New metal coating to optimize composite tooling

Near the end of its development cycle, this nanostructured metal overlay promises to extend the working life and improve the cost-effectiveness of carbon/epoxy tooling.

As composites practitioners well know, tooling for composite parts is a challenge. Metal tools are the most robust option and support rate production, but they need to be carefully engineered to match the coefficient of thermal expansion (CTE) of the composite parts that will be produced. Although conventional tooling steel and aluminum make dur-able tools, they exhibit much higher thermal expansion than carbon/epoxy parts. However, tools made with Invar, a family of nickel/steel alloys that closely match the CTE of carbon/epoxy materials, are very costly, require long lead times to manufacture and are, therefore, justified only for very high cost and/or high rate parts. Metal tools have the additional disadvantage of being heavy and hard to move and manipulate. With the huge increase in the size and complexity of composite aerospace structures, however — Boeing’s 787 Dreamliner and Airbus’ A350 aircraft, as just two examples — parts manufacturers are looking to lower manufacturing costs by improving tooling performance in terms of weight, durability and cost.

Composite tooling is a lightweight, less costly solution that has lower thermal mass and is relatively easy to produce. In terms of thermal expansion, this option is ideal: A tool of the same material as the part eliminates concern about CTE mismatch. But composite tools tend to have a much shorter useful life than metal tools because they are more susceptible to surface damage during repeated thermal cycling in a production environment. Further, microcracking and porosity in the laminate can lead to loss of vacuum integrity that has a negative impact on the degree of laminate consolidation, resulting in reduced strength and quality in the molded structure. Inevitably, production must halt for repair or replacement of the tool at much shorter intervals than those required for maintenance or replacement of metal tools. On a long run of large parts, this ultimately sacrifices much of the savings realized in the original tool.

One solution is to combine the best features of both: prolonging tool life by forming a relatively thin, durable metal face or skin over the surface of a carbon/epoxy composite tool. Such metallic skins aren’t new, and many technologies exist. They can be grouped as follows:

Thermal spray coating. As the name implies, this technology involves spraying molten metal onto the tool surface. However, when the melted droplets of metal fly through the air, they oxidize. Metal oxides tend to be brittle. Ultimately the resulting metal coating has low strength and forms a rough, defect-rich surface.

Electro-deposition and electrodeless deposition. These coating technologies, which include conventional chrome plating, are cost-effective, but purveyors of the processes have not been able to produce a coating alloy that has thermal expansion low enough maintain a good CTE match with carbon/epoxy.

Physical vapor deposition. This group includes esoteric technologies that can create a coating on a substrate via sputtering or the use of electron beam energy within a vacuum chamber that is filled with inert gas. However, these techniques are best suited for forming very thin, accurate layers on small objects. They are impractical for use on larger composite tools.

Two other techniques have sought to reduce the cost of an all-metal tool:

Chemical vapor deposition. This technique is a fast and well-commercialized method for creating a robust free-standing nickel-shell tooling (see “Editor's Picks"); because the master shape or mandrel must be heated to a high temperature to induce deposition, the technology is limited to depositing nickel onto metal masters.

Metal cladding involves adhering a metallic foil or tack welding a metal sheet to a backing structure. Although these methods significantly reduce the material cost of a large tool and provide a durable mold surface, these approaches are only suitable for tool surfaces that have low curvature, and they are not practical for mold surfaces with compound curvature or complexity.

Each of the options previously listed involve trade-offs that make them impractical for large, complex tools. So what’s the solution? The ideal metallic tool face for a composite tool would have a low CTE, compatibility with the carbon/epoxy substrate and durability in a production environment — specifically, damage resistance, ductility, and very low porosity to minimize vacuum leaks and good adhesion to the substrate. It also would have a thin profile to minimize thermal mass and weight in the tool and facilitate scalability to any tool size. That’s a tall order, but it’s one that might be filled by a company that is currently bringing its metallurgical experience to bear on the problem.

A nanostructured option

Integran Technologies Inc. (Toronto, Ontario, Canada), a developer of metallic technologies, has recently begun targeting the composites industry for tooling and part applications. The company was founded in the early 1990s as a spin-off from research activities undertaken at the University of Toronto by Uwe Erb and at Queen’s University by Karl Aust. A subsequent strategic partnership with Canadian power company Hydro One Inc. (Markham, Ontario, Canada) resulted in the company’s development of one of the first large-scale industrial applications for nanostructured metal materials, the “electrosleeve process” for nuclear steam generator pipe and tube repair.

