Carbon Fiber: Refiguring the supply/demand equation

CW editor-in-chief Jeff Sloan returns from Carbon Fiber 2015 in Knoxville TN, US, with news that carbon fiber demand will outstrip supply by 2020, prompting expansion in the 2018-2019 timeframe that could include sources in China.

As I write this, I’m just back from the 2015 edition of CompositesWorld’s annual Carbon Fiber conference (Dec. 8-10, Knoxville, TN, US). It was, as usual, an informative and interesting exploration of where and how carbon fiber is applied today, and where and how it might be applied in the future.

The pre-conference seminar featured Chris Red, principal of Composites Forecasts and Consulting LLC (Mesa, AZ, US), who revised his data on carbon fiber supply and demand — highly anticipated and coveted information that always sheds light on how the composites market is evolving. We’ll provide a more in-depth review of Red’s and other’s presentations in the February issue of CompositesWorld, but in the meantime, I’ll provide here a quick review of what I heard and what struck me as important.

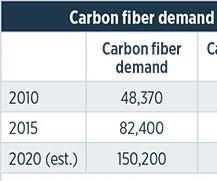

First, the data from Chris Red. The chart at left shows Red's prediction for overall carbon fiber demand and supply through 2020. As you can see, he anticipates demand will outstrip supply by the end of that period, which likely will prompt additional expansion from carbon fiber suppliers — perhaps in the 2018-2019 timeframe. Through 2024, Red also anticipates a compound annual growth rate (CAGR) in carbon fiber demand of 9.21%.

Red divides the carbon fiber market into three segments: consumer/recreational, aerospace and industrial. As has been the case for several years now, growth will be driven primarily by the industrial segment, which accounts for 75% of carbon fiber demand. Within the industrial sector, most of the activity will be centered on pressure vessels (5,364 MT in 2015, 22.2% CAGR), automotive (10,056 MT in 2015, 13.4% CAGR) and non-wind energy (2,800 MT in 2015, 25.9% CAGR).

Aerospace remains a stalwart of carbon fiber, but with the Boeing 787 and the Airbus A350 XWB in production, and with no major aircraft program on the horizon other than the 777X wings, growth will be relatively modest: 15,460 MT in 2015, 3.42% CAGR.

There were two questions asked several times during Carbon Fiber 2015. The first concerned replacements for the Airbus A320 and Boeing 737, which likely will be designed/developed in the 2025-2030 timeframe. The first question was whether or not carbon fiber will be used to fabricate their fuselages. Unlike the 787 and A350, these smaller craft have thinner-walled fuselages, and composites at that thickness are more susceptible to damage from runway debris and other impacts. Further, the build rates of these planes demands throughput capacity greater than current composites technology provides. Those who fielded this question expressed hope that as the next decade approaches, composite materials and processes will have evolved sufficiently to meet these needs.

The second question was geopolitical: What about China? Conventional wisdom at the conference indicated that Chinese industry in general, and the Chinese government in particular, are working diligently to develop carbon fiber manufacturing capacity that could complicate the supply/demand picture over the next decade. China’s biggest challenge appears to be development of a source of high-quality polyacrylonitrile (PAN) precursor for carbon fiber manufacture. However, given China’s vast chemical resources, it seems only a matter of time before this challenge is met.

There were, of course, many other topics tackled at the conference, including automotive, wind, recycling, additive manufacturing and the 777X wings. For more information on these subjects, click on "Highlights from Carbon Fiber 2015" under "Editor's Picks" at top right. CW’s staff will follow up with some final observations in CW's February issue.

Related Content

ASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MorePlant tour: Teijin Carbon America Inc., Greenwood, S.C., U.S.

In 2018, Teijin broke ground on a facility that is reportedly the largest capacity carbon fiber line currently in existence. The line has been fully functional for nearly two years and has plenty of room for expansion.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MorePlant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreRead Next

Highlights from Carbon Fiber 2015

Carbon Fiber 2015 once again offered an engaging roster of speakers, and some eye-opening presentations.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;maxWidth=300;quality=90)