Gardner Business Index at 50.0 in March

New orders and production are up. Capital spending plans foreshadow equipment investments.

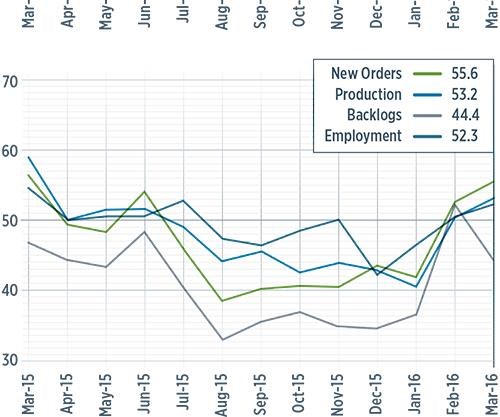

With a reading of 50.0, the Gardner Business Index showed that conditions in the composites industry were largely unchanged in March from February. Prior to February, the industry had seen a period of contraction from July 2015 through January 2016.

New orders and production increased in March for the second month in a row. And both subindices grew at a faster rate in March than they had in February. As March closed out, new orders, generally, had increased more than production in recent months. Although the backlog subindex expanded for the first time since December 2014 in February, it fell back into contraction in March. But the rate of contraction was significantly slower than that seen in the second half of 2015. The employment subindex, in March, increased for the second month in a row and the third time in five months. Exports continued to contract because of the strength of the US dollar. However, the rate of contraction, when March survey results were in, had slowed steadily in recent months. Supplier deliveries shortened at the fastest rate since the Index began in December 2011. This indicated increasing slack in the supply chain.

Materials prices increased for the second month in a row in March. Although this subindex rebounded sharply, it was still relatively low compared with the levels seen during the course of the past three years. Prices received decreased in March for the sixth month in a row, but the rate of decrease decelerated for the second month in a row. The future business expectations subindex improved modestly after a significant increase in February.

Larger composites manufacturing facilities struggled for the second month in a row in March. Plants with more than 250 employees contracted for the fourth straight month, although the rate of contraction had slowed each of the previous three months. Facilities with 100-249 employees contracted for the first time since November 2015. Companies with 50-99 employees grew for the second month in a row. Conditions at these companies, in March, had improved notably since November. Companies with 20-49 employees expanded at a very strong rate for the second month in a row. In fact, February and March were the strongest months of growth for this fabricator category since March 2015. Composites fabricators, generally, fell back into contraction after expanding the previous month.

By the end of March, the aerospace industry had expanded four of the previous six months. The growth in February and March was very strong, with the industry growing at its fastest rate in March since May 2012. Although the aerospace industry had performed well for composites fabricators recently, the automotive industry showed signs that it was struggling. In March, the automotive subindex contracted for the fifth month in a row.

Future capital spending plans in March increased 37% compared with one year ago. This was the first month-over-month increase in spending plans since August 2015. The annual rate of change continued to contract at a significant rate, but the rate of contraction did slow from the figure logged in February. This could indicate the early stages of a recovery in capital equipment spending.

Related Content

JEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreRTM, dry braided fabric enable faster, cost-effective manufacture for hydrokinetic turbine components

Switching from prepreg to RTM led to significant time and cost savings for the manufacture of fiberglass struts and complex carbon fiber composite foils that power ORPC’s RivGen systems.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More

.JPG;width=70;height=70;mode=crop)