The company has scaled from four to 24 employees and moved into a new, 20,000-square-foot manufacturing facility in Woodlawn, a Cincinnati suburb located one mile from GE Aviation’s headquarters in Evendale and an hour south of the Air Force Research Laboratory (AFRL) at Wright-Patterson Air Force Base in Dayton, Ohio. Sprengard leads CW’s tour through Veelo Technologies’ new production site, walking through the company's evolution from nanomaterials supplier to advanced broad goods specialist to innovation partner for future composites.

From nano to multifunctional composites and processing

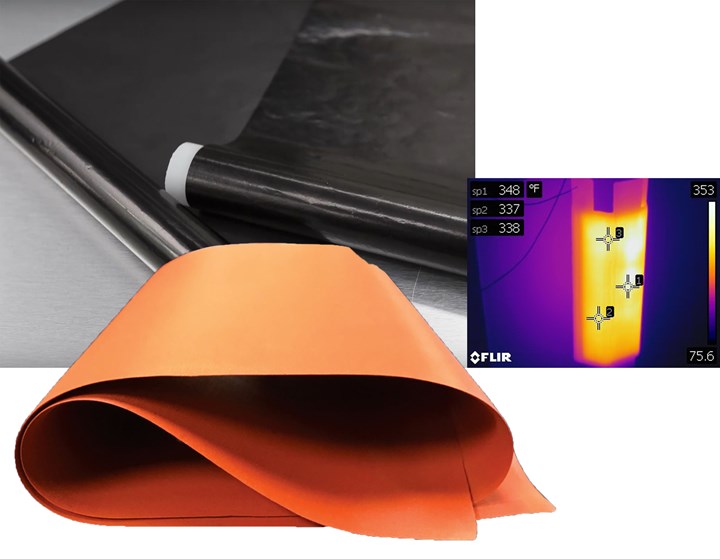

Veelo Technologies began by developing continuous CNT fiber sheets (top left) but has now evolved to use a range of materials in its products for lightning strike protection and nonmetallic heating blankets for composites processing and de-icing systems for aerostructures (bottom and right).

CNT fibers and sheets

Veelo Technologies was originally spun out of the University of Cincinnati (UC) as General Nano. The university had produced the world’s longest CNT arrays — 18 millimeters long — in 2007. “AFRL’s Materials and Manufacturing Directorate took an interest and began a multi-year evaluation,” explains Sprengard, who joined the company in 2009. “For the first three years, we were trying to figure out how to convert these long CNTs into high-strength, macro-scale fibers, which is what AFRL was interested in. But the properties never materialized.”

So, the company pivoted, developing a way to convert the CNTs into a continuous sheet. Boeing became interested, eyeing the technology as a potential solution to its need for LSP and electromagnetic interference (EMI) shielding for its composite aircraft structures. “On average, commercial aircraft get hit by lightning every 1,000 hours,” says Sprengard. Though carbon fiber is conductive, the matrix resins in composites are not. Thus, the carbon fiber-reinforced polymer (CFRP) aerostructures that Boeing was producing in record numbers for its 777 and 787 commercial aircraft relied on expanded metal foil and other metallic solutions to quickly conduct electrical current to a grounded connection in order to prevent heat damage. “But metal mesh is heavy, produces lots of parasitic weight and can be challenging to process in composite parts,” says Veelo Technologies product development engineer Larry Christy.

By 2015, Boeing had an enterprise-wide push to develop a next-generation LSP solution, and General Nano was a key partner. CW visited General Nano soon after, in 2016, at its original location in a Cincinnati-based business incubator facility that housed multiple start-ups. Christy led that tour of the company’s labs and discussed the technology evolution then in progress. “The effectiveness of metallic LSP and shielding decreases with frequency,” he explained. “You need to improve conductivity and reduce impedance but be less than 25 microns thick. However, CNT-to-CNT junctions add resistance within the sheet. From 2014 to 2016, we improved conductivity by 12 times and proved a drop-in solution for shielding at a frequency of 200 [megahertz] MHz with 25% weight savings versus metal. But we still need to reduce thickness.”

