Mission critical: An additive manufacturing breakthrough in commercial aviation

The GE9X is the first commercial aircraft engine to reach production with significant additive content. The story of GE’s accomplishment and why it matters.

At last year’s World Economic Forum in Davos, Switzerland, the CEO of China’s largest online travel service predicted that the number of Chinese passport holders could nearly double in the next 24 months. If that sounds impossible, consider that less than 10 percent of Chinese citizens own a passport today. Then consider that from 2000 to 2017, the number of Chinese residents traveling outside of mainland China skyrocketed from 10.5 million to 145 million — an increase of nearly 1,400 percent — according to the China Outbound Tourism Research Institute.

The shockwaves of increased outbound travel from emerging markets such as China, not to mention India and the Middle East, are radiating across industries. But in many ways, this projected surge impacts one industry above all: commercial aviation.

Boeing and Airbus, respectively the first and second largest aerospace manufacturing companies in the world, each project that the in-service fleet of passenger and freight aircraft will double over the next 20 years to roughly 40,000. Meeting this demand will require unprecedented manufacturing rates enabled by new technologies, materials and processes. As one leading aerospace technology development director recently said, status quo production methods would require simply doubling the number of factories in existence today. If that scenario comes to pass, the skilled labor shortage alone will ensure that production takes place largely outside of the United States or Europe.

Yet, one blueprint for industrialized next-generation aerospace manufacturing may already exist. Boeing’s new 777X twin-engine jet will be powered by the GE9X, a massive high-bypass turbofan engine that boasts 304 additively manufactured parts integrated into seven multi-part structures. General Electric (GE) Aviation (Evendale, Ohio, U.S.) is currently printing these parts at its manufacturing plants in Auburn, Ala., U.S., and Cameri, Italy, while the largest, most fuel-efficient engine the company has ever produced is on track to gain final Federal Aviation Administration (FAA) certification this year.

That achievement would be the result of systematic changes to production methods and material selection across GE Aviation’s supply chain. According to Lara Liou, materials engineering leader at GE Aviation, the GE9X represents the first time the company has placed multiple additive manufacturing (AM) materials and modalities into production toward a single aviation application. In doing so, GE Aviation believes it has created a first-of-its-kind industrialized aerospace supply chain for additive manufacturing. Examining that process could provide clues as to how the commercial aviation industry plans to greet the coming wave of travelers.

A logistical leap

While news about additive manufacturing’s contributions to the GE9X has been widely reported, GE Aviation has (until now) never identified the seven additively manufactured components in the engine. They are:

- Fuel nozzle tip

- T25 sensor housing

- Heat exchanger

- Inducer

- Stage 5 low pressure turbine (LPT) blades

- Stage 6 LPT blades

- Combustor mixer

The internal process of identifying GE9X components suitable for additive manufacturing was necessarily complex. The company was able to leverage and build upon earlier successes printing intricate assemblies and complex geometries, namely the 3D-printed fuel nozzle for the LEAP engine — a part that’s still often pointed to as a prime example of industrial additive manufacturing’s promise.

The GE9X’s fuel nozzle is largely identical to that of the LEAP engine, which is often assumed to be the first 3D-printed part that GE Aviation identified and produced for additive manufacturing. However, the company first printed its T25 sensor housing units for more than 400 GE90 engines well before it printed its first LEAP fuel nozzle tips. When the first sensor appeared on a GE90-94B jet engine in 2015, it became the first additively manufactured aircraft engine part to receive FAA certification. All of which is to say that when initial work on the GE9X began around 2013, it was no surprise that the company decided to continue printing fuel nozzle tips and sensor housing units.

The GE9X heat exchangers and inducers are a different story. GE Aviation’s heat exchangers traditionally have been composed of dozens of thin metal pipes. The 3D-printed heat exchanger for the GE9X has a completely different profile, one that includes optimized channels and complex internal geometries that take full advantage of AM’s design freedoms.

The inducer was designed to improve engine durability, combining the design freedom of additive to meet the challenging technical requirements of GE Aviation customer needs worldwide. Ryan Chapin, design engineering leader at GE Aviation, says that the inducer represents the company’s continuous evolution from engine to engine: “One of the beautiful aspects of GE Aviation is that we can look at the GE90 on the Boeing 777 or the GEnx on the 787 Dreamliner, and learn from them to incorporate the new changes into the next engine so it continually gets better and better.” The GE9X inducer represents another example in which design engineers combined multiple component features into a single unit through additive manufacturing.

While the heat exchanger and inducer showcase significant efforts to advance that continuum for GE Aviation, the decision to print low-pressure turbine blades for the GE9X was a logistical leap of faith for the company. But it was a leap the company had been preparing for since 2013, the year it purchased a former supplier based in the rolling hills of northern Italy.