The term “nanostructured metal” doesn’t imply the addition of exotic nanoscale additives, such as carbon nanotubes or “buckyballs” — the term refers instead to the crystal size of the metal itself. A nanostructured metal coating exploits a phenomenon known as the Hall-Petch effect. Around 1950, researchers E.O. Hall and N.J. Petch independently observed that metal crystal grain boundaries impede dislocation movement, such as crack propagation. Thus, by decreasing the grain size and increasing the number of grain boundaries, one can minimize dislocation movement, impeding the onset of plasticity and improving the yield strength of the material. Thus, the smaller the grains, the stronger the metal material.

Integran wanted to leverage its existing experience and success with the nanostructured electrosleeve repair process to develop and capitalize on a similar metallic coating technology that could bring the benefits of a hard metal coating to composite tooling. “A metal alloy coating that has low coefficient of thermal expansion can extend the lifespan and reduce the lifecycle cost of a carbon fiber/epoxy tool by making it more durable,” says Rich Emrich, the company’s program manager for business development. “We’re in a position to create value for the com-posites industry by extending tool life and performance.”

The company spent four years researching and developing a solution it calls Nanovate NV (previously Nanovar). Specific details on the exact coating process aren’t available, but according to Dr. Jon McCrea, Integran’s senior technical researcher, it is a low-temperature, wet chemical immersion technique carried out in a tank, similar to electrodeposition. It creates an extremely fine-grained ferrous/nickel alloy coating similar to Invar on the tool face, 0.006 to 0.008 inch/150 to 200 microns thick. Unlike steel or chrome, which have crystalline grains of 10 microns to 100 microns in size, the nanostructured Nanovate NV coating has a grain size of 20 nm or less, or 1,000 times smaller. Notes McCrea, “It’s like comparing a beach ball — the typical metallic crystal size — to a grain of sand.”

An important goal in development of the process — achieving good adhesion between the metal coating and the composite tool substrate — was reached, says McCrea, with a proprietary surface treatment. The treatment, applied to the tool surface beneath the coating, creates physical/mechanical “grips” that ensure a strong bond between the metal and the polymer-based composite.

The entire coating process can be completed within several hours (not counting preparation and postprocess quality inspection).

The long road to market

In any industry, new materials tend to be adopted cautiously. That’s especially true for composite tooling. Molders are very reluctant to abandon traditional toolmaking materials and approaches because of existing qualifications and to keep risk to a minimum. Integran, therefore, has initiated a program of material and applications testing to thoroughly validate its product for composite tool producers.

Material tests on prepared coupons have gauged coating hardness, adhesion to the substrate, scratch resistance, impact resistance, and other properties.

The hardness of the Nanovate NV material was measured with the Vickers hardness test, which employs a square-based diamond pyramid with a 136º point angle pressed against a sample under load, typically 50 kgf/110.2 lbf, for 30 seconds. The resulting hardness value is the applied load divided by the area of the permanent impression or dent in the material in square millimeters. Nanovate’s Vickers hardness (or HV) of 450 is nearly six times higher than Invar 36 material and 18 times higher than typical cured carbon/epoxy, reports Emrich. Because the Nanovate coating has essentially the same composition as Invar 36, its CTE is a similarly close match with the CTE of carbon/epoxy composite (see comparison charts at right). Aggressive thermal cycling tests have demonstrated good adhesion between the coating and the substrate because their expansion and shrinkage rates are very similar.

The adhesion strength of the nanostructured coating was measured in accordance with ASTM D4541-02 “Standard Test Method for Pull-Off Strength of Coatings Using Portable Adhesion Testers.” In this test, al-uminum “dollies” or wafers are bonded to the surface of the coupon and the Nanovate coating is cut around the dolly circumference, without cutting the composite substrate. The prepared specimen is placed in a testing device, and the dolly is pulled upward while the coupon is held rigid. The force required to pull the coating from the carbon/epoxy substrate for the given surface area of the dolly is measured, indicating adhesion strength of the coating. Although exact numbers are not yet ready for release, Integran says that adhesion has been increased by an order of magnitude on some substrates over the last year.

Three different samples — Nanovate-coated carbon/epoxy, uncoated carbon/epoxy and conventional Invar — were subjected to a scratch test. A steel knife blade, held at a 65° angle, was applied to the coupons under a constant load of 20N/4.5 lbf. The sample coupon then was pushed a distance of 1.5 inches/38 mm at a constant speed. The resulting scratch depth was measured with a Mitutoyo SJ-400 profilometer (Mitutoyo America Corp., Aurora, Ill.). When scratch profiles were compared, the depths were 73 ?m for the unprotected carbon/epoxy, 39 ?m for the Invar but only 0.9 ?m for the Nanovate, reports the company.

