The next evolution in AFP

Automated fiber placement develops into more compact, flexible, modular and digitized systems with multi-material and process capabilities.

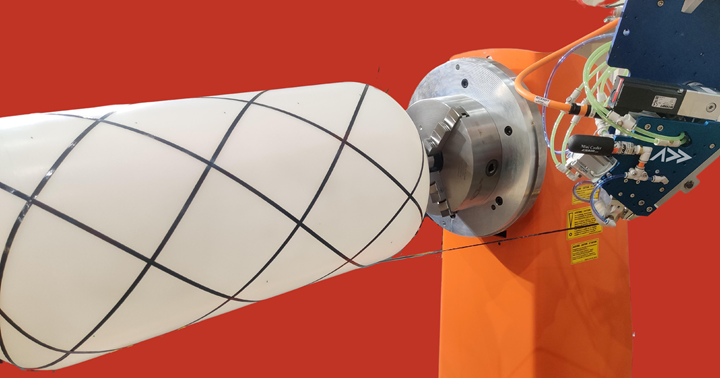

New capabilities in more compact systems (top left, clockwise). Addcomposites launched its 4-tow AFP-X head in 2023, Carbon Axis has added filament winding capability to its XCell AFP system, MTorres’ new compact eVTOL AFP head features updated online inspection (OLI) and M&A Dieterle offers a spectrum of options for new entrants to AFP, including heads for cobots. Photo Credit: Addcomposites, Carbon Axis, MTorres and M&A Dieterle

As the composites industry matures, hand layup of multi-ply and increasingly complex laminates continues to be replaced with automated tape layup (ATL) and automated fiber placement (AFP) using prepregged tows (towpreg) or unidirectional (UD) prepreg slit into precise-width tapes, typically using carbon fiber. Dry fiber tapes can also be used, held together with a thermoplastic binder. This article is not a complete survey, but instead a selection of suppliers that highlights trends such as smaller size, adding winding for pressure vessels and rotor sleeves, increased digitization and process control. It also shows the evolving spectrum of available systems from the simplest, easiest entry into AFP to automated mass production of more than half a million parts per year.

MTorres launches eVTOL head, OLI for ATL

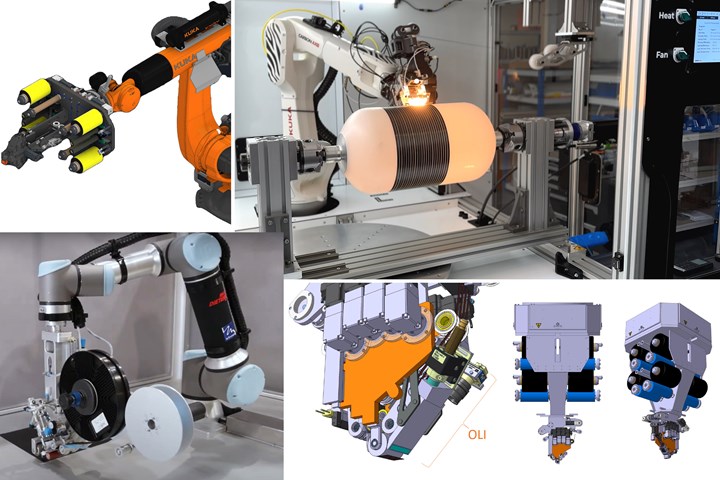

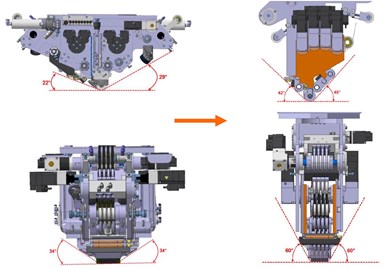

Figure 1. High-angle eVTOL head. For its latest AFP head, MTorres increased the clearance angles for layup of smaller, more complex parts and continues to upgrade its online inspection (OLI) to increase overall equipment efficiency (OEE) to 75-85% for layup of up to 7 kilograms/hour, or 5-6 times higher than hand layup. Photo Credit: MTorres