The ramp to production

Of the seven components and 304 parts being additively manufactured for the GE9X, all except the LPT blades and the heat exchanger are cobalt chromium alloy parts printed via direct metal laser melting (DMLM) on Concept Laser M2 machines. GE purchased the majority stakes in Concept Laser in 2016 — the same year it purchased Arcam AB and launched GE Additive. 2016 was also the same year that GE overhauled a former Dell Computers distribution warehouse in Cincinnati, Ohio, and turned it into a massive 3D printing facility and development center.

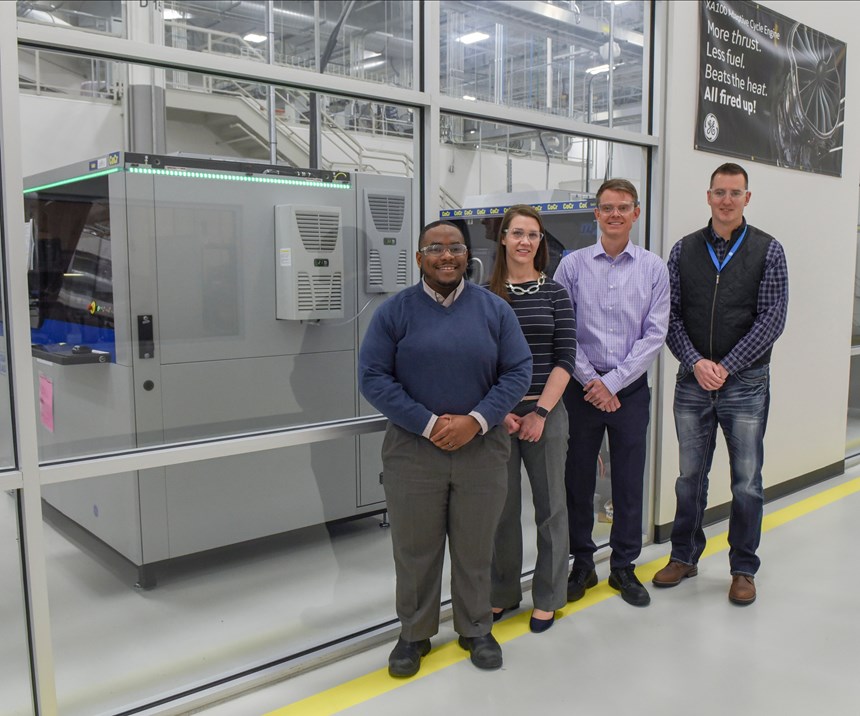

Eric Gatlin is general manager for the aviation additive integrated product team at the Additive Technology Center (ATC), the 125,000-square-foot epicenter of development for GE Aviation. The staff of 300 at the ATC is composed of co-located employees of GE Aviation and GE Additive who work across fields spanning material science, machine engineering, design, programming and logistics.

During my recent visit to the ATC, Gatlin’s team was transitioning the production of GE9X parts to the Auburn plant where the current LEAP fuel nozzle tips are being printed at a rate of 800 per week. “Looking at the scale of our additive manufacturing just in the industry right now, that's not insignificant volume,” Gatlinsays. “That's fully industrialized, high-volume manufacturing that will likely double this year.”

Back at the ATC in Cincinnati, Concept Laser machines are prepped and tested before being shipped to production facilities in Auburn and elsewhere, a task that leaves the number of machines onsite always in flux. But of the 80-to-100 metal 3D printers housed at the ATC on any given day, 18 Concept Laser machines have been dedicated for the past several months to the production of cobalt chromium (CoCr) parts, and F357 aluminum for the heat exchangers. Antroine Townes is the ATC site leader responsible for overseeing the transition from Cincinnati to Auburn. “It's a significant ramp into production,” he says, “steeper than that of the LEAP fuel tip. The ramp we saw in the LEAP engine sales was pretty significant for our supply chain. But the incline we’re expecting for the GE9X from 2019 to 2020 is even steeper, which is why we're building right now for 2020 demand.”

The road to additive production for the LPT blades was steeper still. The titanium aluminide (TiAl) blades are being printed at Avio Aero’s 3D-printing factory in Cameri, Italy. The modern facility houses 30 large, black Arcam A2x printers, each outfitted with a 3-kilowatt electron beam that can be used to produce up to six of the 15.75-inch blades at once. By the end of the year, there will be 50 machines there largely dedicated to LPT blade production.

Titanium aluminide provides a vastly superior strength-to-weight ratio than nickel alloys traditionally used for these parts. But that advantage comes at a price. Just as electron beam melting is a technologically demanding process, TiAl is a notoriously fussy material. Previously, GE Aviation had cast the TiAl blades in a foundry and then machined them to a final finish — a procedure that involved long lead times to create tooling and to machine the overly large castings. So, across the Atlantic Ocean, GE Aviation turned to Avio Aero’s extensive experience printing TiAl powder. The company had experimented with several parameters of the EBM process to customize it for the material, including increasing layer thickness and speed, and preheating the TiAl powder to avoid creating residual stress.

