CompositesWorld 2018 Operations Report

CW’s inaugural Operations Report aims to shed some light on the state of composites manufacturing today, and how it might evolve.

To help its audience better understand how the composites industry is evolving, and how manufacturing technologies are currently evaluated and deployed, CompositesWorld recently conducted its first Operations Survey. The results are in, and the data are presented here.

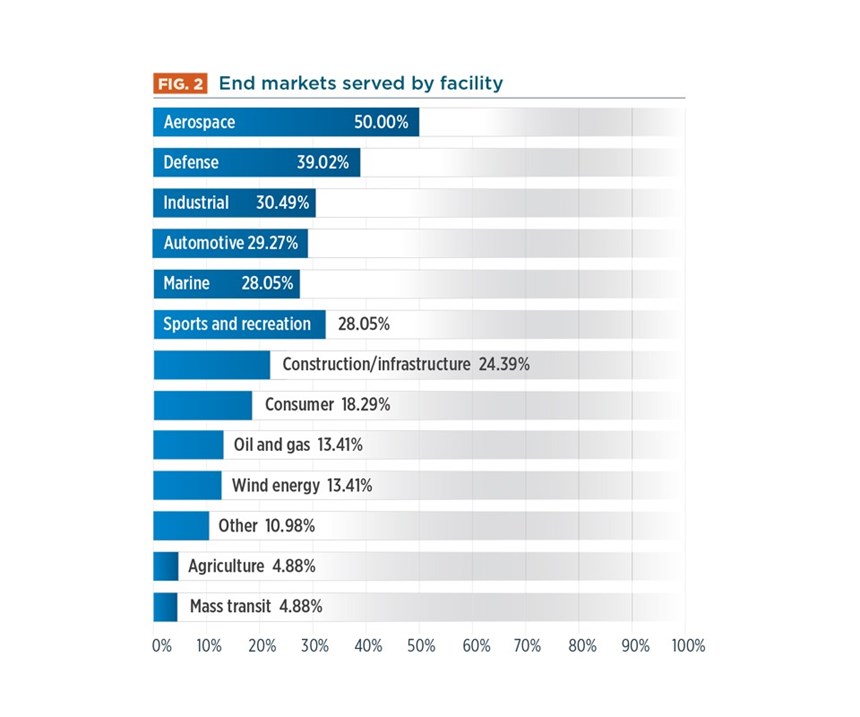

Conducted in late 2017, the Operations Survey was sent to a variety of CompositesWorld readers in a host of manufacturing environments, ranging from aerospace to automotive to marine. The goal was to learn as much as possible about the markets served, the materials and processes used, the emerging technologies and the outlook for growth.

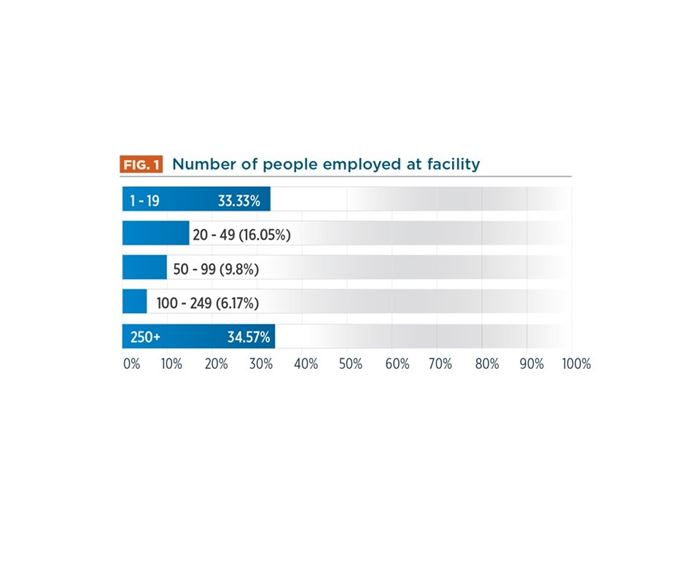

Respondents were based mostly in the United States and work primarily in management, manufacturing, factory automation, engineering and product design and R&D. Survey questions asked for information based on the respondent’s primary facility/location only.

