Recycled carbon fiber update: Closing the CFRP lifecycle loop

Commercial production of recycled carbon fiber currently outpaces applications for it, but materials characterization and new technology demonstrations promise to close the gap.

In the automotive industry, carbon fiber is big news. Despite grumblings about its cost, most auto OEMs are, at a minimum, privately conducting R&D efforts in active pursuit of carbon fiber-reinforced polymers (CFRP) — a key means to lightweight production passenger vehicles and light trucks — as they seek to comply with impending CO2 emission and fuel-economy regulations. European automakers are leading the way. Some have already fielded commercial vehicles with significant CFRP content, creating quite a stir, both in the trade press and public media.

The CFRP lifecycle loop is indeed closing: Carbon fiber reclaimed from end-of-life sources — aging aircraft and, eventually, scrapped automobiles — can be repurposed for use in automotive composites applications. But current RCF production outpaces uptake from commercial applications

Photo Credit: MIT-RCF

An inconvenient truth

Largely absent from these discussions until recently has been the cost of, and the means for, compliance with the European Union (EU) end-of-life-vehicle (ELV) directive. It requires that 85 percent, by weight, of the materials used in each car and light truck built for the 2015 model year and beyond must be reusable or recyclable. Metals and neat plastics — amorphous materials — have proven recycling track records. But CFRP does not. Yes, the ELV does permit some disposal — up to 10% of the vehicle’s weight can be incinerated and the remaining 5% can find its way into a landfill. But the math doesn’t work: If carbon fiber is to become a significant tool in the automaker’s lightweighting toolbox, recycling of CFRP from ELVs is an imperative. The good news is that this problem, once considered almost intractable, is proceeding apace toward solution, thanks to a determined and growing effort to develop CFRP recycling

technologies.

Two-pronged attack

Recycling strategies are focused on two fronts. The first is the reclamation and repurposing of CFRP waste streams (off-spec material, scrap from cutting/trimming operations, etc.) in the form of dry fiber and prepreg.

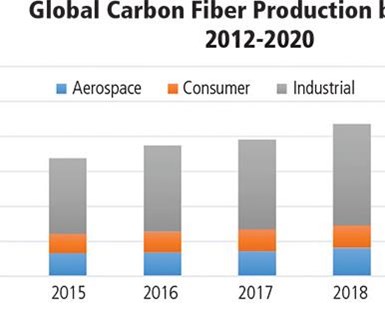

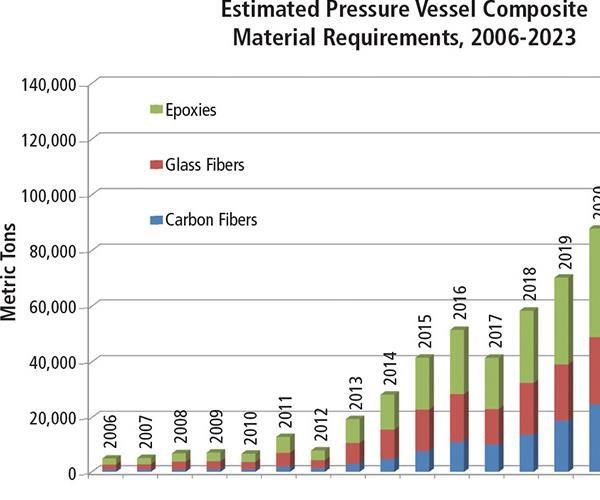

Fig. 3: Forecast sales growth from one carbon fiber producer aligns well with RCF potential in consumer and industrial applications.

Photo Credit: Composites Forecasts & Consulting LLC

Tim Rademacker, a managing director at CFK Valley Recycling (Stade, Germany), cites an estimated demand for virgin fiber in 2014 (See Fig. 3, at left) of 50,000 metric tonnes (110 million lb), noting that if 30% of that ends up as production waste — a commonly quoted figure — the result is ~10,000 metric tonnes/~22 million lb of commercial recycled carbon fiber (RCF) before end-of-life (EOL) structures are considered. Recyclers predict that automakers will be big beneficiaries of fibers reclaimed from carbon fiber waste streams generated by fabricators in other industries. “We can receive up to 50 metric tonnes of CF waste in a given month from wind,” claims Alex Edge, sales and business development manager for recycler ELG Carbon Fibre Ltd. (Coseley, U.K.), noting that much of it is generated when materials are kitted for turbine blade layup.

