Blades? Yes! Towers ... maybe

Although steel dominates the utility-scale wind turbine tower market, height increases, on- and offshore, are shifting the wind toward composites.

Looking to expand their reach, wind power developers are pushing for wind turbine towers that rise to new heights, capturing the high-quality wind found at higher elevations. These towers likely will surpass the current height standard of 80m/265 ft for 3-MW turbines, growing to between 100m and 150m (325 ft and 492 ft) in height for turbines of 5-MW to 7-MW capacity, particularly in deepwater offshore wind farms. As a result, traditional steel designs for utility-grade towers are being pushed to their limits and beyond. Many see in this an opportunity for composites to vie with steel for a piece of the tower market. “It seems inevitable that composites will play a role in utility-scale wind turbine towers for both onshore and offshore installations,” Cedric Ball observed in his tenure as marketing products leader for resin supplier Ashland Performance Materials (Dublin, Ohio). Ball, recently appointed global marketing manager for Bulk Molding Compounds Inc. (W. Chicago, Ill.), explains, “For large onshore wind, steel towers are at their size limits for over-the-road transport.”

Typically, a steel monopole for an 80m/262-ft utility-grade tower is prefabricated in sections as large as 14 ft/4.3m in diameter by 70 ft/21.3m in length, then trucked to the wind farm. But as tower height goes up, “you also must increase its diameter, at which point the steel structure can no longer be shipped via highway,” explains Brian Rice, division head, Multi-Scale Composites & Polymers, University of Dayton Research Institute (UDRI, Dayton, Ohio). Further, concrete footings massive enough to accommodate towers for turbines of 5 MW or more are stretching the technical abilities of wind farm contractors, says Chris Red, editor and VP of market research, Composite Market Reports (Gilbert, Ariz.). “This is largely a result of supported weight and the dynamic moments induced by wind shear on the tower, nacelle and blades,” he adds.

Composite tower sections, however, would be lighter and, therefore, more easily transported. According to Ball, they also could be built on site: “Shipping the raw materials and constructing the towers at the wind farm would save on logistics costs and allow for tower installation in harder-to-reach, more remote terrains.” For offshore installations, where maintenance costs can be extremely high, “composites offer inherent advantages over steel in the harsh saltwater environment,” he adds.

Ashland is currently working with UDRI and a consortium of companies in Ohio, as well as the DeepCwind Consortium of companies and universities spearheaded by the University of Maine’s (UMaine) AEWC Advanced Structures and Composites Center (Orono, Maine), on projects that could open new doors for composite use in wind turbine towers.

A tale of two tower teams

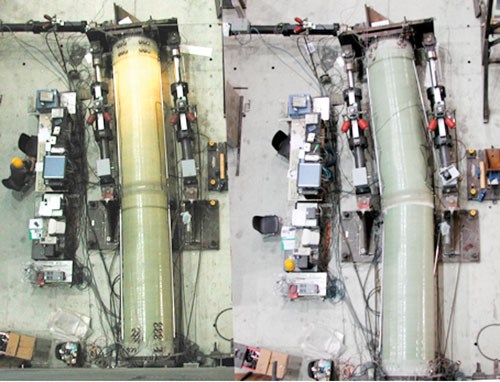

With $1.1 million in Third Frontier funding awarded by the Ohio Department of Development, Ershigs Inc. (Manchester, Ohio) is leading the Ohio consortium. This team plans to design, analyze, build and test a 100m/328-ft tower constructed of glass fiber-reinforced polymer (GFRP). In Maine, the DeepCwind Consortium of companies and universities is designing, prototyping and testing large structural hybrid composite and nanocomposite components for deepwater offshore wind installations.

These organizations aren’t the first to make the attempt (see "A decade of research," by clicking on the title under "Editor's Pick's," at right or "Sidebars" at the end of this article), but previous attempts stalled due to cost. Economics will be the key in current efforts as well. “It is not just the cost of the composite material,” notes UMaine’s Dr. Habib Dagher, director of the university’s AEWC Advanced Structures and Composites Center. “We are looking at the costs of materials, manufacturing, transportation, erection and maintenance.”

