SGL Carbon achieves annual targets for 2023, invests more in growth markets

SGL highlights record profits in three out of four businesses despite drop in demand from wind market, looks into declining Carbon Fibers unit as it enters 2024.

In fiscal year 2023, SGL Carbon SE (Wiesbaden, Germany) achieved sales and earnings targets it set at the beginning of the year despite the drop in wind demand and an increasingly challenging economic environment. Group sales decreased slightly by €46.8 million (-4.1%) to €1,089.1 million (previous year: €1,135.9 million). At €168.4 million, adjusted EBITDA, a key performance indicator for the group, was also down slightly (-2.5%) compared to the previous year (€172.8 million) but was clearly within the forecast range for 2023 of €160-180 million.

While there were positive sales development for SGL’s Graphite Solutions (+€53.5 million to €565.7 million), Process Technology (+€21.6 million to €127.9 million) and Composite Solutions (+€0.8 million to €153.9 million) business units, its Carbon Fibers business had a negative impact on group sales with a sales decline of €122.3 million to €224.9 million.

“Demand for carbon fibers for the wind industry fell dramatically at the beginning of 2023. Construction activities for offshore wind turbines, in which our carbon fibers are needed, almost came to a standstill,” explains SGL CEO Dr. Torsten Derr. “High raw material costs and interest rates, as well as low acceptance prices and high regulatory barriers, are currently making the construction of new wind parks almost unprofitable, particularly in Europe. This has also hit our business unit [Carbon Fibers] hard. Accordingly, its sales and earnings declined significantly. Nevertheless, the record results of the three other SGL business units almost completely compensated for this downturn, meaning that we still achieved our targets for 2023.”

Earnings development

The contribution of the individual business units to SGL Carbon’s adjusted EBITDA reflects the sales development already described. Despite the volume-related drop in adjusted EBITDA for the Carbon Fibers reporting segment (€43.2 million in 2022 to €7.2 million in the reporting period; -€36.0 million difference), the adjusted group EBITDA decreased by only €4.4 million (-2.5%) to €168.4 million. The drop in Carbon Fibers’ adjusted EBITDA was offset by the positive EBITDA development of the three other business units mentioned above, which has improved the adjusted EBITDA margin slightly year on year from 15.2% to 15.5% in 2023.

Carbon Fibers led to an impairment loss of €44.7 million on the assets of this business unit in the first half of 2023, which accounted for the majority of the one-off effects and special items of -€52.9 million in 2023. Taking into account the one-off effects and special items as well as depreciation and amortization of €58.9 million (previous year: €60.8 million), reported EBIT amounted to €56.6 million in 2023 (previous year: €120.9 million).

In general, Carbon Fiber’s financial results have worsened by €7.4 million year on year to -€34.2 million (previous year: -€26.3 million). This is due in particular to higher interest expenses for financial liabilities and pensions amounting to -€30.7 million (previous year: -€24.3 million). Consolidated net income decreased to €41.0 million in 2023 (previous year: €126.9 million). It should be noted that the consolidated net income includes tax income of €19.3 million (previous year: €31.3 million). This development is mainly due to valuation adjustments on deferred tax assets in the amount of €31.0 million based on good business performance combined with positive earnings prospects in the U.S. (previous year: €41.8 million).

Net financial debt and equity

As in previous years, net financial debt continued to decrease in 2023 and amounted to €115.8 million as of Dec. 31, 2023 (previous year: €170.8 million), which corresponds to a reduction of 32.2% compared to the previous year. This is due, in particular, to the increase in free cash flow to €95.6 million (previous year: €67.8 million). The leverage factor was 0.7 after 1.0 in 2022.

SGL expects different developments in its key sales markets in 2024.

At €87.1 million, investments (capex) in intangible assets and property, plant and equipment in 2023 were around 64.7% higher than in the previous year (€52.9 million) and significantly higher than depreciation and amortization of €58.9 million. Almost two thirds of these investments were allocated to Graphite Solutions and in the expansion of production capacities for specialty graphite products for high-temperature processes. Equity attributable to shareholders of the parent company increased slightly by 6.3% to €605.3 million in the 2023 financial year (previous year: €569.3 million). The equity ratio increased accordingly to 41.1% (previous year: 38.5%). At 11.3%, the return on capital employed (ROCE calculated on adjusted EBIT) remained constant at the previous year’s level.

Business unit developments

In fiscal year 2023, the largest business unit Graphite Solutions accounted for 51.9% or €565.7 million of SGL Carbon’s consolidated sales (previous year: 45.1% I €512.2 million). The 10.4% increase in sales is based on the dynamic development of the semiconductor and LED market segment, particularly in the area of silicon carbide-based high-performance semiconductors. Accordingly, sales with customers in these market segments increased by 40.1% compared to the previous year and now account for 46.3% of total Graphite Solutions sales (previous year: 36.5%). Volume and product mix effects led to a disproportionately high increase in adjusted EBITDA compared to sales of 13.1% to €134.0 million (sales increase: 10.4%). The adjusted EBITDA margin also improved from 23.1% to 23.7% in 2023.

