Market Trends: The MRO challenge #x97; managing uncertainty

According to a recent report by Aerostrategy Management Consulting, spending by air transport maintenance and repair organizations (MROs) worldwide totaled $40.8 billion (USD) in 2006. Moreover, Aerostrategy (Ann Arbor, Mich. and Amersham, Buckinghamshire, U.K.) reports that spending on air transport maintenance

According to a recent report by Aerostrategy Management Consulting, spending by air transport maintenance and repair organizations (MROs) worldwide totaled $40.8 billion (USD) in 2006. Moreover, Aerostrategy (Ann Arbor, Mich. and Amersham, Buckinghamshire, U.K.) reports that spending on air transport maintenance materials alone was $16 billion and is likely to increase to $20 billion by 2011. More than 50 percent of those material funds go to engine maintenance and repair. Smaller portions are spent on the rest of the aircraft — 14 percent for airframe structures and 21 percent for other aircraft components. Today, composites account for a fraction of that.

Composite materials manufacturer Cytec Engineered Materials Inc. (Tempe, Ariz.) estimates that the MRO market currently consumes anywhere from $15 million to $25 million (USD) annually in raw composite materials — a relatively small portion of current overall expenditures. Indeed, composite components make up, on average, less than 10 percent of each aircraft in our American Airlines fleet. This, of course, will change dramatically industry-wide as Boeing’s 787 Dreamliner comes online followed later by the Airbus A350 XWB.

What can the MRO industry expect when aircraft airframes are more than 50 percent composite materials by weight? Although American Airlines has not yet ordered any 787s or A350s, we’re already assessing the impact that those types of planes will have on our repair strategy in the form of an internal study.

Repair and maintenance of composites already keeps our dedicated Composites Repair Center in Tulsa, Okla., very busy. We operate both as a heavy maintenance repair station under the FAA’s Federal Aviation Regulations (FAR) Part 145 rules and as a Part 121 Owner/Operator, which gives us the leeway not only to simply replace a part but also to make a replacement composite part if the project’s return on tooling investment is favorable. So we’ll need more training at our satellite facilities to bring technicians up to speed, and we’ll have to make room in our facilities to accommodate a greater volume of repairs.

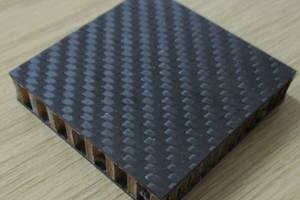

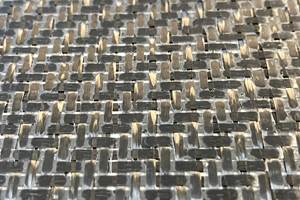

However, the results of our study bode well for the repairs themselves. Boeing has said that “metallic” repairs will be possible for the thick monolithic composite fuselage structure. That is, standard procedures for mechanically fastened repairs will be employed, in which a technician will be able to install a titanium patch directly over the damaged area of a composite component using commonly available standard bolts. That makes it much easier for repair workers to transition the skill sets they already have mastered. In areas where composite laminates themselves will be repaired, established com-posite repair procedures will be used, although, given the laminate thickness, the technique will involve several steps to build up to the total thickness. Ultimately, the transition to a fleet that features a high percentage of aircraft with solid laminate structures should mean fewer repairs because the newer planes won’t be as damage-prone as honeycomb parts on retiring legacy aircraft.

It’s likely that MROs might have to deal with supply issues as well, at least in the early stages of the transition. Even today, our biggest challenge is maintaining adequate quantities of prepregs and other materials that have finite shelf lives, not knowing which of those materials will be actually needed and in what quantities. In the case of older, legacy materials that were qualified decades ago, equivalent alternatives often have to be found. Discarding out-of-spec, unused materials obviously increases the cost of operation. Further, the fiber shortages of the last several years have impacted us and other airlines and repair stations, making it harder to obtain the relatively small quantities of materials that we need. On the heels of the fiber shortage were shortages of syntactic foam adhesives and two-part epoxy systems. The management of materials is a constant challenge in MRO composite repairs.

That said, the enormous effort the carbon fiber suppliers are making to meet the expected demand should prevent serious long-term sourcing issues for MROs as new production lines come online around the world. Further, the number of composite material types and suppliers on the 787 is limited, which will simplify material management and reduce composite inventory requirements thanks to greater standardization. The toughened prepreg used on the 787 is relatively new and doesn’t have an extensive history with MROs, but I’m hopeful that it will prove more damage-tolerant than previous generations of material, as Boeing has promised.

Related Content

BiDebA project supports bio-based adhesives development for composites

Five European project partners are to engineer novel bio-based adhesives, derived from renewable resources, to facilitate composites debonding, circularity in transportation markets.

Read MorePRF Composite Materials introduces primer, adhesive films

Novel RFA570 eXpress cure adhesive film and RF Primer are compatible with PRF’s full range of epoxy prepregs formulations.

Read MoreFilm adhesive enables high-temperature bonding

CAMX 2024: Aeroadhere FAE-350-1, Park Aerospace’s curing modified epoxy, offers high toughness with elevated temperature performance when used in primary and secondary aerospace structures.

Read MorePontacol thermoplastic adhesive films are well-suited for composite preforms

Copolyester- and copolyamide-based adhesive films eliminate the need for sewing threads or binders when stacking laminates while improving the final part’s mechanical properties.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More

.jpg;maxWidth=300;quality=90)