Editorial - 11/1/2004

The big issue at the recent Intertech conference in Hamburg was Is there enough affordable PAN-based carbon fiber to meet projected demand? More to the point, where will that demand come from and is it real? End users, especially outside the aerospace arena, say they are having trouble getting enough fiber and

The big issue at the recent Intertech conference in Hamburg was Is there enough affordable PAN-based carbon fiber to meet projected demand? More to the point, where will that demand come from and is it real? End users, especially outside the aerospace arena, say they are having trouble getting enough fiber and prices are going up. I think the next six months to a year will be dicey as things sort themselves out, but the slightly longer-term outlook is encouraging.

According to the experts at the conference, the next two years will look something like this: By mid-year 2005 (counting known capacity and announced new capacity) there will be almost 57 million lb of aerospace-grade tow available and about 20 million lb of commercial-grade. This takes into account Toho's recent announcement regarding the disposition of Fortafil's lines. Zoltek also will have converted more acrylic fiber production to precursor in Hungary and nine of its approximately 1 million-lb-capacity 48K commercial-grade fiber lines will be online.

In 2006, we'll see an already announced 9.5 percent growth in capacity, as Toray's additional 4 million-lb capacity comes online in the U.S. and Toho's 3.3 million lb line starts up in Germany. All of this will be aerospace-grade fiber, based on 12K nameplate capacity and will brings the 2006 total to 64 million lb. Meanwhile, Zoltek claims -- and has for years -- that it can bring 1 million lb lines up to speed in just six months, so there is some unnamed potential there.

The experts also predicted 8 percent annual growth in aerospace demand for the next few years, to accommodate Airbus's A380 and Boeing's 7E7, so it will consume about 12 million lb in 2006. Sporting goods use is slated to grow at a slower 3 percent per year, demanding about 10 million lb in the same year. The sleeper is, as always, the hard-to-pin-down industrial applications. The experts predicted 12 to 15 percent annual growth, to more than 30 million lb in 2006 -- a conservative figure or not, depending on who you talk to.

If you simply look at the raw figures, total 2006 capacity will be 84 million lb, while predicted demand will be only 52million lb. So ... why should prices go up? There are so many caveats in this scenario it's hard to know where to start. The two biggest are knockdown and product mix. First, experience tells us to use a 10 percent knockdown factor on line capacity because it's virtually impossible to get 100 percent out of the machinery -- that brings our total figure for realizable capacity down to 75 million lb. Second and more important, a machine's capacity for aerospace-grade fiber is based on how much standard-modulus 12K it can produce annually. Smaller tow (3K, 6K) and higher-modulus fiber bring actual production down significantly. Aerospace applications tend to require the more expensive higher-modulus fiber, and demand is rising there. It's all in the mix, and fiber manufacturers closely guard those figures. As far as commercial-grade fiber goes, its hard to know for certain how much of the existing capacity is being used for carbon fiber and how much is dedicated to oxidized PAN. Still, if the mix brought the 12K capacity down by as much as 40 percent, there would still be slightly more than 52 million lb available -- enough to meet projected 2006 demand.

End users are becoming more attuned to the price/performance equation. If higher performance is required, it's available at an aerospace price. Otherwise, end users will demand and get lower-priced standard-modulus or equivalent fiber. If a real blockbuster application materializes within the next 24 months, manufacturers have some flexibility to modify their production to meet demand, and new lines can be up very quickly.

This manufacturing capacity and flexibility should help smooth out the supply-and-demand cycles of the past and enable much needed stabilization of fiber prices. Assuming adequate supply through 2006, there will be a window of a year or so now for manufacturers to watch the markets and decide if, but more probably, when, to invest in additional capacity before we're up against the wall again with a fiber shortage.

The unknown factor is still future demand. Last year, Toray was the only manufacturer that added new capacity. This year Toray, Toho and Zoltek are adding lines and other fiber producers are "debottlenecking" as fast as they can. Are some of the new aerospace, military, wind blade, drill pipe, automotive, electrical transmission cable, bridge and "other" industrial applications discussed at Intertech and in High-Performance Composites every month really going to be there this time? Fiber manufacturers seem to be betting they will. I think, this time, they're right.

Related Content

SGL Carbon carbon fiber enables German road bridge milestone

A 64-meter road bridge installed with carbon fiber reinforcement is said to feature a first in modern European bridge construction, in addition to reducing construction costs and CO2 emissions.

Read MoreCCG meets customer demand with StormStrong utility pole lineup

Additional diameters build on the portfolio of resilient FRP pole structures for distribution and light pole customers.

Read MoreCCG FRP panels rehabilitate historic Northamption Street Bridge

High-strength, composite molded, prefabricated panels solve weight problems for the heavily-trafficked bridge, providing cantilever sidewalks for wider shared use paths.

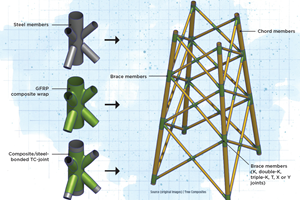

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More