Graphite Solutions’ investments (capex) increased to €57.4 million in 2023 (previous year: €33.3 million). In order to meet the high demand from graphite component customers, investments were made — particularly in plants and machinery — to expand production for these products. Some of these investments are financed by advance payments from SGL customers to secure future production capacities. In total, customer prepayments received in 2023 amounted to €70 million (previous year: €33 million).

The Process Technology business unit increased sales by 20.3% to €127.9 million, continuing its successful course. This positive development is also reflected in the adjusted EBITDA, which rose to a record result of €22.4 million (previous year: €9.9 million). The adjusted EBITDA margin improved accordingly from 9.3% to 17.5% in 2023.

Due to the aforementioned sharp drop in demand in the wind energy market, sales in the Carbon Fibers business unit fell significantly by 35.2% to €224.9 million (previous year: €347.2 million). As a result, some production lines had to be shut down, leading to high idle capacity costs. Accordingly, adjusted EBITDA in this reporting segment fell by €36.0 million or 83.3% year on year to €7.2 million. It should be noted that the adjusted EBITDA of Carbon Fibers also includes the earnings of BSCCB, SGL’s 50:50 joint venture with Italian brake manufacturer Brembo S.p.A. BSCCB’s contribution to earnings amounted to €18.1 million in 2023 (previous year: €16.3 million). Without the positive earnings contribution from BSCCB, Carbon Fiber’s adjusted EBITDA would have amounted to -€10.9 million.

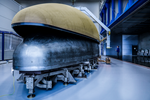

At first glance, sales in the Composite Solutions business unit remained almost constant compared to the previous year at €153.9 million (previous year: €153.1 million). However, it should be noted that the loss of sales from the divestment of the business in Gardena amounting to around €30 million was fully compensated. The volume-related increase in sales led to a significant rise in adjusted EBITDA of 11.0% to €22.2 million (previous year: €20.0 million). The adjusted EBITDA margin consequently improved from 13.1% to 14.4% in 2023.

The non-operating corporate segment contributed €16.7 million to group sales (previous year: €17.1 million). The segment’s adjusted EBITDA improved slightly to -€17.4 million (previous year: -€18.8 million), which is primarily due to lower bonus payments.

2024 outlook

SGL Carbon reports that the global economy will continue to face comparatively high interest rates and subdued growth prospects in 2024. Tighter financing conditions, weak trade growth, and a decline in business and consumer confidence are also weighing on the economic outlook. In addition, heightened geopolitical tensions are contributing to increased uncertainty.

Despite the current weaker demand from some markets, such as the wind industry, SGL believes that its business model will continue to perform well in this challenging environment. The strength of its broad product portfolio has already been demonstrated in the crises of recent years. Furthermore, long-term growth trends remain intact.

SGL expects different developments in its key sales markets in 2024. The most important sales and earnings driver will be demand for specialty graphite components for the semiconductor industry. In contrast, all indicators currently suggest that demand for carbon fibers for the wind industry will remain weak in 2024 and that the company’s Carbon Fibers business unit will therefore continue to record operating losses. Even if demand picks up, SGL assumes that Carbon Fibers will require additional resources to make the most of market opportunities. With this in mind, SGL is reviewing all strategic options for Carbon Fibers. These also include a possible partial or complete sale of the business unit.

The company’s sales forecast for the financial year 2024 takes all four operating business units into account, as SGL is only at the beginning of evaluating the strategic options for Carbon Fibers. In line with the assumptions outlined, SGL is therefore expecting group sales at the previous year’s level (2023: €1,089.1 million).

In the earnings forecast, SGL has taken into account underutilization of production capacity in the Carbon Fibers business unit and the associated high idle capacity costs. The projected operating loss of Carbon Fibers will have a negative impact on the adjusted EBITDA of the SGL Carbon Group in 2024. Due to the expected positive development of Graphite Solutions, the company anticipates an adjusted EBITDA of between €160-170 million for fiscal year 2024, taking into account all four operating business units. Should the process of reviewing all strategic options for the Carbon Fiber business unit result in a sale, the forecast of adjusted EBITDA in 2024 would be between €180-190 million.

“Specialty graphite components for the semiconductor industry, particularly for the production of silicon carbide-based high-performance semiconductors, will be the growth driver for our business in 2024,” says Thomas Dippold, CFO of SGL Carbon SE. “We will continue to expand production capacities in this sector to secure future profitable growth for SGL Carbon. Therefore, the majority of the total planned investments of up to €150 million [previous year: €87.1 million] will also flow into this business.”

Further details on business development in 2023 and the outlook for 2024 can be found in SGL Carbon’s Annual Report here.

Read Next

SGL Carbon Gardena site purchased by Tex Tech Industries

Transaction of SGL Carbon’s U.S. business activities includes certain assets of SGL Composites Inc., as well as plants, machinery and customer contracts.

Read MoreRUAG International sells aerostructures business, grows Beyond Gravity space business by 8% in 2023

Beyond Gravity is expanding and modernizing sites, adding AFP and a new facility in Decatur to double capacity.

Read MoreSGL, Brembo expand carbon ceramic brake disc production capacity

The Brembo SGL Carbon Ceramic Brakes (BSCCB) joint venture will increase Germany and Italy facility capacity by more than 70% for automotive manufacturers.

Read More

.jpg;maxWidth=300;quality=90)