Composites industry perpetuates deceleration trend into July

The Composites Fabricating Index continues to experience slowed growth in a majority of its components, inching closer to a reading of “50.”

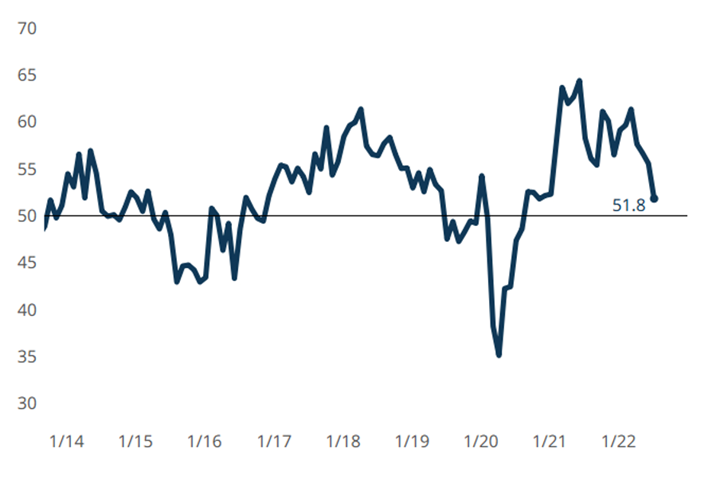

July Index results. GBI: Composites Fabricating showed a fourth month of slowed expansion, on track to a reading of “50” if the course does not change.

The Gardner Business Index (GBI): Composites Fabricating closed July at 51.8, a four-point drop from the previous month. July’s reading conveyed slowed growth for the fourth month in a row, decelerating at a magnitude on par with April’s slowdown.

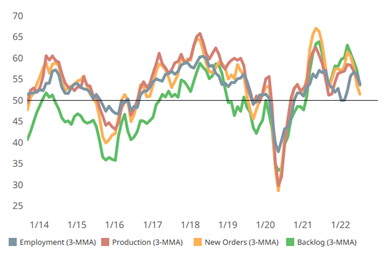

Consistent deceleration. New orders experienced the biggest slowing of expansion again in July, closing in on a reading of “50.” The three components closely linked to new orders also slowed, each landing at nearly the same reading. (This graph plots three-month moving averages.)

All component indices showed slowed rates of growth in July, with new orders registering as the lowest component reading. New orders’ growth slowdown in July puts it lower than it has been in nearly two years, inching closer to a reading of “50,” also known as “flat” or little to no growth. Backlog, production and employment also decelerated, with July indices practically landing on top of each other. Supplier deliveries are still lengthening at a continually slowing rate, though exports continue to contract at an accelerating rate.

Related Content

-

Composites activity returned with accelerated contraction in September

The GBI: Composites contracted faster again in September, closing down 1.6 points to 45.9, the lowest the index has been in more than 2 years.

-

Composites industry gained back some ground in December

The GBI: Composites Fabricating contracted a little more slowly in December, landing between August and September 2023 values.

-

Composites GBI remains relatively unchanged in May

The GBI: Composites closed May at the same reading reported in April, with some minor fluctuations in component activity.