Composites ride and support the rails

Increased ridership and heavier axle loads on rail systems around the world signal a potential boon for composites.

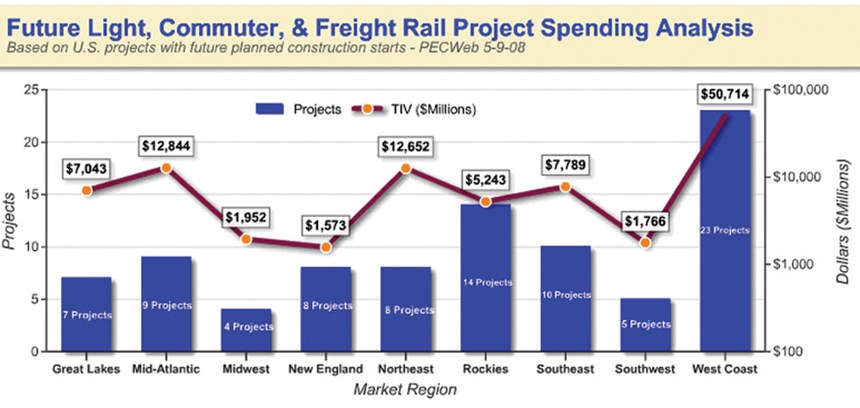

Rail transportation is on the rise. Leading railcar and locomotive makers Siemens AG (Erlangen, Germany), Alstom Transport (Levallois-Perret, France), Bombardier Transport (Berlin, Germany) and GE Transportation (Erie, Pa.) announced trainset orders in 2008 valued at more than $10 billion (USD). Development of high-speed rail systems is on track for the first time in Russia in the 135 mph/250 kmh Sapsan train system, built on the Siemens AG Velaro platform. Meanwhile, Alstom’s 189 mph/350 kmh AGV train will be tested this year in Italy, and Tokyo-based Kawasaki Heavy Industries, builder of Japan’s Shinkansen “bullet” trains (already exported to China), is developing the Environmentally Friendly Super Express Train (efSET) for similar speeds. And the $44 billion U.S. public rail transit network supports more than 155,000 active vehicles, 12 percent of which move people over nearly 12,000 miles (19,000 km) of light, heavy and commuter rail. Ridership on this network has surged by 30 percent since 2005, half of that in the first three quarters of 2008, prompting a projected investment in new U.S. rail projects in excess of $100 billion.

Rich RR history

Composites have been used to great benefit in the rail industry for three decades. Sandwich construction and monolithic laminate in exterior train fairings have reduced train weight and drag and improved aerodynamics and aesthetics. Alstom, for example, reports achieving a 15 percent reduction in fuel consumption and 70 metric tonnes (>154,300 lb) in mass reduction on its AGV train, using composites.Composites in structural railcar applications, however, have evolved more slowly in the conservative rail industry by comparison with the aerospace arena. That said, there are notable milestones: In the late 1990s, pultruded fiberglass profiles were tested in the SMART cargo container and the 52,000-lb/26,000 kg load carrying “Glasshopper” freight car hopper, which was filament wound. Today, upper and lower load-bearing composite floor sections in double-decked passenger trains contribute to overall structural strength.

By far the largest volume of composites in rail is consumed in interior passenger coach components. These encompass ceiling and floor panels, sidewalls, window surrounds and luggage stows, complete bathroom, kitchen and driver compartment modules, and seating units. Composites provide the ability to mold in multiple features that reduce part count and maintenance, as well as surface textures that deter graffiti.

