Addressing the cost of aerospace composites

In the aerospace composites industry’s history, millions of research and development (R&D) dollars have been spent addressing cost.

In the aerospace composites industry’s history, millions of research and development (R&D) dollars have been spent addressing cost. As an industry, we have struggled with the cost issue for many years, yet still have managed a good growth rate. We can only speculate about how much greater industry growth might have been without the persistent cost struggle.

The cost drivers are not a great mystery. Our materials are very expensive, and to a great extent, we still rely on inefficient manufacturing processes. While we’re making progress with regard to material costs, aerospace-grade prepregs are still far more expensive than materials used by our metals competitors. With regard to processing efficiency, we have a lot of room for improvement.

More efficient manufacturing processes can help offset the cost of expensive aerospace-grade prepreg materials and make composites much more cost-competitive with metal aircraft structures. Although some very efficient automated processing methods are available to the industry, not enough fabricators are using them. Companies like Cincinnati Machine, Ingersoll, and ATK have done a great job of developing and maturing the automated tape layer (ATL) and fiber placement (FP) processes. These two processes are very efficient laminating technologies, and they are the closest comparison the composites industry has to metals machining equipment. ATL and FP could actually be characterized as “reverse machining.”

In the metal aircraft parts industry, small- and mid-sized shops normally canafford the latest automated processing technologies. These smaller suppliers are very much in demand by military aircraft programs. Most aircraft prime contractors engaged in military programs actually prefer “small suppliers” for their machined metal parts. In contrast, only the largest aerospace composites manufacturers can afford the most efficient automated processes. The smaller shops normally rely on lower-tech processing methods like hand layup. This must change if we are ever going to see a global improvement in the cost of aerospace composite parts.

Historically, most composites R&D programs have focused on reducing the cost of a specific aerospace composite part, which usually benefits only a specific aircraft program. If we could focus some composites R&D programs on the development of a new generation of more “affordable” composites machine tools, the benefits would be global. Smaller composite shops could more easily afford efficient automated laminating methods and would therefore be in higher demand as suppliers to both military and commercial aircraft programs. Military aircraft programs could rely more heavily on “small suppliers” for their composite parts, just as they do for metal parts.

During the past few years, I have marketed tape layers and fiber placement systems in North America and Europe. While pursuing this work, I’ve met with a large cross-section of composites parts manufacturers. In my conversations with these companies, there has been a consistent message about what composites part suppliers really want in processing equipment … a combination of “affordability” and “capability.” Most composites companies, regardless of size, are interested in improving their processing capabilities. But the investment required for current advanced automated laminating systems is a huge barrier to the smaller shops. The small- and mid-sized suppliers are effectively shut out from the most efficient automated processing methods until equipment becomes more affordable.

Eventually, a new generation (or “next” generation) of ATL and FP machines will be developed. If the machine tool companies received R&D funding from sources like NIST’s Advanced Technology Program (ATP), it would certainly help expedite development of these machines. The next generation of machines should be developed in a wider variety of sizes and configurations — and they must be more affordable to a broader spectrum of composites parts suppliers. When the machine tool companies develop this next generation of machines, they will open up a huge new market for advanced composites processing systems and give small- and mid-sized composites manufacturers the tools they need to compete with metal on a more level playing field.

Related Content

Plant tour: Airbus, Illescas, Spain

Airbus’ Illescas facility, featuring highly automated composites processes for the A350 lower wing cover and one-piece Section 19 fuselage barrels, works toward production ramp-ups and next-generation aircraft.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

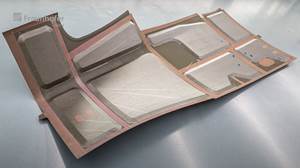

Read MoreOptimizing AFP for complex-cored CFRP fuselage

Automated process cuts emissions, waste and cost for lightweight RACER helicopter side shells.

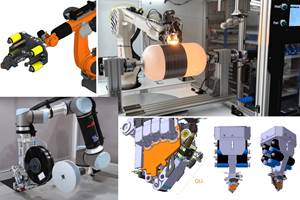

Read MoreThe next evolution in AFP

Automated fiber placement develops into more compact, flexible, modular and digitized systems with multi-material and process capabilities.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More

.jpg;maxWidth=300;quality=90)