The resulting 3D-printed LPT blades are in many ways the culmination of GE’s investment in Avio Aero in 2013. One of the factors in favor of purchasing Avio was the company’s experience printing TiAl, which, in turn, Avio had become interested in after learning that GE Aviation was using it for the GE90 blades. The reason for both companies’ initial interest in the printed material is clear: The new TiAl LPT blades are a driving force behind the 10-percent gain in fuel efficiency the GE9X will boast. Considering that fuel accounts for nearly 25 percent of an airline’s operating costs, that’s an important number.

Gatlin also says that printing the blades represents a significant cost savings on the supply chain side of the business. “Raw material procurement capacity in the forging and casting space is constrained globally across many industries,” he says. “Not having to release tooling steel a year and a half or two years in advance of when you need the part is significant. Our ability to impact that and disrupt it is really where we see the most benefit of additive manufacturing.”

Additive is no different

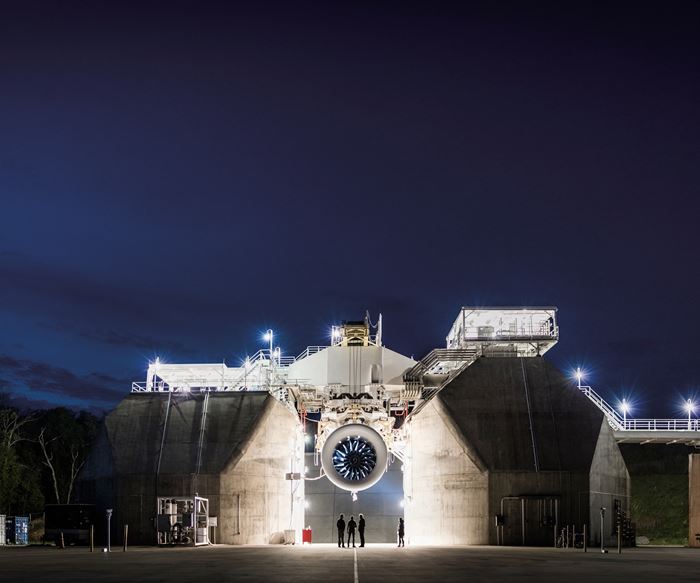

While researching commercial jet engine production, eventually you will run across video footage of a dead fowl being shot from a canon into a rotating fan blade. One example of that footage is of a test that took place at the GE Aviation facility in Peebles, Ohio, where, reportedly, a member of the FAA was lucky enough to choose the goose. Which is to say that the certification program for the GE9X (and all commercial aircraft engines) is something done in conjunction with, rather than being presented to, the FAA. And that’s crucial to the FAA’s ability to adapt its certification process to the rapid advance of additive manufacturing.

Materials engineering leader Lara Liou points out that the GE9X represents the first time GE Aviation has put multiple materials into additive production for an aviation application. “So now we're developing a true industrialized base and creating standards that already exist in other industries. Standards that help us to control production across multiple production sites; that help us to control across multiple raw materials suppliers; that help us to control across multiple materials and modalities — in other words, a foundation for a truly industrialized supply chain for additive manufacturing,” Liou says.

Creating those standards will be key for the FAA, which has maintained a presence in Cincinnati to learn right alongside the engineers at the ATC. “To me it's in parallel to other new materials and manufacturing technologies that we've introduced in the past,” Liou says. “Look at where we were in the early 1990s with polymer matrix composites and what we were doing to introduce fan blades and platforms. Nobody else was flying carbon [fiber]-reinforced materials in their engines at that time. We created that standard and worked with the FAA to ensure that all the proper controls were in place. So to me, we're really building off of a legacy of experience of introducing new materials and manufacturing methods. And additive is no different.”

As production begins for the printed GE9X components at the Auburn plant, the processes used to create those parts have long been locked down. What GE Aviation calls special process substantiation includes the commissioning of new machines, acceptance testing and calibration, and the creation and evaluation of the first material test bars. Every machine that hits the ATC floor goes through the same process that will be used at the high-volume facility.

“And it's no different,” Liou says: “I mean that process is no different than many of our other manufacturing processes where we know that any change could impact the final mechanical property outcomes of the part. We've put those processes through certification here, but I think the story is still to come on the GE9X. The real impact is going to be when our customers are flying, and they feel the impact of this additive manufacturing technology.”

Related Content

Welding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

Read MorePlant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

Read MoreA new era for ceramic matrix composites

CMC is expanding, with new fiber production in Europe, faster processes and higher temperature materials enabling applications for industry, hypersonics and New Space.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More