Founded in 1975 to provide automation for industrial processes, MTorres (Torres de Elorz, Spain) has delivered 89 ATL systems in 25 years and 70 AFP systems in 16 years. From 2011, it launched a new AFP head every 2 years, including: laser-based thermoplastic composites (TPC), spools on the AFP head, a 24-tow head, wide tows up to 2 inches and a more compact, higher angle head in 2017. “But that wasn’t yet the head we wanted,” says Manu Motilva, chief growth officer machines for MTorres. “By 2022, we had what we call the eVTOL head with eight tows and a high angle of at least 40-45° for more clearance to make smaller, more complex parts. It maintains our rotary cutter in the head — servo-driven, not pneumatic — with a minimum cut length of 100 millimeters, integrated online inspection [OLI] and is usable on a gantry or robot.”

MTorres AFP heads have been used mostly for high-spec production of parts that are critical, but larger and less geometrically complex (e.g., Airbus A350 wings and fuselage, Boeing 787 wings). “For the A350, we lay 100 kilograms/hour,” notes Motilva, “but with this eVTOL head, we will lay only 5-8 kilograms per hour but with a very high overall equipment efficiency [OEE] of 85%.” Traditionally, AFP machines laid up for only half the time in use: 25% was manual inspection, 12% downtime, 7% maintenance and 7% reloading the tape spools. “We then integrated the spools into the head so operators could use automated head changeout to reload in parallel, off the machine,” says Motilva, “bringing OEE to 68%. By 2019, we added OLI, for a 75-85% OEE, which equates to 7 kilograms/hour for the new high-angle AFP head and 5-6 times higher than hand layup.”

“These are metrics Boeing, Airbus and other OEMs are very focused on, not on laying faster,” says Motilva. “We already lay 2,400-4,000 inches per minute. You don’t get two times more productivity that way, but by increasing the layup portion within overall operation time. So now, with OLI, we are laying 1.5 times faster. The feedback we have so far on this new eVTOL head from advanced air mobility (AAM) manufacturers is that this is what they need.”

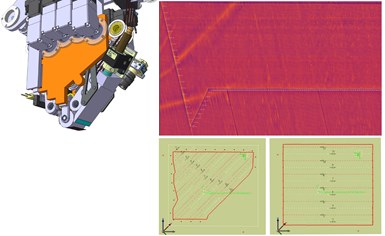

Upgraded OLI. MTorres already launched OLI for AFP, as noted above, “but we needed to upgrade it for 1-, 2- and 4-tape ATL, which works well for high-rate production,” says Motilva. “The OLI hardware is standard: A laser line behind the roller projects onto the composite layup, a camera measures the height of the laser and an optics box with mirrors provides triangulation to calculate the tape height. The key point is the software, which we have developed in-house to present all the needed data with precision. It is like our 2017 approach, but instead of one profilometer, our technique is like putting 1,000 of them right behind the roller.”

The new eVTOL head is compatible with MTorres’ online inspection (OLI) setup (left) which features an HMI that helps users easily see defects and ply locations (shown here). Photo Credit: MTorres

“You can see all the defects online and detect foreign object debris [FOD],” he continues. “We measure the position of each tape and compare it to the CAD file, showing the operator, in-situ, when a layup is out of tolerance, and storing data as proof that the as-built part meets the required specifications. Instead of locating a ply in the layup, black on black, the operator can easily see in our HMI a threshold or skipping map with all the ply position, gap, overlap, FOD and defect measurements. It gives the operator much more information about the actual layup in a much easier way to understand. For example, with the ply location, you can clearly see a height map that shows the typical 0.2-millimeter height for UD carbon fiber tape. We make five to six measurements within that 0.2-millimeter height and can measure down to 0.03 millimeter in the Z-axis, 0.07 millimeter in the Y-axis and 0.4 millimeter in the X- or machine moving axis. And now you have thousands of datasets which then enable big data analysis, and we are starting to see the huge level of benefits that this brings to the market.”