A critical issue here is fire safety. Fire, smoke and toxicity (FST) properties in composite resin formulations for rail interiors have been continually tested and upgraded (see “Learn More,” at right). Suppliers of polyester and vinyl ester resins for rail applications, including AOC LLC (Collierville, Tenn.), Ashland Performance Materials (Dublin, Ohio), DSM Composite Resins AG (Schaffhausen, Switzerland), Gurit (Isle of Wight, U.K.), Hexion Specialty Chemicals (Carpentersville, Ill.), Huntsman Advanced Materials (The Woodlands, Texas) and Reichhold Inc. (Research Triangle Park, N.C.), use nonhalogenated fire retardant additives, fillers such as alumina trihydrate, and intumescents to make their resins compliant with FST performance requirements. FST rules differ by country and operational category (above or below ground). British standard BS 6853 is considered to be the most stringent to date and has been adopted by countries outside the U.K. In the U.S., FST standards are determined by the U.S. Department of Transportation’s Federal Railroad Admin. (FRA, Washington, D.C.). Ashland, which sells HETRON and DERAKANE polyester and epoxy vinyl ester resins and MODAR modified acrylic into rail interiors, hopes to introduce a new grade of MODAR by year’s end that boosts FST performance. But Thomas Johnson, Ashland’s industry manager for corrosion- and fire-resistant products, says meeting the various international regulatory requirements is a daunting task and believes efforts that are underway in the European Union to harmonize FST requirements will make life easier for suppliers and fabricators.

The inherently fire-resistant chemistry of phenolic resins has earned them widespread application, particularly in European rail interiors. In the U.S., San Francisco’s BART underground rail system adopted phenolics for interior components in 1979, and Amtrak also uses phenolics for inside components on the Acela Express in the U.S. northeast. Phenolic resin producers include Hexion Specialty Chemicals (Louisville, Ky.), Huntsman Advanced Materials, Georgia-Pacific Chemicals LLC (Atlanta, Ga.) and Gurit.

Pravin Kukkala, business manager for Hexion’s phenolic resins, says that water-release issues during cure, which make priming/painting difficult, and the natural color that limits resin pigmentation “have been overcome to a large extent by novel systems from Hexion and other suppliers [and] growing customer experience in using phenolics has expanded their application.”

Composites in locomotion

Meanwhile, sheet molding and bulk molding compound (SMC, BMC) are finding use “in applications as diverse as locomotive nose covers, electric box enclosures, such as rectifiers, and insulators of all kinds,” reports locomotive builder GE Transportation’s spokesman Tom Scott, who points out that such composites solutions have been developed by GE engineers “in response to customers’ requirements for less weight and accrued efficiency.” The company’s latest locomotives, the PowerHaul and Evolution series, now run on rail lines in the U.S., Europe, India, Kazakhstan and Turkey. The high insulative properties of BMC/SMC prevent arcing around an electrical contactor, notes Scott. Another electronic component called a bus bar requires an insulating ball at each end, and GE Transportation utilizes BMC in these components, he says, “to ensure the integrity of insulation.”Suppliers of SMC and BMC compounds include Bulk Molding Compounds Inc. (Chicago, Ill.), IDI Composites International (Noblesville, Ind.), Menzolit Compounds International GmbH (Heidelberg/Rohrbach, Germany), Premix Inc. (North Kingsville, Ohio) and Quantum Composites (Bay City, Mich.).

Knock on wood

The most recent and potentially very profitable arena of composites growth in rail transit involves not the rolling stock but rather what supports the rails. Around 20 million wood cross-ties are replaced in U.S. rail systems annually at a cost of $900 million. Typically, 2,500 to 3,500 cross-ties are installed per rail mile. Union Pacific, Burlington Northern and Santa Fe (BNSF), CSX Transportation, and transit agencies in Chicago, Los Angeles, Washington, Atlanta, New York and New Jersey have installed composite cross-ties for testing in maintenance yards and/or in commercial operation at an average weight of 250 lb/113 kg each and a cost per tie that can range from $85 to $105. Although this is twice the cost of creosote-treated wood ties, the latter are subject to degradation by water, temperature, UV radiation and insects, imposing a relatively short cross-tie lifetime of five to seven years in some locations. Composite ties, impervious to such decay, eliminate the need for creosote preservative and, according to proponents, promise service lives of 40 to 50 years.At this point, however, only 1 to 3 percent of replacement ties each year are composites. This leaves plenty of room for growth if the cost disparity with wood ties can be decreased and the product fares well in long-term testing. Still, American Railway Engineering and Maintenance-of-Way Assn. (AREMA, Lanham, Md.) executive director Charles Emely reports that cross-tie manufacturers “are answering the call to reduce costs by increased production efficiencies through the use of new molding methods, as well as by creating pipelines with raw material suppliers for sustainable sources of clean recyclate. The long-term viability of composite cross-ties looks promising.”

