We need reliable, predictable material supplies

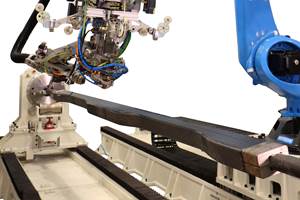

Dr. Mike Holland is VP and general manager of SPARTA Composites. SPARTA Composites, which occupies 70,000 square feet of manufacturing space in San Diego, Calif., designs and manufactures composite components for the aerospace, automotive and defense industries. Processes include compression molding, resin transfer

As designers and molders of custom composite parts, we at SPARTA Composites spend a lot of our time trying to convince potential customers of the benefits of using composites. We extol our ability to tailor physical properties, such as stiffness and strength, to the customer's specific requirements. We praise composites as being more fatigue-tolerant. We stress the noncorrosive aspects of composites and most certainly talk about reduced weight relative to aluminum and steel. But at the end of the day, cost is typically king.

It is our experience that most potential customers view the use of composites with suspicion, perceiving them not only as too costly, but subject to volatile material supplies as well. In reply, we typically show them many examples of composite products that — properly designed for production and made in sufficient quantities — are cost-competitive with other material choices and offer improved performance as an added benefit. We also cite examples where the composite materials we're proposing for the customer's applications are already industry standards, having been produced for many years and at a stable price as well.

In new markets where we finally do succeed in convincing customers to make the transition from metals to composites, it then becomes anathema either for prices to increase rapidly or, even worse, for the supply of the material to be discontinued. Our customers typically spend large nonrecurring engineering and testing budgets to qualify a product for a particular use. Any material change in the product constituents requires costly re-qualification of the product and production delays. Therefore, the worst possible outcome is when the product no longer can be made cost-effectively with the composite materials we've recommended and cannot be produced from other available materials either.

Rapid increases in material prices and/or decreases in availability benefit no one. The recent surge in the use of carbon composites in the commercial aviation industry may benefit suppliers of specific materials but shortages of carbon fiber materials and rapidly rising prices hurt the industry as a whole. Large companies may be able to negotiate long-term supply agreements with their suppliers but preferential treatment of one industry to the detriment of many others casts yet another pall on the composites industry as a whole. The gut reaction of the customer community is "Here we go again — nothing has changed."

Price stability and supply availability are critical to the success of both the material manufacturer and the molder. If we are both to successfully enter into a new market, we both need to commit and understand each other's commitments. We need long-term planning from our suppliers, not only for the large users but also for the rest of us. We, "as a molder" for instance, need cooperation from our materials suppliers, and vice versa.

Toward that end, I make the following observations: We appreciate suppliers' use of aggressive pricing strategies to open new markets, but we molders need to know in advance when these prices will change, or how long this "loss leading" strategy will last. Surprises are very bad for us — and for our customers — especially for the ones in large, established industries, such as automotive. If we are going to be successful in engendering and growing the use of composites in a new application or a new industry, then we must accept and even embrace how that particular industry does business. If we don't, then we all lose. We cannot expect a large, established industry to change its practices to accommodate us as new suppliers.

Designers in every industry are extremely wary of rising prices for any material, whether it is steel, aluminum, magnesium, palladium or composites. Fluctuations in material prices are one of the factors that drive R&D divisions at these large companies to develop products with other materials that have stable prices and reliable, steady supply chains. Materials with fluctuating supply and pricing are labeled "high risk" and left behind. Because of the inertia of these huge, established industries, it takes a very long time to remove the stigma.

Let's stop going for short-term gains and work together to build a sustainable composites industry with reliable and predictable material supplies.

Related Content

MFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MoreGKN Aerospace, Joby Aviation sign aerostructures agreement

GKN Aerospace will manufacture thermoplastic composite flight control surfaces for Joby’s all-electric, four-passenger, composites-intensive ride-sharing aircraft.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreBladder-assisted compression molding derivative produces complex, autoclave-quality automotive parts

HP Composites’ AirPower technology enables high-rate CFRP roof production with 50% energy savings for the Maserati MC20.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read MorePlant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More