Market Trends: This industry is ready to explode

I recently was invited to speak at the COMPOSITESWORLD Carbon Fiber Conference, held Dec. 5–7, 2007, in Washington, D.C. As usual it was a successful gathering of fiber manufacturers and users. As a consultant to the composites industry, I’ve tracked carbon fiber supply and demand for years. Some of you might remember

I recently was invited to speak at the COMPOSITESWORLD Carbon Fiber Conference, held Dec. 5–7, 2007, in Washington, D.C. As usual it was a successful gathering of fiber manufacturers and users. As a consultant to the composites industry, I’ve tracked carbon fiber supply and demand for years. Some of you might remember that in my last “Market Trends” column (see “Related Content,” at left), I predicted that we were entering a market upswing of strong global fiber demand but that we, the industry, lacked basic metrics for measuring market potential.

Well, I was right on both counts. Three years after that 2005 column, in which I said that fiber producers were lagging behind growing demand, carbon fiber capacity expansions are at an all-time high — total production capacity will increase by 78 percent over the next three years, with plenty of precursor available. A heavy revenue stream is funding these huge expansions, with commercial aerospace being the big driver. The composites industry today is seeing strong double-digit growth, with gross margins in the range of 21 to 23 percent and research and development spending in the range of 2 to 5 percent. By my reckoning, the use of carbon fiber in wind turbine blades will be the second largest application after aerospace by 2010. Other major drivers include offshore oil and gas, pressure vessels (particularly those for hydrogen storage), military defense and sports.

The majority of the Carbon Fiber Conference attendees agreed with me that the overall market outlook for the next 20 years is positive, despite the uncertain economy and the weakness of the dollar against the euro and the yen. Here’s a rundown on the fiber industry as well as the overall composites industry and market demand.

Looking at market segment growth through 2010, aerospace (the pri-mary driver) is growing at a 19 percent compound annual growth rate (CAGR). There has been a paradigm shift in aircraft design at Boeing and Airbus, with composites now specified for primary structures. This is a significant change. All future wide-body airplanes shipped from both manufacturers are based on the new paradigm. Both Boeing and Airbus are projecting multibillion-dollar markets for new airplanes over the next 20 years, particularly in Asia.

The industrial market, which can include basically everything outside of the aerospace/military sector and sporting goods, has a 15 percent CAGR. Sporting goods checks in at 7 percent growth. The primary consumers are the U.S., Europe and Japan. China, Taiwan, India, Bangladesh and Vietnam have started using carbon fiber and are driving demand upward. Global demand estimates through 2020 for carbon fiber are presented in the Table.

Meeting this burgeoning demand for carbon fiber are seven major manufacturers: Cytec, Hexcel, Mitsubishi Rayon, SGL, Toho-Tenax, Toray and Zoltek. Three of these, Toray, Toho-Tenax and Mitsubishi, control 70 percent of the market. The early entrants in the business — BASF, Celanese, Conoco-Phillips, DuPont, Exxon, Hercules — either opted out or have been absorbed by consolidation. High capital costs and very long-term payback have traditionally been barriers to entry for new fiber players, but that could be changing in today’s environment. The seven major manufacturers’ known investment in 2007 totals more than $1.4 billion (USD), which includes upgrades or expansions for fiber, precursor and prepreg. The seven have survived because of their visionary management, “patient” money and — key to survival today — established global footprints. Their investments represent a commitment to the long haul, and I believe additional capacity increases are likely within two to four years.

Toray Industries has a $6 billion, 14-year contract with Boeing to supply carbon fiber/epoxy prepreg material for the 787 Dreamliner and other aircraft programs, which can be traced back to the success of Boeing’s composite 777 tail structure. Boeing has increased its demand from 10 prepreg shipsets per month to 14 shipsets per month in 2010 to keep up with the production schedule demand for the 787. Toray, which has a 34 percent global market share today, is aiming for a 40 percent share by 2010. Carbon fiber is Toray’s most profitable product, with a 20 percent operating margin, compared to a 3 percent margin on its main apparel textiles and fiber units. Toray forecasts that its carbon fiber sales will double to $1.4 billion by 2010.

Hexcel has just opened a new prepreg plant in France and is now “planting its flag” in China, in the form of a new prepreg plant being developed in cooperation with French agricultural technology firm XEDA to support the wind energy market. It also is adding a new carbon fiber and precursor line, which will increase its manufacturing capacity by 70 percent. As one of the largest suppliers of composite materials, thanks to its vertical integration, the company is reporting gross margins of 23 percent.

