2025 standard calls for a substantial increase in automotive fuel efficiency. Table 1 highlights what’s in store.

In the European Union (EU), the European Commission, which develops and promulgates most of the regulations that govern EU industry, is focusing on direct reduction of emissions in cars and trucks. The current emissions limit in passenger cars is 130g of CO2/km, but by 2020 that figure will drop to 95g CO2/km. Regulations in the works for the post-2020 era promise more of the same.

Whether a carmaker is trying to reduce emissions or improve fuel efficiency, one of the most effective strategies is weight reduction, and few inside the auto industry dispute that the best tools in the lightweighting toolbox are composites — in particular, carbon fiber-reinforced polymers (CFRPs), which offer a strength-per weight ratio superior to any other materials, whether metal or polymer based. But historically automakers could not act on that knowledge in a significant way because they faced a threefold challenge: cycle time, cost and availability. How can carbon fiber composite structures be made at a cost and manufacturing speed conducive to high-volume automotive production? And, some automakers have pointed out, even if carbon fiber were cheaper, how could the industry commit to carbon fiber composite structures with the fiber supply so volatile and unreliable?

In the prerecession auto world, auto OEMs asked these questions and appeared to be waiting for the composites industry to provide the answers. But in the glare of postrecession realities — the continuing high price of fossil fuels and a recognition that to dismiss concerns about greenhouse gas effects on the environment is, at best, politically indefensible — auto OEMs are now taking the initiative.

In the area of carbon fiber availability, for example, one way to address this challenge is to develop a partnership with a carbon fiber manufacturer to create a carbon fiber supply chain designed exclusively for your vehicles. In 2010 carmaker BMW Group (Munich, Germany) and carbon fiber manufacturer SGL Group (Wiesbaden, Germany) did exactly that, creating SGL Carbon SE, which recently commissioned a carbon fiber plant, with a capacity of 3,000 metric tonnes (6.614 million lb), in Moses Lake, Wash. BMW will need that much because those fibers will see significant use in large parts, including the passenger cell and other chassis structures and, possibly, body panels on the 2013 all-electric i3 passenger car and the 2014 hybrid-electric i8 sports car — the first time carbon fiber composites will have been used in chassis structures on a production passenger car.

The BMW/SGL venture also attacks the issue of cycle time. The manufacturing pace required to meet the high-volume requirements of car or truck production is generally acknowledged to be one part per minute, a cycle duration maintained for decades by auto OEMs in their metal-stamping operations. Ideally, an automotive manufacturer would prefer a true 60-second process, something the composites industry has been unable to promise, particularly with regard to thermoset composites, which necessarily consume some time to crosslink sufficiently to cure. But composites proponents have always maintained that because tooling for composite molding can be built for a small fraction of the cost of metal-stamping molds, the part-per-minute expectation could be met with lengthier processes by using multiple tools and presses. And mold cycle times have been reduced incrementally as innovative molding processes have proliferated over the past few years.

Although the cycle time for the BMW process is unknown, what is known is that it is based on resin transfer molding (RTM) of woven carbon fiber fabrics, a process much faster than the hand layup/autoclave-cure methods used on CFRP in low-rate supercars. At Momentive Specialty Chemicals’ (Columbus, Ohio) Cedric Ball, market development manager — automotive, says the company has developed several fast-cure epoxies for use in high-pressure RTM (HP-RTM) processes (up to 200 bar/2,900 psi and 200 g/s injection rate). Ball says fast-cure RTM resins have been used by BMW since 2009 to mold the carbon fiber roof on the M3 and M6 models, and by Audi since 2011 on the B-pillar side blades for the R8. Further, Ball reports that Momentive has a 5-minute cure epoxy system going into production on several unidentified vehicles, and a two-minute cure system in trial phase. The five-minute technology combines Momentive’s EPIKOTE Resin 05475 and EPIKURE Curing Agent 05443. On the process side, Momentive has worked the most with Italian machinery manufacturer Cannon USA Inc. (Borromeo, Italy) and Krauss-Maffei Corporation/Dieffenbacher North America Inc. (Munich, Germany and Eppingen, Germany). “We believe that one-minute cycle times are not out of the question for RTM with the right combination of resin system, process and tool design,” Ball says. “While the resin system is a key component, Momentive understands that all three elements have to come together to make a successful product.”