Addcomposites: Filament winding, 3D printing

Founded in 2018, Addcomposites’ (Espoo, Finland) plug-and-place AFP-XS head that can be integrated into any existing robot arm has advanced quickly — it offers thermoplastic tape in addition to thermoset prepreg and dry fiber, tape winding, integrated process control, simulation, online defect detection and FEA software interoperability for its purpose-built Addpath software, as well as options for 1-, 2- and 4-tow placement. In 2022, it exhibited its AFP-XS head on cobots from partner IND Group (Sherbrooke, Canada) and in 2023, it unveiled its 4-tow AFP-X system for production of intricate parts at high rates. “We shipped 12 AFP systems in 2023,” says Addcomposites CEO Pravin Luthada, “and have systems going to China, Saudi Arabia, Australia, Singapore and, hopefully soon, India.”

Fusion of AFP and filament winding. The AFP-XS head can now also be a filament winding system. AFP excels at precise placement of prepreg tapes. It’s able to cut and restart at any position, highly control fiber orientation, and apply heat and pressure to create complex geometries with advanced, tailored mechanical properties. Meanwhile, filament winding offers high-speed production of cylinders and pipes, where tows are pulled onto a rotating mandrel guided through a winder eye which determines the winding pattern while active tension control enables compaction for high mechanical properties. Addcomposites’ new system will integrate the bulk material placement of winding with the strategic fiber placement of AFP.

Figure 2. Automated switching: AFP, filament winding and 3D printing. Addcomposites’ automated switching enables fast changes between AFP and filament winding using its AFP-XS head (top) and 3D printing using its new SCF3D head (bottom) using a single robot and software platform. Photo Credit: Addcomposites

When switching from AFP to winding, the system transforms the material storage into a tensioning creel with the compaction roller guide serving as the winder eye. This is moved by a specialized winding module, which enables a wide variety of winding possibilities, including cut and restart. “For applications that need a high amount of tension, you can have an attachment in front of the AFP head that increases tension tenfold,” says Luthada. “Meanwhile, the AFP-XS head can be maintained at an offset distance by our AddPath software.”

“Until now, AFP software has not been able to function as filament winding software,” he continues. “But within AddPath, you can switch between the two. This fusion brings placement precision and material freedom to filament winding and a speed benefit to AFP, as well as new versatility for complex shapes with variable material properties within a structure. It also offers more optimized and efficient production for lower costs. This is where I see systems going because there’s a huge demand for winding in electric motor sleeves, pressure vessels and similar geometries. Companies are choosing this system over a filament winder because for the same price, they also get AFP.”

Adding 3D printing. Addcomposites has also launched its SCF3D (structural continuous fiber/filament) print head for continuous fiber 3D printing (3-6 kilograms/hour) which uses extrusion-based fused granulate fabrication (FGF) that can also print polymer with chopped fiber or no reinforcement (9 kilograms/hour). Equipped with directional heating and a compaction roller, it can achieve 40% fiber volume fraction with continuous fiber. “We are not aiming for aerospace structural parts, but instead broadening automated composite production across industries in a sustainable way,” says Luthada.

“We already offer automated switching between heads,” he notes, “so now you can switch between the AFP-XS head for AFP and filament winding and the SCF3D for continuous fiber 3D printing in a single platform. They are all functioning from a single source software platform. You can 3D print a tank liner, filament wind the first layers and then reinforce selectively with thermoplastic tape and even switch to thermoset tape if you want to.”

Continually enhancing capabilities. Companies who bought Addcomposites’ first systems are now upgrading to thermoplastic composites, says Luthada. “They continue working with us to enhance their capabilities. We are committed to that process evolution with them, and we also see a much higher demand for this in the industry. For example, every aerospace manufacturer is looking to automate their layup work, while non-aerospace companies are exploring where they can use AFP, and companies across industries are exploring where they can use 3D printing.” Addcomposites’ software is central to enabling this multiprocess, multi-material production, but also digital manufacturing. “Every month, our customers get two updates,” says Luthada, “and this expands their capabilities, not just for new processes, but also enabling real digital twins, data analysis and compatibility with AI.”

