Under the hood: Thermoplastics tackle tough jobs

Reinforced plastics save weight and cost, increase underhood productivity.

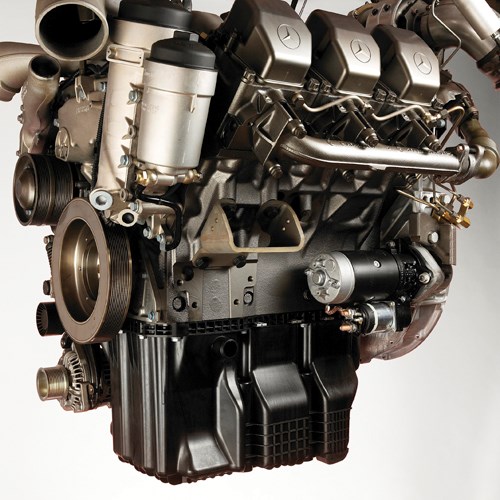

Composites are established in vehicle interiors and also have gained traction in exterior and chassis components in the performance-car, pickup-truck and electric-vehicle segments. But they have been slow to make inroads into the engine compartment. Under the hood, heat from the internal-combustion engine and exposure to engine fluids (fuel, oil and coolant) already make it a tough environment. And it’s getting tougher as increasingly strict emissions and fuel-economy requirements push the market toward smaller, turbocharged gasoline and diesel engines, many equipped with exhaust-gas recirculation systems. Underhood temperatures are on the rise because these harder-working engines run hotter, and available engine compartment space is scarce as cars get more compact and their deeply swept front ends make underhood cooling more difficult. Moreover, auto OEMs’ extended new-car warranties put pressure on suppliers to use materials with longer service lives, yet they also are demanding reductions in component weight and cost.

The need for underhood components that perform better and longer at less weight and cost has opened a growth area for several families of fiber-reinforced, injection-moldable, high-temperature (semi)crystalline thermoplastics. The chemistry of these resins enables higher thermal and chemical performance and greater toughness than commodity thermoplastics.

Further, (semi)crystalline thermoplastics exhibit greater impact strength at lower weight, better aesthetics right out of the tool and melt reprocessability (facilitating welding and permitting recycling) — all advantages vs. common thermosets.

In combination with the injection molding process, these materials overcome weight and design constraints and eliminate costly postproduction steps that are typical for aluminum, steel and thermoset composites, such as bulk molding compound (BMC), which are more difficult to form. The material/process combination facilitates unprecedented design freedom and parts integration. This enables quicker production of complex structures (the cycle times are fast, and smaller parts can be molded in multicavity tools) in a single step — with excellent repeatability and reproducibility (R&R). This makes the process ideal for mid- to high-volume vehicle builds, where production speed is a high priority and the initial higher cost of tooling can be justified. At these production volumes, manufacturing and part costs can be substantially less than those of cast or machined aluminum and steel. Several of the most exciting examples of composites in underhood applications are covered here.

Belly up: Oil pans go high tech

Among the most challenging of underhood applications is the engine oil pan. It must not only handle hot aromatic hydrocarbons, which attack many polymers, but it also is mounted low on the undercarriage where it is battered by stones and gravel kicked up by tires. In winter climes, oil pans are exposed to road salt, another chemical that is unfriendly to both plastics and metals. Most oil pans also have fairly complex internal geometries, which in metals can translate to heavy multipiece assemblies produced in numerous manufacturing steps. But that’s changing as injection-molded, glass-reinforced polyamides (PAs), which first earned a place in hybrid composite/aluminum oil-pan modules for commercial trucks, are now gaining acceptance in all-composite modules for passenger vehicles and light trucks.

The first composite oil-pan module, a complex multichambered design, debuted on then DaimlerChrysler’s (Stuttgart, Germany) 2004 model year (MY) Actros BR 500 Class 8 heavy trucks. Ultramid A3HG7, a 35 percent short-glass-reinforced PA 6/6 from BASF SE (Ludwigshafen, Germany), replaced sheet molding compound (SMC), which earlier had replaced die-cast aluminum. The resulting pan weighed 6.3 kg/14 lb, which is 50 percent less than the original aluminum part. This helped designers reduce greenhouse-gas emissions and improve fuel economy. The PA pan also was 1 dB quieter — important given Europe’s (and especially Germany’s) strict curb-noise restrictions. Further, collapsible-core tooling was used in the injection molding process to flare (extend) the pan sides. At a greater width, the pan held 30 percent more oil than its predecessors, extending the vehicles’ oil-change intervals by 50 percent, which on high-mileage, long-haul trucks results in lower maintenance costs and more drive time for fleet owners. Corrosion also was reduced (vs. the original metal pans), and injection molding allowed for integration of a significant number of parts and functionality, saving weight and postmold assembly work.

