AVK report predicts modest GRP growth in Europe

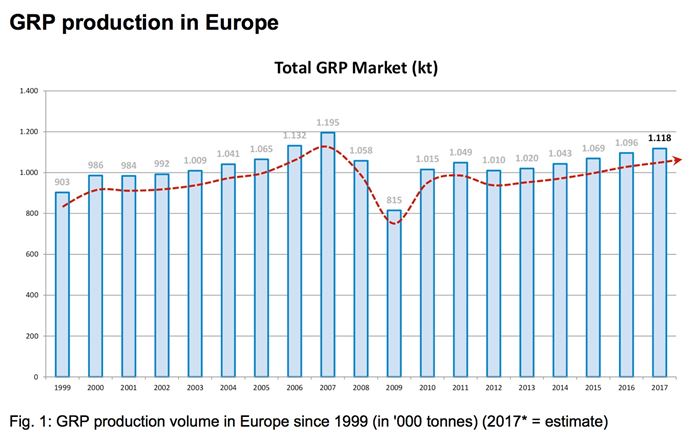

Glass-reinforced plastics (GRP) manufacturing in Europe is expected to expand by 2% in 2017, totaling 1.118 million tonnes.

Share

Read Next

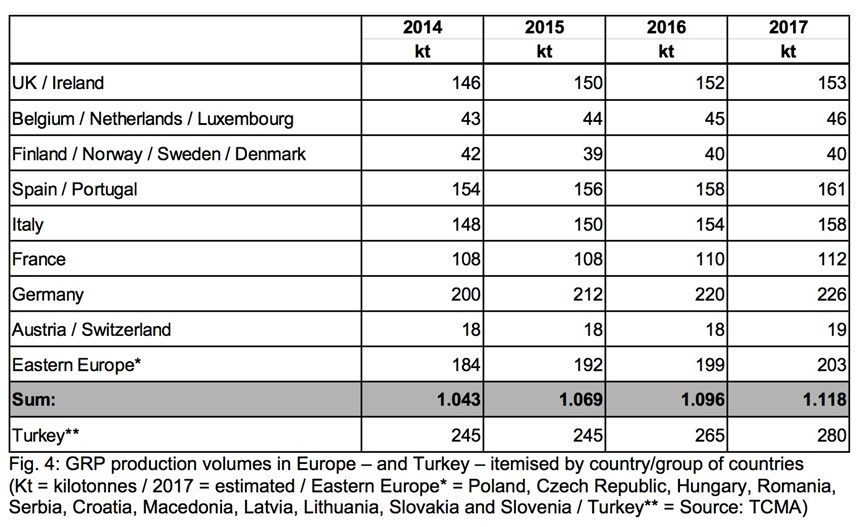

The Industrievereinigung Verstärkte Kunststoffe (AVK; Frankfurt, Germany) has published this year’s market report for glass fiber-reinforced plastics (GRP). In the European countries included in the 2017 study, the GRP market is expected to grow by around 2% compared to 2016, with production forecast to total 1.118 million tonnes. AVK says growth has thus stabilized in this largest segment of the fiber-reinforced plastics and composites industry. Germany remains the European country with the largest GRP production in absolute terms, and has the strongest growth.

As in previous years, the “European GRP Market Report 2017” analyzes those European countries for which production figures can be recorded and validated. Turkey is also included but the data are stated separately. The GRP materials considered include all GRP with a thermoset matrix and, in the thermoplastics market, glass mat-reinforced thermoplastics (GMT) and long fiber-reinforced thermoplastics (LFT). Data on European production of short fiber-reinforced thermoplastics are only available as an overall quantity and therefore stated separately.