“Most of our incoming waste is from aerospace and automotive,” says Rademacker, who, unlike Edge, says, “We are not seeing much from wind yet, which still uses mostly glass fiber.”

The RCF from aircraft sources is especially promising. “Aerospace generates tons of waste,” says Edge,” but it has to be used in other markets.” One big reason is that fiber reclaimed by current means is chopped. Currently unusable in wind turbine and aircraft structures (aircraft interiors are the one exception), discontinuous fiber has long been a staple of automotive composites, particularly in auto interiors and under the hood. “We have been doing a lot of work over the past few years with large OEMs, both in aerospace waste supply and automotive end-use of recycled products,” says Edge.

Given this, the recycler’s feedstock today is primarily from waste. Recyclers, however, don’t see waste processing as an end in itself. In the longer term, they want to help users of CFRP “close the loop”: If automakers must ensure that automotive materials are recyclable, then it is to their great advantage to reuse fiber reclaimed from EOL vehicles in the production of new vehicles. Waste processing, then, is seen as an important first step as recyclers gear up to process the increasing number of CFRP parts that will reach EOL every year.

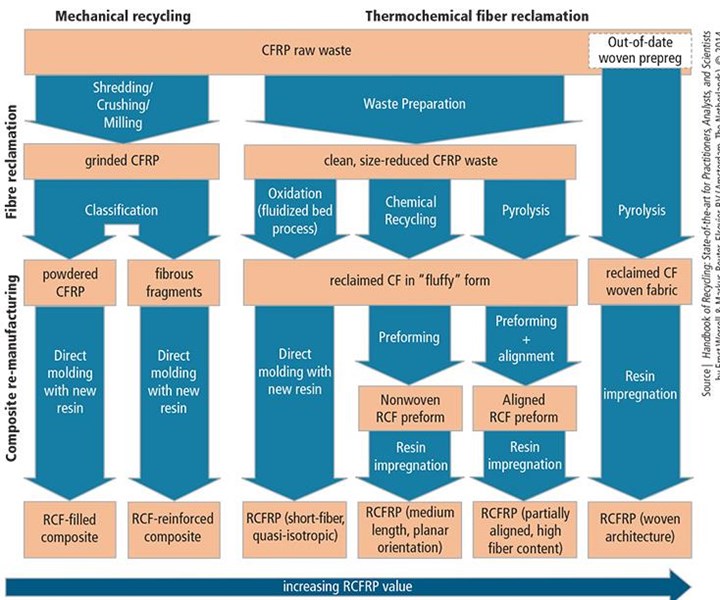

Although several methods have been conceived for recycling carbon fiber, including some that maintain long fibers and even preserve fabric weaves, all of the current commercial RCF is subjected to pyrolysis (see Fig. 1 and, for more information, see it editor's note at the end of this article). Incoming waste is sorted by type (dry fiber, prepreg, EOL parts) and, in some cases, by fiber type. EOL parts are crushed or chopped, and all materials are shredded to a homogeneous size, which increases bulk for pyrolization. Pyrolysis vaporizes the remaining matrix material on crushed EOL parts and prepreg waste (which is then drawn off via ventilation), but, importantly, leaves the fiber intact. It also removes sizings and binders from the fibers. After pyrolysis, as noted below, custom conditioning may include tailored fiber sizing and/or binders applied to the reclaimed fiber’s surface for a customer’s specific reuse.

Fig. 1: Current commercial RCF production uses pyrolysis and outputs milled and chopped fiber, reinforced thermoplastic pellets for injection molding, nonwoven roll goods and more advanced 3-D and aligned preforms. Source: Handbook of Recycling: State-of-the-art for Practitioners, Analysts, and Scientists by Ernst Worrell & Markus Reuter, Elsevier BV (Amsterdam, The Netherlands), © 2014

Commercial capacity

In a few short years, recycling operations have progressed from pilot projects to commercial production facilities. Although their names have changed and others have joined the fray, the major players remain the same.

