Beyond the battlefield: UAS technology 2012-2022

The next 10 years look promising for composite-intensive unmanned aircraft as technical and legal advances open access to civil airspace.

Although there has been no lack of controversy regarding their use on the battlefield, and the ethics and laws surrounding their use will certainly evolve in the coming years, the fact that unmanned aerial systems (UASs) will continue in use is now firmly established. Military customers already make widespread use of a variety of small and large unmanned aircraft in support of ground forces and command posts with over-the-hill battlefield surveillance, intelligence gathering, image capture, data transmission and communications, and as persistent offensive weapons. Removing the pilot and cockpit from aircraft platforms has generally enabled smaller systems that are less expensive to purchase and operate, compared to manned aircraft. In some cases unmanned aircraft can endure and operate in conditions that a human pilot cannot sustain. These characteristics are spawning greater interest in UAS technology as military procurement budgets are tightened and new missions are explored.

In the next few years, new rules and protocols and modernized air traffic control systems in the U.S. and the European Union (EU) are expected to roll back limitations that are now being experienced by UAS operators within civilian airspace. The easing of these restrictions will not only enable military and government customers to fully exploit UAS capabilities, but it also is expected to permit a large number of potential new uses. UAS fleets will still surveil battlefields, but they could be used to monitor crop conditions, too, allowing farmers to improve productivity and reduce the use of fertilizers and pesticides. In populated areas, relatively inexpensive unmanned rotorcraft could provide first responders with a greater ability to rapidly respond to accidents and natural disasters, and they could support law enforcement — potentially reducing reliance on manned helicopters. Civil UASs could assume many roles (see second and fifth accompanying photos).

Because civil applications of UASs represent a relatively new and as yet undefined market in much of the world (Japan is the notable exception), this article will treat military and civil production separately. It will focus on a hard-numbers examination and appraisal of the more established military UAS industry, then highlight the immense opportunities for UAS technology off the battlefield.

The unmanned military

Unmanned aircraft have been in limited use for nearly 100 years. The first reported example was the Aerial Target, based on a famous Sopwith biplane, first flown in 1916. This low-precision aerial bomb was a spinoff made possible through the early developments of radar and radio transmission technologies. Then, as now, it was a tremendous challenge to package all the electronics and payloads intended for use. Although UASs saw only limited, experimental use during WWI and WWII, by the 1950s unmanned aircraft were capable of penetrating deep into enemy territory to provide intelligence gathering and imagery. During this period, unmanned aircraft were primarily used to simulate enemy aircraft during target practice. In the 1980s, the microcircuit revolution miniaturized electronics, which in turn enabled the development of large and very small platforms. Since 2006 the role of UASs has expanded to provide “persistent offensive assets.” U.S. military sources indicate that nearly 2,000 enemy combatants have been killed by weaponized platforms, such as the General Atomics (San Diego, Calif.) Grey Eagle/Reaper aircraft, in operations for the U.S. Air Force and Army.

The ability of these systems to pervasively communicate, gather data, spy and even attack across a broad spectrum of operational situations is driving their development and deployment in at least 60 countries. Within the U.S. there are more than 50 companies developing more than 150 UASs. Worldwide, more than 100 companies are known to be developing UAS platforms. These range from systems the size of insects to aircraft with wingspans comparable to jumbo jets — some with the potential to fly continuously for days or weeks without refueling. In 2012 approximately 2,900 units were delivered. Buoyed by strong support among military operators, that number is expected to double over the next 10 years.