So successful was that first polyamide oil pan that in the past six years, short-glass-reinforced PA 6/6 and PA 6, from BASF and DuPont Automotive (Troy, Mich.), have proliferated on oil pans for light- and medium-duty trucks and passenger vehicles. These include 2008MY Mercedes C-class diesel sedans from Daimler AG (Stuttgart, Germany), as well as 2009MY Excursion sport utility vehicles (SUVs), Super Duty pickups, Econoline vans, and LCF (low cab forward) commercial trucks from Ford Motor Co. (Dearborn, Mich.).

The latest iteration of this evolving technology is designed to channel oil uphill when a trail-rated vehicle climbs a 60 percent grade. It made its debut on the 5.7L V8 Hemi engine on the 2010MY Jeep Grand Cherokee SUV from Chrysler Group LLC (Auburn Hills, Mich.). The module is a 100 percent reinforced thermoplastic — a specially optimized version of BASF’s Ultramid B3ZG7 OSI 35 percent short-glass/PA 6. Molded by systems supplier MAHLE North America (Farmington Hills, Mich.) in tools built by Integrity Tool & Mould Inc. (Oldcastle, Ontario, Canada), the design is said to represent a new level of parts integration. It combines three major subassemblies: the oil pan, windage tray (with cam-scraper function) and oil pickup tube. Too complex to mold as a unit, the subassemblies are separately molded then joined via welding (vibration and infra-stake methods) to form a single module.

BASF notes that the base resin was optimized for stone impact and retention of mechanicals under exposure to hot oil, cold temperatures and road salts. Replacing stamped steel, quiet steel (laminates of steel and elastomeric polymers) and cast aluminum, the all-reinforced plastic oil pan reduces weight by 41 percent, saves 50 percent on tooling costs and eliminates four assembly operations that were necessary with metallic predecessors. Reportedly, reinforced-thermoplastic oil pan modules are now moving into use on stationary generators and agricultural/off-highway equipment, so look for further proliferation of this technology.

Three for one: Injection-bonded charge air duct

As underhood temperatures and pressures increase, charge air ducts merit higher-performing resins and more efficient manufacturing. A good example is a duct developed by Röchling Automotive Leifers GmbH (Leifers/Laives, Italy) and launched on 2-liter diesel engines produced by Volkswagen AG (Wolfsburg, Germany) for the 2009MY Tiguan compact crossover. The duct was molded from two grades of short-glass-reinforced Fortron linear polyphenylene sulfide (PPS) resin from Ticona Engineering Polymers (Kelsterbach, Germany). The application is said to be the first in which glass-reinforced PPS has been successfully blow-molded.

Initially done in aluminum, early plastic iterations of this charge air duct involved engineered blow molding of the complex charge air tube in one set of tools; then separately injection molding clips, lugs and attachment brackets in another set of tools; and finally attaching the injection-molded parts to the blow-molded tube via hot-plate or vibration welding, which required yet another fixture. Working with Ticona, Röchling developed a unique and now patented hybrid process called JectBonding that the company describes as an “in-mold assembly” operation. It combines three previous production steps — blow molding, injection molding and welding — into a single sequential process (using one or more tools, depending on part complexity). This eliminates postmold assembly operations and resulting scrap because it’s easier to maintain positioning tolerances than it would be with downstream welding operations. The single process also increases R&R and improves bond reliability — reportedly making it 20 percent stronger than a conventionally welded assembly, according to Dr. Fabrizio Chini, Röchling Automotive’s R&D manager.

Essentially, the process begins like conventional blow molding. A parison drops and is inflated. It expands outward, contacts the walls of the tool cavity and freezes off to form a hollow structure. Next, an integrated injection unit shoots the fastening lugs against the expanded and still-hot parison, creating a high-strength bond between the pipe and its functional elements prior to demolding. As they contact the hot parison, the lugs bond chemically and mechanically with the tube, yielding a stronger, cleaner joint.

Depending on the complexity of the final part and the amount of secondary parts integration desired, there is a process variant that involves use of a second injection tool. For example, any attachment added to the tube during initial blow molding has to be positioned on the parting line of the tool to be in the line of draw when the tool opens. To mold additional components in an orientation out of plane to the parting line, the carrier tube is first formed in one tool, which is then opened, and the still-hot part is rapidly moved to a second injection tool, which closes and injects the remaining functional components. In this configuration, the carrier part must be designed to allow partial melting of its surface in the region where the additional components are injected to ensure a strong bond. For situations where high automation and fewer process steps and tools are desired, the simpler one-tool version of JectBonding is preferable. However, when greater design flexibility enhances part functionality, the variant with the second injection tool is the better choice. Regardless of which option is selected, Chini says that both solutions improve bond strength and offer cost savings vs. conventional molding methods with postmold welding.