Carbon Axis: Modular, easy-to-use cells for all industries

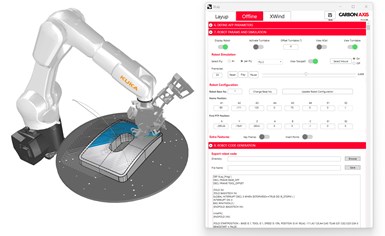

Founded in 2018 by Pavel Perrotey and Chiemi Avila Mori, Carbon Axis (La Rochelle, France) produces the robotic XCell for making parts up to 1 × 0.5 × 0.5 meter using the XPlace AFP head. It is also launching the larger XCell-M, for parts roughly 2.5 × 1.5 meters, with its new XPlace2 AFP head. The modular design of these systems, says Avila Mori, enables standard, compact machines with multiple options, including thermoset, thermoplastic and dry fiber tapes. “We can also integrate a filament winding head and axis as well as ultrasonic cutting for trimming preforms.”

Figure 3. Compact machines, multiple options. Shipped as one piece, the XCell offers easy switching from thermosets (infrared heater) to thermoplastics (hot air gun) using a single software interface. Photo Credit: Carbon Axis

An integrated toolchanger enables switching processes. “You can also have a second AFP head for multi-material placement,” says Perrotey. “One can have carbon fiber and the other glass fiber, and the machine will automatically change between to complete the programmed layup. Carbon Axis machines have been assembled to support all these different options, which can be added at any time because needs are constantly changing.”

“The standard XCell machine applies thermoset prepregs with an infrared heater,” says Avila Mori. “To process low-melt thermoplastics, like PA and PP, you just swap to a hot air gun, which heats up to 300°C. And we can include a heated plate (e.g., 120°C) for adhering the first ply. We’re not processing PEEK or PEKK currently because laser heating increases cost and safety requirements. We want to keep the system simple, shipping the XCell as one piece, and you just plug it in.”

Enabling software. “The XLay software is designed for anyone to use, even without robotics experience,” says Perrotey. “You just follow the steps that it presents. It’s also easy to program and build layups in the simulation for simple parts. But when you make difficult layups, you also have access to more advanced features. In half a day, users are already able to start programming; it takes another day to complete training on both the machine and software. Our customers should be able to focus on making parts, not spend their time programming the machines.”

“Any changes you make are automatically updated in real time, so you don’t have to wait or precompute anything,” he continues. “And you’re able to do all the path layer simulation and machine code export in one software. Everything is in a single interface because the machine has been designed with the software and vice versa.” Similar to Addcomposites, the software is based on Rhino and priced below €5,000 for a yearly license compared to traditional large AFP machine software, which can cost up to €100,000 per year.

Perrotey notes that inline inspection is also being integrated, using a sensor from Edixia Automation (Vern-sur-Seiche, France). “The hardware is standard, but the difficult part is having software trained to detect AFP defects. By working with Edixia Automation, we already have a working software that is ready to detect overlaps and gaps, FOD, etc.”

XCell-M and XPlace2. “The XCell-M enables larger parts using a mid-payload (e.g., 50-kilogram) robot with either of our AFP heads, which use the same controller so you can swap depending on what kind of part you are making,” says Perrotey. “The XPlace is very compact and can do very intricate features while the multi-spool XPlace2 can achieve higher rate production of simpler parts.”

The XPlace2 AFP head enables different configuration spool systems to be swapped as needed. Photo Credit: Carbon Axis

However, the XPlace2 not only moves the spools onto the head, it enables a choice of different spool systems that can be swapped as needed. “We wanted a standard skeleton where you decide which modules and how many you include. You can use a compact, two-bobbin head for more complex parts or a four-bobbin configuration to place wide.”

“For both heads, we made everything so you can swap it quickly,” adds Avila Mori. “The symmetrical head also allows feeding from left and right, so you can place on the way and also on the way back.” She notes XCell systems meet the same quality specs as an aerospace machine, but the output is less. Perrotey adds that the goal is to bring AFP outside of aerospace, including sports/recreation, motorsports, medical and industrial sectors. “That is why we target multi-material, multiprocess machines that cost 10 times less than traditional large robotic AFP systems. We enable both R&D and production of many different parts with complex laminates that have a lot of scrap when produced manually. Our machines also consume very little power because that is becoming very important.” Carbon Axis has sold seven machines up to 2023 but is already seeing a big increase thanks to its new products and greater demand in the market.

