November Editorial

Since September, the High-Performance Composites staff has attended RP Asia, China Composites, the SPE Automotive Conference, the CMOO Offshore Oil Conference, ACMA's COMPOSITES 2005, IBEX, the Intertech Carbon Fiber Conference and the SAMPE Tech Conference. Business, from airplanes to boats, is booming, with few

Since September, the High-Performance Composites staff has attended RP Asia, China Composites, the SPE Automotive Conference, the CMOO Offshore Oil Conference, ACMA's COMPOSITES 2005, IBEX, the Intertech Carbon Fiber Conference and the SAMPE Tech Conference.

Business, from airplanes to boats, is booming, with few areas of concern. Raw material costs are up, except for fiberglass, but end users are becoming more efficient and are able to pass the costs on in most areas.

The Fourth International Conference on Composites Materials for Offshore Operations (CMOO-4) brought together several hundred key representatives from many oil-producing countries and companies, including suppliers. Numerous, potentially high-volume applications were presented, and a newly formed company, Aker Kvaerner Subsea, was introduced to replace the former partnership between Aker Kvaerner and ConocoPhillips, which deployed a composite riser on the Heidrun platform in the North Sea. The new company is making spoolable umbilicals in Alabama, which will be deployed in 2006. Trans Ocean Gas Inc. presented a new concept for economically transporting "stranded" natural gas via ships containing huge carbon-fiber CNG tanks. Other examples included carbon fiber platform tethers, pressure vessels for subsea facilities and several new drilling concepts. There was a notable feeling of disappointment when the much-touted CompRiser composite drilling riser was discussed (see HPC July 2002, p. 40). It was emphasized that the riser's failure had to do with its steel liner, not its composite materials. It's hard to know exactly what the holdup with riser programs is, but I can't help thinking that the current scarcity of carbon fiber plays a role.

The SPE Automotive Composites Conference put long-fiber thermoplastics and their various production methods front and center. SMC and other thermoset materials were featured, of course, but the theme of the conference was innovation in design, parts consolidation and all types of manufacturing. The need to reduce weight for fuel efficiency was a given, but representatives from the OEMs cautioned that composites were not the only materials that could do the job. That said, I was surprised at how much of the discussion centered around the applications, availability and price of carbon fiber.

In my November 2004 commentary on Intertech's Carbon Fiber conference, I predicted carbon fiber supply would be dicey for 6 to 12 months. A year has passed, and it's still tight. At many 2005 events, companies complained that they could not get the fiber they needed. Some said it was stifling their growth. Part of the reason for the shortage is that demand is growing even faster than predicted a year ago. In addition to aerospace increases, the industrial sector is growing at 10 to 15 percent per year, not to mention the wind energy industry at up to 20 percent.

But relief is on the way. Toray is on schedule to bring its 4 million lb Alabama line up in early '06, and Zoltek is scrambling to get all five of its Texas lines up by year's end. But Zoltek is finding it tough to hire experienced labor to run its lines, and Toray says it would speed up its build rate, but labor in the South is occupied, rebuilding Louisiana after Katrina. The 4 million lb Toho/Tenax line in Germany is expected to come online in October 2006. And Acordis, the sole independent supplier of textile-grade PAN precursor, which was to shut down its Grimsby, U.K. plant, has announced a buyout by a consortium of senior managers and private investors. Moreover, Mitsubishi will bring an additional 4 million lb to market in the third quarter of 2007. Thus, 10 million lb of capacity will come online in the next 12 months with another five million soon after. The fiber suppliers, some of whom were skeptical about the market a year ago, are stepping up to meet the demand. End users wish they had started a bit sooner.

Related Content

RTM, dry braided fabric enable faster, cost-effective manufacture for hydrokinetic turbine components

Switching from prepreg to RTM led to significant time and cost savings for the manufacture of fiberglass struts and complex carbon fiber composite foils that power ORPC’s RivGen systems.

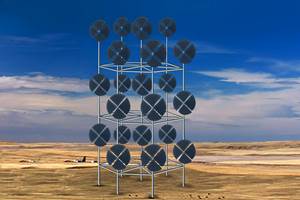

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreHexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreAll-recycled, needle-punched nonwoven CFRP slashes carbon footprint of Formula 2 seat

Dallara and Tenowo collaborate to produce a race-ready Formula 2 seat using recycled carbon fiber, reducing CO2 emissions by 97.5% compared to virgin materials.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;maxWidth=300;quality=90)