Composites Index contracts as COVID-19 disrupts economy

March 2020 Index falls to historic low as domestic and foreign orders activity weakens.

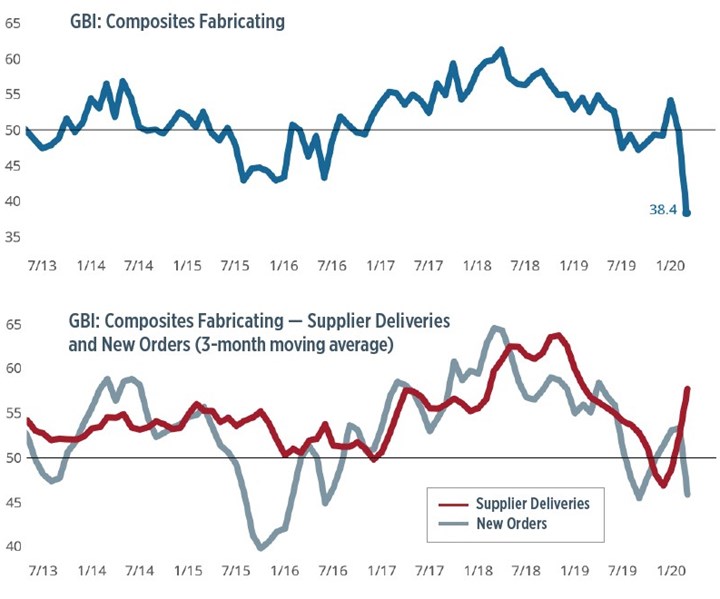

The Index was hard hit in March by the forced closure of much of the world’s economy in order to slow the spread of COVID-19. Activity readings for new orders, exports, production and employment all set record low readings (shown in the top graph). However, the reading for supplier deliveries is designed to increase when supplier deliveries slow, under the assumption that suppliers are experiencing higher backlogs and need longer to get parts to manufacturers. In the current situation, it is COVID-19’s massive disruption to the world’s supply chains that is causing longer delivery times (shown in the red line on the bottom graph).

The Composites Index fell sharply in March to an all-time low of 38.4 as new orders, production, employment and exports all set historic low readings. Data from the second half of 2019 pointed to weakening business activity led by contracting conditions, particularly in the aerospace and automotive markets. Then, towards the end of the first quarter, the world economy began to shut down due to efforts to contain the spread of COVID-19, disrupting supply chains and causing business confidence to sag. It is important to remember that these low index readings represent a decreased level of business activity in March as reported by manufacturers, and are not to be confused with actual rate of decline taking place.

Unlike the other Index components, the March reading for supplier deliveries activity moved significantly higher. In normal times, when demand for upstream goods is high, supply chains cannot keep pace with these orders and the resulting backlog of supplier orders lengthens their delivery times. This delay causes our surveyed firms to report slowing deliveries, and by our survey’s design, elevates the supplier deliveries reading. Global disrupted supply chains, as opposed to strong demand for upstream products, have lengthened supplier delivery times and caused the reading to increase.

The Composites Index is unique in its ability to measure the status of the composites industry on a monthly basis. For this reason, it is one of the industry’s best tools for making data-driven decisions at a time when it is otherwise tempting to make impulsive and emotional decisions. Your participation in the survey enables Gardner Intelligence to accurately back to you, our readers, the impact of COVID-19 on the industry including the virus’ eventual passing and resumption of more normal business conditions. With your help, it is our believe that the Composites Index will provide a first glimpse at that eventual and inevitable rebound.

Related Content

-

Longtime partner New Flyer selects Hexagon Purus to outfit hydrogen transit bus

Hexagon Purus will continue to supply Type IV hydrogen tanks for the Xcelsior Charge H2 fuel cell electric bus, the tanks of which will be produced out of Hexagon’s new Maryland facility.

-

Composites reinvent transportation

Celebrating National Composites Week, CW shares ways in which composites continue to evolve mass transit.

-

Büfa partners with Končar to develop composite electric rail platform

Končar-Električna to use Büfa fire-retardant composite materials for electric vehicle development.

.jpg;width=70;height=70;mode=crop)