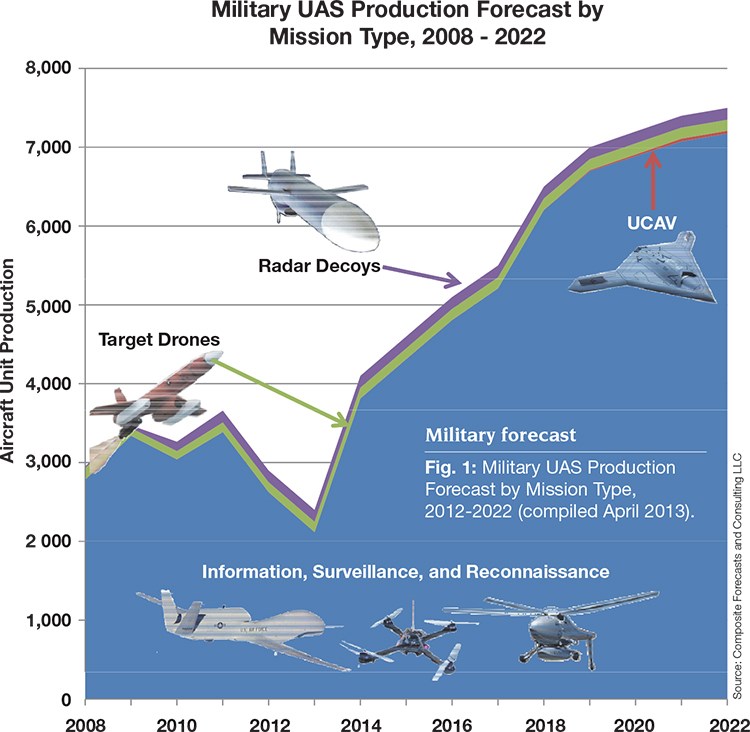

Based on airframe design and mission capabilities, the military UAS market can be subdivided as follows:

Information, surveillance and reconnaissance (ISR): Platforms that provide imaging, surveillance and data transfer. ISR platforms are often adapted to serve as armed delivery systems and cargo transports, and perform other roles as well.

Unmanned combat air vehicles (UCAVs): Aircraft with low-observable technologies designed for suppression of enemy air defenses (SEAD) and target support for manned fighter aircraft.

Radar decoys: Defense countermeasures to mask the signature of aircraft or confuse enemy radar with extraneous signals.

Target drones: Designed to provide simulated enemy aircraft and missile threats for training exercises.

Our research into UAS sales and deliveries has identified a global market for approximately 57,000 military units. Although it is not directly comparable to this outlook, a 2012 report from Teal Group Corp. (Fairfax, Va.) on global research, development and procurement spending for UASs indicates that the total UAS spending in 2013 — military and civil — is expected to exceed $6.5 billion and then roughly double by 2022. More than one-third of these aircraft are destined for one of the U.S. armed services. The impact on the U.S. Air Force is particularly significant because U.S. Department of Defense (DoD) data indicate that the DoD currently does not have enough remote pilots and ground crews to support its entire UAS fleet. At present, the Air Force reports that it is training more pilots and sensor operators for UASs than for its manned aircraft fleet.

Drilling down into the four military UAS platform categories, sales and production data indicate the ISR segment will account for about 95 percent of all units delivered during the forecast period. As the drawdown of combat operations in Afghanistan and Iraq has proceeded, deliveries of ISR platforms, this year and in 2012, have been notably smaller than in previous years. The DoD procurement budget, prior to 2013, was slashed by about $50 billion. The effects of the cuts will be seen over much of this forecast. The fiscal cliff, and the sequestration measures that kicked in on Jan. 1 to deal with it, could cut an additional $50 billion from the budget annually. Despite the fact that sequestration was intended to make widespread cuts across all weapons programs, the U.S. armed services have, in practice, continued to make UAS capabilities a priority. If we combine U.S. systems development numbers with those reported elsewhere at the rate of international adoption of similar unmanned systems, the military market for them could easily exceed 7,000 units per year by 2020 (see Fig. 1). Although ISR programs are expected to see fluctuations in the near term, the target-drone and radar-decoy segments will remain fairly steady over the forecast, representing about 5 percent of the total unit production. Of particular interest to fighter aircraft OEMs and subcontractors, this forecast includes a number of developmental UCAVs. Although a fully operational UCAV system is probably more than a decade away from active service, known development projects include three acknowledged by the Russian military. One, the RSK MiG Skat, is a low-observable, subsonic craft designed to carry weapons in two ventral weapons bays large enough for missiles. The second, the Luch UCAV, is based on the manned Sigma-5 aircraft. The third is based on the Sukhoi Su-27 Flanker, dubbed the Su-27RV Flanker UCAV. Meanwhile, China’s Shenyang Aircraft Corp. (Shenyang, Liaoning Province) is also developing three craft: the J-21, the Dark Sword, and the Tiannu. And in the EU, BAE Systems Plc (London, U.K.) is working on the Taranis; EADS (Leiden, The Netherlands) has its Barracuda; Paris, France-based Dassault Aviation will field the Neuron; and Sweden’s Saab AB (Bromma) is developing two: the Sharc and the Filur. It might be premature to predict the demise of manned fighters and bombers, but it seems nearly certain that UASs like the Northrop Grumman (Falls Church, Va.) X-47B UCLASS will begin to displace manned fighter aircraft during the next decade.