At this point, the company had developed the ability to produce aligned CNTs on a 5-foot-wide substrate in lengths measuring hundreds of feet. It was also making 20-grams-per-square meter, 2-millimeter thick CNT paper and nonwoven materials — a kind of CNT continuous nonwoven — using a network of toll manufacturing partners with excess capacity on their paper-making equipment. “This approach gives us flexibility,” Christy explained, “and allows us to focus on working with our customers to add functionality and to tailor the properties and format of our products.” The company had also been asked to make continuous tapes, which it again made using its toll network.

Pivot to high-performance broad goods

This tailorability and willingness to modify its products based on customer requirements was key, as roughly a decade into its existence, the company understood that its future might look much different from its past. Christy explained there were multiple needs, not just for LSP but also for EMI shielding. “You have to tailor the electrical performance for each. The properties of metal mesh are frequency-dependent and go down as frequency increases because of leakage from the holes in the sheet. Our performance goes up with frequency because our products are continuous with no holes and no leakage. CNTs outperform metals at high frequencies, so they are great for high-intensity radio frequency (HIRF) and high-power satellite communications applications. CNTs also have no skin effect, which is an issue with metals.” Skin effect is the tendency for alternating current to avoid travel through the center of a conductor, limited instead to its surface or skin, which effectively reduces the cross-sectional area available for carrying current and increases resistance. Christy continues, “But CNTs can’t compete at low frequencies. Their conductivity is just not high enough and there is too much signal loss. So, we are looking at hybrids.”

“This led to other sheet materials that are not based on nanomaterials,” says Sprengard. “We have developed VeeloVEIL, a metallized carbon fiber solution for LSP that is 70% lighter than expanded copper foil (ECF) and meets Zone 1A lightning strike protection requirements.” Zone 1A includes the radome/nose, wingtips, nacelles and extremities of an aircraft’s empennage and must withstand 200,000 amps of electrical current, as defined by U.S Federal Aviation Administration (FAA) requirements (see “LSP strategies for composite aircraft” and “LSP for composite structures”). “VeeloVEIL is four times more conductive and yet half the weight versus other metallized nonwovens,” he continues. “This is possible due to the chemistry and materials processing we have developed.”

Next-gen LSP for aerostructures

Commercial aircraft are hit by lightning, on average, every 1,000 hours. VeeloVEIL metallized carbon fiber nonwoven meets Zone 1A lightning strike protection (LSP) requirements for composite aircraft at 70% less weight vs. expanded copper foil. Engineered to be processed by automated fiber placement/tape laying (AFP/ATL) machines, VeeloVEIL delivers disruptive conductivity in a single 80-micron thick ply and reduces total LSP materials and processing time by more than 75%.

The aerospace industry doesn’t currently use carbon fiber veil for LSP, says Sprengard, “because there are no products conductive enough to meet Zone 1A requirements.” VeeloVEIL has been engineered to deliver 5-10 milliohms of electrical resistivity (lower resistivity means a more conductive material) at an areal weight of 40-50 grams per square meter, and meets aircraft LSP requirements using a single, 80-micron thick ply. “This makes the material very drapeable, which results in a smooth surface finish without the porosity-filling post-processing often required with ECF products,” he notes. “This, in turn, allows manufacturers to use less surfacing resin, which saves material and manufacturing costs. We’ve been told by the top three aerostructures OEMs that VeeloVEIL allows them to reduce total LSP materials and processing time from more than twenty hours to less than three hours.”

VeeloVEIL is supplied in the same product form as ECF, which allows manufacturers to use it without changing their existing manufacturing processes. “All of our electrically conductive materials for aerospace composites are engineered to be processed by [automated fiber placement] AFP machines,” says Sprengard. Veelo Technologies is also in the process of integrating VeeloVEIL into a standard surface layer product, working with Tier 1 aerospace prepreggers.

Tailoring conductivity for heating

During development of VeeloVEIL, Sprengard’s team realized that the ability to tailor electrical conductivity of its broad goods could also be used for electrothermal heating applications. This opened the door to another of its product families, VeeloHEAT.

