Wind turbine blades: Back to the future?

Dayton Griffin, MSc, a senior principal engineer at DNV GL (Seattle, WA, US), considers the challenges that increasing blade length poses for designers/manufacturers in terms of weight mitigation, stiffness optimization, manufacturability and transportability.

In 1987, a 3.2-MW prototype wind turbine was installed in Hawaii. At the time, it was the largest wind turbine in the world. Manufactured by the Boeing Co. (Chicago, IL, US) under a NASA/US Department of Energy (DoE) development program, the MOD-5B had a rotor diameter of 97.5m and two blades, which featured partial-span, variable-pitch control, that is, the outermost portion of the blade could be rotated to adjust its aerodynamics.

This NASA program exposed the challenges for the design, manufacture and operation of MW-scale wind turbines. During the 1990s, mainstream commercial wind turbines were kW-scale and gradually growing in turbine power rating and rotor size. The prevailing rotor configuration was the “Danish” type: three blades with full-span, that is, entire-blade, pitch control.

Fast-forward to 2012. The Chinese company Envision Energy Co. Ltd. (Beijing) and its Danish subsidiary’s design team installed a 3.6-MW prototype with a two-bladed, partial-span pitch rotor. Currently, the U.S.-based company Zimitar Inc. (Benicia, CA US) is developing a similar rotor.

Are wind turbine rotor designs going “back to the future”? Not necessarily. First, the Danish configuration still prevails. More importantly, the MOD-5B rotor was all-steel and weighed 144 MT. The Envision prototype uses FRP materials for the blade structure, and incorporates a carbon fiber-reinforced polymer (CFRP) main rotor driveshaft — a first for a commercial, MW-scale turbine. In addition to reducing component weight, Envision reports the CFRP shaft has flexibility characteristics that mitigate loading compared with the steel alternative. Similarly, the Zimitar rotor design employs FRP blades and aerodynamic control devices. It has a 64% larger diameter than the MOD-5B and nearly twice the rated power at approximately 68% of the weight.

That points to another difference. Over the past two decades, blade length has increased in proportion to turbine rated power, and as rotor size expanded at a given rating. A decade ago, a typical 2-MW rotor had an 80m diameter. Today, to capture more energy, some 2-MW rotors have diameters of 110m and greater.

As blade length increased, it was increasingly critical to mitigate weight growth yet ensure adequate stiffness. These objectives were realized by using FRP materials with increased stiffness-/strength-to-weight. Current strategies fall into three categories: 1) increasing the fiber weight fraction (Wf) for glass fiber-reinforced plastic (GFRP), using standard E-glass, 2) using intermediate or high-modulus glass fibers, and/or 3) using alternatives with increased stiffness-/strength-to-weight, such as carbon fibers.

Historically, wind blades have benefited from a shift to manufacturing by vacuum-assisted resin transfer molding (VARTM) or by using prepreg materials, with increased compaction and Wf compared to the earlier wet-layup process. Although this resulted in weight and stiffness improvements, there are practical limitations for compaction of the thick laminates typical of MW-scale blades. Also, the fatigue strength of blade laminate tends to decrease with increased Wf. For GFRP materials, ongoing developments in fiber sizing and fabric architecture are improving fatigue strength and infusibility of heavy fabrics in thick laminates.

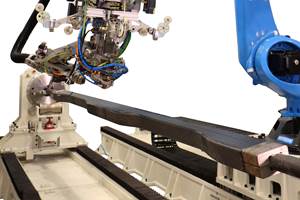

Another trend is the increased use of pre-consolidated elements in blade construction. These can include sub-elements that are fabricated and cured, using the same basic processes as the rest of the blade, or other processes, e.g., pultruded “rods” or “slats.” Sub-elements are integrated into the structure during layup and infusion of the blade shells and can enable increased Wf, improve fatigue resistance and ease manufacture.

CFRP has been used for load-carrying blade structure, most notably by turbine manufacturers Vestas Wind Systems A/S (Aarhus, Denmark) and Gamesa (Zamudio, Spain), and, in some recent models, by GE Wind Energy (Fairfleld, CT, US). CFRP has known strength and stiffness benefits, but disadvantages include cost, sensitivity to manufacturing variations and electrical conductivity, which can complicate lightning protection.

A “middle ground” approach between use of standard E-glass and CFRP is intermediate- and high-modulus glass fibers. Owens Corning (Toledo, OH, US) is an industry leader in this technology, with several fiber and fabric products developed for wind blades. Today, the use of these glass fibers appears to be growing somewhat faster than the use of CFRP.

Longer blades complicate not only manufacturing but transportation as well. Therefore, modular designs are of increasing interest. Gamesa was the first to commercialize a mid-span joint at the MW-scale on its G128 4.5-MW turbine blades. Wetzel Engineering Inc. (Lawrence, KS, US) also is developing a modular blade concept, using “spaceframe” technology.

As the trend toward increased blade size continues, the challenges of weight mitigation, stiffness optimization, manufacturability and transportability will motivate further developments in materials, processes and design. Not “back to the future,” but a promising future, nonetheless.

Related Content

MFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MoreCompPair adds swift prepreg line to HealTech Standard product family

The HealTech Standard product family from CompPair has been expanded with the addition of CS02, a swift prepreg line.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreRead Next

Plant tour: Daher Shap’in TechCenter and composites production plant, Saint-Aignan-de-Grandlieu, France

Co-located R&D and production advance OOA thermosets, thermoplastics, welding, recycling and digital technologies for faster processing and certification of lighter, more sustainable composites.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More

.jpg;maxWidth=300;quality=90)