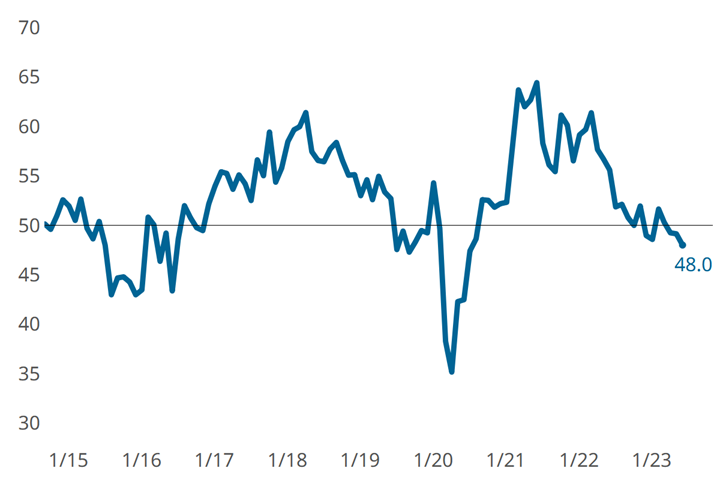

Composites GBI lost a little ground in June

The GBI: Composites has contracted since April, just barely remaining within a two-point range of 50.

Downturned activity. GBI: Composites Fabricating in June is slightly down versus May. Photo Credit, all images: Gardner Intelligence

The June Gardner Business Index (GBI): Composites Fabricating could be worse and it could be better. A reading of 48 is down one point from May, just barely staying within a two-point range around flat, or a reading of 50.

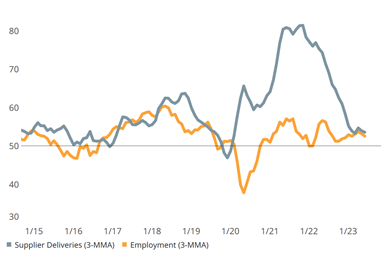

The three closely linked manufacturing GBI components, new orders, production and backlog, contracted faster in June for the second month in a row. Employment and supplier deliveries tracked hand-in-hand in June, both in expansion territory, but even this activity has slowed the past couple of months.

Slowing down. Supplier deliveries and employment remain in expansion, but growth rates have slowed. (This graph is on a three-month moving average.)

Future business, a sentiment/outlook measure included in the survey that is not part of the index calculation, but related to it, sometimes paints a more positive picture than GBI components because of its “look ahead” nature. However, that is not the case for the composites industry at this time, given the future business metric joined supplier deliveries and employment in expanding more slowly in June.

Related Content

-

Composites industry activity meaningfully slowed contraction in March

The GBI: Composites Fabricating still contracted in March, though it landed just one point shy of 50, which could eventually lead it into expansion territory.

-

Composites industry index ends February in growth mode

The GBI: Composites Fabricating closed February at the same level it was in November 2022, right before experiencing a rare two months of contraction.

-

Composites industry gained back some ground in December

The GBI: Composites Fabricating contracted a little more slowly in December, landing between August and September 2023 values.