“No one is going to buy a composite wind tower simply because it’s composite,” adds URDI’s Rice. “We have to equal or beat the installed costs of a steel tower to be successful.” Rice believes the team approach will help. “It’s not just one company pushing this technology,” he says. Each supplies a key element: Ershigs specializes in large GFRP cylindrical structures and has developed onsite composite manufacturing processes and a proprietary “slip-form” method to eliminate joints/seams in the outer shell of large-diameter structures. WebCore Technologies (Miamisburg, Ohio) will engineer core material for the tower’s shell. Owens Corning (Toledo, Ohio) will provide advanced, high-strength glass fiber. The Edison Materials Technology Center (EMTEC, Dayton, Ohio) will support project management. UDRI will provide design and prototype testing.

In the coming year, tower subelements will be designed and manufactured for testing purposes, says Rice. “There are engineering challenges, but there are no technical breakthroughs needed.”

Although its details are proprietary, the concept likely will involve the delivery of modular, precured GFRP sections to the job site. These will be bonded and, possibly, overwrapped with a composite shell. Resin selection will depend on the requirements of the installation and interplay with the final design, explains Ball. It is likely that several resin types will be evaluated. “Unlike metal, composites can be tailored to provide additional strength exactly where needed,” Ball points out. “While different grades of metal can be used, basically a designer can only modify thickness and section geometry to achieve desired performance. With composites, this can be done by varying characteristics of the reinforcement, core material and resin in any number of ways.”

Making towers more seaworthy

Transportation isn’t a big issue for offshore towers. Sections can be fabricated in waterfront port facilities and barged to installation sites, thus easing transport/erection logistics. Given these advantages, a composite tower design like that envisioned by the Ershigs team could niche into deepwater wind, compelled by several other factors: corrosion resistance, weight reduction and the possibility that active structural-health and wind-condition monitoring systems could be incorporated into the composite structure.

“For stability reasons, topside weight reduction is significantly more critical for floating deepwater turbines than it is for fixed-based offshore or onshore turbines,” explains Dagher. “Topside weight reduction can be achieved by using a lighter turbine, a lighter tower, or even placing the generator and other equipment further down,” he adds.

“For onshore turbines,” Dagher notes, “the tower weight as a percentage of the total weight above ground increases with the size of the turbine.” For example, on turbines of 1.5 MW or greater, the tower can account for 40 to 65 percent of the above-ground weight. “So, reducing the tower weight for a floating turbine by using composite materials is an opportunity,” he suggests, “assuming that the costs can be controlled.”

Ball believes a GFRP tower solution could offer a weight savings of 25 to 30 percent compared to steel. Moreover, a variety of composite designs could be feasible, says Dagher, including concepts similar to those used in blade construction. “A major concern for composite materials vs. steel towers will be achieving stiffness and reducing deflections while keeping costs down,” Dagher maintains, suggesting that in pursuit of stiffness, for example, carbon fiber “is an expensive alternative.”

UMaine is adding a new $30 million offshore wind laboratory to its Advanced Structures and Composites Center. The lab will be able to manufacture and test components of offshore wind turbines and, according to Dagher, it will use advanced composites manufacturing processes for blades, towers and foundations.

Predicting a bright future for composite towers, Ball appeals to wind industry history: “Similar to the evolution of blades from wood to aluminum to fiberglass,” he observes, “it makes sense for towers — large, weight-sensitive structures — to evolve toward composites as well.”

Related Content

Composites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

Read MoreNCC reaches milestone in composite cryogenic hydrogen program

The National Composites Centre is testing composite cryogenic storage tank demonstrators with increasing complexity, to support U.K. transition to the hydrogen economy.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreHexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreRead Next

Developing bonded composite repair for ships, offshore units

Bureau Veritas and industry partners issue guidelines and pave the way for certification via StrengthBond Offshore project.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More

.jpg;maxWidth=300;quality=90)