In 2011, German metals recycler ELG Haniel (Duisburg, Germany) acquired Recycled Carbon Fibre Ltd. (Coseley, U.K.; previously Milled Carbon Group) and its commercial-scale recycling plant (commissioned in 2009), renaming it ELG Carbon Fibre.

Why would a metals recycler enter the RCF market? “They saw more and more metals contaminated with carbon fiber and an opportunity to capture high value out of aerospace waste,” explains ELG Carbon Fibre’s Edge. “We process 2,000 metric tonnes [4.4 million lb] of waste and generate 1,000 metric tonnes of reclaimed CF per year using a patented pyrolysis process and a 21m/69-ft long belt furnace.”

ELG CF sorts the waste and shreds it. “We then use an automated system to call out a selected waste volume from one of four storage bunkers,” Edge details, “which is then transported to the furnace.” Fibers are then processed to produce chopped, milled or pelletized fiber products, and a needle-punched mat is in development.

Fig. 2: Recycler ELG Carbon Fibre (Coseley, U.K.) produces milled fiber (left), with average length of 100µ; chopped fiber (center), with random lengths (6 to 60 mm); and lightly compacted thermoplastic pellets (right) made with milled or chopped fiber and matrix-compatible binders

Photo Credit: ELG Carbon Fibre

Edge says interest in both milled-fiber and long-fiber pellets used in long fiber thermoplastics (LFTs) has increased. ELG CF is working with 10 to 20 LFT industry suppliers and offers a standard 6-mm/0.24-inch diameter pellet using 6-mm to 10-mm (roughly 0.2-inch to 0.4-inch) long fibers (see Fig. 2). The company says it can tailor formulations, such as a PEEK-compatible binder vs. the standard system for nylon (polyamide or PA) and polypropylene (PP) thermoplastics. “There is a big push for long-fiber injected parts,” Edge observes, “and CF has a real benefit vs. talc and silica fillers. We are well-matched to that outlet and have only recently started looking at the opportunity in thermoset compounds.”

Founded in 2005, Materials Innovation Technologies LLC (MIT LLC, Fletcher, N.C.) began reclaiming carbon fiber in 2009 and opened its Lake City, S.C., commercial recycling facility, MIT-RCF, on the strength of equity investments from South Carolina Research Authority (SCRA, Columbia, S.C.) and Toyota Tsusho America (Maryville, Tenn.). Renamed Carbon Conversions Inc. in 2015, the company processes streams from multiple sources: dry scrap from fiber manufacturers, braiders and weavers; uncured prepreg from prepreggers, Tier 1s and OEMs; and fully cured parts. Sorting is a priority. “Customers want a defined input for the preform or roll goods they will use,” explains Carbon Conversions president and COO Mark Mauhar. “There is one type of part and one type of fiber per batch. We track the material pedigree very closely.”

Fig. 4: Recycler MIT-RCF (Lake City, S.C.) converts chopped RCF into 3-DEP preforms, continuous nonwoven roll goods and pellets for LFT. Applications successfully demonstrated include automotive parts like the door bolster support for the Ford Escape and the 2014 C7 Corvette's upper plenum (pictured here).

Photo Credit: MIT-RCF

After pyrolysis, Carbon Conversions sells the resulting chopped RCF directly or converts it into LFT pellets or into rolls of chopped fiber mat. Mat weights range from 50 to 1,000 g/m2 (1.5 to 29.5 oz/yd2), and in widths up to 49 inches/1.2m. Value-added products include blends of chopped carbon and thermoplastic fibers — e.g., 60% polyphenylene sulfide (PPS)/40% CF — produced by the firm’s proprietary Co-DEP process (see Fig. 4). Carbon Conversions also fabricates net-shape preforms as large as 1.8m by 1.8m/5.9 ft by 5.9 ft, using its patented 3-DEP slurry forming process, which offers high uniformity (areal weight standard deviation of 1-3%) and cycle times of one to two minutes, regardless of size. Mauhar summarizes, “We have very flexible processes that can tailor materials and produce uniform thickness and weight with low variation in properties.”