Zoltek is coming on strong with its strategic acquisition of the acrylic fiber manufacturing assets of Cydsa, a large, publicly traded Mexican chemical and industrial company. The company plans to retool and modify the Crysel fiber lines to produce precursor and eventually carbon fiber. Precursor production is planned to begin by the end of fiscal year 2008. With this acquisition, the company has set a goal of $500 million in sales of commercial grade carbon fiber by 2011.

All of these developments and growth are cascading through the composites industry value chain. Prepregs are making a big comeback because they are a proven material form. Weaving, stitching and braiding companies also are establishing a larger presence, with estimated sales in the range of $60 million to $70 million in 2007. My estimate for the overall value of fabricated carbon fiber structures for 2006 is $12.3 billion, with aerospace accounting for about half, followed by industrial and sporting goods.

That said, I still believe that carbon fiber production increases are only barely keeping up with the rapid growth in demand. There is a wave of change underway, with outsourcing continuing as a trend and increasing automation creating faster production rates. Boeing is a large part of these changes — the company is reportedly looking for small, nimble business partners that can stay ahead of today’s rapidly changing business environment. In today’s climate, a company’s survival might depend on doing business faster, better and cheaper.

It’s my opinion that carbon fiber-filled thermoplastics are going to be the “killer app,” spanning a huge and diverse range of markets, from automotive to electronics to industrial gaskets. Small injection and compression molded parts reinforced with carbon fiber represent a huge opportunity for application development and growth. Carbon fiber in such parts will be able to provide multiple performance features, such as adding reinforcement strength and electromagnetic shielding. It also can help eliminate secondary processing steps. Components and structures for offshore oil drilling, alone, could consume huge quantities of carbon fiber.

Supply, however, must keep up with demand. A few years ago, when carbon fiber was plentiful and relatively inexpensive, many manufacturers developed products that contain carbon fiber, only to watch the supply wither and prices increase. The consensus of the conference attendees was that this time, we just might have enough momentum to meet and sustain the demand.

Part of the momentum comes from new fiber producers. At least two Chinese carbon fiber plants are operational — Dalian Xingke and Yingyou Group. New plants are in the planning stages (or under development) in Saudi Arabia, India, Turkey and Canada. It remains to be seen how quickly these new players will come on stream and how well their products will be received.

Do we still lack good metrics for gauging demand? Yes, but the situation is getting better. Composites industry forecasters see profitability, robust double-digit growth and a bright future from now until 2020. Innovative part designs, streamlining of manufacturing processes and outsourcing are helping. But we’re still not a drugstore business where you can walk in and pick something from the shelf — we’re still in our infancy. That’s what makes it hard to predict and measure demand. Three years ago, I challenged HPC to take the lead to create a global annual summit where attendees could compare notes, discuss investment opportunities and better understand the financial dynamics of this industry. The first COMPOSITESWORLD 2008 Composites Industry Investment Forum was held Feb. 21–22 in New York to do just that. We’re getting there.

Related Content

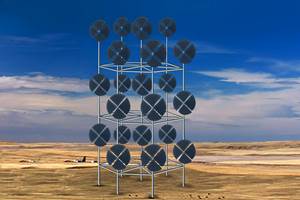

Drag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreJEC World 2023 highlights: Recyclable resins, renewable energy solutions, award-winning automotive

CW technical editor Hannah Mason recaps some of the technology on display at JEC World, including natural, bio-based or recyclable materials solutions, innovative automotive and renewable energy components and more.

Read MoreHonda begins production of 2025 CR-V e:FCEV with Type 4 hydrogen tanks in U.S.

Model includes new technologies produced at Performance Manufacturing Center (PMC) in Marysville, Ohio, which is part of Honda hydrogen business strategy that includes Class 8 trucks.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreModeling and characterization of crushable composite structures

How the predictive tool “CZone” is applied to simulate the axial crushing response of composites, providing valuable insights into their use for motorsport applications.

Read MoreCFRP planing head: 50% less mass, 1.5 times faster rotation

Novel, modular design minimizes weight for high-precision cutting tools with faster production speeds.

Read More

.jpg;maxWidth=300;quality=90)