From The Publisher - 1/1/2008

COMPOSITESWORLD’s Carbon Fiber 2007 conference in Washington, D.C. (Dec. 5-7, 2007) was very successful, both in attendance and in the quality of the speakers, bearing out our optimism when we asked Scott Stephenson and Ralph Jessie to join forces with High-Performance Composites and Composites Technology. The

COMPOSITESWORLD’s Carbon Fiber 2007 conference in Washington, D.C. (Dec. 5-7, 2007) was very successful, both in attendance and in the quality of the speakers, bearing out our optimism when we asked Scott Stephenson and Ralph Jessie to join forces with High-Performance Composites and Composites Technology.

The optimism of the industry at the event was higher than I’ve ever seen it. Some industry veterans might even say it seemed too good to be true. Having been through three boom/bust cycles in carbon fiber capacity myself since 1987, I understand where the skeptics are coming from. During the big military aerospace buildup at the end of the 1980s, we were predicting 100 million lb of nameplate capacity within a few years — a figure producers finally achieved in 2007. Looking at the nameplate capacity expansions announced to date, producers are telling us that they will invest collectively around $700 million dollars by 2014, nearly doubling capacity in just seven years.

Too good to be true? Lets take a look.

Aerospace/military demand is projected to grow by 13 percent annually. Boeing claims to be close to its build schedule on the much anticipated Dreamliner and Airbus is finally delivering the A380 and predicting the A350 XWB will be even more “economical,” meaning carbon-intensive, than the 787. Although fraught with production delays and order changes, the F-35 Lightning II will go into full-rate production around 2013. It seems to be accepted generally that carbon fiber composites will be the future material of choice for both military and commercial aircraft. Coming in at around 27 million lb of required PAN-based fiber by 2014, this market looks solid.

Industrial markets are expecting a 13 percent annual boom as well. Many people in our industry (myself included) still tend to see aerospace as the big gorilla of the carbon fiber markets, so we are always somewhat surprised when reminded that industrial applications already represent the largest market sector at around 34 percent, compared to 11 percent market share for aerospace. “Industrial” is a mixed bag, which includes materials from high-modulus prepreg tape to molding compound, and the end uses are equally diverse. The most discussed applications at the conference were wind turbine blades, pressure vessels and offshore oil applications. In each, and in different ways, composites materials will enable increased efficiencies. Production of less expensive, less polluting and/or renewable energy will remain our greatest engineering challenge for years to come. I think composites will figure into many of the solutions.

Automotive is a growing segment in the industrial bag. The majority of carbon fiber now goes in to race cars and low-production, high-cost sports cars, but that will probably change. As I write this, Congress has just passed its new, much debated energy bill, and Bush has promised to sign it. By 2020, automakers will have to meet a fleet average of 35 miles per gallon, up from 27.5 for cars and 22 for light trucks (including SUVs, which won’t be big sellers if they save gas but have no towing power). Auto OEMs already have produced high-mileage automobiles, so bringing those averages up to 2020 expectations will take some clever technology. Hydrogen-fuel-cell powered electric, hybrid-electric, and much-improved internal combustion engine vehicles are all under consideration. But no matter what powers the vehicles of tomorrow, lightweighting will be a necessity. Perhaps when the new generation of automobile factories goes into production, they’ll be building carbon fiber parts with automated tape laying machinery. Now that might be too good to be true. But then again, maybe not.

By the time you receive this, COMPOSITESWORLD Expo ’08 booth space will be available. Exhibitors and attendees should find the show’s central Chicago location ideal. And its educational focus — not only composite materials but part design and manufacturing as well — should be just what the growing industrial sectors can use.

Happy 2008!

Related Content

Honda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

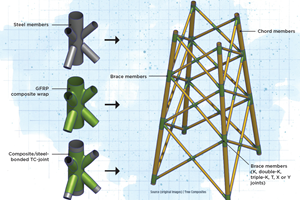

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreVIDEO: High-volume processing for fiberglass components

Cannon Ergos, a company specializing in high-ton presses and equipment for composites fabrication and plastics processing, displayed automotive and industrial components at CAMX 2024.

Read More