Indeed, the company has multiple automotive parts on the path to adoption and is working to validate new high-speed processes to transform its RCF products into cost-effective automotive parts. Carbon Conversions’ growth plan is to expand facilities once the market catches up. According to Mauhar, “We need to hit 3 [million] to 5 million lb/yr of reclaimed fiber sold before we expand capacity.”

Environmental and disposal services group Karl Meyer AG began work on recycling with CFK Valley e.V. (Stade, Germany) in 2005, establishing an industrial-scale RCF facility called CFK Valley Recycling, in 2007. In 2010, the company moved to Wischhafen, Germany. Today, its plant can yield up to 1,000 metric tonnes (more than 2.2 million lb) of RCF per year and has long-term disposal contracts with airframer Airbus (Toulouse, France), automakers Bugatti (Molsheim, France) and BMW (Munich, Germany) and other CFRP market leaders, to guarantee its raw material supply. It also founded carboNXT GmbH as the distributor for its chopped and milled RCF products.

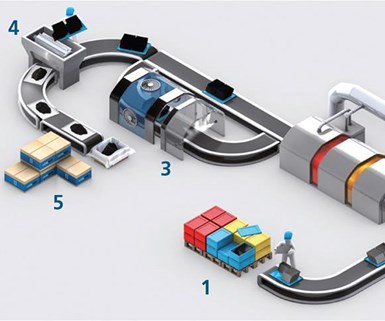

Fig. 5: CFK Valley Recycling touts an automated process that enables the company to offer RCF customers high-quality, customizable products, such as mats and veils. Process steps include: (1) sorting, (2) pyrolysis, (3) tailored surface treatment (4) cutting to tailored length and (5) distribution

Photo Credit: CFK Valley Recycling

CFK Valley Recycling sees preparation of fiber for customer reuse as an important value-added feature of the recycler’s mission (see Fig. 5). The focus is fiber-to-matrix adhesion. “We have modified our process so that we have no bonding issues, in response to market demand,” explains CFK’s Rademacker. “For thermosets, we can reapply sizing, and for thermoplastics we can add a specific binder in order to maximize matrix adhesion.” Fiber length also can be customized, for example, to meet compounding needs.

“We have invested in textile machinery and can produce nonwovens,” adds Rademacker. These range in width from 1,100 to 1,300 mm (43 to 51 inches) at weights from 10 g/m2 (0.3 oz/yd2), using a wet-lay process, to 600 g/m2 (18 oz/yd2) using an air-lay method.

From pull to push

Scaled up to deliver commercial quantities of customer-friendly RCF, the major players’ footing is more firm, but the road ahead is not yet straight and smooth. Four years ago, the recyclers’ big concern was the security of their raw material supply (see “Learn More”). But Carbon Conversions’ Mauhar says that’s no longer the case: “Aircraft manufacturers are generating so much waste as they ramp production rates that the volume of scrap is ahead of the market for the reclaimed products.” And there is no doubt that there will be a sufficient supply of EOL feedstocks: 35 million vehicles enter the recycling infrastructure each year — 13 million in North America and 11 million in Western Europe. Further, the earliest aircraft that were built with CFRP components are likely to reach EOL within the next 10 years, and more than 12,000 aircraft will be retired worldwide over the next two decades, just before the first CFRP-laden Boeing 787 and Airbus A350 XWB aircraft are ready to retire.

For fiber reclamation specialists, then, the present concern is reselling what they are already capable of processing. Current estimates of combined RCF capacity run from 3,500 to 5,000 metric tonnes (>7.5 million to 11 million lb) per year.

The greatest sales potential lies with high-volume automotive applications. Mauhar believes reuse of RCF could be accelerated if waste generators, recyclers and automotive users worked together to complete required development. Although some fiber and textile producers (see “Carbon fiber recycling update: The supply side” at the end of this article or clock on its title under "Editor's Picks") and some OEMs are recycling their own waste — most notably, BMW — few players within the CFRP supply chain have committed to using RCF produced by commercial recyclers.