Since the part represents the hot side of the charge air tube, two different grades of glass-reinforced PPS were used because each process requires material with different melt viscosities. Fortron 1115LO, a 15 percent glass/PPS with high melt strength and viscosity, was used for the charge air tube itself because that grade had the high hang strength needed to drop the approximately 1m/39-inch parison (which is somewhat longer than the final part) without breaking it and then inflate it without tearing through the part walls. A 30 percent glass/PPS grade (Fortron FX4330T7) was used for sequential injection of the functional components because that material offers high impact strength and toughness as well as very good flow properties. This enabled injection bonding of the functional elements at the lowest possible pressures and temperatures, which reduced warpage and minimized the potential for blowing through the tube’s wall. The PPS contributed excellent dimensional stability and extremely low creep, a coefficient of linear thermal expansion (CLTE) comparable to aluminum, inherent flame retardance, high hardness and stiffness at elevated temperatures (to 240°C/464°F), excellent resistance to underhood automotive chemicals, low moisture absorption and ease of processing.

Processing PPS via JectMolding results in fast cycle times, high process reliability, significantly lower capital costs and fewer secondary operations. In fact, manufacturing costs were lower than those for previous aluminum assemblies. Further, the composite part is 30 percent lighter, helping reduce fuel use and CO2 emissions on this already impressively efficient engine. An added benefit is that the overall visual effect of the component design and its finish quality are more attractive. According to Röchling, similar technology could be a boon for automakers in Europe, where 50 percent of new vehicle registrations since 2006 have been diesels.

Planting a stake: Bio-composite radiator end tanks

One of the most unusual new underhood applications is a pair of bio-composite radiator end tanks that made its first appearance on Toyota Motor Corp.’s (Toyota City, Japan) 2010MY Camry sedan. The Zytel RS short-glass-reinforced PA 6/10, produced by DuPont Automotive, features 40 percent bio-plastic, by weight. The bio-plastic’s renewably sourced monomer is derived from castor bean oil. This is the first time a bio-composite part has been used in a demanding underhood application subject to elevated heat and aggressive chemicals. Previously, most automotive applications of bio-based polymers have been inside the vehicle cabin, a far less demanding environment, as decorative or semistructural interior trim. In the case of the radiator end tanks, the parts are exposed to hot ethylene glycol over extended periods of time, as well as road salts, and must provide excellent mechanical properties and thermal and chemical resistance. Further, they must maintain tight dimensional tolerances to avoid cracking and leakage of radiator fluid. The application was a joint development between DuPont and systems supplier and materials processor DENSO Corp. (Kariya, Japan), which also produced the injection molding tools for the parts.

DuPont Automotive reports that a study conducted for it by MarketTools Inc. (San Francisco, Calif.) indicates that 65 percent of U.S. consumers said they are willing not only to buy products that are made from renewably sourced materials but also to pay more for them as well. In fact, the new-grade PA joins a growing number of renewably sourced products that are now commercially available from DuPont. Each is derived (in whole or in part) from agricultural feedstocks (e.g., corn, soy, castor beans, sugar cane or wheat). The company points out that since these plants absorb CO2 during their lifecycles, the carbon footprints of the molded bio-resin parts are correspondingly smaller than those of plastic components made from conventional all-petroleum thermoplastics.

Boosting heat-tolerance of cooling systems

As they are most everywhere else under the hood, the thermal requirements for cooling-system components are on the rise. This is demonstrated by a new engine-mounted oil-filter module on Chrysler’s 2011MY Pentastar engines. Unlike most oil-filter modules, which are mounted low on the engine in locations that are cooler but not easy to access, this one sits deep in the engine valley, a placement possible only because the molder had access to a specially formulated grade of 35 percent short-glass PA 6/6. Produced by system supplier and material processor Hengst of North America Inc. (Camden, S.C.), the oil-filter module eliminates numerous parts and reduces the module weight by 43 percent. It also saves Chrysler more than 60 percent in direct costs and offers harder-to-quantify indirect cost savings, owing to greater part reliability. In addition, the plastic module can be burned for energy cycling at the end of its useful life, something that wasn’t possible with the previous metal-intensive system.

