Composites: Irrational exuberance?

Columnist Dale Brosius advises against overoptimism as he reflects that much of the composites technology on display at JEC World 2019 were prototypes and proof of concepts, not revenue-generating products.

Another March has passed, and with it the 2019 edition of JEC World. Per JEC, 1,300 exhibitors saw more than 43,000 people come through the exhibition, once again demonstrating that Paris is “the place to be” as winter turns to spring, especially if you are in the composites industry. I witnessed strong attendance at the various presentations and events across the show floor over the three days, numerous new products being introduced and novel automation solutions being performed during live demonstrations. It is clear that the overall health of the industry is good and sales are growing, and the number of countries represented on the floor indicate strong global optimism for the future.

In December 1996, then U.S. Federal Reserve Chairman Alan Greenspan delivered a speech to the American Enterprise Institute during which he introduced the term “irrational exuberance,” referring to investor enthusiasm that propels stock prices to levels not supported by fundamentals. He was referring to U.S. share price/earnings ratios well above historical norms. In early 1998, the NASDAQ index stood at 1500, and in early 2000, the famous dot-com boom drove it to 5000, more than tripling the index in only two years. Internet companies with little to no revenues (remember Pets.com?) attracted huge investments from initial public offerings, spectacularly crashing in 2000 and taking the NASDAQ back to 1500 in only a year. It took another 14 years for the NASDAQ to again break through the 5000 point barrier.

My own portfolio at the time contained a handful of tech stocks, but I was careful to own only those that made real products, with real revenues and real profits — companies like Sun Microsystems, Cisco Systems and Applied Materials, which produced hardware that built the backbone of the internet. Certainly, I was safe, right? Unfortunately, when a large number of the dot-com enterprises went bankrupt, they liquidated all their hardware, causing an interruption in the equipment supply chain and dragging down the share prices of the “real” companies I owned in my portfolio. Fortunately, these companies recovered, and most of my holdings were restored, but not to the levels of early 2000.

So how does this relate to JEC World, or even to composites? As I wandered around JEC this year, I could not turn a corner without seeing a composite automobile component on display — body panels like hoods, fenders and deck lids, carbon fiber wheels, structural crossmembers or subframes, and entire monocoque structures. Similarly, albeit less in number, were aircraft fuselage and wing structures, many featuring thermoplastic materials or out-of-autoclave thermoset solutions. And it wasn’t just the U.S.- and European-based company stands: such parts were also pervasive on Chinese, Japanese, Korean and other countries’ displays. By my estimate, over 90 percent of the auto and aero parts on display were either prototypes or proof of concept, not production components. In other words, these parts are not generating revenues or profits, like the many dot-com companies of 1999-2000.

So, the question is, have we reached a point of irrational exuberance in the composites industry? Are we being unrealistic about what the future holds for these applications and how quickly that future will arrive? I hope not, as there is still a lot of work to be done to reduce costs and cycle time to realize significant auto penetration, and new aircraft programs willing to incorporate novel materials and technologies are few and don’t come along very often.

I am a persistent cheerleader for the composites industry, having spent 35 years in it. But I also keep an ear to the ground and know that entrenched material providers remain vigilant against new entrants. I did see applications at JEC that I think are poised to see rapid adoption and in substantial volumes. One is the maturation of pultruded carbon and hybrid carbon/glass fiber spar caps for wind turbines. These have the potential to be cost-neutral to infused glass fiber spar caps, enabling longer and lighter blades. Another is composite battery enclosures for electric and hybrid electric vehicles, which are forecasted to see high growth rates. The attributes of composites make our materials ideal for this application.

We can remain optimistic, but we also need to be realistic and redouble our efforts to make composites the obvious choice for transportation, energy generation and infrastructure. While the dot-com bust set the internet back for a period, e-commerce and information delivery via the internet is today an undeniably major economic force. It took focus on ideas that could generate revenue, time and scale to achieve. We can replicate that in composites, I believe, if we do the same.

Related Content

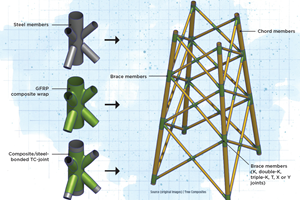

Novel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreVIDEO: One-Piece, OOA Infusion for Aerospace Composites

Tier-1 aerostructures manufacturer Spirit AeroSystems developed an out-of-autoclave (OOA), one-shot resin infusion process to reduce weight, labor and fasteners for a multi-spar aircraft torque box.

Read MoreCompPair adds swift prepreg line to HealTech Standard product family

The HealTech Standard product family from CompPair has been expanded with the addition of CS02, a swift prepreg line.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;maxWidth=300;quality=90)