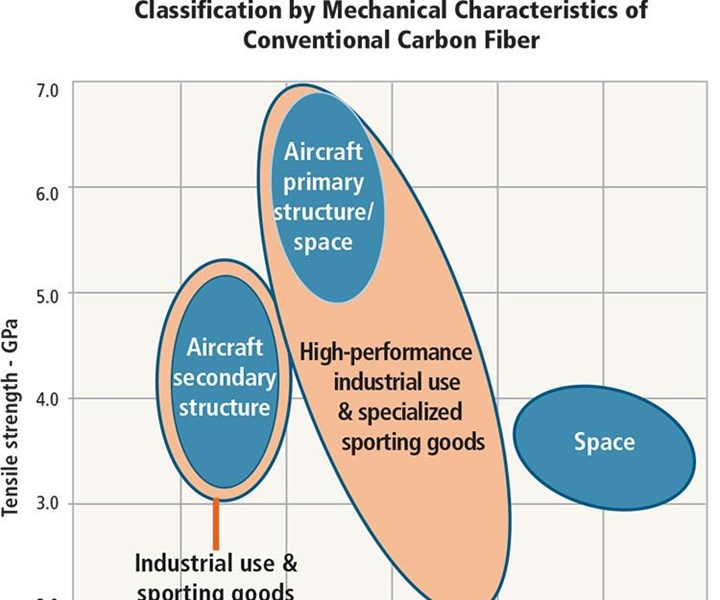

Recyclers admit that the market for RCF applications is lagging but claim that the issue is not mechanical performance: RCF studies reportedly show tensile strength and modulus well within fiber producers’ targets for virgin products in industrial applications (see Figs. 6 & 7).

Fig. 6: Comparison of recycled carbon fiber (RCF) vs. virgin carbon fiber (VCF) in terms of modulus (E) and strength (X). Source: Handbook of Recycling: State-of-the-art for Practitioners, Analysts, and Scientists by Ernst Worrell & Markus Reuter, Elsevier BV (Amsterdam, The Netherlands), © 2014

Fig 7: When it is reused in new parts, pyrolysis-produced RCF can reach the carbon fiber producer-defined industrial envelope of 200 to 300 GPa for tensile modulus and minimum 3 GPa for tensile strength.

Photo Credit: CW

Further, reclamation of longer fibers is a possibility. According to a 2014 report by Hitachi Chemical (Tokyo, Japan), the Japan Carbon Fiber Manufacturers Assn. (JCMA) recycling plant now jointly managed by Toray Industries and the Teijin Group (both based in Tokyo, Japan) and Mitsubishi Rayon Co. Ltd. (Osaka, Japan), has been expanded to include a pyrolysis process that, unlike JCMA’s older 1,000 metric tonnes/yr (2.2 million lb/yr) line, does not require preshredding. Developed by Takayasu Co. Ltd. (Kakamigahara City, Japan), this new process reportedly has a capacity of 60 metric tonnes/yr (132,000 lb/yr). And even newer recycling methods, designed to reclaim continuous fibers (see “Recycled carbon fiber: Comparing Cost and Properties”) and methods for aligning discontinuous RCF (e.g., oriented vs. random) indicate that, sometime soon, recyclers might be able to offer RCF products capable of performance near aerospace targets.

Commercial recyclers also point out that RCF offers a 20-40% cost savings vs. virgin fiber. That’s no empty claim. The Carbon fiber/Amid (short for polyamide)/Metal Interior Structure using Multi-material System Approach (CAMISMA) project recently demonstrated the potential for RCF in thermoplastic processes. Tier 1 automotive seat supplier Johnson Controls (JCI, Burscheid, Germany) and partners successfully molded a CFRP seat back using RCF materials that cut weight more than 40% vs. conventional metallic designs without exceeding the project’s $5 in cost per saved kg limit. (The process is described in this issue’s “Inside Manufacturing” feature, titled "CAMISMA's car seat back: Hybrid composite for high volume.". For the automakers concerned about fiber cost, such data might not end the grumbling, but could reduce its decibel level.

