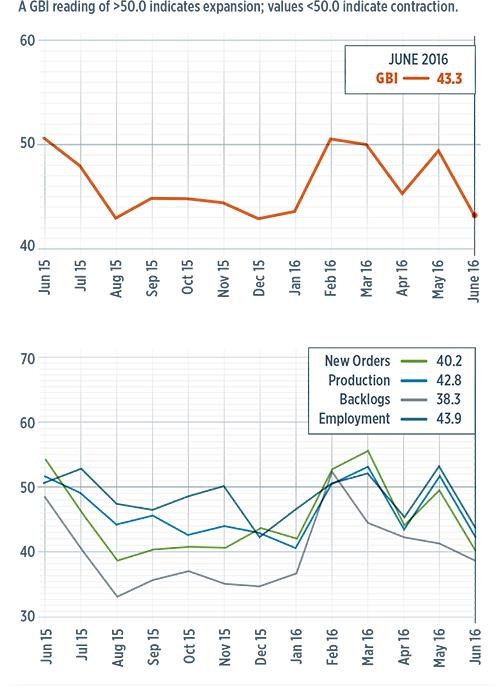

Gardner Business Index at 43.3 in June

Compared with one year ago, future capital spending plans are up by 43%.

With a reading of 43.3, the most recent Gardner Business Index showed that the US composites industry had contracted at a significantly faster rate in the month of June than it had at any reference point previously in 2016. The decline brought the Index back to the general level recorded in the second half of 2015.

New orders contracted for the third month in a row. The new orders subindex had, by the end of June, fallen sharply since March. The production index contracted for the second time in three months as its subindex fell to its lowest level since January of this year. The backlogs index contracted as well, and did so at an accelerating rate for the fourth straight month. The employment figure contracted, too, for the second time in three months, and its subindex fell to its second lowest level since the GBI Composites survey was initiated in December 2011. Despite the moderation in the value of the US dollar, US exports continued to contract in June. Supplier deliveries lengthened for the fifth time in the first half of 2016.

The materials prices subindex, as June closed out, had increased dramatically in 2016. Although the rate of increase did slow down in June, the subindex was at its second highest level in the previous 18 months. Prices received decreased for the ninth month in a row. The future business expectations subindex, in June, was fairly flat again, as it had been in four of the preceding five months.

For the most part, US composites manufacturers felt the effects of industry contraction. Plants with more than 250 employees contracted for the seventh straight month. Their subindex fell to its lowest level since the survey began. Facilities with 100-249 employees contracted in June after having posted growth in five of the previous six months. Companies with 50-99 employees, however, were the exception: As a group, they posted expansion as June closed out — the third posting of growth during the preceding five months. Facilities with 20-49 employees contracted in June after growing in three of the previous four months. Plants with fewer than 20 employees contracted for a fourth month in a row.

The aerospace industry contracted, but it was its first time under 50.0 since January 2016. Although the aerospace industry had performed well for composites fabricators from January through May, the automotive industry, through June, had posted contraction for seven consecutive months. This mirrored motor vehicle and parts consumer spending, which had contracted five of the previous six months.

Future capital spending plans, in June, fell to their lowest level of 2016. But, compared with one year earlier, future capital spending plans actually were up by 43%. Month-over-month, they had increased, as June closed out, in three of the previous four months. The annual rate of change, in June, had contracted at a decelerating rate since February 2016, which as CW went to press, was a positive sign for the US composites industry.

Related Content

-

Composites end markets: Boatbuilding and marine (2025)

As 2023-2024 consumer demand slows, boat and marine vessel manufacturers continue to focus on decarbonization and new technologies using composites.

-

Nlcomp launches recyclable composite sailing boat Ecoracer30

Italian startup featured its 30-foot sustainable production boat at the Ocean Race Grand Finale in Genoa, Italy, citing the challenges, highlights and future related to its development.

-

Al Seer Marine, Abu Dhabi Maritime unveil world’s largest 3D-printed boat

Holding the new Guinness World Record at 11.98 meters, the 3D-printed composite water taxi used a CEAD Flexbot to print two hulls in less than 12 days.

.JPG;width=70;height=70;mode=crop)