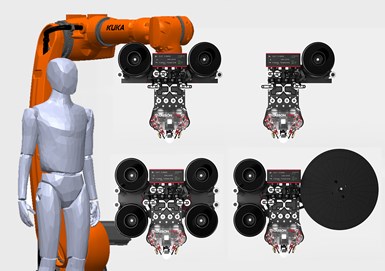

Open Fiber Systems for simplest entry to AFP

Machine construction specialist, M&A Dieterle (Ottenbach, Germany), founded its composites business unit in 2015. Its Open Fiber Systems portfolio comprises AFP heads, placement systems and a modular tape production line. “Our focus is to keep the technology as simple as possible, so that it’s easy for companies to start and then move up,” says Benjamin Grisin, head of composites, Open Fiber Systems for M&A Dieterle. “They can begin with our CrossLayer machine which can use any of our placement heads, and these can be swapped out in a few minutes. You can also put our placement heads on a cobot or industrial robot. Everything is modular and open so that you can modify it as you need. We don’t withhold information because that decelerates development needed to move technology forward.”

Figure 5. CrossLayer 2.5D AFP. Designed to be simple and easy to use — programming is a list of start and end points, training takes <4 hours — this 2.7 × 1.9 × 1.9-meter baseline system features a preform laying frame attached to the bed area which moves beneath an AFP head that can rotate 360° and moves up and down with a kinematic piston to accommodate 2.5D shapes. Photo Credit: M&A Dieterle

CrossLayer 2.5D AFP. Developed together with the Institute of Aircraft Design, University of Stuttgart (IFB, Stuttgart, Germany), CrossLayer is a gantry-based system measuring 2.65 × 1.87 × 1.85 meters in its baseline version, where a preform laying frame is attached to the bed area with magnets. Composite tape is applied onto this frame by a head that can rotate 360° but stands still while the frame moves like in a tailored fiber placement machine. Currently, placement heads include for dry fiber, thermoset prepreg and infiltrated towpreg, a special product that we’ll come back to later. The prepreg and dry fiber heads are similar, using an infrared (IR) heat source, with a minimum layup length of 40 and 120 millimeters, respectively. “You cannot precisely fill a rectangular corner,” concedes Grisin, “but we accept this drawback to keep the system simple.”

“I can show someone how to run the machine in half a day,” he continues. “You enter a list of start and end points, press ‘convert’ and load the layup program into the machine. It takes maybe one hour more to review layup parameters and how to load the tape.” The CrossLayer is designed mainly for 2D layups, but the head, activated by a kinematic piston, will accommodate 2.5D shapes. “A wave-shaped tool would just push the head upward,” explains Grisin. “The head will also adjust to place onto another preform or a sandwich core.”

M&A Dieterle’s infiltrated towpreg technology enables making small amounts of AFP tape using different resins and fibers. Photo Credit: M&A Dieterle

Infiltrated towpreg. The third placement head for infiltrated towpreg was developed to meet the need for small amounts of AFP tape for different projects. It uses a perforated spool developed by IFB and spread tow tape. For true in-house materials development, the tape can be made with M&A Dieterle’s UDfixed Tow Line, which includes modules to unwind a spool of fiber (e.g., 15-50K carbon fiber, flax fiber, etc.), spread it, apply powder binder, heat-set the binder, cool the tape and rewind onto an AFP spool. Such tape wound onto the perforated spool is placed into a shaped container. A pre-measured amount of infusion resin is then poured into the spool center, the container is closed and placed under vacuum, and the resin infiltrates the tape. “The resin content is controlled by the spread tape and amount of powder binder applied in the UDfixed Tow Line,” says Grisin. “There’s a natural equilibrium for each material. The powder binder acts as flow medium keeping a gap between the wound tape and helping resin infiltration. The tape takes up a certain amount of resin, resulting in 45-50% fiber volume.”

“You can use the resin and fibers you want to make small batches, which isn’t possible from big suppliers who require at least 1-2 tons or charge very high prices,” says Grisin. “The infiltrator towpreg head was developed primarily for our winding machine that will be delivered to customers later this year.” For now, his company is not working with thermoplastics and its placement technology uses third party software. “Our goal is to enable modular, affordable capability that companies can use to create preforms for infusion or autoclave/oven cure and to play with a wide range of materials and processes.”

