Airborne, Siemens and SABIC partner to mass produce thermoplastic composites

Flexible, automated production lines, featuring radically low conversion costs, aimed at millions of parts/yr — CW’s interview with all three companies.

Share

|

|

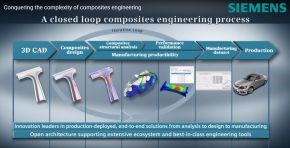

These three companies believe that thermoplastic composites (TPCs) are the next generation of lightweight-enabling materials, with adoptions and developments growing in industries from electronics to automotive to aerospace. Each partner’s expertise is key. Airborne’s experience in composite parts development and process industrialization is further empowered by Siemen’s digitalization capabilities, which span a complete composites CAD-CAE-CAM chain through to digital factory solutions and digital twin platforms. SABIC offers its UDMAX thermoplastic composite unidirectional tapes, as well as extensive materials knowledge and its own R&D in composites processing and product design. The goal: low cost mass production of thermoplastic composites.

CW interviewed:

- Arno van Mourik — founder and director, Airborne

- Gino Francato — business leader for composites, SABIC

- John O’Connor — Director, Product and Market Strategy at Siemens

Partner background

Airborne has established itself as the leading manufacturer of thermoplastic composite pipe for oil and gas. It has developed and built fully automated production processes, commissioning its new-build factory in 2012 and spinning the business out two years later as Airborne Oil and Gas, attracting shareholders such as SHELL, Chevron, Saudi Aramco and Evonik.

Airborne has also pursued a vision of affordable composites by developing automation and processes for the digital manufacturing of composite parts, including an automated laminating cell, automated kitting cell and a pick & place system for thermoplastic blanks. Its Digital Factory for Composites fieldlab was built in 2015 with partners Siemens and Kuka.

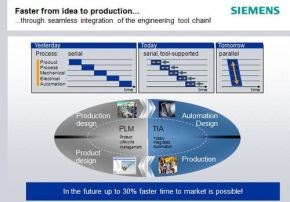

Siemens, meanwhile, has been advancing digital design and manufacturing in composites for decades, spanning a wide range of industries and processes, including aircraft and automotive; prepreg molding, liquid molding and compression molding; and most recently, 3D printing.

|

SABIC also has a history of investing in composites development, including:

- A partnership with Lockheed Martin for carbon nanostructured materials founded in 2014

- Development of composite wheels for automotive with Kringlan and others

- Acquisition of Fibre Reinforced Thermoplastics B.V. (FRT, Lelystad, Netherlands) in 2016.

-

Invesment in a new state of the art development center in Geleen, Netherlands in 2016.

SABIC’s FRT business produces the UDMAX thermoplastic tapes using its “proprietary HPFIT” technology that, with speed and precision, spreads thousands of glass or carbon fibers and combines them with a polymer matrix. The resulting tapes reportedly feature a high fiber content, high-quality impregnation of the fibers with minimal void content and fewer broken fibers. (Read Jeff Sloan’s recent feature on thermoplastic tapes.)

(Note: UDMAX and HPFIT are trademark names of SABIC and its affiliates.)

The partnership coalesces

SABIC was looking for a partner to produce large quantities of thermoplastic composite parts at radically lower cost, says Arno van Mourik. “At Airborne, we have been doing this for a variety of industries,” he notes, adding that production requires not only development of part design, materials and process, but also of equipment and software. “So this is what we are doing in this partnership, building an actual production line, which will produce parts later this year.”

“Airborne has a unique ability to combine process and automation with an understanding of both part and production requirements,” says Gino Francato at SABIC.

SOURCE: Airborne.

“We had met SABIC during our development for an oil and gas application,” says van Mourik. “For these continuous composite spoolabe pipes, we have developed software and an industrialized process that now produces 40-50 tonnes of product in one go without touch labor.”

“This is a really impressive example of the full industrialization of composites that is taking place in the industry,” says John O’Connor at Siemens. “The state of the art is reaching the point where composites are treated like any other industrial material solution.” He notes that production rate has always been a limiting issue for composites’ competitiveness. “So this is where we at Siemens feel we have unique capability. Our focus is digitalization. We can provide design and simulation all the way to the manufacturing floor with CAD-CAE-CAM products. We can also apply our Digital Factory solutions, such as controllers and production system enablers, and our Digital Twin technology.”