The emerging civil market

In 2012, the U.S. government tasked the Federal Aviation Admin. (FAA, Washington, D.C.) with determining how to integrate UASs into the National Air Space (NAS). This integration is considered essential for facilitating the widespread basing of military UASs across the country. There are at least 88 basing locations that operate UASs within the U.S., and the DoD is considering an expansion of these assets to another 110 locations in the next five years. Before UAS flights can enter into restricted civil airspace (essentially anywhere there is an urban population and existing flight traffic), UAS operators must obtain a Certificate of Authorization. But submitting a request for a certificate is a time-consuming process, and that hampers the ability of military services to fully implement UAS basing, training and mission objectives. UAS implementation strategies in Europe face similar obstacles in their next-generation air traffic control systems.

Although the U.S. efforts are intended to support military access to the NAS, the FAA is also mindful of the UAS opportunities this will create for civilian and business interests. Envisioned civilian uses include not only the previously mentioned police, first responder and farming applications, but also aerial imaging and mapping, disaster management, environmental monitoring, freight transport, oil and gas exploration, thermal infrared power line surveys, media (news, sports coverage and moviemaking), weather monitoring and wildfire mapping.

Access to the NAS could open in the next two or three years. That, in turn, would open viable opportunities for UAS manufacturers and their supply-chain partners. A March 2013 report, “The Economic Impact of Unmanned Aircraft Systems Integration in the United States,” published by the Association for Unmanned Vehicle Systems International (AUVSI, Arlington, Va.), indicates that NAS clearance could add more than 100,000 UAS-related jobs and $80 billion to the U.S. economy between 2015 and 2025. The AUVSI study predicts that 90 percent of total UAS sales for this emergent civil sector will be in public safety and “precision agriculture.”

Based on extensive surveys of UAS OEMs and potential operators, and on the experience of agricultural UAS operators in Japan who began adopting unmanned helicopters in 1990, the AUVSI report indicates that the potential market for agricultural UASs in the U.S. alone could quickly grow from a supposed 2015 “zero point” to as many as 160,000 aircraft per year. AUVSI sees law enforcement applications as the next largest sector, representing a potential demand for as many as 10,000 UASs annually. Applied on a global scale, the potential for large and small civil UASs could represent a potential global business of more than 300,000 aircraft per year — more than 30 times greater than anticipated military demand!

It seems reasonable to assume that the lower initial capital costs and operating costs that are possible with smaller UASs could provide transformative capabilities for civil operators, much as it has for military users. Despite this high potential, however, some established UAS manufacturers have privately expressed some skepticism about the overall size and timing of civil UAS demand. Among the factors that could enable — or if missing, severely curtail — civil opportunities include the following:

- Successful modernization of air traffic control to allow for UAS traffic among traditional manned aircraft.

- The development of highly reliable aircraft avoidance systems.

- The availability of qualified flight and sensor operators.

- Sustained economic growth.

- Financing and insurance for purchasers and operators.

- Public acceptance of UAS traffic in civil airspace.