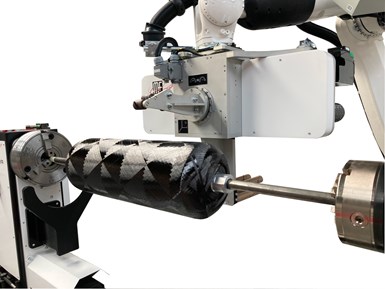

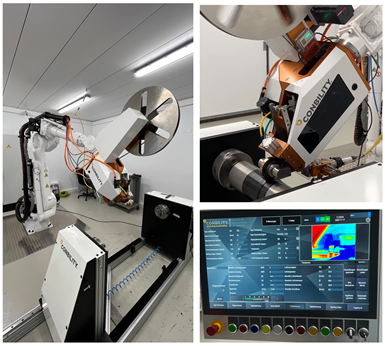

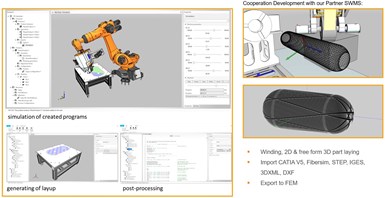

Conbility multi-material/process 3D cells

Founded in 2015, Conbility (Herzogenrath, Germany) produces turnkey, laser-safe 2D TPC tape laying cells with in-situ consolidation (ISC) and modular, multi-material 3D tape laying and winding cells. The latter feature its 3D multi-material applicator head, on the market since 2018, which can be integrated into existing robots for layup at up to 1 meter/second. “We have delivered integrated robotic production cells with winding axes, heated layup tables, a certified laser safety enclosure and CAM software,” notes Michael Emonts, Conbility co-founder/managing partner.

Figure 6. Multi-capability 3D cell. Conbility’s production systems are turnkey robotic cells that can switch between laser-based TPC and infrared-heated thermoset materials in 3D layup and winding with dedicated CAM software and inline inspection. Photo Credit: Conbility

Multi-material, -process cells. “Most of our customers want to process TPC tapes using ISC — i.e., laser-assisted tape winding,” says Emonts. “This makes sense to produce various pipes, but our systems can also wind thermoset towpreg, attractive for producing, for example, thin-walled rotor sleeves for electric motors. This multi-capability is good for research groups but is also requested for serial production. We have customers who started with thermoset winding and then upgraded to TPC tape by adding a laser source, fiber optic and a few other process components. All the interfaces in the head and control system are already integrated for adding the laser. We also have customers producing parts with TPC tape who then want to add thermoset winding. With our system, they can swap the laser for an infrared heater, which takes 4-5 minutes and is very intuitive. Our control system also detects automatically what heat source is plugged in and switches the HMI to a different mode, so the user sees which functionality is being used.”

Multi-process digitalization. Conbility has recently developed dedicated CAM software in collaboration with SWMS (Oldenburg, Germany). “We enhanced the 2D and 3D placement with a module for winding path planning,” explains Kai Fischer, Conbility co-founder/managing director. “This enables offline programming of complex paths. For example, a hydrogen pressure vessel can have 30-60 layers, each with different winding angles, while winding around the caps is also very complex. This software receives the CAD file with the mold/mandrel geometry and layer architectures, and then automatically creates the program for the robotic applicator system, taking into account process parameters and collision control.”

This software also enables measuring all process parameters online — e.g., laser power, heat input, consolidation force, tape tension and tape characteristics. “We can define quality boundaries and the system will alert if the material exceeds these or if something goes wrong,” says Emonts. “The process can be stopped immediately to prevent scrapping of parts.” This high-speed process monitoring is combined with closed-loop control of the TPC system’s laser heating. “The user does not define the laser power, but instead the desired temperature,” explains Emonts. “It doesn’t matter if the process speed varies during layup or winding due to geometry, the system always maintains the desired temperature within ±5°C, even at maximum process speed.”

Conbility also offers software modules to realize digital twins of each manufactured part. “In cooperation with an automotive OEM, we recently manufactured ISC thermoplastic inlays to reinforce injection molded parts,” notes Fischer. “This reduced cost, CO2 footprint and weight compared to the already cost-effective short glass fiber-reinforced component. Besides using only a small amount of TPC along the main load paths, our software enables part-individual mapping of all quality relevant material and process data along the complete production chain for improved material efficiency, cost and sustainability. Our production systems connect to customer MES systems via OPC-UA, enabling extraction of quality data and analysis.”

