NRP Zero invests in hydrogen pressure vessel producer Umoe Advanced Composites

Nordic shareholding investment funds UAC’s manufacturing expansion in Norway and Asia, with an initial target volume of 12,000 fiberglass storage tanks annually for both facilities.

The Nordic cleantech fund NRP Green Transition I, which is managed by NRP Zero (Oslo, Norway), invests to become shareholder in the fast-growing glass fiber pressure vessel producer Umoe Advanced Composites AS (UAC, Kristiansand, Norway). The investment funds UAC’s manufacturing expansion in Norway and Asia.

UAC develops and manufactures advanced lightweight composite pressure tanks (e.g., glass fiber) and transportation modules for hydrogen, biogas and compressed natural gas (CNG). UAC says it uses glass fiber because it is significantly less costly than other materials like carbon fiber, and, because of its weight advantage, its application enables the transportation of two to three times more hydrogen compared to similar-sized tanks in steel, representing major cost and environmental benefits.

“UAC is a global technology leader that is well positioned to win market shares within transport and storage in a rapidly growing hydrogen market,” Carl Petter Finne, managing partner at NRP Zero AS, which is the asset manager of NRP Green Transition I, says. “The company’s management has proven that it can deliver strong growth and improved profitability. We are pleased to invest into UAC and look forward to collaborating with existing owners and the management to develop the company further.”

NRP Zero invested an undisclosed amount for a 10.7% shareholding in UAC. The parties have agreed to not disclose the financial details of the transaction. The proceeds from the investment will be used to facilitate a manufacturing expansion in Kristiansand, Norway, plus an investment in China, where UAC’s Chinese joint venture company is building a manufacturing facility with an estimated annual production of 8,000 pressure vessels. The new facility will reportedly provide significant scale advantages and improve UAC’s competitive position in all markets, including China and the rest of Asia.

UAC is majority shareholder in the joint venture company. Other shareholders are Yield Capital and Chinese industrial group Befar Group, which is one of China’s 500 largest companies. Yield Capital is the investment arm of China’s leading technology university, Tsinghua University.

“Yield Capital’s previous investment in UAC contributed towards establishing the Chinese joint venture. We have also ordered long lead items such as machines and other equipment,” Øyvind Hamre, CEO of UAC, adds. “The new investment from NRP Zero means that we can increase production volumes in both Norway and China quicker than we originally planned. The initial target volume for both manufacturing facilities is 12,000 pressure tanks annually.”

The Chinese companies Hypower and Befar Group have already placed a conditional $60 million order for hydrogen pressure tanks from UAC.

Increased capacity in Kristiansand

During the past year, UAC has reported a significant increase in its annual production capacity in Kristiansand, Norway. With new machines already in place, UAC says it will enter 2023 with three times higher manufacturing capacity than the company had in 2021. To manage the growing demand for the company’s products, UAC has increased its workforce in Kristiansand from 30 to 50 employees during the past year.

Since 2017, UAC has had a compound annual growth rate of 46%. The company delivered revenue of NOK 150 million (~$15 million) in 2021, which represents a 50% increase from the previous year.

“We expect revenue well in excess of NOK 200 million [~$20 million] this year,” Hamre says. “The key is strong focus on operations and our value chain, plus the strategic choice we have made to retain world-leading product expertise and specialist competence here in Kristiansand.”

Norwegian industrial investment company Umoe AS remains UAC’s largest shareholder following NRP Zero’s investment, with a shareholding of 64.4%. Other shareholders are Yield Capital, UAC’s management and other minority shareholders.

“The demand for UAC’s products is strong in several markets,” Thomas Moe Børseth, UAC’s chairman and investment director in Umoe, says. “China has launched its ambitious hydrogen plan, the Biden administration is subsidizing the deployment of hydrogen and the EU has defined hydrogen as a key component for an emission-free Europe. This represents great opportunities for UAC, which is well positioned to capitalize on this growth.”

NRP Zero is a licensed asset manager (AIFM) and investment advisor to the fund NRP Green Transition I. The fund invests in small- to medium-sized cleantech companies in the Nordics with an identifiable growth potential beyond Nordic boarders and alignment with EU’s taxonomy for sustainable business. NRP Zero is a subsidiary of the independent Nordic asset manager and finance company, Ness, Risan & Partners AS.

Related Content

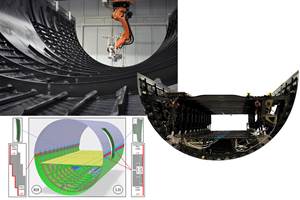

Manufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreNatural fiber composites: Growing to fit sustainability needs

Led by global and industry-wide sustainability goals, commercial interest in flax and hemp fiber-reinforced composites grows into higher-performance, higher-volume applications.

Read MoreBio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MorePlant tour: Teijin Carbon America Inc., Greenwood, S.C., U.S.

In 2018, Teijin broke ground on a facility that is reportedly the largest capacity carbon fiber line currently in existence. The line has been fully functional for nearly two years and has plenty of room for expansion.

Read MoreRead Next

Umoe Advanced Composites enters JV for large-scale glass fiber pressure vessel production in China

Large-scale production facility ramps up hydrogen expansion, with an annual production capacity of 12,000 glass fiber pressure vessels.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;maxWidth=300;quality=90)