The markets: Automotive (2015)

Composites — in particular, those reinforced with carbon fiber — continue to make headway into the automotive world, but suppliers of competing steel and aluminum are fighting back.

According to market research firm Lucintel (Dallas, Texas), sales of cars and light trucks were projected to reach 15.6 million units in 2013, up from 14.7 million vehicles in 2012, driven mainly by low interest rates, increasing consumer confidence and vehicle replacement. The demand for composites in the U.S. automotive market grew by 8.8% in 2013. Increasing use of composite materials in racecar and high-performance street-vehicle components, such as chassis, hoods, wheels and roofs, is one of the driving factors for the increase in composites penetration in the automotive industry. Composite materials are now regularly used in some production passenger cars, in interior headliners, underbody systems, bumper beams and instrumental panels.

Pressure to expand composites use in passenger cars will increase: Corporate average fuel economy (CAFE) standards in the US will require manufacturers to achieve a fleet average of 35.5 mpge by 2016 and then hit 54.5 mpge by 2025. In the European Union (EU), CO2 emissions restrictions will reduce passenger cars emission limits from 130g of CO2/km today to a much more difficult-to-achieve 95g of CO2/km in 2020. Automakers are a mere two model development cycles from these compliance due dates. Faced with the one-two punch in fuel-economy and carbon-dioxide (CO2) emission standards, the auto industry has made lightweighting a design imperative. Significantly, the major automakers that produce more than 90% of all vehicles sold in the U.S. announced their support for the new standards. So they’re motivated.

Although composites remain a viable candidate as the means of compliance via lightweighting of next-generation vehicles, the competition showed it is unlikely to yield without a fight. Industry consultant and CompositesWorld contributing writer Dale Brosius points out that the introduction of the aluminum-intensive 2015 Ford F-150 pickup, a vehicle known for durability, and Ford’s best selling model in North America, sends a strong signal. By using aluminum in the body and structure, Ford claims a weight reduction that exceeds 318 kg. In mid-February 2014, GM followed Ford’s lead, signing major contracts with aluminum sheet suppliers to convert its line of pickups from steel to aluminum in 2018. This shift to aluminum for high-volume trucks is seen as the easier choice in an environment still dominated by “metal benders.”

The steel industry, however, has been busy as well: During an Executive Session at the 2014 SPE Automotive Composites Conference and Exhibition (ACCE), Harry Singh the executive program manager at design firm EDAG (Fulda, Germany), pointed out that the steel industry has reinvented itself, quoting a cost of only US$500 for a complete steel car body. Today’s steel, he added significantly, is 10 times stronger and better in quality than that of a decade ago. He did admit that, given the new CAFE standards, “any material is on the table, due to the activity in many areas.” And Dr. Peter Friedman, manager of manufacturing research at Ford Motor Co. (Dearborn, MI, US) noted that automakers cannot simply substitute new materials for old. “We try to be material-agnostic,” he explained, “and use any material where it needs to be within a multi-material vehicle.”

New, lighter-weight aluminum and steel alloys have captured the attention of OEMs and will increase the competitive pressure composites proponents face to a greater degree than many realize in the automotive market. Composites proponents are seeing that as a wake-up call. The trend is clear: the need for change is putting lightweight materials in the spotlight. But it’s also clear that composites will share a crowded stage. A key question will be, Can the composites industry meet cost and volume challenges?

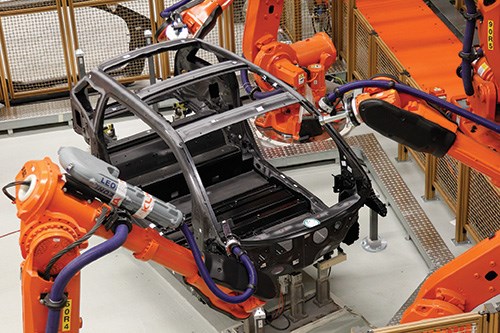

For automakers on the high end in terms of price and the low end in terms of production volume, composites are finding their place. The much-discussed BMW i3, BMW AG’s (Munich, Germany) first fully electric vehicle and a followup, the industry’s first plug-in hybrid, two-plus-two sports car, the BMW i8, both feature a passenger cell and other parts made from carbon fiber composites. They will be joined by other “i”-series cars and by cars from other automakers.

So-called “snap-cure” resin technologies, both epoxies and polyurethanes, began to make a mark in the strategic thinking behind automotive mass-production strategies. Momentive Specialty Chemicals (Columbus, Ohio) introduced a 5-minute-cure epoxy in 2011, and others have followed. Today, 2 minutes is the talk. At CAMX 2014, Hexcel (Stamford, CT, US) introduced a good example: A snap-cure prepreg, with a 2-minute cycle at 150°C (80 bar pressure), formulated for automotive production. Its low tack reportedly enables the prepreg to be cut into precise shapes by laser cutter, then oriented, assembled and consolidated into flat preforms by robot. The high Tg of 125°C enables demolding of cured parts while hot for a faster production cycle — all necessary attributes if an automotive application is to be successful.