In support of these efforts, AREMA developed recommended practices for composite cross-tie design, materials selection and testing, which can be found in the group’s Manual for Railway Engineering, Volume 1, Track (Chapter 30). And the Federal Railroad Admin. has been testing composite cross-ties for more than a decade at its Transportation Technology Center Inc./Facility for Accelerated Service Testing (TTCI/FAST) in Pueblo, Colo. Ongoing tests are assessing vertical track stiffness, surface and alignment retention, tie-center deformation under load and wheel-off derailment damage. Magdy El-Sibaie, director of the FRA’s Office of Research and Development, confirms that composite cross-ties offer a viable option to wood ties, though he says further advancements could be made in material uniformity and homogeneity as well as in spiking and fastening performance. Richard Lampo, materials engineer and senior researcher at the U.S. Army Corps of Engineers/Construction Engineering Research Laboratory (CERL) in Champaign, Ill., began evaluating composite cross-ties in 1994 and agrees with El-Sibaie’s conclusion about material consistency and quality control. This is particularly important relative to tie fracture behavior. He adds that the derivation of polyethylene from recyclate poses definite challenges for material consistency in finished ties.

AREMA members — rail industry OEMs, related government agencies, suppliers, consultants and end users — are studying tie performance and compiling a cross-tie performance database. Lampo chairs the AREMA subcommittee on composite cross-ties and says the goal “is not to just mimic the performance of wood.” His latest R&D work is focused on establishing test methods for elastic modulus under load and bending forces. (Inquiries about “Development, Testing, and Applications of Recycled Plastic Composite Cross-ties,” 2003,

by Richard Lampo et al., should be directed to richard.g.lampo@usace.army.mil.)

Growing and green

High-density polyethylene (HDPE) from recyclate is the primary composite cross-tie resin, but reinforcement, tie design and molding processes vary. The latter include extrusion, pultrusion and compression molding techniques. Composite cross-ties are typically surface textured to promote ballast interlock. Most of the OEMs interviewed here claim that their ties require no predrilled pilot holes for spikes, which would add to installation costs.TieTek LLC (Marshall, Texas), a subsidiary of North American Technologies Group, has sold more than one million of its cross-ties to date, each utilizing glass and mineral fibers in the HDPE matrix. One of its customers, the Chicago Transit Authority (CTA), acknowledges replacing 125,800 of its 650,000 wood ties over the past decade, primarily with TieTek products. Should composite cross-tie service life prove to be as long as that of the rails — about 50 years — CTA hopes to reduce maintenance costs by synchronizing the replacement intervals.

Recycle Technologies International Inc. (RTI, LaBelle, Fla.) uses up to 35 percent talc filler in its 8.5-ft to 16-ft long (3m to 6m) PermaTie for both transit and Class 1 freight lines. RTI’s process addresses extended postmold cooling time, a processing challenge with composite ties. “We use a cold mold and water bath to start solidifying an exterior boundary layer,” says RTI CEO Rex Crick, “so we can achieve demold in less than two hours.” This is followed by up to 48 hours on a cooling rack.

Tested continuously at the TTCI/FAST facility for over 650 million gross tons, PermaTies combine the strength and flexibility properties from the PE with the mechanical properties of the talc, which also reduces extruder wear and finished part brittleness. PermaTies have demonstrated good spike-holding power during five years’ use in a Gulf Coast rail line, Crick claims, noting that “spike pullout is a constant maintenance-of-way cost for railroads and directly relates to keeping rail gauge intact, especially in hot coastal zones.” BNSF is RTI’s largest railroad customer. (Read a December 2008 study by the FRA’s TTCI/FAST engineers, regarding assessment of composite cross-ties relative to fracture behavior under tie plates, at www.fra.dot.gov/downloads/Research/rr0821.pdf.)

Axion International (Basking Ridge, N.J.) is the exclusive territorial licensee of 13 patents and patents pending developed by a scientific team at Rutgers University (Newark, N.J.). James Kerstein, Axion CEO, says more than 150,000 cross-ties manufactured with formulations based on these patents have been in service for 12 years on inline, elevated and switch-set track. The company uses glass fiber and/or recycled, shredded or flaked acrylic, polystyrene and polycarbonate with the HDPE matrix in multiple material formulations. A 2008 test order of inline and switch-set ties for the Toronto Transit Commission (Ontario, Canada) received positive feedback when used to replace wood and concrete ties, and Axion anticipates followup business this year.

