While it’s not the first transportation segment most people think about as a growing market for composites, perhaps agricultural equipment should be and, in time, will. After all, as human populations increase across the planet, more resources will be needed to grow the plants and livestock to feed us. Despite a century of horrific wars and some significant international plagues, human populations managed to grow 400 percent during the 20th century. Today’s world population is 7.6 billion, and the United Nations (New York, N.Y., U.S.) projects that another billion will be added by 2030, still another by 2050, and that by 2100, the world population will be 11.2 billion. As agriculture grows, equipment market will grow, too.

Currently the agricultural equipment industry is geographically fragmented, with only a few global OEMs building at the industry’s highest production volumes — and these are generally still lower volumes than even the heavy truck industry. However, a constellation of trends — including land consolidation in the Americas, tougher fuel efficiency and emissions standards for diesel-powered vehicles in many geographies, the complex issue of weight reduction, greater interest in the use of design differentiation as a marketing tool, and changes in how backward-integrated machinery OEMs are still in metals — has led to more and larger components being converted to composites using a broader array of materials and processes. As those trends gain traction, it’s not hard to envision a time when agriculture equipment could become a major market for composites.

Transportation — but different

One of the first things to understand about the agricultural equipment market is how big but fragmented it is, and how that affects the kind of equipment produced and used in each region.

“Regionality is an interesting factor in this market,” explains Deavron Farmer, global key account manager/agriculture market manager, LyondellBasell Engineered Composites (Houston, Texas, U.S.). “Thanks to consolidation over the last five decades, the biggest farms in the Americas [particularly in the U.S., Canada, Argentina and Brazil] tend to be tens of thousands, if not hundreds of thousands, of acres in size, often with contiguous fields. Given the size of these fields and the tendency toward monocropping [planting single crops under huge acreage], equipment has gotten larger and more modular so farmers can service increasingly large tracts of land efficiently.” He adds that that’s not necessarily the case in Europe, where farms have remained smaller and equipment is appropriately sized.

On the other hand, in developing countries, other drivers are at play. “Cost — which is an issue everywhere — is an especially sensitive issue in developing regions, where equipment like a tractor might also serve as family transportation into town,” adds Farmer. “Although farmers there may use older-style equipment, change is escalating so rapidly that farmers in developing nations may well leapfrog entire generations of equipment that took decades to evolve in other regions — as happened with consumer electronics.” Given how geographically fragmented the agricultural equipment market is, there are fewer opportunities for global OEMs like John Deere (Deere & Co., Moline, Ill., U.S.), Case New Holland (CNH Global NV, Amsterdam, Netherlands) and AGCO (AGCO Corp., Duluth, Ga., U.S.) to create world models that permit sharing of parts and reduction of costs as is done in other transportation segments. This means that global purchasing agreements are less common, so manufacturers, molders and materials suppliers must qualify in each region where they wish to make sales.

Another difference in this market is that farm equipment is designed to have a long life. Carmakers these days target a use-life of a decade. Commercial truck manufacturers test and warranty for 482,803 kilometers for severe service vehicles and 1.9 million kilometers for long-haul trucks — the latter target of which could be achieved in as little as five years — while dump trucks, concrete mixers and the like may operate for several decades.

However, even in North America, it’s nothing to see farm equipment still in use that’s 40, 50 or 60 years old. The used-equipment market is very active and, as a consequence, farm machines are designed to operate for a long time. That’s complicated by the fact that most farm equipment spends its entire life outside, constantly exposed to heat, cold, wind, moisture and UV radiation while being subjected to stone, gravel and dust impingement during operation. Not only must materials used on such equipment be corrosion- and dent-resistant and have good weathering characteristics, but they also must provide chemical and thermal stability.