And in the push to reduce vehicle weight, automotive designers in Germany are focusing on hybrid structures rather than choosing between metals and plastics/composites. Prof. Dr. Jürgen Leohold, head of Volkswagen Group Research (Wolfsburg, Germany), explains: “Expensive lightweight materials, by themselves, aren’t enough. Rather, an intelligent multi-material mix is required for success in the market.”

The hybrid trend, and the production methods it spawns, have exploded over the past 3-4 years. Volkswagen, which has proudly touted cutting 23 kg from the Golf VII using high-strength steel — not carbon fiber — has nevertheless formed the Open Hybrid LABfactory in a new 7,000 m2 facility located near Wolfsburg. With partners, VW will develop hybrid multi-material structural components, made of plastic, metal and high-performance fibers in a single production step. The facility is expected to be operational in 2015.

Another example of the hybrid trend is the CAMISMA car seat back: Funded by the German Federal Ministry of Education and Research (BMBF, Bonn and Berlin) and, like Volkswagen’s Open Hybrid LABfactory effort, a product of collaborative work on the part of a number of automotive supply chain representatives, CAMISMA’s complex automotive seat back combines recycled discontinuous carbon fiber mat, continuous unidirectional carbon fiber tapes impregnated with polyamide 12 (polymerized after fiber impregnation), and injection molded glass fiber thermoplastic, in a one-shot, short-cycle fabrication process that combines thermoforming and injection molding. To read more about the project, click on “CAMISMA’s car seat back: Hybrid composite for high volume,” under “Editor’s Picks,” at top right.)

A number of other collaborative projects with similar goals have sprung up elsewhere in Germany and are at various stages of research, development and implementation.

In the automotive industry, carbon fiber is now big news. Despite grumblings about its cost, most auto OEMs are, at a minimum, privately conducting R&D efforts in active pursuit of carbon fiber-reinforced polymers (CFRP) — a key means to lightweight production passenger vehicles and light trucks — as they seek to comply with impending CO2 emission and fuel-economy regulations. European automakers are leading the way. Some have already fielded commercial vehicles with significant CFRP content, creating quite a stir, both in the trade press and public media. Largely absent from public discussion, until recently, has been the cost of, and the means for, compliance with the European Union (EU) end-of-life-vehicle (ELV) directive. It requires that 85 percent, by weight, of the materials used in each car and light truck built for the 2015 model year and beyond must be reusable or recyclable. Metals and neat plastics — amorphous materials — have proven recycling track records. But CFRP does not. Yes, the ELV does permit some disposal — up to 10% of the vehicle’s weight can be incinerated and the remaining 5% can find its way into a landfill. But the math doesn’t work: If carbon fiber is to become a significant tool in the automaker’s lightweighting toolbox, recycling of CFRP from ELVs is an imperative.

The good news is that this problem, once considered almost intractable, is proceeding apace toward solution. In the near term, reclamation and repurposing of CFRP waste streams (off-spec material, scrap from cutting/trimming operations, etc.) in the form of dry fiber and prepreg is the focus. Tim Rademacker, a managing director at CFK Valley Recycling (Stade, Germany), cites an estimated demand for virgin fiber in 2014 of 50,000 MT, noting that if 30% of that ends up as production waste — a commonly quoted figure — the result is roughly 10,000 MT of commercial recycled carbon fiber (RCF) before end-of-life (EOL) structures are considered. Commercial recyclers also point out that RCF offers a 20-40% cost savings vs. virgin fiber. (Read more about carbon fiber recycling for automakers online at “Recycled carbon fiber update: Closing the CFRP lifecycle loop,” under “Editor’s Picks.”)

Related Content

Seat frame demonstrates next-generation autocomposites design

Light weight, simplified/cost-effective manufacturing, passenger comfort and safety informed materials and process innovations and won awards for the 2022 Toyota Tundra‘s second-row seat frame.

Read MoreAptera reveals first composite production parts for BinC vehicle

Pre-production efforts are underway to begin building production-intent vehicles.

Read MoreComposites end markets: Automotive (2024)

Recent trends in automotive composites include new materials and developments for battery electric vehicles, hydrogen fuel cell technologies, and recycled and bio-based materials.

Read MoreBcomp ampliTex makes appearance in Cupra EV Cup Bucket seats

The entire Cupra Born VZ line-up features all-natural fiber front seats that highlight functionality, aesthetics and reduced CO2 emissions.

Read MoreRead Next

Recycled carbon fiber update: Closing the CFRP lifecycle loop

Commercial production of recycled carbon fiber currently outpaces applications for it, but materials characterization and new technology demonstrations promise to close the gap.

Read MoreCAMISMA’s car seat back: Hybrid composite for high volume

Recycled fibers, in-situ polymerized PA12 and steel inserts combined in one-shot process to cut weight 40 percent at competitive cost, cycle time and safety.

Read More