This first-of-its-kind collaboration in the automotive industry apparently set the stage for what followed — a series of similar pairings among carbon fiber manufacturers and carmakers looking to reduce weight and develop high-speed manufacturing processes for carbon fiber composites. One of the most interesting and intriguing relationships has been established between General Motors (GM, Detroit, Mich.) and carbon fiber manufacturer TEIJIN ARAMID BV (Tokyo, Japan) because its goal is to attack the part-per-minute challenge head on. Teijin says it has developed a true 60-second manufacturing process for production of carbon fiber composites via press forming of prepreg. The difference? The prepregs feature thermoplastic matrices, which, unlike thermosets, need no extended time to crosslink or cure. The partnership was announced in late 2011, and the two companies have since established a technical center near Detroit that will serve as the research and development bed for this process. The center is assessing polypropylene and polyamide resins and intermediate-modulus carbon fiber forms that include unidirectional and isotropic constructions, as well as long-fiber thermoplastic pellets. GM officials told CT in 2011 that integration of carbon fiber composites in a production vehicle would require “from ground up” design and engineering to optimize material use and minimize weight. How soon parts and structures from this process might appear on GM vehicles is unknown. For this report, Teijin Advanced Composites America VP Eric Haiss said, “As GM announced last December, Teijin provides the opportunity to revolutionize the way carbon fiber is used in the automotive industry and that this technology holds the potential to be an industry game changer for GM. We are very pleased with the progress that’s being made so far and excited about our future growth opportunities.”

In January 2011, Daimler AG (Stuttgart, Germany) and carbon fiber manufacturer Toray Industries Inc. (Tokyo, Japan) formed a joint venture based in Esslingen, Germany, to make and market carbon fiber composite parts for automobile parts. Like BMW, Daimler is using an RTM process developed by Toray called Short Cycle RTM, to make parts for Daimler’s Mercedes-Benz passenger cars.

A fourth partnership has made public its intention to directly attack the cost of manufacturing carbon fiber. Ford Motor Co. (Auburn Hills, Mich.) and Dow Automotive Systems (Midland, Mich.) teamed up in April of this year to develop cost-effective carbon fiber composite structures that will help Ford reduce the weight of new vehicles by as much as 750 lb/340 kg by 2020. Dow, which is not an established carbon fiber manufacturer, has been collaborating with carbon fiber maker AKSA (Istanbul, Turkey) and, significantly, the U.S. Department of Energy’s (DoE) Oak Ridge National Laboratory (ORNL, Oak Ridge, Tenn.). The DoE has tasked ORNL with finding a way produce carbon composite less expensively. Derived from petroleum, the polyacrylonitrile (PAN) precursor used by most carbon fiber producers, when pyrolized, produces a carbon fiber of very high quality, especially in terms of strength, but is extremely expensive. ORNL is attempting to develop a less-expensive, sustainable (that is, plant-based) precursor that could reduce the cost of finished fiber. Neither Dow nor Ford would comment further about their cooperation, but Ford did assert in 2009 at the CompositesWorld Expo that it would not consider increased carbon fiber use unless the cost for the material dropped to $5/lb. Clearly, the economic picture has changed since then. When asked what structures Ford is considering for carbon fiber use via its work with Dow, a Dow spokesperson said, “We do not disclose targets associated with the JDA [joint development agreement], but clearly the intent is a significant usage of carbon fiber composites to drive Ford’s vehicle mass-reduction aspirations.”

Also in April 2012, RTM specialist FRIMO Inc. (Lotte, Germany) and material supplier Huntsman Polyurethanes (Everberg, Belgium) signed a cooperative agreement to develop fiber-reinforced polyurethane (PU) solutions for automotive applications. Although the Huntsman PUs are thermosets, they crosslink and cure with great speed. Huntsman has purchased a FRIMO pilot production unit for its Everburg technical center. This equipment, specifically designed for PU systems, enables Huntsman to expand testing and validation of a new range of resins for auto composites under the trade name VITROX, for which the exotherm curve and gel and cure times can be accurately formulated and achieved predictably. Huntsman Advanced Materials, a separate division, is promoting for auto manufacturing what it calls Fast RTM, which uses high pressure (> 15 bar/>217 psi) in mixing and molding and has reported cycle times of 5.5 to 13 minutes, including preform set, injection, cure and demolding.

In June 2012, Umeco (Heanor, U.K.) announced its ACOMPLICE (Affordable COMPosites for LIghtweight Car structurEs) partnership, which includes Aston Martin Lagonda (Gaydon, Warwick, U.K.), Delta Motorsport Ltd. (Northants, U.K.), ABB Robotics (Zurich, Switzerland) and Pentangle Engineering Services Ltd. (Grantham, Lincolnshire, U.K.) to examine the potential for using high-performance composites in mainstream automobiles. Umeco’s role in ACOMPLICE is to develop fast-cure prepregs and enable the rapid manipulation and placement of plies via robotics. Novel materials formatting and molding techniques will be developed alongside these technologies to optimize component output rates. The process is based on Umeco’s Dform prepreg press-forming process.