“We are offering a complete solution,” says Fischer, “including the mechanical laying and winding system but also the software for process control and data analysis, so that companies are ready for production.”

Conbility has sold eight multi-material, multiprocess machine systems worldwide and expects to reach more than 12 systems delivered in 2024 for a range of projects including hydrogen tanks. “We are working with large companies on a new hydrogen pressure vessel design using a high-speed winding technology that we invented for thermoset towpreg,” says Emonts. “The winding is many times faster than current processes to produce higher quantities of high-quality pressure vessels. We hope to unveil this later next year.”

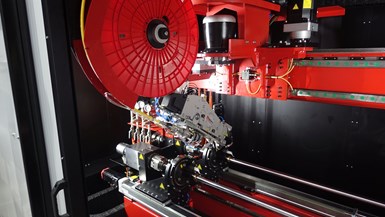

AFPT advances TPC winding for mass production

Advanced Fibre Placement Technology (AFPT, Dörth, Germany) was founded in 2003 as AFPT BV in the Netherlands by co-owner and managing director, Coert Kok, to commercialize laser-assisted TPC winding in Europe. He then worked with Fraunhofer IPT in Aachen, Germany, to develop a closed-loop control system and formed AFPT GmbH in Dörth with partners in 2007. “At first, we focused completely on R&D to make people aware of what you can do with in-situ consolidated thermoplastic composites,” he says. “But now we are working nearly exclusively for industry.”

Alformet was founded to produce thermoplastic composite tubes, pipes and pressure vessels. Photo Credit: Alformet

Kok also founded Alformet (Dörth, Germany) to make parts. “AFPT is a machine builder,” he explains. “But customers would ask us to make small series of parts before investing in equipment, so Alformet deals with that.”

Lucas Ciccarelli is managing director of Alformet. “Our long-term vision is to commodify thermoplastic composite tubes and pipes,” he adds. “But because we’re continuously producing components, we can improve the AFPT equipment.”

Building systems for industry. “We are building machines for producing 500,000 or more units per year,” says Kok. Markets include sporting goods, power tools, pumps and certain parts for cars, offshore piping and automated machines. “It’s very broad and complex, with very different requirements per industry,” says Ciccarelli. One market is rotor sleeves in electric motors which require very thin-walled structures with a low cost point that demands short production times. “So, instead of having a machine that can do different things with multiple materials and add-ons, we’ve found our footing in systems that do one thing as quick and efficiently as possible.”

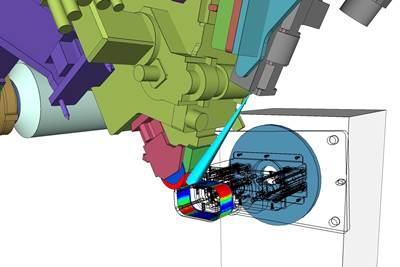

Figure 6. Multi-spindle TPC winding. AFPT’s laser-based ISC cells are now multi-spindle, moving from robots to CNC control for robust, reliable mass production 24 hours/day.

“So, you must build your machine completely differently,” says Kok, “which influences its price. Our machines are now multi-spindle (up to five) and designed to run 24 hours a day. We are also moving away from robots manipulating the placement head, and instead using more CNC control,” says Kok. “The robot becomes not fast or accurate enough for mass production.” This also affects process control. “We can’t afford process destabilization, such as peaks and valleys in temperature,” notes Ciccarelli. “Our control system takes care of that, handling corners or complex geometries while maintaining constant temperature.”

“We have had this type of closed-loop process control for a long time,” says Kok. “The big difference is that we are now solving complex production issues for these industrial machines, which must run continuously.” Ciccarelli agrees, noting, “We have to make these systems reliable and easy to use because we’re opening new markets with companies that have never worked with AFP or winding before.”

Multiple lasers. This is a more recent development to solve an issue with laser-based ISC for TPC parts made more complex in higher rate production. “A lot of people think if you add more laser power, you can go faster,” says Kok. “But that’s not always true because some surfaces and materials absorb less energy than others. We’re advancing this using multiple lasers, such as in our endless winding machine for offshore tubing. And it must be integrated with our process control, which then requires storing more data and being able to process that data in order to go as fast as possible.”