“VeeloHEAT is a carbon-based, nonmetallic material that is integrated into aerostructures for de-icing,” says Sprengard. Note this is not carbon fiber. “Today, aircraft de-icing systems often use metallic wires, which have issues with durability, especially in high-fatigue environments such as rotorcraft. If one of the wires breaks, the system no longer performs. These conventional metal de-icing systems commonly fail, and must be repaired, which is time- and cost-intensive. We have demonstrated that our products are much more durable, which dramatically decreases downtime for the aircraft.” He notes that these products are indeed being used on rotor blades for helicopters and have significant potential for EVTOL (electric vehicle takeoff and landing) aircraft that are currently being developed for urban air mobility and the next generation of transportation.

More near-term, Sprengard says VeeloHEAT products are scheduled to fly on a fixed-wing commercial aircraft in Q1 2020 for early-stage qualification. “The appeal of this technology is no secret,” he says, noting that Collins Aerospace (formerly UTC, which will now be part of Raytheon) announced an exclusive license for CNT-based de-icing systems in January 2017. “They know the market well and are positioning themselves for the future. Their investment is a good indication of where this technology is headed,” Sprengard adds.

Veelo Technologies tests every VeeloHEAT Blanket for temperature output and uniformity.

From de-icing to composite processing and repair

Conventional heat blankets have been used for decades to cure relatively small areas — typically less than 1 square meter — of composite structures during bonded scarf repairs. These heat blankets use traditional metal wires embedded in silicone rubber or other materials (depending on the cure temperature required). “Similar to the metal-based de-icing systems, if one wire breaks, heat blankets short and no longer work,” says Sprengard. “We have leveraged our carbon-based de-icing product into a nonmetallic heating blanket that has unmatched durability and drapeability, as well as performance.” The industry standard for the latter is 3% coefficient of variance (COV), which is a measure of uniformity in heating products, cover-to-cover and edge-to-edge. The VeeloHEAT Blanket exceeds this standard at the typical energy output of 5 watts per square inch.

Veelo’s heat blankets can produce temperatures up to 550°F (288°C) and can be net shaped to fit parts and tools. “This capability is possible because of our ability to formulate chemistries and manufacture unique advanced materials with tailored resistivities,” notes Sprengard. Veelo Technologies commercialized this technology in 15 months and is now in full production. “We are seeing very good growth in this product line,” he adds, “and are now manufacturing large volumes of VeeloHeat Blankets that are used to bond large composite structures out of the autoclave and oven, making use of multiple temperature zones and other processing features that our customers have requested.”

Relocating and ramping production

Veelo Technologies’ new 20,000 sq. ft. production hall offers plenty of space to scale up VeeloHEAT Blanket production, which was relocated and ramped to full speed in phase one of the manufacturing transition. Phase two will be completed by 3Q 2019.

Manufacturing to meet customer needs

In October 2018, Veelo Technologies received confirmation that it had won a major defense program that required immediate ramp-up. “Thankfully we found a near perfect, move-in ready facility that was already equipped with the infrastructure we needed to hit the ground running,” Sprengard recalls. The Woodlawn facility features state-of-the-art environmental control, lighting and wall-to-wall epoxy flooring — features Sprengard notes as standard in aerospace from his tours of customer’s operations. “We took no shortcuts — our investment in the highest quality materials and finishes reflects our long-term strategy and vision for the future,” he explains. This investment is also seen in the facility’s access control and security staffing, necessary for its defense contracts.

The required build-out of the facility was completed in 2Q 2019, after which Veelo began relocation of its production lines. “All of our equipment is running at nearly full capacity, which has made scheduling shut-down for moving all of the lines into the new facility a challenge,” he concedes. The company completed phase one of its manufacturing transition in July 2019, relocating the VeeloHEAT Blanket line and ramping it back to full production.