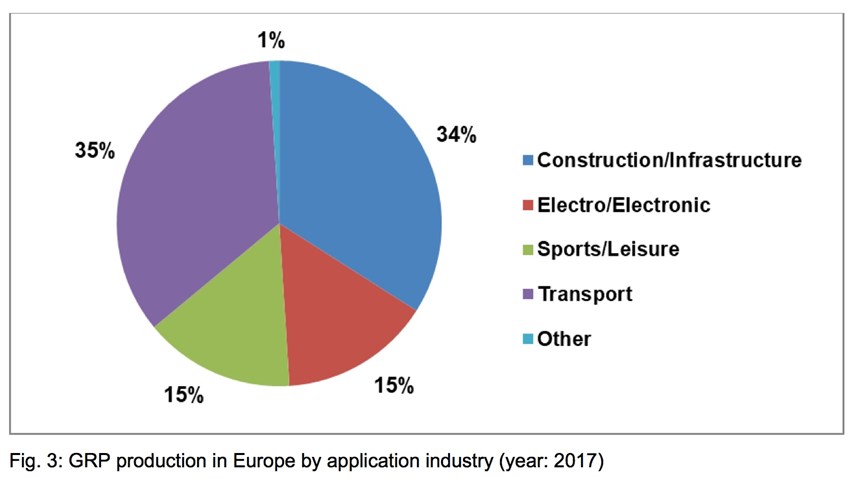

The trends differ from country to country, as well as in terms of the major manufacturing processes and materials used. xThe largest buyers of GRP components continue to be the transport/mobility and construction sectors. These each consume around one-third of total production and play a major role in national economies. The key role played by these two most important sectors in national economies is one reason why the production of GRP tends to follow the long-term growth trend in GDP. Although there is still excellent potential for new applications, GRP materials are already standard products. The diverse nature of the market means that fluctuations in the individual customer industries are usually “smoothed out” by applications in the others.

GRP production in Europe continues to grow but is expected to lag behind the global trend. Growth in global production volume is greater than 2%. As a result, Europe’s share of global production continues to fall despite the positive trend in absolute terms.

SMC/BMC:

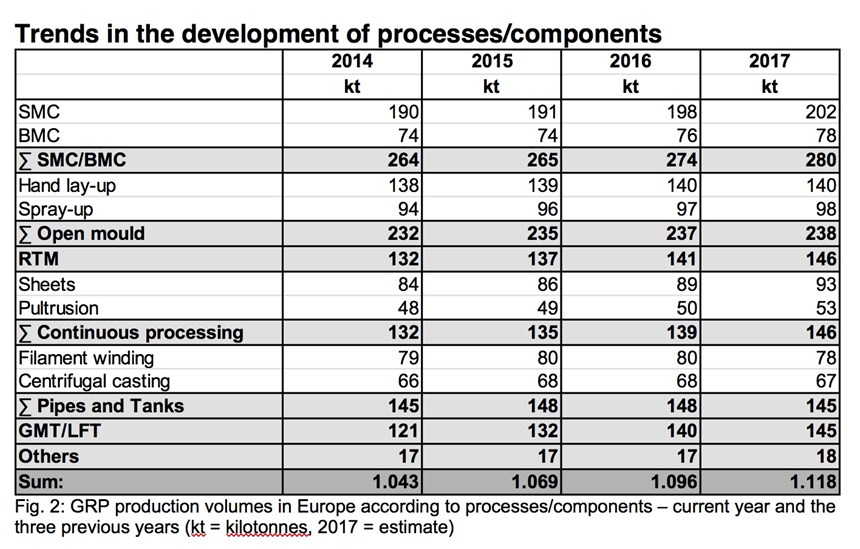

SMC (sheet molding compound) and BMC (bulk molding compound) components account for around one-quarter of total production and are the largest market segment of the GRP industry. Semi-finished products manufactured using pressing (SMC) and injection molding (BMC) processes are turned into components that are used primarily in the electrical/electronic and transport sectors, especially in the automotive industry. This year, the SMC/BMC sector is growing slightly more slowly than last year at a rate of 2.2%. Total production volume this year will be 280,000 tonnes, of which over two-thirds is SMC.