These machines are routinely exposed to everything from hydrocarbon fuels and lubes to fertilizers and pesticides, many of which are chlorinated or dispersed in lipid bases. And like cars and trucks, heat around the engine compartment is increasing due to new tailpipe-emissions regulations. Add to that the fact that farmers spend long days cooped up in tractor cabs, which increases demand to reduce noise, vibration and harshness (NVH) and to increase operator comfort. All in all, that’s a tall order for any group of materials.

Lower production volumes, though, can make composites less cost effective than traditional materials. With the exception of small riding lawnmowers, which can be produced in car-like volumes of 350,000 annually, most equipment is produced on the order of a few hundred to the low tens-of-thousands annually. That’s partly because there are a lot of customization options available in the new machinery segment and partly because some of the newest equipment is being designed in larger sizes and with new features that add cost and complexity. Depending on type of equipment and model, it can be as expensive as purchasing a new car or even a new house. In fact, the high capital investment required to enter and stay in farming has become one of the largest barriers preventing new farmers from getting into the industry.

Additionally, the lightweighting that composites offer over traditional materials can be a benefit — but weight reduction in agriculture equipment is a complex issue. On the one hand, high vehicle weight can lead to soil compaction, which stunts plant growth. In certain applications, like sprayer boom arms used to apply water and chemicals to fields, lightweighting is a real benefit. To efficiently service increasingly large fields, boom arms have been getting longer and longer, reducing the number of passes needed to cover a field. However, that, in turn, means that larger support structures are required to keep the arms from sagging over such long spans — which can exceed 15 meters on each side of the vehicle. Efforts to reduce weight — by switching from aluminum to composites — can provide real benefit to OEMs and farmers.

On the other hand, lightweighting is not always beneficial — especially if it impacts vehicle stability. Front-heavy combines, for example, need weight at the back of the vehicle to keep the rear wheels on the ground during operation. Hence, distribution of weight is key to ensuring safety and efficiency. All these factors mean weight is complicated when it comes to agricultural equipment, and its reduction doesn’t have nearly the buzz that it does in truck, bus and passenger vehicles.

Many materials, many processes

Given the range of size and production volumes seen in agricultural equipment — from riding lawnmowers and compact-utility tractors (CUTs) to bailers and combines — a variety of open- and closed-mold processes are used to produce mostly thermoset composite parts in this segment, although reinforced thermoplastics are beginning to gain ground in specific applications. Surprisingly, one of the newest materials being used in agricultural equipment is aerospace-grade, autoclave cured carbon fiber-reinforced epoxy prepreg for sprayer boom arms. In aluminum or steel, these arms require so much support structure that there are practical limits to how long they can be. However, by converting to high-performance, lightweight carbon fiber composites, not only can support structure be reduced or eliminated but booms can be made longer. 3D printing also is gaining ground in this segment — mostly for tools and assembly fixtures but also to produce some parts on production vehicles.

As appearance fit and finish, as well as part consistency, become more important to OEMs and customers, both for product differentiation and visual branding, equipment manufacturers are exploring the well-known benefits of plastics and composites to facilitate design freedom, parts consolidation and high aesthetics. Color is another well-used aspect of visual branding in this segment via paint, gel coat and pigmented polymer. In fact, some OEMs combine different paint textures on the same body panel (for example, light stipple plus gloss) to hide scuff marks in wear areas while still achieving a pleasing look. Ongoing work among the supply base is searching for ways to extend the durability of paints and coatings and to eliminate both technologies in favor of films and molded-in-color (MIC) materials with higher UV-stability.

Greening ag composites

Sustainability — from improvements in fuel efficiency to the use of recycled and plant-derived polymers — is just as important and desirable in farming as it is in other transportation segments. Interestingly, bio-based monomers turned out to be a much easier sell here than in automotive. “It just makes sense to our customers in the farming community,” explains Jay Olson, materials engineering & technology manager at John Deere, as well as brand owner/council chair and officer on the board of the PLASTICS Industry Association (Washington, DC, U.S.). “They use our equipment to grow corn and soy and then those commodities are used to make polymers that are molded into components for new equipment that we produce for those same customers.”