Obstacles to adoption are the same as those composites proponents confront as they seek to replace legacy materials: Poor education, disruption of established supply chains and the need for credible demonstrations of waste-to-reuse process viability and RCF end-product performance.

Proving RCFRP producibility

SGL Automotive Carbon Fibers (Wackersdorf, Germany) processes CF scrap from weaving and preform kitting operations for reuse in the BMW i-series CFRP Life Module. Reclaimed fiber is incorporated into stitched nonwoven materials (see next photo), which are then molded into the i3’s rear seat structure and roof sections for both the BMW i3 (pictured) and i8.

Photo Credit: BMW

Those looking for an educational demonstration of this sort, however, need look no further than the high-profile BMW i3 and i8 vehicles (see “BMW Leipzig: The epicenter of i3 production” under "Editor's Picks"). Somewhat obscured by the publicity surrounding BMW’s development of its vertically integrated supply chain for virgin heavy tow, is the automaker’s reuse of production scrap in the roofs for the i3 and i8 and in the i3’s rear seat structure. SGL Automotive Carbon Fibers (SGL ACF, Wackersdorf, Germany) collects weaving and preform-kitting scraps from production of the i vehicles’ CFRP Life Modules and cuts them into chips, which are then processed to open the constituent fibers, followed by mechanical carding to disentangle and align the fibers (see “Recycled carbon fiber: Comparing Cost and Properties” under "Editor's Picks"). The fibers are then layered in different angles — according to where the final part will be used — and stitched to form nonwoven textiles (mats or fleece).

Stitched nonwoven recycled carbon fibers like this molded into the i3’s rear seat structure and roof sections for both the BMW i3 and i8.

Photo Credit: BMW

The nonwovens for the roof structures are molded using high-pressure RTM (HP-RTM) and Araldite epoxy resin from Huntsman Advanced Materials (The Woodlands, Texas and Basel, Switzerland), while the self-supporting rear seat shell uses BASF’s (Ludwigshafen, Germany) Elastolit polyurethane (PUR), reportedly the first CF/PUR part in series production. Molded by automotive seating specialist F.S. Fehrer (Kitzingen, Germany), the part also integrates a cupholder attachment and a storage tray. This reduces assembly steps and part weight, and the part meets crash requirements with a mere 1.4-mm/0.6-inch wall thickness.

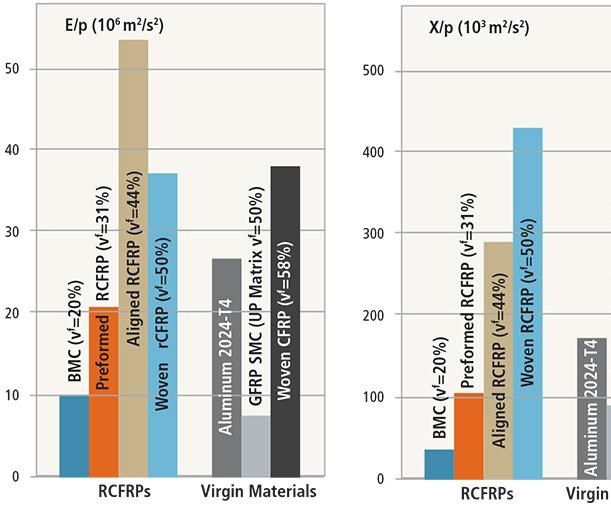

Carbon Conversions also sees the necessity for demonstrating that RCF products can meet automaker needs (Fig. 8 compares RCF materials with legacy materials). Mauhar says, “We are working with Roctool Inc. [Charlotte, N.C.] to demonstrate our materials in its fast-cycle-time molding processes.” Toward that end, RocTool is seeking to improve the speed of RCF thermoforming via its Light Induction Tooling (LIT). LIT uses an induction-heated (no fluids) and cooled steel cavity tool and silicone core with vacuum assist to mold parts without preform preheating and only 8 bar of air pressure. RocTool says the tools cost one-fifth that of those used in traditional methods with cycle times as short as 105 seconds.