Materials and parts

Materials are where SABIC’s contribution begins. “We have a large portfolio of thermoplastic resins,” says Francato. “At SABIC, we believe that thermoplastics can bring composites to the next level due to lower cycle time. There is also less issue with repeatability versus thermosets. We started looking at thermoplastic composites years ago based on UD tapes, which we believe is the optimal material form.” He points out that thermoset composites have also moved toward automated placement of unidirectional tapes for applications that demand the ultimate performance. “We make laminates and sheets with our UDMAX tapes, which our customers then form and overmold into complex components,” says Francato. “This cannot be done in thermosets with the same low cycle time, low cost and additional functions integrated into the part.”

He continues, “We believe this will enable mass production, allowing the broader car industry to tap into the benefits thermoplastic composites can bring.” So automotive is one target. “We believe the type of low cycle times and part-to-part consistency demanded by high-volume automotive applications can happen,” Francato contends. Other target markets include aerospace, consumer electronics, commercial vehicles (trucks) and pipes. “The space available for parts is very wide,” he says. “The materials space is wide also. We are looking at glass and carbon fiber, Nylon (polyamide, or PA), polypropylene (PP) and polycarbonate (PC) in the beginning. We are also willing to go into high-performance polymers such as PEEK (polyetheretherketone), PEKK (polyetherketoneketone), PEI, (polyetherimide), etc.”

Automation

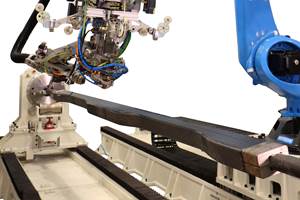

Francato says that automation through Airborne and Siemens is key. “We have started first with automating the material, buying FRT in 2016 and thus we have high-quality, perfect impregnation of large-width tapes at the right speed, which is not easy to achieve. But now we need to make laminates with different plies at different orientations, also at high speed.” He says that though many systems are in pilot projects, there are few actually in production. “Much more has been done for automation using overmolding by Engel and KraussMaffei,” notes Francato. But he sees very fast, mass-produced layups are still lacking. “This is why we looked to find the right company to partner with. Airborne and Siemens have the ability to help automate laminates for specific end-use products. The machines we are now building will attain our goal: hundreds of thousands to millions of parts per year.”

|

|

Airborne has developed automated tape laying (ATL) and pick-and-place work cells for thermoplastic composites. SOURCE: Airborne.

Airborne’s approach is flexible, to meet the need. “We buy equipment but also build our own and combine technologies. We try not to reinvent the wheel but instead integrate machines from other industries that bring innovative improvements. For example, we have looked to the paper industry, cable-winding industry, etc. to meet our needs for product manufacturing. We are also developing ATL (automated tape laying) equipment, but only when we see a niche that is not occupied yet.”

‘We see companies in high rate production but not also in advanced material systems and vice versa,” says O’Connor. “There is an intersection of machine capability, material capability and process capability that leaders in the industry will have to achieve.” He says that Siemens brings a large digital umbrella, of sorts, that can span all of these areas, combining data from each in order to reach a higher level of performance throughout the supply chain and process chain.

Zero defect manufacturing

The digitalized production that O’Connor describes and Siemens enables sounds a lot like the zero defect manufacturing initiative called ZAero. “It’s the same approach,” says van Mourik, noting that these types of optimized material and process chains are what everyone wants to see. “This is exactly what we have done in oil & gas spoolable pipes. If you build a 3-km long, 50-ton high-value product, you don’t want to scrap it during production. But you have to cope with variations in materials and environment and still produce a qualified product. To be able to do that, we have developed the ability to adapt the process parameters continuously based on advanced manufacturing process models and inline process control.”

Francato says this is where process modelling comes in. “What is the impact of a defect in the materials or the layup? We want to be able to manage material adjustments on the fly. However, a lot of data is needed to really convince the OEMs. There is no way to do this without having a fully automated supply chain and process chain.” Francato notes that a lot of simulation is being done in injection molding, but not as much in continuous fiber composites. However, SABIC did just this, two years ago, qualifying a generic composite hybrid beam made using UDMAX tapes in selected locations. “We made the part in less than one minute and used it to test and validate our simulation models. We need to know how to translate from one tape to a finished part but also understand consolidation and forming of parts.”

O’Connor says the whole process can be digitalized by Siemens. “We have in-house products and also partnerships to supply additional capabilities that may be needed.