But aren’t multiple lasers expensive? “If you go to mass production, it’s actually one of the cheapest energy sources,” says Kok. “The intensity of the energy is so high that you can go much faster than infrared, hot gas or other heat sources. Lasers are also more accepted in industry, so the price per kilowatt is dropping. A 4-kilowatt laser today costs one-fourth what a 2.5-kilowatt laser cost 10 years ago.”

Tape supply, hydrogen and speed vs. wet winding. Kok says that TPC tape supply is stabilizing both in availability and quality. “There are now tape suppliers focusing not only on aerospace materials, but also more affordable industrial materials. The general quality of TPC tape is quite mature and the necessary quantities are there, but that could change depending on the electromobility and hydrogen pressure vessel markets.”

“We already do a lot of work in hydrogen and there is a huge opportunity there,” says Kok. Here, he refers to Type IV tanks, where a thermoplastic liner is overwrapped with thermoset composite laminate. “We call ours Type IV+ because we achieve fusion between the liner and the TPC laminate that gives some advantages, including for recycling.” But what about the lower speed of TPC tape winding versus filament winding with wet resin? “We will become competitive in the next 2-3 years,” says Kok. “And we can also place local reinforcement, which enables completely different designs.”

Continued competition, growth

New AFP suppliers have expanded the market for composites, which in turn, creates more opportunities for developments. “I think competition is great because it brings the technology to a higher level,” says Motilva at MTorres. Ciccarelli at Alformet agrees, noting, “We complement each other in the market, from smaller machines at a lower cost to machines designed for mass production.”

“I don’t look at other AFP suppliers as competitors,” says Kok. “We are all co-enabling the potential of composites, and in our case, thermoplastic composites. It is also important that our customers see there are multiple potential suppliers of equipment. And then it’s up to them to decide what best fits their needs. But the market is booming because companies are starting to discover the potential that thermoplastic composites offer,” and also the potential that AFP offers across all composites.

Related Content

Plant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreSulapac introduces Sulapac Flow 1.7 to replace PLA, ABS and PP in FDM, FGF

Available as filament and granules for extrusion, new wood composite matches properties yet is compostable, eliminates microplastics and reduces carbon footprint.

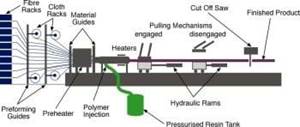

Read MorePultrusion: The basics

A primer describing what pultrusion is, its advantages and disadvantages, and typical applications.

Read MoreRead Next

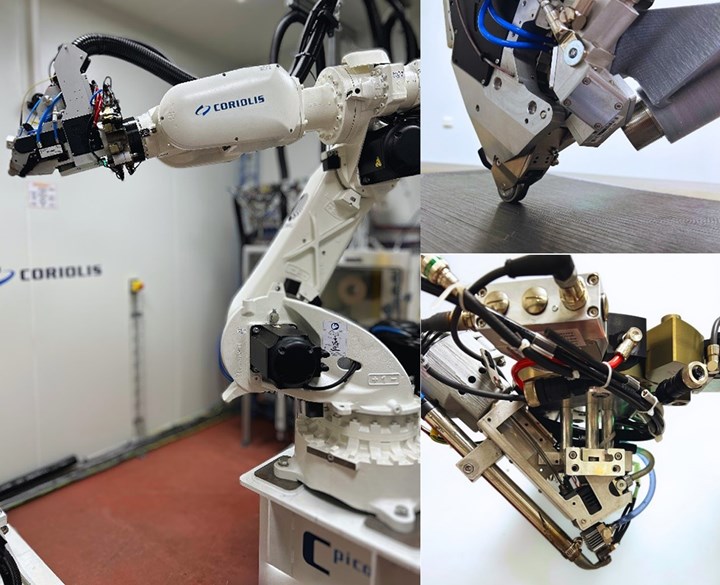

Heat mapping simulation to improve AFP parts

An optical model developed for Coriolis Composites’ SimuReal AFP process simulation software enables verification of energy distributions during AFP to better define heating laws.

Read MoreThe potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More