“We have a few snap-cure resins, not just epoxy, at various stages of maturity ....,” says Nigel Blatherwick, strategic marketing director at Umeco. “Some products are already under evaluation at tier suppliers and OEMs. However, the consistent message is: we are targeting maximum three- to four-minute cycle times, not only in part molding but, critically, also at the preforming stage. The point is, a snap-cure resin is only part of the equation.” He adds, “As is always the case with advanced composites — part design, manufacturing process and material are inextricably linked.”

Meanwhile, Plasan Carbon Composites (Bennington, Vt.) has spent the past couple of years working with press manufacturer Globe Machine Manufacturing Co. (Tacoma, Wash.) and toolmaker Weber Manufacturing Technologies Inc. (Midland, Ontario, Canada) on a rapid-cure, out-of-autoclave system for molding thermoset-based carbon-fiber composites with a cycle times of about 17 minutes, and is targeting 10 minutes. Plasan has opened a technical center in Wixom, Mich., close to auto industry customers, and last summer, it demonstrated the manufacture of a six-layer carbon fiber composite test plaque with a Class A surface and excellent consolidation.

Keeping it in context

If, in fact, carbon fiber composites are on the verge of widespread adoption in structural auto parts, it’s likely that, as has happened in aerospace and other industries, the initial impulse will be design and manufacture of “black metal.”

Antony Dodworth, lead composite engineer at Dodworth Design (Birmingham, U.K.) and former engineer at carmaker Bentley (Crewe, Cheshire, U.K.), argues that composites’ biggest hurdles in automotive aren’t material or process related. “It’s design,” he says. “Most car applications are stiffness driven, therefore it’s about section size and incorporating as much into each part as possible. New materials and processes open up new design possibilities, so the challenge is to make structures that are manufacturable in an automated method and chase the material properties that you require.”

Umeco’s Blatherwick also notes that while auto OEMs focus on piece-part cost, the integration of composites into cars and trucks requires a more thorough analysis of the design process. Although cycle time is a major issue as annual volumes move from hundreds to thousands to hundreds of thousands of parts, “molded part cost will always come top of the list in terms of OEM concerns about adopting advanced composite materials,” he says. “Of course, there are a raft of other real concerns that need addressing — material characterization, simulation, scrap levels, joining technologies, recycling, etc. None are insurmountable if we — materials suppliers, tier manufacturers and OEMs — work in close collaboration.”

Given the relative youth of composites in automobile structures, Dodworth says the industry can expect a steady progression of design maturation as vehicles are developed to accommodate composites, not vice versa. Correspondingly, this could be the dawn of true automation in automotive composites. “The big European auto producers are now looking for new composites manufacturing capability to satisfy their higher volume applications,” he says. “There are no preconceptions or prejudices regarding where this capability comes from, as long as it will be accessible within Europe. The production techniques required for this type of manufacturing are going to be heavily dependent upon automation, so it is going to be linked to the ability to invest in equipment and capacity and with a relative insensitivity to labor rates.”

So, where is all of this R&D leading? Blatherwick says, “Within Umeco, we are thinking about advanced composite materials as a whole and certainly planning on supporting significant growth over the next 5 to 10 years.” And even if current automotive composites development is clouded in secrecy, it’s clear that the composites industry is enjoying unprecedented interest from the automotive sector that appears to presage the shape of things to come.

Related Content

Composites manufacturing for general aviation aircraft

General aviation, certified and experimental, has increasingly embraced composites over the decades, a path further driven by leveraged innovation in materials and processes and the evolving AAM market.

Read MoreIndustrial composite autoclaves feature advanced control, turnkey options

CAMX 2024: Designed and built with safety and durability in mind, Akarmark delivers complete curing autoclave systems for a variety of applications.

Read MoreVIDEO: One-Piece, OOA Infusion for Aerospace Composites

Tier-1 aerostructures manufacturer Spirit AeroSystems developed an out-of-autoclave (OOA), one-shot resin infusion process to reduce weight, labor and fasteners for a multi-spar aircraft torque box.

Read MoreBusch expands autoclave solutions

Busch announces its ability to address all autoclave, oven and associated composites manufacturing requirements following the acquisition of Vacuum Furnace Engineering.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More