SAMPE Europe highlights: Composites face challenges in next commercial airframes

Airbus Research & Technology presented a sobering outlook and emphasized the need for improved cost, manufacturing and robustness.

but further expansion is far from guaranteed.

SOURCE: Chris Red, Composites Forecasts and Consulting

Christian Ruckert, head of Research & Technology Integration for Materials and Processes at Airbus (Toulouse, France), gave a presentation at SAMPE Europe (Mar. 10-11, Paris, France) in which he cautioned against thinking that the recent steep growth in composites usage on commercial aircraft will continue unabated.

What has changed?

Ruckerts says that in 2013, Airbus R&T planning was split between 75 percent disruptive technology approaches and 25 percent quick wins. For 2014, this changed to 40/60 and is headed toward 30/70. Thus, Airbus wants performance improvements from new technology but without excessive costs. For example, Ruckert says that changes in materials and/or structures “have to pay off in terms of weight and cost reduction” and now must “be realized within a quite short amortization period of two years maximum.” He adds that this will be difficult for composites due to required modifications in work flow, jigs, tools and new manufacturing processes. Thus, the cost to develop and implement new composites technologies on upcoming aircraft will have to be much lower than what we have typically seen with recent models.

Ruckert said that Airbus R&T funding is now production-driven, so that projects must succeed in being part of a specific platform’s downselected options or they will not be pursued. Engineering development will be clustered around existing airframes and major changes will only be implemented if specific critical factors are met.

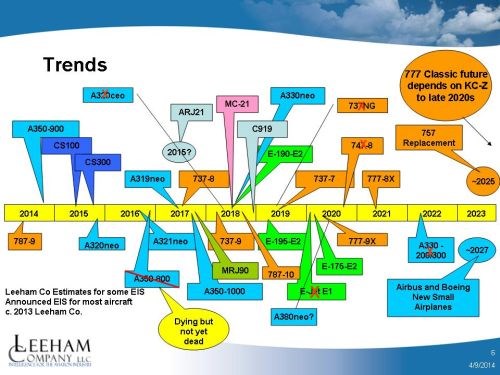

Expansion of composites in Airbus airframes will be affected by how the OEM looks at the next platforms in its pipeline. As shown in the graph below, the majority of new aircraft entering production over the next decades are single-aisle/narrow-body, which do not value weight savings as highly as wide-body models. According to Ruckert, “Development of a brand new single-aisle aircraft is not considered a top priority” for Airbus right now. That also does not favor composites' expansion any time soon, as there are less opportunities for new materials on step changes to current models vs. clean-sheet designs. Another challenge in narrow-body aircraft is the high manufacturing rates. Ruckert cited up to 60/month for the A320neo. These put more pressure to have a dependable supply chain, without risk of late part deliveries or quality issues. Ruckert also said that nondestructive testing (NDT) cannot continue to be a bottleneck (e.g. 100 percent visual inspection required after each ply layed by an automated machine, during which layup is stopped).

New commercial aircraft Entry Into Service (EIS) timeline.

SOURCE: Leeham Company, LLC

Competition

Meanwhile, Ruckert reported that the three pillars of qualification documentation — design, manufacturing and support (e.g. inspection and repair) — are almost complete for a selective laser sintering (SLS) material, which will give Airbus the ability “to print any part cargo to cabin”. He said titanium additive layer manufacturing (ALM) is also very mature with an NDT process and the triplet documents in place. There is still a gap in design and stress analysis, as well as certification, but ALM is already flying and has a technology readiness level of TRL6. A form of polymer ALM is also close to flying.

Ruckert said that both ALM and Glass Laminate Aluminium Reinforced Epoxy (GLARE) will see growth in future aircraft. He noted that GLARE was used on the A380 and then dropped off, but recent changes in automation make it lower cost vs. straight composites. New metal alloys are also changing the traditional cost and weight competitive analysis vs. composites.

R&T for cost, manufacturing and robustness

All of that said, Ruckert believes composites will have a place in Airbus structures and may even be able to widen their scope, but only if cost, manufacturing and robustness develop as required. He listed the following as key areas for composites R&T at Airbus:

- Multi-functional structures: adding new functions, such as enhancing lightning strike protection (LSP) via automated coating or improving fire,smoke and toxicity performance via a cabin interiors part integrated with structure.

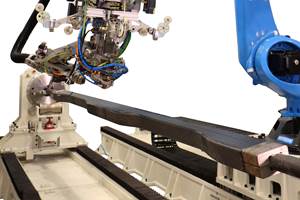

- Automation for the realization of large-scale composite structures including fast and reliable inline inspection and remote NDT systems during manufacture.

- Structural health monitoring (SHM) for smart engineering. Airbus is working with Fuji Heavy Industries (FHI, Tokyo), Kawasaki Heavy Industries (KHI, Kobe), Mitsubishi Heavy Industries (MHI, Tokyo), Tokyo University and Japan’s Material Process Technology Center (SOKEIZAI Center in Tokyo) in the Japan Airbus SHM Technology for Aircraft Composites (JASTAC) project to mature this technology for production aircraft.

- Out of autoclave (OOA) bonded structural repair to achieve cobonding of a soft patch (not precured) using vacuum compaction only.

In the March issue of HPC, Chris Red asserts that composites' best shot at growth in commercial airframes is via OOA development in The Market for OOA aerocomposites, 2013-2022.

Editor’s Note: In 2003, Christian Ruckert was a team leader for the Composite Technology Materials & Processes Department at Airbus, handling all technology projects. He was appointed as head of local composite technology at Airbus Bremen in 2005, with responsibilty for textiles and infusion technology, CFRP and metal bonding and sandwich structures. As head of R&T Integration for Materials & Processes, Ruckert assumes responsibility on all R&T related subjects. He was also nominated as technology product leader for the development of technologies for a second generation CFRP fuselage.

Related Content

Composite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreVIDEO: One-Piece, OOA Infusion for Aerospace Composites

Tier-1 aerostructures manufacturer Spirit AeroSystems developed an out-of-autoclave (OOA), one-shot resin infusion process to reduce weight, labor and fasteners for a multi-spar aircraft torque box.

Read MoreMFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;maxWidth=300;quality=90)