Last month, I wrote about the frustration of spending three weeks working from home due to protective measures necessitated by the coronavirus pandemic. Now, 30 days later, most of us, including me, are still doing the same, although there appears to be signs of “flattening the curve” and some promise of treatment and eventual prevention of infection. Here in the U.S. Midwest, spring weather is allowing us to spend time outdoors, albeit while maintaining social distancing. Some countries and U.S. states, after two months or more of partial lockdown, are starting to allow businesses and factories to reopen, although it will still take a while for manufacturing to return to robust levels. Similarly, it may still be some months before we are able to congregate as a composites community in something other than a virtual environment. I hope to be able to attend September events like the SPE Automotive Composites Conference (ACCE) in Detroit and CAMX in Orlando.

The world has changed as a result of COVID-19, and the implications are far-reaching. Two of the largest markets for composites, commercial aviation and automotive, have been hit severely, with production levels for 2020 shrinking to levels not seen in many years. As the economy – and employment – recovers, one hopes that there will be significant pent-up demand for automobiles such that assembly plants, and those factories supplying them, will start humming again. The travel and hospitality industry, which includes aviation, is in for a longer period of recovery, especially given the wild card of how virtual meetings may change business travel. Social distancing is difficult on airplanes, so it will be some time before the flying public develops enough confidence for airlines to justify taking deliveries of new aircraft from Boeing (Chicago, Ill., U.S.) and Airbus (Toulouse, France). The marine industry is also likely to see some contraction until employment strengthens. While the wind industry may suffer a temporary setback, it is still poised to keep expanding, which is positive for composites. And if part of government stimulus worldwide includes infrastructure investment, composites should benefit.

I believe the mindset of humanity is changing as a result of COVID-19. After years of increasingly nationalistic trends, the global pandemic has quickly reminded us that we all share a relatively small sphere, and our fates are intertwined, even if we are forced to temporarily close borders to fight an invisible, insidious enemy. Overcoming this coronavirus requires a global effort, be that developing therapeutic treatments for those infected, or conducting clinical trials of promising vaccines in multiple locations around the world. The results of these treatments and trials will be shared across borders and, as supply chains are being restructured to reduce distance, scaling production of these solutions will occur simultaneously in many countries, as is now happening for personal protective equipment (PPE).

Innovation can happen anywhere, and much of the time, not in our backyard.

This mindset change will accelerate underlying trends that were already underway prior to the rise of COVID-19, including a transition from fossil fuels to renewable energy, battery storage and electrification of vehicles, despite historically depressed oil prices. These trends are positive for composites. I am reminded of the term “think globally, act locally,” coined decades ago and originally used in the context of the environment and sustainability, which applies here. The pandemic is also forcing OEMs to look hard at supply chains. While automotive suppliers have long set up factories close to assembly plants for just-in-time delivery, aerospace has developed increasingly longer-distance supply chains, partly driven by foreign government manufacturing offset demands. It is inevitable that some of these supply chains will become much shorter. To increase competitiveness of local manufacturing in all industries, other trends that will be accelerated include increased automation in manufacturing and faster deployment of machine learning, artificial intelligence and Industry 4.0. I suggest, following the example of the medical community, that we, as a composites industry, invigorate our efforts to “innovate globally, fabricate locally.”

What do I mean by this? Innovation can happen anywhere, and much of the time, not in our backyard. It is essential that we, as an international community of composites scientists and engineers, work together to address critical manufacturing competitiveness needs, and share those technologies with colleagues globally, preferably via physical interaction, but also in virtual environments. While some of this collaboration has started happening on an organic basis, ideally, industry and governments should actively fund global collaborative research in composites that address these evolving trends, led through national institutes, consortia and technology clusters. Commercializing these innovations around the globe will benefit the composites industry, and mankind, for the long term.

Related Content

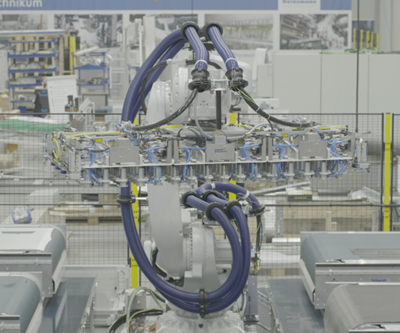

ASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MorePlant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

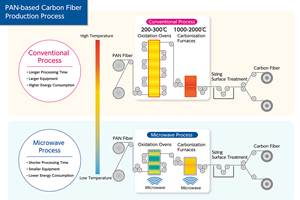

Read MoreMicrowave heating for more sustainable carbon fiber

Skeptics say it won’t work — Osaka-based Microwave Chemical Co. says it already has — and continues to advance its simulation-based technology to slash energy use and emissions in manufacturing.

Read MoreNatural fiber composites: Growing to fit sustainability needs

Led by global and industry-wide sustainability goals, commercial interest in flax and hemp fiber-reinforced composites grows into higher-performance, higher-volume applications.

Read MoreRead Next

Kanfit coping with COVID-19 and managing growth using Composites 4.0 systems

Bluetooth sensors and AI track parts and tools, save time and suggest production line improvements.

Read MoreComposites suppliers, fabricators respond to coronavirus

Companies across the composites industry supply chain share how the COVID-19 pandemic is affecting their businesses, and how they are available to help.

Read MoreLeaders in the composites industry work together to develop ventilators for COVID-19 patients

A U.K.-government funded project collects Meggitt, GKN, Rolls-Royce, Airbus and others to quickly help meet demand.

Read More