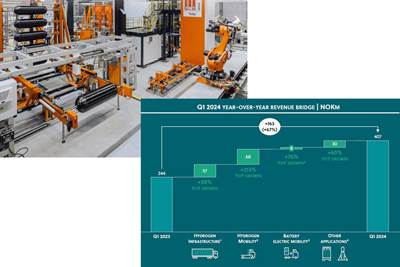

FACC records more than 24% revenue growth in Q1 2024

Workforce expansion, new contracts and diversified portfolios, supply chain stabilization and footprint expansion may lead to €810-850 million revenue for the 2024 financial year.

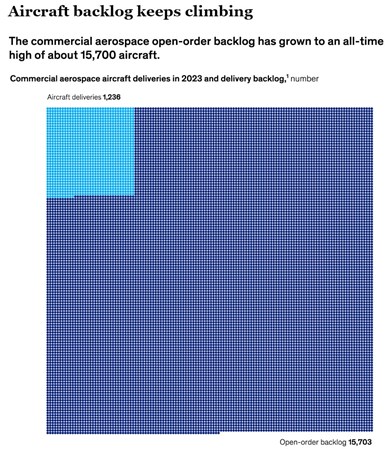

The commercial aerospace open-order backlog has grown to an all-time high of about 15,700 aircraft. 1 Includes narrowbody and widebody aircraft. Source | McKinsey & Company, “Aircraft backlog keeps climbing”

The high demand for air travel as well as record aircraft orders placed by airlines with major aircraft manufacturers have led to a strong order intake at FACC (Ried im Innkreis, Austria), which reports a revenue increase of +24.4% to €202.4 million in the past quarter.

The company cites that this growth is well above the aerospace industry average; FACC is represented on all major platforms of Airbus, Boeing, Bombardier, Comac, Dassault and Embraer and their respective engine families. In addition, new contracts won in recent years, which are now entering the series production phase, are also positively contributing to this high revenue growth.

Moreover, revenue growth, the associated use of capacities at the company’s sites, a noticeable stabilization of supply chains as well as cost benefits from the increased capacity utilization at FACC’s new plant in Croatia have resulted in a significant increase in operating EBIT to €9.9 million.

The growth of the industry, and consequently of FACC, is set to continue in the coming years: airlines had a total of 14,885 passenger aircraft on order from Airbus (8,626) and Boeing (6,259) as per the end of March 2024. In order to process these orders, all aircraft manufacturers are gradually ramping up production rates for their major aircraft types. The business jet market, which is of significance to FACC, is also developing positively at an above-average rate. Compared to previous years, demand in individual segments will increase by around a third over the next 2 years.

New orders and diversification of the product portfolio. In addition to stable growth in its core business, FACC AG was awarded a contract for the manufacture of key components of Eve Air Mobility’s (São José dos Campos, Brazil) electric vertical takeoff and landing (eVTOL) aircraft in Q1 2024. This strengthened FACC’s position in the advanced air mobility (AAM) market.

Latest market analyses forecast an annual market volume of $25 billion from 2040 onward. To date, FACC has concluded development and production contracts with several AAM manufacturers. Within the next 3 years, FACC expects to generate additional revenue of around $90 million for commissioned R&D services in this new sector. Customers are vigorously working toward the approval of AAM solutions for logistics and passenger transport to enable the first commercial applications in the next 12-24 months.

Expanding its international footprint. Expansion of the Croatian plant, which was started in 2023, progressed according to plan in Q1 2024. This is also reflected in an increased investment volume of €10 million (prior-year period: €2.3 million). The construction work to triple the plant area will be finalized by June 2024. After completion, the Croatian site will offer a capacity of 1 million manufacturing hours, increasing the capacities and sustained improvements in FACC’s cost structures.

Workforce expansion continues at all locations. At the end of Q1 2024, the number of FACC employees grew by 602 compared to the end of the first quarter of 2023. In the first quarter of 2024 alone, workforce was increased by 156 employees to a total of 3,612. In order to further raise its standard of quality, FACC is investing in a new Welcome & Training Center at the Reichersberg site in Upper Austria. The campus will be completed in 2024 and will be available for training new and existing employees.

When considering the rest of the year, FACC expects this upward trend in the industry to continue. Based on its incoming orders and short- to medium-term customer forecasts, a revenue ranging from around €810 million (+10%) to €850 million (+15%) is anticipated for the 2024 financial year. Investments in the region of €50 million are also planned. The number of employees will increase to around 4,000 worldwide by the end of the year.

For related content, read “FACC sees 23% increase in revenue, beginning of ramp-ups for widebody aircraft.”

Related Content

PEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreA new era for ceramic matrix composites

CMC is expanding, with new fiber production in Europe, faster processes and higher temperature materials enabling applications for industry, hypersonics and New Space.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreRead Next

Arris Composites secures $34 million to fuel growth in aerospace, consumer markets

Next-gen Additive Molding platform is expected to go mainstream with scaled global operations, thanks to investments from companies like Youngsone and ST Engineering.

Read MoreHexagon Purus reports all-time high quarterly revenue, up 67% over Q1 2023

Type 4 CFRP cylinder manufacturer continues ramp-up, with H2 infrastructure up 38% and H2 mobility up 213% year over year while momentum continues in aerospace applications.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More