Open Mold/Open Processes:

Open processes like hand lay-up and spray-up continue to be the second largest segment in the European GRP market with total production of 238,000 tonnes. The segment’s trend of comparatively weak growth over recent years continues and is less than 1% in 2017. The larger of the two segments – hand lay-up – is stagnant.

Typical products include housings for wind turbines, swimming pools, boat hulls or attachments, add-on components for special vehicles, prototypes and molds. Parts using these materials are also found in the construction/infrastructure sectors, e.g., in facades.

RTM:

The segment of components manufactured using the RTM (resin transfer molding) process has continued its trend of stronger-than-average growth. Expanding at a rate of 3.5%, it now produces a total of 146,000 tonnes. As in previous years, this category includes all components manufactured using a closed mold. Today, many versions of these production technologies have already reached the market. Applications include vehicle construction, housings for wind turbines, boat and ship building as well as the sport and leisure sector.

Continuous Processing:

The production of GRP components using continuous processing (pultrusion) grew by 5% in 2017 – the strongest growth of any sector. This continues the positive trend of recent years. Total production volume is now in the range of 146,000 tonnes. These products have been used in vehicles for many years, primarily in truck side panels, caravan superstructures or the conversion of commercial vehicles. They are supplemented by applications in the facade sector. The market for GRP pultrusion profiles had the strongest growth rate (6%) in the European GRP industry and now has a production volume of 53,000 tonnes. The largest applications in the segment, each with about a 20% share of the market for pultrusion components, are the consumer/private sector and the construction industry. Typical applications for GRP profiles currently include the production of bridge elements, support or cable duct systems, railings, steps in plant construction and certain areas of the transport industry.

Pipes and Tanks:

After last year’s stagnation in production volume, the GRP market segment of pipes and tanks manufactured using centrifugal casting or filament winding processes is the only area of European GRP to decline this year. The total volume fell by 2% to 145,000 tonnes. GRP pipes and tanks are principally used in plant construction and public/private pipelines as well as by customers in the oil/gas and chemicals industries.

GMT/LFT:

In 2017, the markets for glass mat-reinforced thermoplastics (GMT) and long fiber-reinforced thermoplastics (LFT) have continued their above-average growth at a rate of 3.6%, although this is slightly slower than last year. The trend of recent years means that the market share of GMT/LFT products in relation to the total GRP market has risen from 5% in 2000 to 13% today. The total production of 145,000 tonnes in the segment is split between LFT and GMT in a ratio of around 2:1, with the proportion of LFT rising. These data also include continuous fiber-reinforced materials such as organosheets and tapes. Typical applications for these products include underbody protection, bumpers, instrument panels or seat structures.

Despite the different trends in the markets for the various manufacturing processes, the proportions of GRP used by the major application industries in Europe remain the same as last year. The transport and construction sectors each consume one third of total production. Other application industries include the electrical/electronics sector and the sport and leisure segment (see Fig. 3).

Click here to download “European GRP Market Report 2017.”

Related Content

Composite wrap system combats corrosion in industrial tank repair

A fiberglass and carbon fiber composite wrap system enabled an Australian nickel mine to quickly repair a stainless steel ammonium sulphate feed tank and protect against future corrosion.

Read MoreOwens Corning initiates review of strategic alternatives for glass fiber business

Owens Corning considers alternative options like a potential sale or spin-off as part of its transformative move to strengthen its position in building and construction materials.

Read MoreComposites manufacturing for general aviation aircraft

General aviation, certified and experimental, has increasingly embraced composites over the decades, a path further driven by leveraged innovation in materials and processes and the evolving AAM market.

Read MoreAviation-specific battery system uses advanced composites to address electric, hybrid flight

BOLDair’s composite enclosure, compression structures and thermal runaway management enables high-performance electric energy storage.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.jpg;maxWidth=300;quality=90)