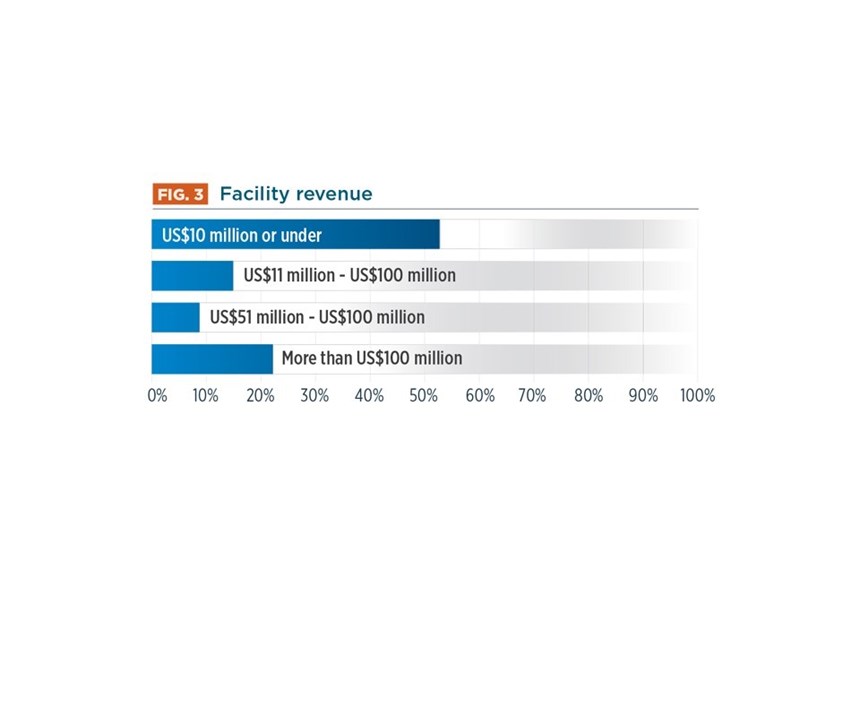

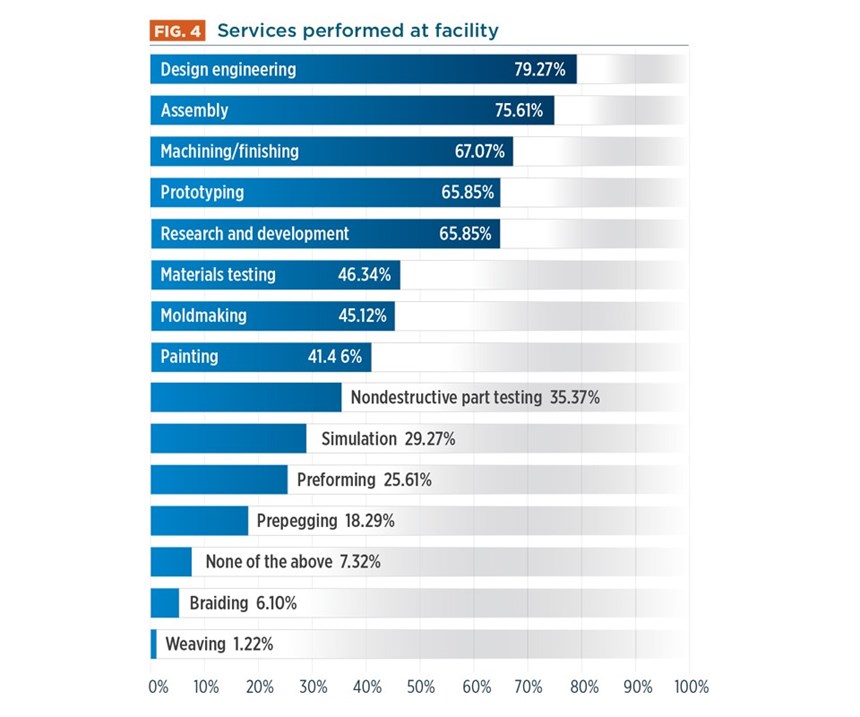

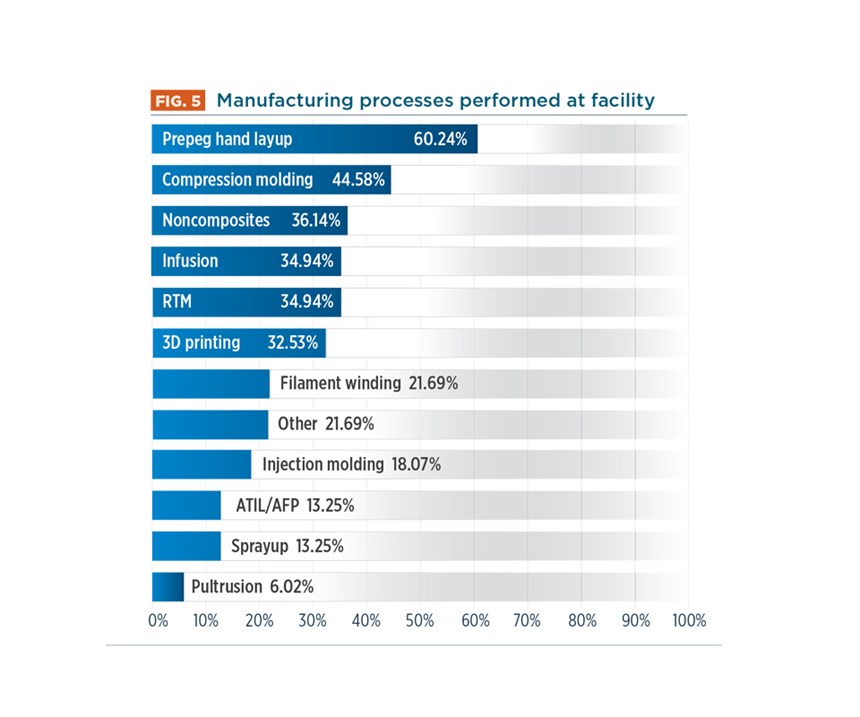

Responses were, not surprisingly, dominated by people who fabricate composite parts for the aerospace end-market (Fig. 2), followed by defense, industrial, automotive and marine. Further, a little more than 50% of respondents work in facilities that generate US$10 million or less in annual revenue (Fig. 3). Of all composites fabrication processes, the most common in the survey were prepreg layup, compression molding, infusion, resin transfer molding (RTM) and 3D printing. And, in addition to composites fabrication, more than 60% of survey respondents work in facilities that provide design engineering, assembly, machining/finishing, prototyping and research and development services (Fig. 4).

The good news is that respondents were, on the whole, highly optimistic about composites use at their facility and by their customers. Over the coming 12 months, 50% of respondents expect their facility’s volume of composites manufacturing, and revenue from composites, to increase. Another 49% expect those two values to remain unchanged.

Similarly, 46% expect the volume of composites used by customers to increase, while 53% expect it will stay unchanged. And 52% expect to spend more money on composites manufacturing equipment in the next 12 months, while another 44% expect equipment investment to remain unchanged. In fact, respondents indicated that about 10% of gross sales revenue was spent on new manufacturing equipment in 2017.

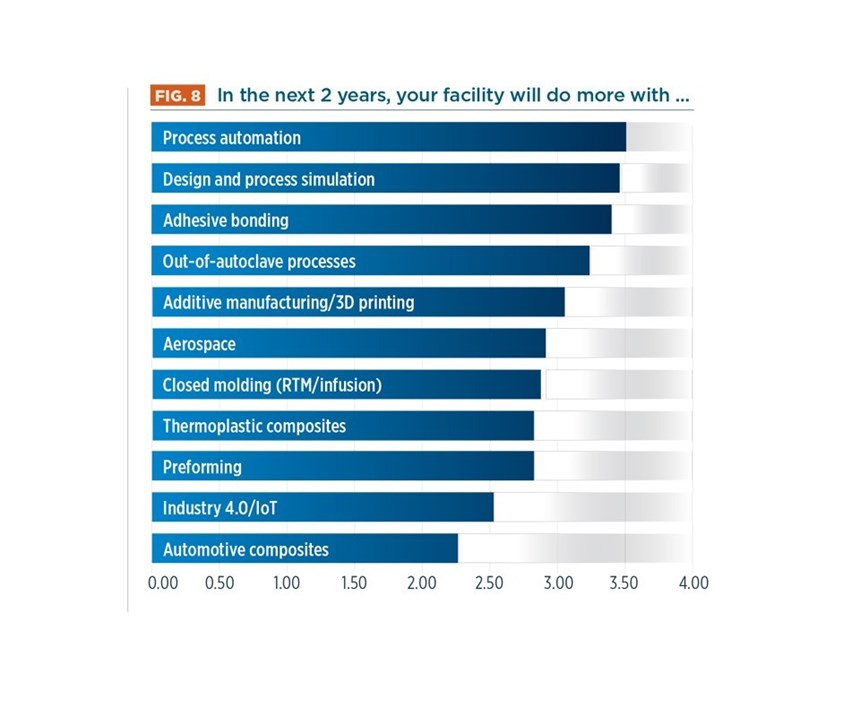

