Parker Hannifin completes acquisition of Meggitt PLC

With the acquisition, Parker Aerospace Group aims to expand its portfolio with Meggitt’s global defense and aerospace technologies.

Motion and control technologies company Parker-Hannifin Corp. (Cleveland, Ohio, U.S.) announced on Sept. 13 that it has completed its acquisition of aerospace and defense components manufacturer Meggitt PLC (Coventry, U.K.) for approximately £6.3 billion.

Meggitt reportedly had annual revenue of approximately £1.63 billion for the 12 months ending June 30, 2022 and employs more than 9,000 team members serving customers globally.

Meggitt is said to have diverse aerospace and defense exposure with technology and products on almost every major aircraft platform. According to Parker-Hannifin, combining Meggitt’s and Parker’s product lines will enable greater support of electrification and net-zero emissions goals.

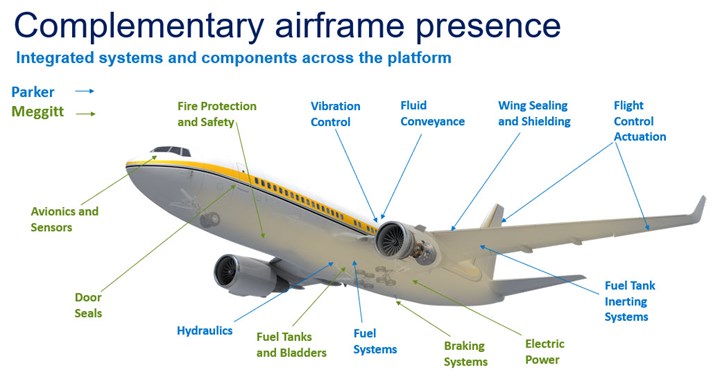

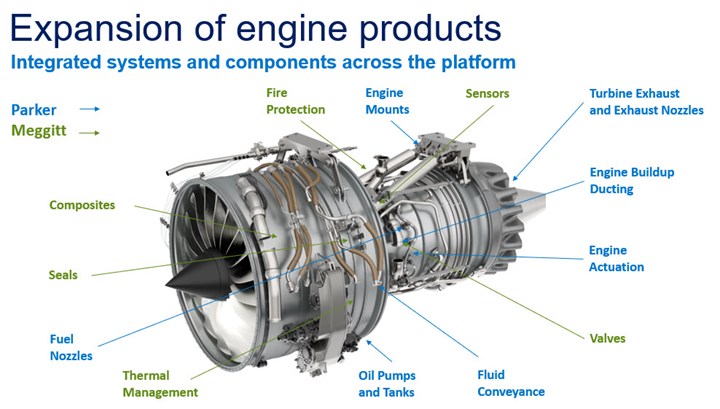

Parker reports that its core offerings now include braking systems, advanced engine sensors, safety systems, engine valve and actuation, electric power and thermal management. To Meggitt’s portfolio, Parker adds insight and pedigree of flight controls and hydraulics, fluid systems including fuel tank inerting, fluid conveyance, lubrication and more (See images below for a breakdown of Meggit’s and Parker’s technologies).

“We are excited to have reached the closing of what is a very compelling strategic and cultural combination,” says Tom Williams, chairman and CEO of Parker-Hannifin Corp. “Meggitt’s complementary product portfolio and geographic footprint, as well as its proprietary and differentiated technologies, will significantly enhance Parker’s capabilities, positioning us to provide a broader suite of solutions for aircraft and aeroengine components and systems. This acquisition continues the transformation of Parker’s portfolio with greater exposure to longer cycle, more resilient businesses that are well positioned for secular growth trends.”

According to Parker-Hannifin, the transaction is expected to drive significant value creation for shareholders through increased organic growth, stronger cash flow and add to Parker’s earnings per share, excluding one-time costs and deal related amortization. Meggitt will add complementary technologies, increase Parker Aerospace’s aftermarket mix through recurring revenue, and enhance growth opportunities through commercial aerospace recovery, anticipated global aircraft fleet renewal, and in emerging trends such as electrification and low-carbon technologies.

Roger Sherrard, president of Parker’s Aerospace Group, adds, “Parker has great respect for Meggitt, its heritage and its place in British industry. We are committed to being a responsible steward of the company and we plan to continue to innovate and invest in key markets that are of importance to Meggitt. The combination of Parker and Meggitt is exciting for both companies and provides our customers with a broad array of solutions for the global aerospace industry. We welcome the Meggitt team to the Parker Aerospace Group. Our joint integration team will work collaboratively to ensure a seamless transition for customers, distributors and suppliers.”

The acquisition follows a decision announced by Meggitt’s Board of Directors in Aug. 2021.

Related Content

-

From the CW Archives: Airbus A400M cargo door

The inaugural CW From the Archives revisits Sara Black’s 2007 story on out-of-autoclave infusion used to fabricate the massive composite upper cargo door for the Airbus A400M military airlifter.

-

Hypersonix receives CMC scramjet manufacturing demonstrator

HTCMC component demonstrates manufacturing of future Spartan scramjet engine required for reusable hypersonic vehicles capable of up to Mach 12 flight.

-

MATECH C/ZrOC composite is deployed in hypersonic aeroshells

Ultra high-temperature insulating CMC targets hypersonics, space heat shields and other demanding applications, tested up to 2760°C under extreme stagnation pressures.

.jpg;width=70;height=70;mode=crop)