Composites industry heads into slightly accelerated contraction in November

The GBI: Composites Fabricating in November continued its general slow-going path of contraction that began in April 2023.

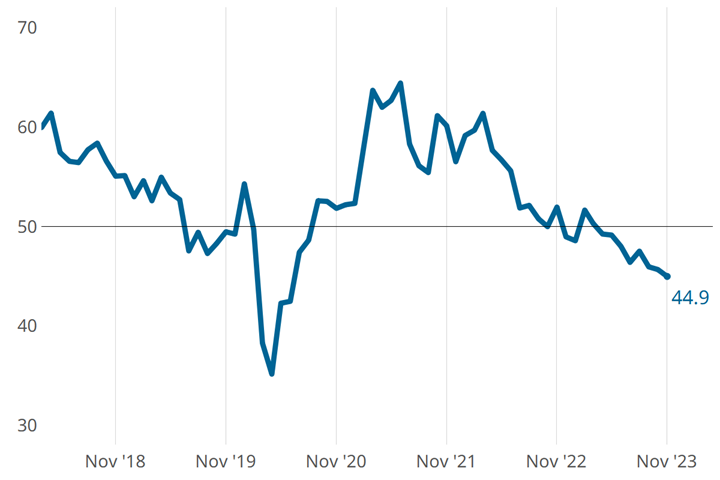

Taking a step back. GBI: Composites Fabricating in November was down 0.7 points relative to October. Photo Credit, all images: Gardner Intelligence

The GBI: Composites limped along again in November, experiencing minorly accelerating contraction to about the same degree as October, closing at a reading of 44.9 compared to the previous month’s 45.6. This general slow-going contraction began in April 2023.

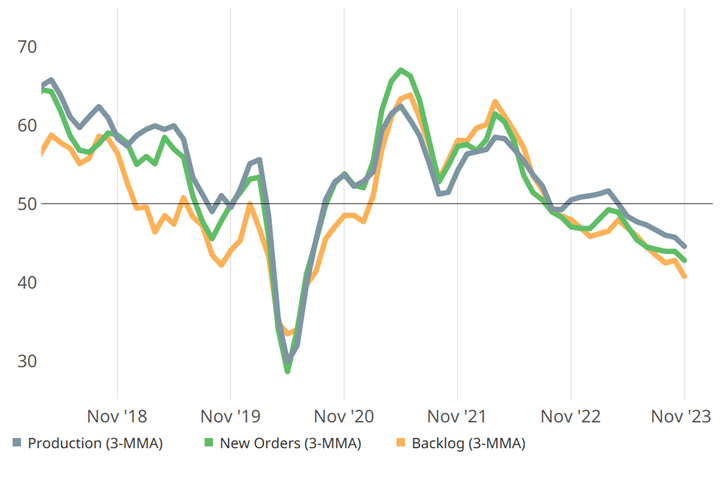

Closely connected composites fabricating components — production, new orders and backlog — primarily drove November contraction. Exports marched along its slowly accelerating contraction path while employment contraction slowed a bit, potentially starting a return to a more normative state following the accelerated contraction that emerged in August. Supplier deliveries continued to lengthen, but at a slowing rate that inches it closer to flat every month.

Downward spiral. Production, new orders and backlog components drove November’s accelerated contraction. (This graph is on a three-month moving average.)

Related Content

-

Composites industry gained back some ground in December

The GBI: Composites Fabricating contracted a little more slowly in December, landing between August and September 2023 values.

-

Composites GBI lost a little ground in June

The GBI: Composites has contracted since April, just barely remaining within a two-point range of 50.

-

Composites industry activity meaningfully slowed contraction in March

The GBI: Composites Fabricating still contracted in March, though it landed just one point shy of 50, which could eventually lead it into expansion territory.