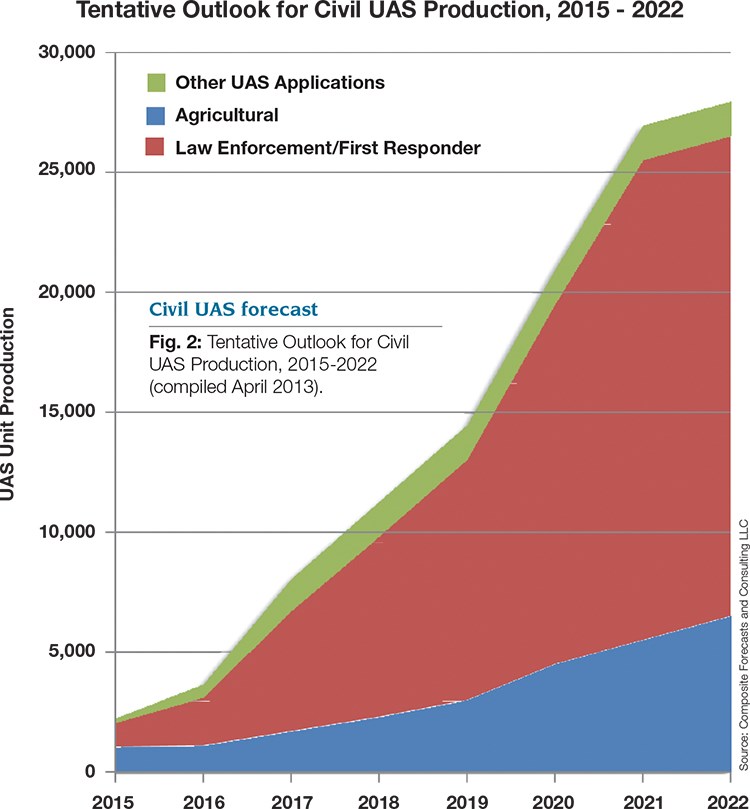

Assuming that the barriers to UAS integration into airspace are surmounted by 2015 and robust and low-cost aircraft collision avoidance systems can be developed, training enough flight, sensor and maintenance personnel to support these aircraft still presents a challenge without an immediate solution. The vast majority of qualified personnel are employed by the armed forces, which already struggle to recruit and train enough personnel for their growing UAS fleets. For these reasons, this outlook, in contrast to the AUVSI report, includes a more conservative civil forecast of roughly 115,000 UASs, with annual deliveries approaching 30,000 aircraft by 2020 (see Fig. 2).

While the exact nature of the aircraft that will serve the civil market is far from certain, it appears that a majority will be relatively small, with rotorcraft making up a much larger portion than winged craft because they are better suited to urban applications. Most of the UAS platforms under development for the market have empty operating weights of 5 to 660 lb (2.3 to 300 kg). Given the versatility of existing UASs, we expect that at least some military systems will be adapted for civilian use. And as is true in military applications, composite structures and components will be employed.

Translating deliveries to demand

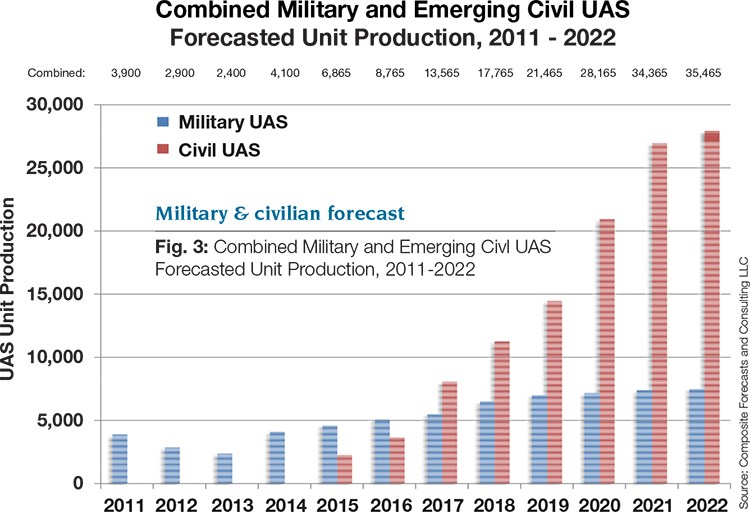

Almost nonexistent before the turn of the millennium, UAS production now looks to be very robust over the next 10 years. Not only is military R&D and procurement expected to double in a decade, but a much larger, more robust civil market will emerge as well. Assuming that regulatory and technical hurdles for safe operation in civil airspace are overcome within the next two years, the civil marketplace could demand legions of aircraft. Together, these two UAS segments are expected to deliver nearly 2,400 aircraft this year. Almost 90 percent of these units will have a maximum takeoff weight of 22 lb/10 kg or less. By 2022, total annual production could exceed 35,000 units — a 15x growth factor!