We also asked respondents to look at emerging technologies and agree or disagree that use of them at their facility will increase over the next two years — 1 = strongly disagree, 5 = strongly agree. The graph in Fig. 8, above, shows the average rating (characterized as “intent”) for each technology category. Not surprisingly, process automation, design/process simulation and adhesive bonding top the “agree” list, followed by out-of-autoclave, 3D printing, aerospace composites, closed molding, thermoplastics, preforming, Industry 4.0 and automotive composites.

There is, however, a story within this data. Responses to our query about aerospace composites intent were highly polarized, with 29% each strongly agreeing and disagreeing that use would increase at their facilities, which might reflect the fact that aerocomposites manufacturing can be highly lucrative, but also very challenging. Responses regarding automotive composites intent, however, were more clear: 62% either disagreed or strongly disagreed. This might be symptomatic of widespread uncertainty regarding the potential of composites use in high-volume vehicles. Responses regarding 3D printing intent, on the other hand, were more evenly distributed, with 20% each rating it 1, 3, 4 or 5.

CW will conduct this Operations Survey again in late 2018, with data reported in 2019. If you have suggestions for other types of information the survey might seek, please contact CW editor Jeff Sloan at jeff@compositesworld.com.

Related Content

SmartValves offer improvements over traditional vacuum bag ports

Developed to resolve tilting and close-off issues, SmartValves eliminate cutting through vacuum bags while offering reduced process time and maintenance.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreCompPair adds swift prepreg line to HealTech Standard product family

The HealTech Standard product family from CompPair has been expanded with the addition of CS02, a swift prepreg line.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More