The new facility’s large, open production hall is accessed from the front lobby. To the right is the VeeloHEAT Blanket manufacturing area. Four 4-foot by 10-foot layup tables are used to layer VeeloHEAT film with other materials onto shaped metal molding tools. These layups are then cured in a 10-by-10-foot oven supplied by JPW Industrial Furnaces (Trout Run, Pa., U.S.). The finished blankets are demolded and connected to electrical supply wires, which enable use with computerized control units (hot bonders) to cure composite laminates and repairs. Each VeeloHEAT Blanket is tested for temperature output and uniformity.

More durable and conformable, non-metallic heat blankets

Although wires are used to heat metal tooling in the production of VeeloHEAT Blankets (above) and to deliver electrical current from computerized control units (hot bonders) to the blankets during composite curing and repair, metal wires are not used inside. This enables these non-metallic heat blankets to be produced in 3D shapes without broken wires, shorting and issues in temperature uniformity (hot and cold spots). The carbon-based VeeloHEAT film inside produces temperatures up to 550°F (288°C) with 3% COV at 5 W/in2.

Just beyond the heat blanket production area is the wet chemistry production room. Here, industrial equipment sourced from Silverson Machine (East Longmeadow, Mass., U.S.) and Netzsch (Burlington, Mass., U.S.) is used to mix the advanced chemical formulations used in Veelo’s products. Next is the film manufacturing room, which houses a proprietary system for manufacturing Veelo’s carbon-based VeeloHEAT film, the key technology inside the VeeloHEAT Blanket. Again moving left is the VeeloVEIL production area. Though empty at the time of this tour, both the 15-inch and 36-inch-wide roll-to-roll manufacturing lines for VeeloVEIL production were moved into the new facility in August. The company is also in the process of designing a 60-inch-wide line to meet future demand. By October, Veelo Technologies will have all of its product lines operating under one roof and ramping toward increased production.

Next-generation solutions

The road to Veelo Technologies’ current success has been long, and not always straightforward. “Yes, we started in nanomaterials, and we still maintain a significant expertise in this domain, but none of our customers care if we use nanomaterials or not,” says Sprengard. “They only care if we supply a compelling solution that meets their performance and ROI targets. For example, products that enable the next generation of de-icing systems to use less power on the aircraft, which opens new opportunities for air vehicle designs and operational efficiencies.”

Sprengard says all three Veelo product families are moving forward, either being finalized into OEM and supplier qualified products lists (QPLs) “or being added as a part number in our customer’s supply base.” Though the vast majority of what the company does now is for thermoset composites, he notes it is beginning to look at thermoplastic composites and additive manufacturing as well.

Where is Veelo Technologies focused for the future? “Our first priority is to continue delivering on our existing orders and strategic opportunities,” says Sprengard. “The market is pushing us to meet new levels of demand, which is great and challenging. Remaining focused is our top priority.”

The goals Veelo has set for itself now are just as impressive as its tenacity and forbearance through 12 years of development to reach this point. “If you look at the best aerospace composite suppliers, such as Airtech and A&P Technologies,” says Sprengard, “they have a seat at the table early in their customers’ development cycles. To be such an innovation partner takes time.” He adds, “and commitment.”

Veelo Technologies has scaled from four to 24 employees and evolved from a nanomaterials supplier to advanced broad goods specialist to innovation partner for future composites, recognized by Boeing as Supplier of the Year in 2015.

Related Content

Plant tour: Teijin Carbon America Inc., Greenwood, S.C., U.S.

In 2018, Teijin broke ground on a facility that is reportedly the largest capacity carbon fiber line currently in existence. The line has been fully functional for nearly two years and has plenty of room for expansion.

Read MorePlant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreTU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreMcLaren celebrates 10 years of the McLaren P1 hybrid hypercar

Lightweight carbon fiber construction, Formula 1-inspired aerodynamics and high-performance hybrid powertrain technologies hallmark this hybrid vehicle, serve as a springboard for new race cars.

Read MoreRead Next

Episode 15: Joe Sprengard, General Nano

Joe Sprengard, president and CEO of nanomaterials specialist General Nano, talks about carbon nanotubes, the company’s work with Boeing and more.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More