German composites industry group reports on thermoplastics pre-JEC

I and other members of the CompositesWorld team are preparing for our annual trek to Europe for the JEC World trade show event. A new AVK report came across the desk, with some information about thermoplastic composites in Europe, just in time.

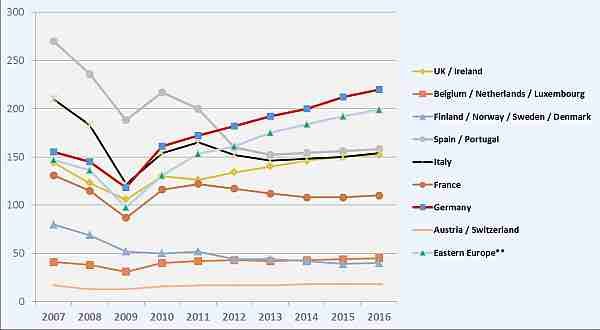

Figure 1 from AVK's recent thermoplastic market report

I and other members of the CompositesWorld team are preparing for our annual trek to Europe for the JEC World trade show event. Each year, we try to make the most of the travel and visit composites fabricator companies or supplier facilities, to stay in touch with European sources and new applications. And, the JEC event always affords an opportunity to meet and reconnect with industry friends, from around the globe. So it was serendipitous timing that a report from Germany’s AVK – Industrievereinigung Verstärkte Kunststoffe e. V. (Frankfurt, Germany), that country’s oldest industry group representing plastics and composites, came across the desk, with some information about thermoplastic composites in Europe.

According to the AVK report, the European market for fiber-reinforced plastics and composites has been growing steadily for a number of years now, based on the group’s 2016 market report. But, there are differences depending on market segment. Growth rates differ, sometimes substantially, from one region or country to another and also with regard to manufacturing processes. Some segments are even in decline.

Where regions are concerned, strong growth has been especially noticeable in the German market in recent years. Germany’s market share in the biggest composites segment – glass-fiber reinforced plastics (GRP) – was around 13% in 2007, and by 2016 it had reached 20% (see Fig. 1, above, showing GRP production in kilotonnes on the vertical axis). Other regions and countries have experienced losses in market shares.

These differences, says AVK, can be explained by major variations in the predominant use of composites in each country. For example, in countries where most of the volume has always been taken up – and continues to be taken up – by state-subsidized infrastructure projects, there has been a far greater impact from cost pressure and negative economic developments, compared to regions where composites are largely applied in sectors that have recovered more quickly from the economic crisis. In Germany, for instance, large volumes of composites have been flowing into research and development, transport and the electrical and electronics industries.

Funds for research and development, particularly in the mobility sector, have increased greatly in recent years, due to growing efforts to achieve lightweight construction. This has been of special benefit to the German market with its characteristic focal areas and state subsidies, says AVK.

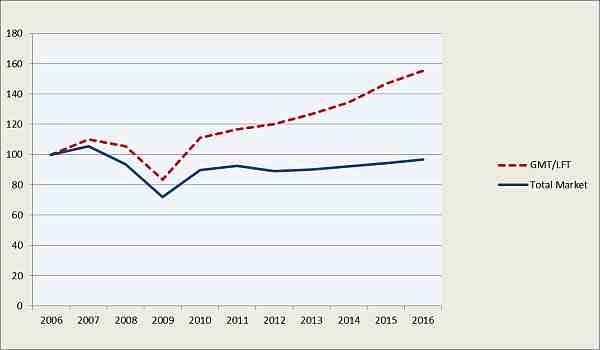

Figure 2

Another factor supporting this positive trend is an increased interest in thermoplastic composites systems. In recent years above-average growth has been noticeable both in long-fiber and continuous fiber-reinforced composites (LFT/GMT, see Fig. 2 comparing development of GMT/LFT with total market value; numbers above 100% show growth, numbers below 100% mean market shrinkage).

Due to the specific qualities of those material systems and especially their benefits in serial manufacturing, it is often believed that thermoplastic composites are beacons of hope, says the report, making it possible to move more vigorously into new areas of application, especially large-scale production and structural market segments.

For quite a while now – since 2000 – many AVK members have collaborated within a special workgroup on thermoplastic composites. The EATC (European Alliance for Thermoplastic Composites) comprises more than 20 companies and institutions, and is considered an “expert task force” of the AVK. Its activities include a regular seminar on the subject of thermoplastic Composites, which was recently held on March 2 in Weasel.

Also, nearly two years ago, several well-known raw material manufacturers formed an alliance under the umbrella of the AVK and decided to conduct a long-term project. Its purpose is to establish the more widespread use of continuous fibre-reinforced thermoplastics in the automotive industry. The project group is continually in touch with numerous OEMs, seeking to generate specific results that will eventually benefit the entire market. The first phase of this project was concluded recently, when the project group also decided to continue its work. A further roadshow on the subject has been scheduled for this summer, with a presentation of the latest results.

Take a look at the EATC’s web site, which has an interactive graphic at the “Automotive Applications” page (here’s the link: http://www.eatc-online.org/?page_id=11). At first glance, it looks completely blank. But, click on one of the automotive OEMs along the left side, and you’ll see that automaker’s parts, for each model, and what material is being used. A basic quick look at how many European OEM are incorporating composites, and in how many models.

CW will continue to keep tabs on the AVK’s market information, and we’ll of course report back on what we learn at the JEC World event — which will be heavily focused on composites’ inroads into mobility markets. Come visit us at our booth/stand in Hall 5, C75.

Related Content

Plant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreThermoplastic composites: Cracking the horizontal body panel nut

Versatile sandwich panel technology solves decades-long exterior automotive challenge.

Read MoreCarbon fiber, bionic design achieve peak performance in race-ready production vehicle

Porsche worked with Action Composites to design and manufacture an innovative carbon fiber safety cage option to lightweight one of its series race vehicles, built in a one-shot compression molding process.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.jpg;maxWidth=300;quality=90)