Oil drives the Big Three

This is, in some ways, a tough time to be a U.S.-based automaker. Detroit’s traditional Big Three (GM, Chrysler, Ford) are struggling to keep up with Japan’s Big Three (Toyota, Honda, Nissan) and trying hard to develop cars and trucks that are good-looking, reliable and fuel-efficient. On top of this, rising oil

This is, in some ways, a tough time to be a U.S.-based automaker. Detroit’s traditional Big Three (GM, Chrysler, Ford) are struggling to keep up with Japan’s Big Three (Toyota, Honda, Nissan) and trying hard to develop cars and trucks that are good-looking, reliable and fuel-efficient. On top of this, rising oil prices, concerns about global warming and increased consumer eco-sensitivity are forcing all carmakers to develop and explore new technologies (the batteries that enable plug-in electric cars, fuel cells, hydrogen storage tanks and the like) that have high upfront cost but a long return on investment. Still, the effort at innovation is being made and change is afoot in automotive development. The question before us is this: Is the composites industry ready to be a part of this technology shift?

Things certainly looked promising as 2007 started. First out of the gate was the Tesla Roadster, the composites-intensive, all-electric sportscar that debuted in January last year. This was followed by the introduction of GM’s Volt, a plug-in gas/electric hybrid that, promisingly, used composite body panels in concept form, but sadly, from what we hear, is headed into production sans composites panels. Then, this month, at the North American International Auto Show (NAIAS) in Detroit, Mich., came Fisker Automotive’s Karma, an $80,000 plug-in gas/electric hybrid that should be available to consumers by 2009. Designed to run 50 miles on a single charge, the Karma would be a prime candidate for composites. Alas, it’s aluminum-intensive.

While all this was happening, the U.S. Congress responded to oil’s scarcity and increasing cost by passing new corporate average fuel economy (CAFE) standards as part of the 2007 energy bill that was signed into law in mid-December. On paper, the new CAFE standards seem reasonable: by 2020, the fleet of cars and light trucks fielded by each carmaker must average 35 mpg. Automakers, however, claim that the CAFE standards impose artificial and sometimes unattainable goals on the industry and handcuff them when it comes to responding to consumer demand.

For the time being, however, consumer demand and CAFE standards are congruent: we drivers, tired of paying $50 to fill our gas tanks, are demanding efficient, eco-friendly, safe, sleek and sometimes fast cars.

Each of these demands should be driving automakers toward greater use of composites: When it comes to strength-to-weight ratios, styling freedom and the potential for parts consolidation, composites are impossible to beat. Their biggest hurdle — and it is a high one — is production cycle time for large composites parts, such as body panels. The goal, we keep hearing, is a sub-two-minute cycle time for a composites molding process using an affordable material. And we don’t have it yet. SMC is promising but offers relatively modest weight savings given wall thicknesses required. Carbon fiber prepreg as a material is ideal but too expensive and requires autoclave cure. Reinforced thermoplastics have made huge strides in recent years and meet the affordability requirement, but cycle times are still too long. The automotive composites industry, therefore, needs two things: A proven, fast manufacturing process using an affordable material, and an automaker willing to take the risk of embracing it. The former seems a likely, if slow-developing, prospect given past and ongoing technological advancements in composites. The forthcoming Corvette ZR1 is emblematic of this potential, but primarily in low-volume, more expensive vehicles (click on “NAIA Show Highlights,” under “Related Content,” at left). The latter, a risk-taking automaker, might be harder to find, but one has to hope that the built-in value of composites will help the material sell itself. Ultimately, though, the automotive composites industry will have to pull together to collectively, aggressively, assertively and positively sell itself to become a major player in the rapidly changing automotive world. What is known for sure is that the window of opportunity is open now as it never has been before.

Related Content

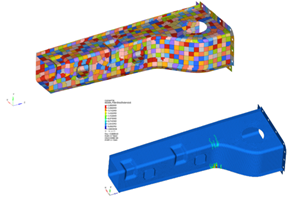

SMC simulation tool enhances design optimization

CAMX 2023: FiRMA, Engenuity’s new approach to SMC, uses a predictive technique that accurately reflects material properties and determine the performance range an SMC part or structure will exhibit.

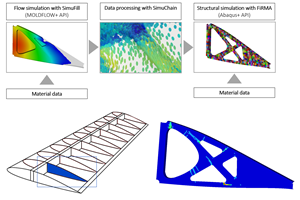

Read MoreImproving carbon fiber SMC simulation for aerospace parts

Simutence and Engenuity demonstrate a virtual process chain enabling evaluation of process-induced fiber orientations for improved structural simulation and failure load prediction of a composite wing rib.

Read MoreCo-molding SMC with braided glass fiber demonstrates truck bed potential

Prepreg co-molding compound by IDI Composites International and A&P Technology enables new geometries and levels of strength and resiliency for automotive, mobility.

Read MoreComposite materials, design enable challenging Corvette exterior components

General Motors and partners Premix-Hadlock and Albar cite creative engineering and a move toward pigmented sheet molding compound (SMC) to produce cosmetic components that met strict thermal requirements.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;maxWidth=300;quality=90)