Aerospace: R&D investment now is critical to post-pandemic growth

While reduced R&D investments may be a natural response to the pandemic’s swift and brutal impact to commercial aviation, ramping up innovation is more imperative for the long-term.

My February 2020 column “The coming decade: Clarity with a strong dose of uncertainty” was written at the beginning of the 2020 calendar year, a time when very few people had any inkling that a new virus emanating from Wuhan, China, might turn into the pandemic that it did, with such consequential effects on the world’s population and economy. Even as March arrived, and the seriousness started to become evident, few thought we would still be under the thumb of this pandemic a year later. With multiple vaccines approved and in distribution, one can see a possible end and a path back to something that seems like “normal.” Still, that timeline varies by region and country.

In that February 2020 column, I postulated that the direction of the aerospace industry as it relates to composites was coming into focus — significant R&D investments were being made into higher rate manufacturing, adapting technologies from other markets, like automotive, to meet aerospace qualification processes. The targets were clearly next-generation single-aisle aircraft, built in much larger volumes than typical composites-intensive airplanes.

In contrast, I opined that the direction of the automotive market was much more uncertain. Electrification was gaining momentum, but it seemed internal combustion engines (ICEs) were not going away soon, so the supply community had to work in both spaces. It was not clear how composites fit into that landscape.

History has shown that companies that continue to invest in innovation during a downturn are better positioned than rivals to capitalize when the recovery gains steam.

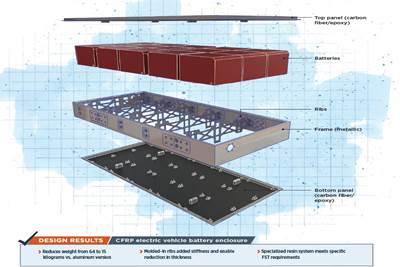

What a difference a year makes. The direction of the automotive industry today has made it clear that electric vehicles (EVs) are the future. As I outlined in my January 2021 column, governments and automakers are moving swiftly, with OEMs developing electric-powered platforms, driven by mandates and falling battery costs. Although Tesla finished 2020 as the leading EV manufacturer, that lead may not last long, with General Motors (GM) and Volkswagen announcing investments of $27 billion and $41 billion, respectively, to develop and manufacture up to 100 electric models combined by 2025. A number of companies are already supplying composite battery enclosures, with new materials being developed for these and other applications on battery electric vehicles. Although the automotive industry suffered a drop in production in 2020, and the initial response of the supply community was to reduce spending, investments in R&D are climbing again.

Compared to the automotive industry, the pandemic had a swift and large impact on commercial aviation, with passenger volume falling by 90% in the first months. Entities along the entire aerospace supply chain moved quickly to contain costs as aircraft orders were delayed or canceled, furloughing or laying off both young and experienced personnel. While many layoffs were in manufacturing roles, OEMs and suppliers have also reduced R&D investments and exited R&D consortia. I have heard of some smaller suppliers shutting down their research departments entirely.

I fear this will have a significant impact on the launch timing of future aircraft. Having seen so many cool innovations being developed in 2019 to reduce layup time, automate inspection and move away from the autoclave, I worry about the maturation of these technologies.

We know it will take time for the aerospace industry to recover financially. Masses of people have to start flying again, domestically as well as internationally. I went almost 10 months, the longest stretch in over 40 years, without setting foot on an airplane. I’ve now made three trips, albeit none for business purposes, and we know the return of business travel is essential before profitability occurs, and for robust delivery of aircraft to resume. The planes I have been on haven’t been full, for safety reasons, but they have been far from empty. It seems the airlines are doing a good job with sanitation, so I hope this, combined with vaccines, portends a stronger-than-expected return to the skies for many people.

History has shown that companies that continue to invest in innovation during a downturn are better positioned than rivals to capitalize when the recovery gains steam. There are sectors within aerospace, like urban air mobility (UAM), space and defense that are still investing, and some government funding continues. However, commercial aviation is the lifeblood of the aerospace industry. Composites have established a significant position in twin-aisle designs, yet are still trying to gain traction for the large structures in single-aisle aircraft. The efforts underway pre-pandemic seemed to be on a course to deliver major breakthroughs, and still have a chance to do just that. Resuming R&D in these projects doesn’t have to happen all at once, but a strong commitment to progressively ramping up investment in composites innovation is imperative for the industry to take advantage as soon as the time is right.

Related Content

A new era for ceramic matrix composites

CMC is expanding, with new fiber production in Europe, faster processes and higher temperature materials enabling applications for industry, hypersonics and New Space.

Read MoreComposites manufacturing for general aviation aircraft

General aviation, certified and experimental, has increasingly embraced composites over the decades, a path further driven by leveraged innovation in materials and processes and the evolving AAM market.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreCombining multifunctional thermoplastic composites, additive manufacturing for next-gen airframe structures

The DOMMINIO project combines AFP with 3D printed gyroid cores, embedded SHM sensors and smart materials for induction-driven disassembly of parts at end of life.

Read MoreRead Next

EV battery enclosure inspires material, process innovations

High unit volume and low weight requirements for electric bus battery enclosures fueled development of TRB Lightweight Structures’ specialized epoxy system and automated composites production line.

Read MoreThe evolution of the commercial aerospace landscape

Following the grounding of the 737 and the downturn caused by the pandemic, Boeing finds itself a distant second to Airbus. What should it do?

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.jpg;maxWidth=300;quality=90)