Flexible production lines, first apps in automotive

Van Mourik also sees that production lines must become so flexible that they can run small series in between large series. “The digital manufacturing concept enables this reconfiguring of the line to the precise, optimized settings for each product.” The vision is a small number of very flexible production lines. “Consolidation stations will be the least flexible, while the building block approach for layup will be closer to generic,” he adds.

“For automotive and consumer electronics, qualification is not as lengthy as in aerospace,” says Francato, “so changing from one part to another, from one model to another, we can make sure we have a very robust system here first.” He acknowledges that TPCs in automotive can certainly play a role in autonomous driving and sensors, “but also in interiors because so much functionality is needed. We can drop cost here versus traditional materials and SABIC also has a large expertise in materials for automotive interiors. We see hat this collaboration with Airborne and Siemens can help SABIC customers to make parts in a very reliable and consistent way.”

Reining in cost

This partnership is in direct contrast to the very fragmented composite parts value chain that Van Mourik says has been the norm in the past. “In the 1990s you could afford to pay a lot of money to get CFRP (carbon fiber reinforced plastic) parts onto aircraft because of the weight savings and the value that offered. But the cost and lead time of converting carbon fiber into these parts was very high. So we need to reduce both cost and time to market drastically.”

For Airborne, this means chemical companies like SABIC have to be tied in. “Because in the past, formulations were not necessarily optimized for cost-effective production of specific parts. Because we are cooperating with SABIC, this is the first time we can speak that openly to the material supplier to ask for material properties to upgrade performance or downgrade to hit cost targets.” Francato agrees, “Lightweight at the right cost.”

“Now we are optimizing materials and processes together to radically reduce cost and time to market,” says van Mourik. “In consumer electronics, 2-3 years to develop a component is not acceptable. The reality of that market is more like 6-9 months.”

Machine learning to speed production line development

Van Mourik concedes there is a lot of work to do to connect all of the dots in this digital production line. “We try to digitalize the process first,” he explains. “Machine learning can be quite local, for example with press-forming, but then we connect this for each part of the process.” He notes this is also where the partnership with Siemens and SABIC helps, for example, “if the machine tells us to change the process settings but also the material parameters. In the future we’d like an automated connection to the tape production. But we will take one step at a time.”

“This falls within our Industry 4.0 initiative,” says O’Connor. “We have the ability to integrate intelligence throughout the whole process chain. People make million-dollar decisions every day, but typically without the data and view into the whole process that they should have.”

“The potential for thermoplastic composites is very new,” says Francato. “But this partnership will accelerate the development and application of thermoplastic composites via digital processes.” He adds that the digitalized lines themselves will help shorten development. “We don’t have to do all of the analytics by hand. These digitalized systems will help to fill in much of the data and detail.”

Van Mourik gives an example. “To get a composites manufacturing process right, you have to monitor and control dozens of parameters. Our engineers typically look at a handful that are easiest to understand and control. On one of our lines, we had identified the acceptable window for 2-3 of these key parameters. However, using advanced data analytics for the whole process, we were surprised to find alternative combinations of parameters that were outside of this window and intuititvely not very logical, yet they actually gave much better results.” He notes it took two Ph.D. chemists some time to understand why, “but now we have a very in-depth knowledge and understanding of this process as well as a new level of performance and efficiency.”

“To give you an example from our side,” says O’Connor, “there are Siemens controllers operating in factories with hundreds of settings optimized for fast, flexible and intelligent production. The composites industry is on the cusp of being able to utilize this level automation and control.

“If we can combine the knowledge of Siemens and SABIC with what we have proven we can achieve in composite parts and process development,” van Mourik posits, “then we can accelerate in a way that has not been possible before. We will start small, but the potential is huge.”

Stimulus for the industry at large

“We want to enable our customers to leverage these continuous fiber thermoplastic materials, but also to bring new solutions much faster than ever before,” says Francato. He sees the opportunities for composites growing due to increased demands for reduced carbon emissions and energy usage. “Consider the size and experience of these three partners. We can inspire other players in this market, that, until now, has been too small.”

Related Content

MFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreTU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreManufacturing the MFFD thermoplastic composite fuselage

Demonstrator’s upper, lower shells and assembly prove materials and new processes for lighter, cheaper and more sustainable high-rate future aircraft.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More