Bigger, better, faster, more

Editor-in-chief Jeff Sloan considers the implications of propitious aircraft OEM announcements for the aerocomposites supply chain.

Back side of the Spirit AeroSystems ASTRA demonstrator fuselage panel for next-generation, high-rate, single-aisle aircraft. Source | CW

It’s June 11 as I write this. I am on United flight 81 en route to the 2019 Paris Air Show (June 17-23) by way of Manchester, U.K. I have attended the Farnborough Air Show before, but this will be my first time at the Paris event.

I am going this year because the show, it appears, is poised to be a propitious one on many levels. First, on the composites level, there is the possibility that Boeing will informally announce the NMA (New Midsize Aircraft), a double-aisle, twin-engine replacement for the now-discontinued 757. And any new aircraft program has major implications for the composites industry — namely, how and where composite materials will be applied.

Second, also on the composites level, the NMA is widely assumed to be the first in a series of new aircraft program launches over the next few years. It will likely be followed by single-aisle replacements for the Boeing 737 and the Airbus A320, which are the largest volume, most profitable aircraft manufactured by both companies. A new single-aisle aircraft program is expected to have a rate of 60-100 per month.

Third, on the commercial aerospace level, is the Boeing 737 MAX, which was grounded in the wake of two crashes, one in late 2018 and the other in early 2019. Identifying the cause of the crashes, developing a solution and implementing it has absorbed almost all of Boeing’s organizational energy. In fact, if Boeing does not make a major announcement regarding NMA next week in Paris, it will be because Boeing feels that it must clear the 737 MAX hurdle first.

All of this is to say that no matter how propitious the 2019 Paris Air Show is, however, the composites industry perspective will be the same: The aerocomposites industry is facing an unprecedented demand for its materials and services — in quantity and quality — that we are just not used to. Manufacturing 100 shipsets every 30 days of large aerostructures is not a trivial exercise.

I don’t make this claim hopefully, or because the evolution of composites use in aerostructures points inevitably to such a future. I make this claim because I think the customers of Boeing and Airbus, the airlines themselves, will demand composite aerostructures. I think the customers of Boeing and Airbus appreciate the benefits composites convey — from maintenance to fuel efficiency — and want them in their aircraft going forward. And historically, what the customer wants, the customer gets.

I also think that the aerocomposites supply chain is keenly aware of this demand. In conversations we here at CW have had lately with composite materials suppliers and tier fabricators, it is impossible not to discuss the rate implications of next-generation aircraft programs. Take, for instance, our June 2019 story on work automated fiber placement (AFP) specialist Electroimpact is doing to improve machine utilization, streamline in-process inspection and integrate data into process assessment and control for aerostructures fabrication.

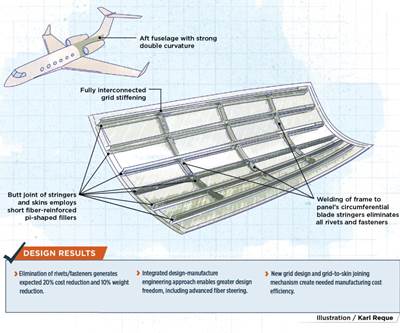

Consider as well another story in the June 2019 issue, written by contributor Karen Mason, on work GKN Fokker has done with business jet manufacturer Gulfstream to iterate and mature a carbon fiber/PEKK fuselage panel with fully integrated stringers, designed to minimize fastener use and provide a structure better able to cope with the pressures and impacts that a fuselage suffers.

The point is that just as we are on the cusp of a series of new commercial aircraft programs, we are also on the cusp of a new wave of aerocomposites production automation, efficiency and throughput that will, I think, drive growth and maturation for years to come. And at the heart of this evolution is data — design data, materials data, process data, testing data, quality data, in-service data. And, increasingly, airframers like Boeing and Airbus will demand that their suppliers harness, organize, assess, deploy and store this data to build those digital twins we’ve been hearing so much about. High-quality manufacturing will require high-quality data management.

In the meantime, I will let you know what I learn in Paris — propitious or not.

Related Content

A new era for ceramic matrix composites

CMC is expanding, with new fiber production in Europe, faster processes and higher temperature materials enabling applications for industry, hypersonics and New Space.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MorePlant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreRead Next

Evolving AFP for the next generation

‘Aerospace quality at automotive pace’ is the mantra of the supply chain being developed for next-generation commercial aircraft. Automation is evolving to meet the challenge.

Read MoreNext-Gen Aerospace Special Edition

Read the Next-Generation Aerospace Special Edition, produced in partnership with CompositesWorld, Modern Machine Shop and Additive Manufacturing.

Read MoreThermoplastic primary aerostructures take another step forward

Employing new manufacturing techniques and the design freedom they create, GKN Fokker has joined forces with Gulfstream to assess thermoplastic composites for primary aircraft structures.

Read More