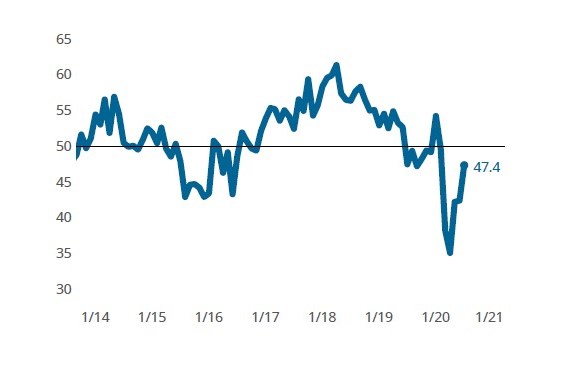

Rising Composites Index points to slowing contraction in business conditions

Broad-based increase in Index components suggest an industry is slowing its decline.

Composites Fabricating Business Index: The Composites Index advanced 5 points in July, representing a slowing contraction in industry activity.

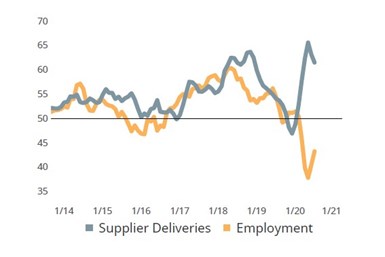

The Composites Index increased by 5 points during July to finish the month at 47.4. Supported by higher readings for backlogs, new orders, production and exports, an increasing index reading below a level of 50 is indicative of a slowing contraction in business activity. An unwelcomed increase in the reading for supplier deliveries in July signaled that deliveries of input goods slowed from June to July. A delay in the delivery of production inputs can have detrimental effects on production and employment activity.

Supplier deliveries activity worsen after recent months of improvement: A slowing of supplier deliveries in July may have acted as a headwind for further gains in production and employment activity. The 3-month moving average of employment activity hides the accelerating contraction in the 1-month readings for employment activity in June and July.

Out of the more than 20 end markets that Gardner tracks, only fabricators operating in or serving the rubber and plastics end market have indicated that conditions have reached their lowest point, and have begun to rebound since the COVID-19 pandemic first began its economic disruption in March. In contrast, many of the most important end markets served by fabricators, including aerospace and automotive, continue to signal that business activity is still contracting, although at slowing levels.

This prolonged contraction in activity has had a significant impact on expected capital spending among fabricators. At the start of 2020, large fabricators of more than 250 employees in size reported that they planned to spend on average $1.75 million over the next 12 months. These earlier projections, when compared to recent monthly readings, indicate that expected capital equipment spending this year will decline by 75%.

Related Content

-

Composites industry GBI stayed the course in February

The GBI: Composites Fabricating contracted in February to the same degree as January, maintaining its position in a contraction zone.

-

Composites industry gained back some ground in December

The GBI: Composites Fabricating contracted a little more slowly in December, landing between August and September 2023 values.

-

Composites industry index was flat for March

The GBI: Composites Fabricating closed March flat, losing 1.3 of the 3.1 points gained in February.

.jpg;width=70;height=70;mode=crop)