Fig 8: Specific mechanical properties (divided by density, (ρ) including tensile modulus (E) and tensile strength (X) of typical RCFRP vs. virgin structural materials. Source: Handbook of Recycling: State-of-the-art for Practitioners, Analysts, and Scientists by Ernst Worrell & Markus Reuter, Elsevier BV (Amsterdam, The Netherlands), © 2014

Trialed materials include PP, PET and PA12 with RCF and other fibers, and, according to RocTool North America president Mathieu Boulanger, LIT offers both textured and glossy surfaces. Capabilities can include inmold decoration, and postmold results reportedly include zero warpage, even with thin (1-mm/0.04-inch) laminates. “The opportunity to mold thousands of parts per day using RCF materials could really change the current landscape,” he says. Mauhar adds that volume production is a must if significant percentages of recycled CFRP waste are to be reused successfully and complete the circle for carbon composites sustainability.

Real progress = real parts

CFK’s Rademacker believes that CF use will increase, especially in autocomposites, where BMW has clearly demonstrated the value of both virgin fiber and recycled production waste, each optimized accordingly. “They will transfer this into their series products for use in partial structures,” Rademacker predicts. Indeed, SGL ACF says 10% of the CFRP used in the BMW i vehicles is recycled, and BMW has already declared that it will apply its CFRP technology beyond its i and M models. “Here is where there is opportunity for recycled carbon fiber as well.” He also sees others in the auto industry looking increasingly to thermoplastic applications. Quoted widely by the auto industry press, BMW’s lightweight construction manager Franz Storkenmaier has listed seat frames, instrument panel frames and spare wheels as RCF targets and recently told Auto Express magazine: “Carbon fiber is an expensive material to work with, but if you are using production waste, then it’s a different cost structure from working up raw carbon fiber.”

Indeed, Carbon Conversions has developed a hood inner for a mid-volume vehicle that is completing OEM demonstration. The company sees potential for more applications in luxury models. It also has submitted a quote to a Tier 1 supplier for an SUV produced at 500,000 vehicles/year. “This is an interior part, using our Co-DEP process and thermoplastic fibers, which can be mixed with RCF and other fibers,” Mauhar explains, claiming that Carbon Conversions offers a 30% lighter, cost-neutral replacement for the natural fiber/thermoplastic used for door inners and interior backing structures in Europe, and a 40% lighter, cost-neutral replacement for the injection molded acrylonitrile butadiene styrene (ABS) used in the U.S.

But Rademacker says several issues still hinder widespread adoption of RCF. Working only with large CF waste producers, he contends, isn't beneficial because they already have established supplier bases that they are not interested in disrupting because the materials and suppliers are already qualified. He suggests that opportunities lie, instead, with large waste sources that also need new forms of raw CF materials — forms that still need to be refined and qualified. This is one big reason why recyclers are targeting the auto industry. Further, virgin fiber customers are accustomed to specifying strength and modulus. “I can sort the incoming waste and affect the RCF properties,” Rademacker explains, “but the industry needs applications that fit the products we can supply, based on the waste streams already established. The designers need to think about where these products can be used,” he adds, “We still must develop a better understanding of what RCF products will produce in the final parts.”

Editor's note: Read more about solvolysis and other alternatives for reclaiming carbon fibers in “Recycling carbon fibre reinforced polymers for structural applications: Technology review and market outlook,” authored by Soraia Pimenta and Silvestre Pinho | Copies may be requested here.

Related Content

Bio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreMcLaren celebrates 10 years of the McLaren P1 hybrid hypercar

Lightweight carbon fiber construction, Formula 1-inspired aerodynamics and high-performance hybrid powertrain technologies hallmark this hybrid vehicle, serve as a springboard for new race cars.

Read MoreJeep all-composite roof receivers achieve steel performance at low mass

Ultrashort carbon fiber/PPA replaces steel on rooftop brackets to hold Jeep soft tops, hardtops.

Read MoreComposites manufacturing for general aviation aircraft

General aviation, certified and experimental, has increasingly embraced composites over the decades, a path further driven by leveraged innovation in materials and processes and the evolving AAM market.

Read MoreRead Next

BMW Leipzig: The epicenter of i3 production

A glimpse into the inner workings of an automaker at the forefront of serial-production autocomposites.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More