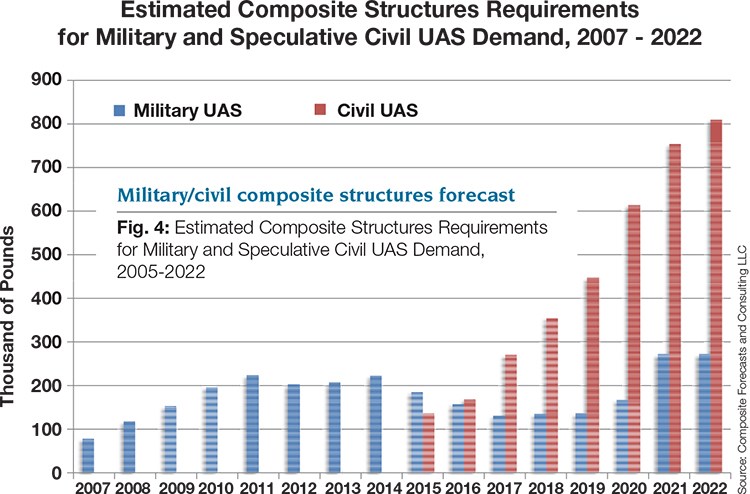

Based on an examination of the composite components and materials used to service military markets, and a compilation of a detailed production forecast, the roughly 2,400 UASs delivered this year will require 200,000 lb/90,909 kg of finished components — less than 1 percent of the total weight of aerospace and defense composite applications. This is a 10 percent decrease compared to 2011-2012 levels (see Fig. 3). Anticipating reduced operational tempos and lower replacement rates, this forecast sees overall military UAS-related composite volumes declining by one-third over the next four to five years (see Fig. 4), in part, because there will be fewer RQ-4 Global Hawk-sized aircraft and much greater numbers of small UASs. But the military demand is expected to grow significantly toward the end of this forecast as the result of advanced development of UCAVs, such as the X-47B UCLASS.

As Figs. 2, 3 & 4 indicate, the potential growth in the civil UAS market presents incredible opportunities for composites, starting around mid-decade. While it is much more difficult to characterize the application of composites for a market that has yet to take form, there are many areas of similarity with existing military models. After accounting for the type and size of aircraft to be used among the various roles outlined earlier in this article, and after applying generic content values based on existing UAS airframes, we conclude that the addition of civil UASs could double the demand for composites within the UAS sector within a few quick years. The civil UAS market expansion could propel UAS composites manufacturing to levels roughly equal to other aerospace sectors, including fighter jets, rotorcraft and business jets.

The impending entry of UASs into civil airspace is expected to open up many new opportunities for aircraft developers and, thus, stimulate local and national economies. These opportunities do not come without uncertainties. New regulations governing UAS operations will likely add significant certification requirements — analogous to those for manned aircraft. Training and sustaining flight and maintenance personnel to support this expansion also could slow the rate of adoption. To achieve the growth outlined here, a host of financing, liability and public acceptance issues also must be addressed. But it is clear that UASs will become commonplace and will continue to rely on advanced composites to deliver their transformative capabilities.

Related Content

AMRC Training Centre introduces composites apprenticeship opportunity

With partners McLaren and Teledyne CML Composites, the Training Center will train new composites technicians in South Yorkshire to build up the future industry workforce.

Read MoreNASA names university teams for aeronautics research challenges

As part of the agency’s University Leadership Initiative, three multidisciplinary teams will address topics related to growth in AAM, while a fourth examines electricity generation for future airliners.

Read MoreDaher inaugurates Learning Center for training aeronautical talent

Daher offers a concrete solution to the shortage of qualified professionals in aerospace, providing a range of technical programs that prepare workers for the sector’s rigorous demands.

Read MoreWomen in the Composites Industry brings together women for networking, educational opportunities

Aiming to support the growth of women in this industry, the WCI industry group and its partners recently held its first live training event hosted by Owens Corning.

Read MoreRead Next

“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read MoreDeveloping bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More