Sekisui Chemical Co. Ltd. (Tokyo, Japan) pultrudes cross-ties up to 31.5 ft/9.6m in length from its Eslon Neo Lumber FFU, a rigid structural foamed polyurethane (PU) skin reinforced with long glass fibers. Baydur 60 PU from Bayer AG’s Bayer MaterialScience (Lever-kusen, Germany) provides light weight, corrosion-resistance, electrical insulation and low water-absorption properties in these rail cross-ties. Pultrusion offers a cost-effective process capable of high material consistency and tailorable tie cross-section and length. More than 1 million Sekisui glass/PU ties are in service in Japan, and Bayer estimates that 90,000 are currently being laid in that country every year. Installation of 136 of these ties occurred this past August in Leverkusen on a 235-ft/74m section of turnout rail.

Other suppliers of polyurethane resins to the rail market include Huntsman Polyurethanes (Auburn Hills, Mich.), Reichhold and Sika Deutschland GmbH (Bad Urach, Germany).

Dynamic Composites (Columbia City, Ind.) produces a 320-lb to 350-lb (145-kg to 159-kg) tie composed of an inner steel core and concrete roll-formed into a double-U-shaped beam. Insert blocks made from PE/crumb rubber fit into the beam’s channels to accommodate rail spikes. Then the beam’s open side and ends are vacuum-sealed with an all-over outer cover about an inch thick made from PE, crumb rubber and carbon black, which provides sufficient flexibility to grip the ballast, resist fracturing during spiking and provide a quiet, cushioned ride. BNSF has recently installed Dynamic Composites’ ties in Oklahoma, and Kansas City Southern Railroad plans an installation.

IntegriCo Composites (Temple, Texas) compression molds its ties from calcium carbonate and talc mineral fillers in PE matrix over an oak core. “This creates the necessary load bearing and flexural properties and avoids brittle failure or crack propagation that can arise when significantly increasing the stiffness of a plastic or composite material,” explains Ryan Nielson, VP of railroad operations. “Our design also capitalizes upon the reinforced composite to protect the wood and provide a consistent tie plate surface with excellent abrasion resistance.” With the capacity to compression mold up to 150,000 ties a year, IntegriCo recently installed composite cross-ties at the Dow USA industrial operations facility in Freeport, Texas. “It is cost prohibitive to use virgin resins to make cross-ties … yet extremely difficult to source recyclate materials with consistent properties and in sufficient quantities at a competitive price,” Nielson acknowledges. For that reason, IntegriCo has made use of several nontraditional material streams, such as recycled insulation from wire chop.

Performance Rail Tie (PRT, Paris, Texas) markets an I-beam shaped tie made from low-density polyethylene (LDPE) recyclate filled with shredded recyclate nylon or PE and small, ductile iron inserts carefully located at the top and bottom of the geometry to ensure that steel spikes will not short circuit the electrical signal integrity of the tie in service. PRT cross-ties are in place with both Class 1 freight and commuter rail systems in the U.S. and are in testing in South America and Europe.

International Track Systems (ITS, New Castle, Pa.) tells CT that it combines virgin or premium recycled HDPE with polystyrene, polyurethane, rubber and other fillers for its EcoRail cross tie. ITS vice president Tye Tyson describes the company’s proprietary “flow molding” process as a pressure-based process that combines the benefits of extrusion and compression molding. While its cross-ties could be made with recycled HDPE, Tyson believes the limitations of the recyclate supply in both quality and quantity must be considered carefully as a basis for volume levels of composite cross-ties. “We feel the green aspect of our composite tie is primarily that it can be recycled after its use in the railroad,” Tyson says.

Innovative hot rail cover

LRM Industries LLC (Rockledge, Fla.) is applying its patented TPF ThermoPlastic Flowforming process to produce chopped glass/polypropylene (PP) third rail covers for Eastern Rail Corp. (Miami, Fla.). The third or “hot” rail sits between the two rails that support the train and carries the primary voltage for electric-powered rolling stock. LRM’s composite cover is designed to offer protection, in the hot, salt-air humidity of south Florida’s climate, from stray electrical arcing, corrosion of the rail and debris damage along the tracks.

