New Growth Demands Careful Planning

D.J. DeLong has been involved in the manufacture and sales of carbon fibers for 18 years. Formerly general manager of BP Amoco's carbon fiber business, he's currently president of DeLong and Associates LLC (Atlanta, Ga.) In October 2005, I had the pleasure of co-chairing the Intertech 2005 Global Outlook for Carbon

In October 2005, I had the pleasure of co-chairing the Intertech 2005 Global Outlook for Carbon Fiber conference with Len Poveromo from Northrop Grumman Corp. (Bethpage, N.Y.). Conference speakers summarized the latest data on supply and demand and reviewed new technologies that could increase use of carbon fiber composites in a variety of industrial applications. Attendees felt that the current tight supply situation was cutting off future developing business.

The growth forecasts of carbon fiber demand for the Airbus A380 and the Boeing 787 have become a reality in 2005. The fourth A380 is flying and the "pipeline" of subassemblies for future deliveries is full of carbon fiber parts. Boeing is fabricating components, testing and lining up its supply chain. Boeing 787 first deliveries are set for 2008. Fred Hadjuk (SRI Consulting, Menlo Park, Calif.) predicted that annual demand will grow an average of 10.2 percent from 2004 through 2009. At the conference, it appeared the supply would increase 20 percent in 2006, with new output from Toray and Toho/Tenax. Even with announced capacity additions through 2007, it seems that supply/demand will be delicately balanced for a few years. There is little room for unplanned growth and that is the real bind. In late 2005, Hexcel, Mitsubishi Rayon/Grafil and Toray announced additional expansions. These newer facilities will help by 2008, but users need to work carefully and openly with suppliers to jointly plan for business growth.

Consultant Jon DeVault (DeVault and Assoc., Pinehurst, N.C.) covered the recent National Research Council carbon fiber report, reviewing past business cycles and pointing out the declining share consumed by defense applications. He asked if there was interest in forming another trade association to gather industry statistics. Lobbyist Ted Lynch (SMI Inc., Washington, D.C.) noted that Defense Federal Acquisition Regulations Supplement (DFARS) legislation provides strong support for the industry, but warned that a key provision, which mandates U.S. military use of PAN fiber to that produced by U.S. sources, will expire in May 2006. He emphasized that domestic carbon fiber suppliers cannot provide needed capacity in reasonable time without congressional passage of Defense Production Act Title III funding.

David Warren from the Oak Ridge National Laboratories (ORNL, Oak Ridge, Tenn.) updated ORNL's work on lignin-based precursors for automotive applications and a carbonization method based on microwave heating. Mohamed Abdallah (Hexcel, Dublin, Calif.) reviewed that company's efforts, on behalf of the U.S. Navy, to develop stretch-broken fiber forms and preforms that enhance reinforcement conformity to complex mold/part contours. Tom Hughes from Applied Sciences Inc. (Cedarville, Ohio) covered that company's latest work on carbon nanofibers.

On the applications side, there was a commercial update on the status of Beacon Power's flywheel energy storage products, and Ron Allred described Adherent Technologies' (Albuquerque, N.M.) progress toward development of a recycling process for carbon composites. In the long term, this could be an enabling technology that spurs automotive industry acceptance of carbon fiber. Dr. Chung from the University of Buffalo spoke of the promise for embedded carbon fibers for monitoring "smart" concrete structures. Dr. Gopalakrishnan from GE Wind Energy (Atlanta, Ga.) outlined one of the fastest growing industrial applications (at 25 percent per annum): composite wind turbine blades. Glass reinforcement is reaching its practical limits, as blade lengths extend to 60m/197 ft. Carbon fiber usage is growing, but assurance of supply is needed, if it is to gain wide acceptance.

The "mega-application" that really tested the supply picture last year was the composite deckhouse on the U.S. Navy's DD(X) destroyer. Len Poveromo presented a high-level review of the joining issues and potential growth for this program. It was estimated that last year, for prototypes and testing, Northrop Grumman purchased 1 million lb (453.6 metric tonnes)! The nominal usage per ship will be roughly 500,000 lb (226.8 metric tonnes) of fiber.

Progress in infrastructure repair were described by Ed Fyfe of Fyfe Co. LLC (San Diego, Calif.) and Vistap Karbhari of the University of California at San Diego. In this area carbon fiber continues to make steady progress in parallel with fiberglass.

Christian Kissinger (SAERTEX USA LLC, Huntersville, N.C.) ably covered noncrimp fabrics as a way to produce high-quality resin infused products. Jeff Martin (Omniglass Ltd., Twinsburg, Ohio), described the "universe" of pultruded shapes that have been produced from carbon and glass fibers. David Money (SPARTA Composites, San Diego, Calif.) advocated the comprehensive design of part and process to reduce scale-up time. Dale Brosius of Quickstep Technologies (Canning Vale, Australia) detailed the company's proprietary liquid heated/cooled curing process for composite parts.

The conference highlighted the fact that supplies are increasing, but not fast enough to meet short-term demand. Suppliers are investing hundreds of millions of dollars in new capacity, in each of the next three years -- a major vote of confidence in carbon fiber's future. Users continue to innovate and invest in application development to grow the business base. The key to adequate supply continues to be a good planning process between producer and consumer.

Related Content

Plant tour: Arris Composites, Berkeley, Calif., U.S.

The creator of Additive Molding is leveraging automation and thermoplastics to provide high-volume, high-quality, sustainable composites manufacturing services.

Read MoreComposites end markets: Electronics (2024)

Increasingly, prototype and production-ready smart devices featuring thermoplastic composite cases and other components provide lightweight, optimized sustainable alternatives to metal.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

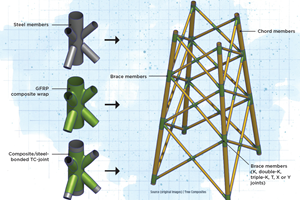

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More