To measure a Nanovate-coated tool’s ability to maintain vacuum integrity after impact — by a dropped hammer, for example — the team designed a test that dropped a 4-lb, 0.25-inch-diameter (1.8-kg, 6.5-mm-diameter) weight from a height of 1m/39 inches onto a series of small Nanovate-covered demonstrator tool faces, each with a different coating thickness, ranging from 0.002 inches through 0.010 inches (0.05 mm through 0.25 mm). A vacuum was pulled on the tools both before and after each test and compared to a raw carbon/epoxy sample. While an impact can tear a thinner coating via plastic deformation, creating a vacuum leak, the company is working on defining the optimal coating thickness for adequate durability in a manufacturing setting.

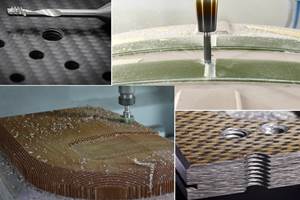

On the applications side, tests have included sample part mold and demold cycles on a 2-ft by 2-ft demonstration tool (see "Step" photos at right), with an approximately 0.008 inch/0.2 mm thick Nanovate coating. Additionally, Integran has entered into a joint development agreement with Advanced Composites Group Inc. (ACG, Tulsa, Okla.) to investigate the interaction of the coating with various composite tool substrates. ACG is working with some of its customers to introduce Nanovate into actual production environments.

Process scale upand product availability

Although test results are promising, several open-ended issues remain. Integran has yet to determine the life expectancy of the composite substrate beneath the Nanovate coating — and, thus, long-term adhesion between the two — after multiple thermal cycles. The company must also develop the means to manage coating deflection in large tools. At the present time, Integran’s existing process can accommodate a tool of moderate geometry, no more than about 4 ft by 4 ft (1.2m by 1.2m). Integran needs a larger infrastructure that will permit process scale up, says Emrich. Because the company’s technology is proprietary, the process likely will not be licensed for manufacturers to apply themselves, says Emrich. Customers’ tools will have to be sent for coating, initially, to Integran’s facilities in Toronto. However, Integran is exploring the possibility of a second plant in the U.K. and, says Emrich, alliances and partnerships probably will be formed to make the technology more accessible. A final consideration is price: the Nanovate coating adds 30 to 40 percent to the cost of the tool, but Emrich points out that it extends tool life by two to three times. The added cost of the coating is still less than the price of an Invar tool, and the ancillary benefits of a lighter tool and much shorter lead times might outweigh the extra shipping time.

Beta and beyond

Beta testing of Nanovate-coated tools is ongoing with select customers to generate feedback from actual part manufacturing environments. Each tester is using its customary mold releases, methods and curing processes, which will give Integran and ACG a wide range of data, enabling them to make any needed improvements as the technology moves into the marketplace.

Although practical issues remain, testing has advanced to the point that Emrich is confident that the technology will be successfully commercialized: “This is a unique technology approach that’s fundamentally scalable, and it will help take composites fabrication to the next level.”

Related Content

Composites end markets: Boatbuilding and marine (2024)

As the marine market corrects after the COVID-19 upswing, the emphasis is on decarbonization and sustainability, automation and new forms of mobility offering opportunity for composites.

Read MoreOptimizing machining for composites: Tool designs, processes and Industry 4.0 systems

Hufschmied moves beyond optimized milling and drilling tools to develop SonicShark inline quality control system and Cutting Edge World cloud platform for optimized tool use and processes.

Read MoreSulapac introduces Sulapac Flow 1.7 to replace PLA, ABS and PP in FDM, FGF

Available as filament and granules for extrusion, new wood composite matches properties yet is compostable, eliminates microplastics and reduces carbon footprint.

Read MoreThermoset-thermoplastic joining, natural fibers enable sustainability-focused brake cover

Award-winning motorcycle brake disc cover showcases potential for KTM Technologies’ Conexus joining technology and flax fiber composites.

Read MoreRead Next

CFRP planing head: 50% less mass, 1.5 times faster rotation

Novel, modular design minimizes weight for high-precision cutting tools with faster production speeds.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MorePlant tour: A&P, Cincinnati, OH

A&P has made a name for itself as a braider, but the depth and breadth of its technical aptitude comes into sharp focus with a peek behind usually closed doors.

Read More