Currently the most common plant products used in thermoset agricultural composites include soy and corn that go into unsaturated polyester resins for sheet molding compound (SMC) and bulk molding compound (BMC). Around 2000, Ashland LLC (Columbus, Ohio, U.S.) introduced Envirez 1807 bio-based unsaturated polyester (UP) resin to compounders who, in turn, convert it into SMC and sell it to molders for parts that go into the agricultural equipment market — primarily for use in large combine sidewall panels. The company claims that Envirez was the first commercially available UP resin containing a significant portion (18 percent) of grain-derived monomer from corn or soy. The polymer is supplied uncatalyzed and is said to offer uniform thickening response, good paintability and good surface characteristics at low cure temperature in SMC. It’s also less prone to price fluctuations than polymers derived from petroleum feedstocks.

Another green SMC product that eliminates the cost and environmental burden of paint is a weatherable, structural UP resin first used for visible surfaces on pickup boxes and now featured on after-treatment diesel (ATD) panels on John Deere 8000 tractors. Arotran 805 is a UV-stable, molded-in-color (MIC) black grade that was jointly developed by Ashland and additive supplier Chromaflo Technologies LLC (Ashtabula, Ohio, U.S.) and is compression molded by Ashley Industrial Molding (Ashley, Ind., U.S.). When compounded into SMC and used in applications like the ATD panels, it helps maintain aesthetics long-term, which helps support higher resale values for tractors.

A new-generation SMC targeted at agricultural equipment as well as building/construction and the electrical/electronics markets was introduced at the 2018 CAMX show by LyondellBasell Engineered Composites. “As an industry, we know that thermoset composites have limitations with respect to end-of-life recycling,” explains Mike Gruskiewicz, director of technology for the U.S. region, LyondellBasell Engineered Composites. “As we continue to work on recycling, we see many benefits to incorporating renewable and recycled content in the manufacture of SMC, thus contributing to the circular economy on the front end of the life cycle. As we started looking for green solutions, we set a goal of zero compromise in terms of performance, moldability and aesthetics compared to petroleum-based SMCs.”

The company offers two new sustainable SMC products, both of which offer fire-retardant performance. “Premi-Glas 7001 grade produces Class A paintable surface profiles, allowing tractor hoods to achieve aesthetics comparable to fine automobiles, and adding the fire-retardant aspect for the severe ag environment, and Premi-Glas 3501 offers molded-in color and is intended for parts such as electrical enclosures, brackets and housings, and cab components,” Gruskiewicz explains. Additionally, 3501 incorporates recycled thermoplastic content to bolster its sustainability footprint. In both cases, the resin’s propylene glycol monomer is produced using either soy or corn and is said to yield properties identical to monomers created from traditional petroleum products. The 3501 grade includes post-industrial recyclate (PIR) polyethylene terephthalate (rPET), which has been chemically digested to yield terephthalic acid and then reacted back into the polyester resin. Although no commercial applications have yet been announced, Gruskiewicz says the 7001 grade is already being sampled for tractor hoods, combine doors and body panels. “Another exciting area for SMC involves valve covers for large diesel engines as well as oil sumps [pans],” he adds. “Compared with similar parts on passenger vehicles that have converted from SMC to thermoplastics, we see much more severe operating conditions in ag. For example, on larger engines, stiffer materials are required owing to the large spans across those bigger units.”

