November 2015 — 42.9

Composites fabricators see materials price breaks, mid-level plants expand, future business expectations rebound.

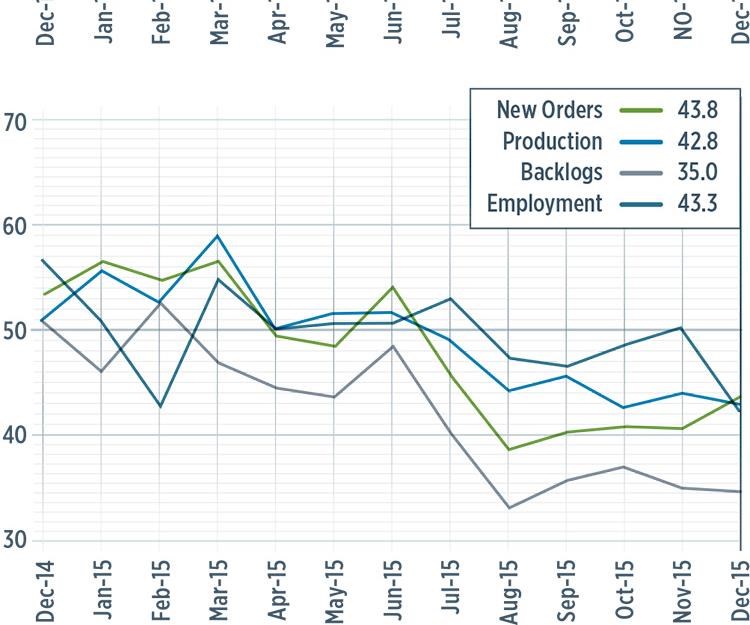

With a reading of 42.9 in December 2015, the Gardner Business Index for the US composites industry showed contraction for the eighth time in nine months. At that point, the rate of contraction had remained virtually unchanged during the past five months.

New orders in December had contracted for the sixth month in a row. However, the index had been contracting at a decelerating rate since August. The production subindex also had contracted six months in a row. However, its rate of contraction had been relatively consistent over that time period. The backlog subindex continued to contract at a significant rate in December, but the rate of contraction had slowed somewhat since August. But, the trend in backlogs indicated falling capacity utilization at composites fabricators. The employment subindex decreased sharply in December, falling to its lowest level since the GBI began in December 2011. Exports continued to contract because of the strength of the US dollar over the past year. Supplier deliveries shortened for the first time since the survey began. This indicated increasing slack in the US composites industry supply chain.

Materials prices decreased for the first time since December 2011. That subindex dropped significantly in December after peaking in July 2015. Prices received decreased for the third month in a row. In December, they were decreasing at their fastest rate since the survey began for the second month in a row. Future business expectations rebounded noticeably in December.

After expanding significantly in the preceding three months, composites manufacturing plants with more than 250 employees had a subindex in December of 40.9. The weakening conditions at large facilities was a significant reason for the slight decline in the overall index. While the largest facilities contracted, plants with 100-249 employees expanded for the second time in three months, recording their strongest subindex since April 2015. Facilities with 50-99 employees had a subindex above 40 for the first time since August. Companies with 20-49 employees continued to contract, but at a slower rate, while those with fewer than 20 employees posted a subindex below 40 for the first time since December 2012.

The four largest categories of composites fabricators based on the primary NAICS codes of CW’s circulation list are job shops, automotive, custom processors and aerospace. In December, job shops had contracted for the past six months while custom processors had contracted four of the previous five months. Those who serve the automotive industry had mostly expanded since December 2013. However, that category contracted in November and December. Those who serve the aerospace industry expanded significantly in October and November but in December, they posted their lowest subindex since June.

Future capital spending plans remained well below their historical average. But compared to one year earlier, the rate of contraction had decelerated since September. So, there was some very modest improvement in future capital spending plans.

.JPG;width=70;height=70;mode=crop)