Gurit 2021 net sales impacted by reduced wind blade, balsa demand

Preliminary, unaudited net sales of approximately $507.9 million indicate a -19.8% decline at constant exchange rates. A single-share structure and share-split are also proposed to the AGM.

Photo Credit: Getty Images

As of Jan. 31, Gurit Holdings AG (Zurich, Switzerland) has reported preliminary and unaudited net sales of CHF 467.9 million (approx. USD $507.9 million) for the full year 2021. This is a decline of -19.8% at constant exchange rates or -18.9% in reported CHF versus the prior year. The company’s Board of Directors is proposing to the Annual General Assembly a share split and the introduction of a single-share structure, as a measure to further strengthen the company’s Corporate Governance and ESG performance.

Overall, Gurit saw its 2021 net sales impacted by a globally reduced demand for wind blades and by a decreasing demand and price of balsa, compared to a very strong demand the previous year. Comparatively, the Marine and Industrial markets have picked up double-digit growth rates in the second half of the year, compared to 2020.

Composite Materials reports net sales of CHF 221.8 million (approx. USD $240.8 million) for 2021. This is a decline of -21.1% at constant rates compared to 2020. The decrease is due to lower wind demand and globally reduced volumes and prices in balsa. The Marine and Industrial markets have performed strongly and saw double-digit growth rates.

Kitting recorded net sales of CHF 185.5 million (approx. USD $201.3 million) for 2021. This is a decrease of -17.8% at constant exchange rates compared to 2020. Kitting net sales were also negatively impacted by the slowdown in wind blade manufacturing as well as lower material pricing.

The Business Unit Manufacturing Solutions (Tooling) reported net sales of CHF 73.2 million (approx. USD $79.4 million), which represents a decrease of -28.3% at constant exchange rates compared to 2020. The second half of 2021 saw a weaker tooling market in general and particularly in China.

Aerospace reported net sales of CHF 30.1 million (approx. USD $32.7 million) for 2021. This represents a decrease of -5.3% at constant exchange rates compared to 2020. While the Business Unit faced a sharp decline compared to pre-COVID-19 levels, sales trends continue to head in a positive direction with global aircraft OEMs increasing build rates.

|

Net sales in million CHF

|

Full year

|

Sales by quarter |

||||||

|

2021 |

2020 |

Change in reported CHF |

Change at constant 2020 rates |

Q1 2021 |

Q2 2021 |

Q3 2021 |

Q4 2021 |

|

|

Composite materials |

221.8 |

276.2 |

-19.7% |

-21.1% |

59.8 |

58.4 |

51.1 |

52.6 |

|

Kitting |

185.5 |

225.6 |

-17.8% |

-17.8% |

43.0 |

52.2 |

42.8 |

47.5 |

|

Manufacturing solutions (tooling) |

73.2 |

98.7 |

-25.8% |

-28.3% |

30.6 |

24.7 |

8.6 |

9.2 |

|

Aerospace |

30.1 |

31.6 |

-4.6% |

-5.3% |

6.6 |

7.6 |

7.8 |

8.1 |

|

Elimination |

-42.7 |

-55.3 |

-12.3 |

-12.0 |

-8.0 |

-10.4 |

||

|

Total continued operations |

467.9 |

576.7 |

-18.9% |

-19.8% |

127.7 |

130.9 |

102.3 |

107.0 |

|

Composite components (discontinued operations) |

0.0 |

2.1 |

-100.0% |

-100.0% |

0.0 |

0.0 |

0.0 |

0.0 |

|

Total group |

467.9 |

578.8 |

-19.2% |

-20.1% |

127.7 |

130.9 |

102.3 |

107.0 |

The Board of Directors proposes the adoption of the “One Share, One Vote” principle by introducing a single registered share structure. The proposed new share structure is reported to further strengthen the Corporate Governance of Gurit and provide equal voting rights for all shareholders.

Current significant registered shareholders have indicated their agreement to waive their voting rights privileges in favor of a new single-share structure, without compensation. The voting rights of current registered shareholders together would change from 36.4% to 10.3% after the introduction of the single registered share.

The listed bearer shares of Gurit have also seen a significant price increase over recent years. To facilitate trading for private investors, the Board of Directors will propose a 1:10 share split at the Annual General Meeting scheduled for April 20, 2022. This affects 420,000 Gurit bearer shares with a nominal value of CHF 50.00 each (Swiss security No. 801223, ISIN CH0008012236, symbol GUR) listed on SIX Swiss Exchange. At the same time the Board will propose a 1:2 share split of the currently unlisted registered shares of Gurit Holding AG. Provided the Annual General Meeting approves these proposals, the share splits would become effective at the beginning of May 2022.

Related Content

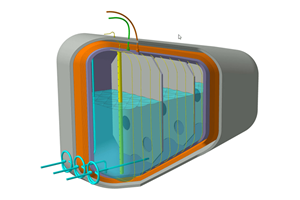

Infinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreCollins Aerospace to lead COCOLIH2T project

Project for thermoplastic composite liquid hydrogen tanks aims for two demonstrators and TRL 4 by 2025.

Read MoreMingYang reveals 18-MW offshore wind turbine model with 140-meter-long blades

The Chinese wind turbine manufacturer surpasses its 16-MW platform, optimizes wind farm construction costs for 1-GW wind farms.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.jpg;maxWidth=300;quality=90)