Prepreg forecast: Strong growth through 2013

Prepreg applications are on the rise in the composites industry as manufacturers in a variety of industries increasingly adopt this versatile material. Today, prepregs find use in commercial aerospace, military/defense, general aviation, space/satellite, marine, sporting goods, automotive, civil engineering, wind

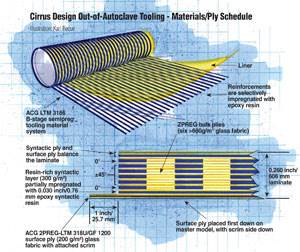

Prepreg applications are on the rise in the composites industry as manufacturers in a variety of industries increasingly adopt this versatile material. Today, prepregs find use in commercial aerospace, military/defense, general aviation, space/satellite, marine, sporting goods, automotive, civil engineering, wind energy and transportation markets, and more. Prepreg materials offer a number of advantages, compared to the metals that they are typically targeted to replace: higher specific stiffness and specific strength, greater corrosion resistance and faster manufacturing. Composite products made with prepreg materials can provide a higher fiber volume fraction than products made by other processes, such as filament winding or pultrusion. In addition, prepregs offer an extensive range of resin and fiber combinations, enabling the user to maximize performance. Further, prepregged fiber forms, ranging from advanced precision slit tape to woven and multiaxial broadgoods built with specific tack and drape, are being designed for tomorrow's low-cost manufacturing technologies — such as automated fiber placement (AFP) and out-of-autoclave (OOA) processing. OOA prepregs can enable a manufacturer to avoid capital investment in autoclave equipment and ongoing autoclave processing costs. Hexcel's (Dublin Calif.) trademarked HexPly M56, for example, is intended for aircraft secondary structures. Unlike traditional aerospace prepregs that must be autoclave-cured to achieve the required properties, this material is designed to provide similar quality and performance from a simple oven cure under vacuum. Available with woven carbon, unidirectional carbon tape, woven glass or metallic mesh reinforcements, the product is suitable for hand layup, automated tape laying (ATL) and AFP. A range of OOA prepregs also are available from Advanced Composites Group (Heanor, Derbyshire, U.K. and Tulsa, Okla.) — see "Learn More."

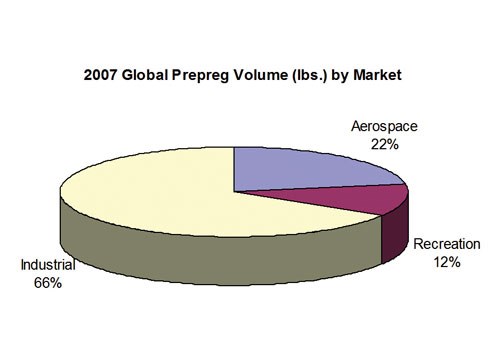

In 2007, total worldwide prepreg shipments exceeded 125 million lb (56,700 metric tonnes), up from about 60 million lb (27,215 metric tonnes) in 2002 and representing $2.2 billion (USD) in revenues. On a volume basis, the global market has doubled in five years, growing at a rate of more than 10 percent per year since 2002, mainly due to the booming wind energy market, the rapid growth of composites manufacturing in Asia and a strong aerospace industry in North America and Europe.

The industrial market, led by the wind energy segment, is the largest user of prepregs on a volume basis, accounting for roughly two-thirds of total shipments in 2007 and posting a 25 to 30 percent growth in that year alone. The aerospace industry is the second largest, followed by the recreational/sporting goods industry.

On a shipment-value basis, aerospace represents the largest market for prepreg, with an approximate 60 percent share of industry revenue, followed by the industrial and recreational/sporting goods markets.

From 2002 to 2007, the prepreg market's annual growth in terms of shipment volume averaged nearly 12 percent, led by the wind energy, commercial aerospace and general aviation markets. In terms of revenue, the wind energy, commercial aerospace and general aviation segments again led the growth of prepreg, both in the 2002-2007 period and in 2007 alone.

The prepreg market is growing rapidly in all regions. North America is the largest prepreg market, with more than 45 percent of the global market share, mainly because of huge demand in the aerospace market from both the commercial and military/defense sectors. North American demand for prepreg increased by 12 percent and 19 percent in terms of shipment value and volume, respectively, in 2007. The European prepreg market is ranked second, accounting for 35 to 40 percent of the global market share, and is similar to the North American market. Growth in Europe, Asia and Rest of World (ROW) during the last five years has consistently been in double digits. Although Asia and ROW together represented only about 12 percent of the global market in 2002, in 2007 they represented more than 15 percent with the highest regional growth rate, led by China and India, which have increasingly adopted prepregs for applications in wind energy, aerospace, civil structures, sporting goods and consumer goods.

On a global basis, prepreg market revenue is forecast to grow 13 to 14 percent in 2008 and average almost 12 percent per year during 2008-2013. Global prepreg shipment values are projected to grow to $4.4 billion in 2013 from $2.6 billion in 2008. This growth depends significantly on the performance of the commercial aerospace, military/defense, general aviation, wind energy and sporting goods industries, which represent 75 to 80 percent of the global market in terms of shipment volume and revenue.

In 2008, significant growth is expected in several markets: aerospace (especially commercial aerospace), military/defense and general aviation; wind energy in North America, China and India; marine in Europe; and civil engineering, particularly in China and India.

During 2008-2013, wind energy and commercial aerospace are expected to continue as growth leaders, with annual volume increases of more than 15 percent, followed by the general aviation and civil engineering segments, at 10 to 11 percent per year. Regionally, during that period, the North American prepreg market will see revenues grow at an average annual rate of 10 to 11 percent, while European revenues grow at a slightly faster rate — 11 to 12 percent. But the Asian region will post the highest annual rate — 16 to 17 percent.

Assuming these forecasts hold, Asia/ROW will have a market share of almost 20 percent in 2013, while North America remains the largest market, with a 40 to 45 percent share.

As this forecast indicates, many potentially valuable opportunities exist in the global prepreg industry. A number of manufacturers are opening new plants or expanding current facilities due to high demand, particularly in the wind energy and commercial aerospace markets. In response, prepreg suppliers are building new capacity to meet the increased demand. This trend is likely to continue as prepregs gain even more acceptance for use in various new aircraft models and emerging applications.

Related Content

TU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MorePlant tour: Teijin Carbon America Inc., Greenwood, S.C., U.S.

In 2018, Teijin broke ground on a facility that is reportedly the largest capacity carbon fiber line currently in existence. The line has been fully functional for nearly two years and has plenty of room for expansion.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreRead Next

Out-of-autoclave tooling gets out of the blocks

General aviation aircraft manufacturer adopts new oven-cure tooling.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;maxWidth=300;quality=90)