Meeting crushing loads

One challenge in the agricultural equipment industry is that composites must maintain mechanical performance under loads that can top 9,000 kilograms. For example, Tier-1 molder Plastics Unlimited (Preston, Iowa, U.S.) has developed a molding technology called tooless engineered composites (TEC), which has been used to produce 1.5-by 2.1-meter door flaps/grain-extension doors that can carry loads up to 9,072 kg, for large combines with nominal walls that are 6.4 to 12.7 millimeters thick. TEC blends the high aesthetics and durability of thermoplastics with the strength, toughness and dimensional stability of composites to produce a structure with a Class A surface and a B-side contributing a high stiffness and strength to weight ratio. The appearance A-side is produced by thermoforming a sheet of MIC acrylonitrile butadiene styrene (ABS), which subsequently becomes tooling for half of the B-side of the part, although for these larger, more complex structures, a second composite tool is used during the forming process. The latter is a vacuum-bagged composite produced using UP resin infused into stitched layers of chopped glass fiber cores. Both metal bracketry as well as large ribs (produced in rigid polyurethane foam) can be inserted into the composite during layup.

The result is a UV-stabilized, corrosion-resistant part offering design flexibility and high impact strength that resists chipping and cracking at a reasonable cost. The A side (thermoplastic layer) can provide a grained or shiny surface (the latter in solid colors or clear over patterns, which include metallic, chrome, wood, camouflage and even a carbon-mesh). This thermoplastic layer is said to offer excellent depth of image and is much more durable than painted or gel-coated SMC, permitting minor surface scratches to be buffed out. The non-appearance B-side (composite layer) is pigmented and smooth. Aside from the high-performance grain-extension doors on combines, the TEC process also is used to mold fenders, side shields, hoods and front and rear enclosures for a variety of smaller recreational vehicles and farm-type equipment.

What’s the future of agricultural equipment? In 2016 at the Farm Progress Show in Boone, Iowa, U.S., Case New Holland (CNH) showcased the industry’s first fully autonomous tractor concepts that can plant, spray and harvest, and where humans no longer operate vehicles from onboard, but rather control and monitor the driverless equipment remotely via tablet as the tractor travels pre-mapped guidance routes. Equipped with onboard cameras providing real-time views and advanced obstacle detection, these drone tractors can alert operators of obstacles and other issues, allowing the operator to select the best route to avoid or fix problems. The system’s software is said to automatically plot the most efficient in-field pass to help farmers make the most of narrow weather windows or work around the clock when needed to increase productivity, all while collecting data to monitor current crops and better plan future ones. CNH says this technology will help farmers in many parts of the world who struggle to find skilled labor during peak use seasons. Intermediate equipment likely will combine cabbed machines with traditional driving capabilities and some level of automation.

“Agriculture hasn’t changed from its foundational goals to feed, fuel and clothe the world,” adds Olson. “However, technology — including all aspects of biotechnology and the materials needed for intelligent systems solutions — has accelerated to meet the productivity challenges of feeding a rapidly growing population. Farmers have always been stewards of the land, so sustainability of natural resources is key to our success as an industry, a community and a world.”

Related Content

Automated robotic NDT enhances capabilities for composites

Kineco Kaman Composites India uses a bespoke Fill Accubot ultrasonic testing system to boost inspection efficiency and productivity.

Read MoreActive core molding: A new way to make composite parts

Koridion expandable material is combined with induction-heated molds to make high-quality, complex-shaped parts in minutes with 40% less material and 90% less energy, unlocking new possibilities in design and production.

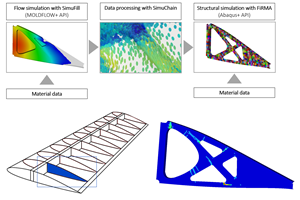

Read MoreImproving carbon fiber SMC simulation for aerospace parts

Simutence and Engenuity demonstrate a virtual process chain enabling evaluation of process-induced fiber orientations for improved structural simulation and failure load prediction of a composite wing rib.

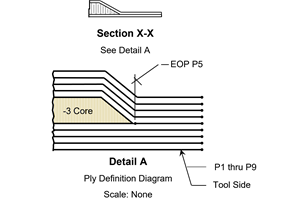

Read MoreThe basics of composite drawing interpretation

Knowing the fundamentals for reading drawings — including master ply tables, ply definition diagrams and more — lays a foundation for proper composite design evaluation.

Read MoreRead Next

All-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)