The key to success in this application is the use of BASF’s new Ultramid A3WG7 HRX BK PA 6/6, a heat-stabilized grade that is modified during polymerization to increase its resistance to hydrolysis in contact with hot glycol (120°C to 130°C/248°F to 266°F) and to extend its heat-age performance in hot air. The company says other modifications reduce swelling and improve weld strength — important properties for a part subject to hot oil and coolant.

Long-lasting beauty: Turbocharged engine cover

Temperature and performance requirements also are climbing for relatively simple, static parts. A good example is the acoustic engine cover for the 2010MY Ecotec 2L turbocharged engine for the Cadillac CTS sports sedan by General Motors (Detroit, Mich.). In addition to exposure to hot oil, coolant and road salt, the automaker requires that the cover withstand a continuous temperature of 180°C/356°F and a peak temperature of 200°C/392°F. Other performance specs include excellent surface finish, the option of flame retardance and molding cycles under a minute to meet cost targets.

“We find most often, in our turbocharged and other high-temperature applications, that the continuous temperature range is higher than what standard nylons may be able to tolerate,” says Shawn Owen, senior project engineer for the GM Power Train Air Delivery Group. “So typically, we have been using polyphthalamide [PPA] materials that come with cost, appearance and processability concerns. For some time, we’ve been looking for a replacement.”

Fortunately, a new technology platform recently commercialized by DuPont Automotive has provided a solution, thanks to a new polymer modification/additives combination that the company calls Shield technology. The modifier/additive package helps extend property retention in a range of DuPont’s PA and PPA products.

GM was the first automaker to make use of one of these materials. “It took GM just 90 days from our product launch to capitalize on this remarkable material,” says Terry Cressy, DuPont Automotive OEM executive account manager. “The speed with which this innovation was adopted shows how powerful collaboration can be in bringing innovation to market quickly and cost-effectively.”

The grade used for the CTS acoustic engine cover is Zytel Plus PLS 95G35DH resin, a proprietary PA copolymer with 35 percent short-glass reinforcement. Its continuous and peak service temperatures, 210°C/410°F and 230°C/446°F, respectively, easily meet the cover’s increased temperature requirements. More importantly, the grade is said to have twice the heat-age property retention of not only conventional PAs but some higher-cost specialty thermoplastics as well, ensuring long service life. The company also reports that higher flow rates make it faster and easier to process than other specialty PAs, yet the material retains a good surface finish.

Shield technology is said to encompass a new polymer backbone, further polymer modifications and a special additives package. DuPont Automotive reportedly filed more than 20 patent applications in connection with Shield technology and describes it as the most important PA development in three decades.

“This new product is the result of several breakthroughs from research and development aimed at cost-effectively improving performance and, especially, durability, to meet automotive market needs,” says Bob Lawton, DuPont’s Zytel PA global technology manager. “The convergence of the chemistries produced a step change in durability that is amazing. We are investigating other polymers whose performance could be greatly enhanced with DuPont Shield technology.” The company also says it is looking to incorporate Shield-enhanced materials into other underhood components, such as oil and transmission pans, oil-filter modules, rocker covers and air-handling components.

Produced by molder and toolmaker Camoplast Inc. (Sherbrooke, Quebec, Canada), the new CTS engine cover brought GM a 30 percent cost savings, yet doubled the cover’s service life and improved is appearance vs. previous PPA grades.

More metal-replacement opportunities

What these applications have in common is that they represent new opportunities to replace metals by taking advantage of what composites do best. Close cooperation between OEMs, resin suppliers and processors clearly paid dividends in materials enhancements and, in some cases, process innovations. The resin modifications represented here indicate significant activity in the high-temperature end of the thermoplastics market. More innovation is likely in the next few years as this technology proliferates to other polymer families. These stories also show that the workhorse injection molding process still has much to offer auto innovators.

Related Content

Nanopoxy, Nione jointly develop nanostructured epoxy resin

Epoxies featuring nanometric niobium pentoxide particles promote toughness, UV radiation resistance and other performance gains.

Read MoreJCB Aero aircraft interior flooring panels incorporate SHD composites

High-performance carbon fiber prepreg using SHD’s FRVC411 epoxy resin system resulted in a durable, compliant design for the MRO market.

Read MoreTCR Composites introduces TR1116 snap-cure epoxy prepreg resin system

Designed for press-cure applications, the resin system is highlighted for its snap-cure capability and tailored properties.

Read MoreBio-based epoxy, recycled materials increase sustainability of all-terrain snowboards

Aiming for a smaller environmental footprint while maintaining high performance, Salomon’s Highpath snowboard line incorporates bio-based epoxy, glass and basalt fiber stringers and recycled materials.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;width=70;height=70;mode=crop)