According to Bart Berghuis, LRM’s VP of sales, the company expects to deliver 4,000 covers to Eastern Rail this month. The three-part cover comprises two cover boards, each 10-ft long by 11.5-inches wide by 0.250-inch thick (3m by 290 mm by 64 mm), and a vertical flat board that differs only in width (8 inches/6 mm). Each board combines 0.5-inch (13-mm) long glass fiber, at 25 percent loading, with a PP matrix. Extruded lengths (shots of 50 lb/22.7 kg per cycle) are compression molded in a three-cavity tool at less than 100 psi. The closed-loop process provides minimal trim and waste, and the cover is recyclable. In its R&D efforts, the company has tested many different reinforced thermoplastic resins from polyetheretherketone (PEEK) to polymers from waste recyclate. While the PP provides good toughness properties and cost-efficiency in the third-rail cover, Berghuis suggests that refinements may be made in matrix selection to increase FST properties. The company is optimistic about the rail market and has additional components, such as electric cable trays, under consideration.

A moving market

In the overall rail transit market — prior to the late-2008 financial meltdown — investment dollars already pledged and planned rail line expansions ensured positive growth for composites. Ashland’s Johnson verifies this trend globally, citing China’s plans for an $84 billion investment in 4,349 miles/7,000 km of new high-speed rail line that will be serviced by 140 trains by 2010, plus an additional 342 miles/550 km of metropolitan commuter railway by 2020. This has prompted Ashland’s construction of two new resin production facilities there. Hexion, which currently has resin sales of more than 250 metric tonnes (551,156 lb) in the global rail market, reports that “Asian markets for mass transit and rail are booming and will provide substantial and sustained growth for the next several years, primarily due to government-imposed specifications on FST requirements.”In the U.S. rail system, according to Hexion’s Kukkala, the market for composites “is showing steady growth due to updates in infrastructure.”

Johnson agrees, believing that the 800 miles/1,278 km of high-speed rail network proposed in the California corridor between Sacramento and San Diego “will really help to turn the corner for composites in rail usage in the U.S.” The initial backbone link will cost $33 billion to construct and $1.3 billion annually to operate and maintain, with expected revenues of $2.4 billion a year by completion in 2030. Says Johnson, “This project could create the tipping point needed in the North American market comparable to that for composites in rail in Europe.”

However, the global economy’s current volatility cannot be ignored. Johnson observes that “the measure of this market as growing, static or decreasing is in the eye of the beholder, depending upon emphasis in passenger rail, freight or locomotives. In passenger rail, ridership is up, but state and federal budgets are in a cash crunch, with limited funds likely to go to infrastructure over rail.”

Realistically, the current economic woes might delay some rail transit development. But the need for such development will only increase in the interim. And those who build the rolling stock and the rail systems that support them will, sooner or later, look more intensely to the materials and methods of fabrication that promise the best performance over the longest service life. When they do, composites will be riding the global rails even farther.

Related Content

Hexagon Purus Westminster: Experience, growth, new developments in hydrogen storage

Hexagon Purus scales production of Type 4 composite tanks, discusses growth, recyclability, sensors and carbon fiber supply and sustainability.

Read MoreWatch: A practical view of sustainability in composites product development

Markus Beer of Forward Engineering addresses definitions of sustainability, how to approach sustainability goals, the role of life cycle analysis (LCA) and social, environmental and governmental driving forces. Watch his “CW Tech Days: Sustainability” presentation.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

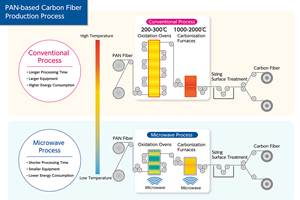

Read MoreMicrowave heating for more sustainable carbon fiber

Skeptics say it won’t work — Osaka-based Microwave Chemical Co. says it already has — and continues to advance its simulation-based technology to slash energy use and emissions in manufacturing.

Read MoreRead Next

Passenger Safety: Flame, Smoke and Toxicity Control

Tried, true -- and some new -- FST-resistant products for manufacturers of composites in rail- and road-based people movers.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More

.jpg;maxWidth=300;quality=90)