Natural fiber composites: Market share, one part at a time

Suppliers and adventurous composites fabricators put the “feel good” aspect in the rearview mirror, winning customers by competing on price and performance.

Natural fiber for a natural challenge: A variety of ski manufacturers offer skis made from Bcomp’s (Fribourg, Switzerland) flax/Banova balsa core, ultralight flax/balsa bCore, and ampliTex flax-yarn fabrics. Flax reportedly offers better damping properties than conventional cores and glass or carbon fibers, translating to a smoother ski-run down challenging big-mountain terrain. The skier pictured here is on bCore-cored glass skis designed for extreme deep-powder skiing. Source | Bcomp

With decades of development work behind it, the natural fibers industry is maturing. Indeed, it appears to be on the verge of leveraging the products’ numerous cost, performance and environmental benefits for big-time technical and potentially high-volume commercial applications.

In the auto industry, for example, natural fibers — hemp, flax and others — are used in combination with polypropylene and other resins. They are especially well suited for door and trunk liners because of their lower cost and lower density (See a case study for a natural fiber composite roof frame for the 2017 Mercedes-Benz E-Class). Glass fibers, for example, have densities in the range of 2.6 g/cm3, but flax fibers have densities of approximately 1.5 g/cm3, yielding a net weight savings of nearly 40%. The cost discount per kilogram of material is also significant — in the range of 20-100%. Lastly, a paper published by S.V. Joshi, et. al. (2003), at Michigan State University (East Lansing, Mich., U.S.), evaluated the lifecycle impacts of the production of glass vs. flax and found overall energy use, as well as emissions for eight of the 10 chemical compounds, to be substantially less for flax. The only blemish: Production of the natural fiber did result in a significantly greater discharge of nitrates and phosphates into water as a result of fertilizer use and agricultural runoff.

Since CW’s coverage of this subject in 2013, development of a critical mass of natural fiber sources, an expanding materials’ knowledge base and wider acceptance of the materials by composite manufacturers have encouraged a number of new bio-fiber suppliers to spring up, offering products that have significantly advanced the technology.

Flax gets a sporting chance

Founded in 2011, Bcomp Ltd. (Fribourg, Switzerland) manufactures a trademarked product line that comprises three main families: 1) a line of non-crimp and low- twist, uni- and bidirectional flax-yarn fabrics, called ampliTex; 2) a flax and Banova balsa wood core material called bCore (supplied by 3A Composites, Benton, KY, US), which Bcomp claims is the lightest core material on the market, designed for sandwich composite construction of skis; and 3) a recently launched, high- damping, flax-yarn 0°/90° “grid” fabric, called ampliTex power-Ribs. All of the fabrics are compatible with epoxy, vinyl ester and thermoplastic resins, and are available dry and prepregged.

“We are the young guns,” claims Patrick Vuagnat, Bcomp’s sports manager, noting that the company sources its flax fiber feedstock through an exclusively European supply chain. The company’s defined mission is designing and producing natural material fabrics that can be processed by widely used means, such as resin transfer molding (RTM), vacuum infusion and compression molding, with no compromise in performance compared to conventionally reinforced composites.

The bulk of the company’s first commercial applications are sports equipment: new ski and snowboard products in which Bcomp’s flax fabrics provide tangible performance benefits. Flax is lighter than glass but, more significantly, compared to carbon/glass (a commonly used layup), flax improves damping properties by as much as 300%. That, says Bcomp, translates to a smoother ride and greater rider control.

As of March 2016, nearly 20 ski manufacturers produced skis using Bcomp cores or fabrics, including Black Diamond, Nordica, K and DPS. That said, skis made with some natural-fiber reinforcement still represent a small percentage of the total ski market. Further, lightweight carbon fiber prepreg, not glass, is the most common material of choice for high-performance skis, but Vuagnat reports that even here, things are changing:

“People realize carbon, despite being light, vibrates too much,” he explains. “Therefore, the carbon/flax hybrid construction is the next step in terms of performance.”

Flax/balsa-cored high-performance carbon fiber composite skis: Bcomp’s primary customers, ski and snowboard manufacturers, use their materials (flax-yarn fabrics and flax/ balsa core materials) to manufacture wet layup, sandwich composite parts with various structures. In 2014, Black Diamond Equipment (Holladay, UT, US) introduced its carbon series of skis, comprising carbon fiber prepreg and Bcore flax/balsa core, a ski line designed for highly technical skiing on steep terrain. Source | Bcomp

It is no coincidence that all of the company’s first commercial end-use applications are skis. Bcomp’s founders are all avid ski enthusiasts. This passion, and serendipity, played roles in the current hybrid-fiber design of high-performance skis manufactured by many of the company’s customers.

In 2003, Cyrille Boinay, currently one of the managing directors, was working out of his garage, trying to build a new type of ski that would handle better in powder-snow conditions. His initial plan was to make the ski entirely from carbon fiber composites, but a chance encounter with two engineering friends, who knew about natural-fiber composites, convinced him to try designing a ski that mixed carbon and flax. The two engineers, Julien Rion and Christian Fischer, are now Bcomp’s director of new product development and co-managing director, respectively.

A typical ski construction involving Bcomp fabrics comprises a bCore sandwiched between layers of glass or carbon fiber fabric (triaxial 450 g/m2 is one fabric type often specified) on the bottom with a top layer of ampliTex shear-web, comprising ±45° flax fibers. Some ski manufacturers use only the company’s core material, with glass or carbon reinforcement in faceskins. The most common method is wet layup by hand followed by compression molding.

Bcomp’s flax feedstock is processed by standard methods (retting, scutching, hackling) used to extract fibers for the clothing industry, resulting in a fiber approximately 30 cm in length and 40 microns in diameter. Although the snowboard is its largest market, Bcomp also has commercial products in the surfboard, skateboard and hockey-stick segments, and is engaged in developmental efforts to expand into other markets. Its new powerRib fabric is manufactured using precise fiber placement methods in order to maximize flexural rigidity and buckling resistance. Vuagnat reports it is targeted to applications such as kayaks and bicycle frames and auto body panels.

The company has introduced two ampliTex fabrics, combining glass fiber and low-twist flax yarns, especially for surfboards: a 120 g/m2 unidirectional and a 200 g/m2 balanced satin weave. Marketed as ampliTex Surf, both are bleached, yielding a white fabric that makes the boards easier to decorate/finish and less likely to absorb the sun’s heat energy and melt board wax. Vuagnat reports that Bcomp also is in the early stages of developing some new fabrics for a US-based skateboard manufacturer.

BComp has also supplied flax fiber for a zero-emissions eCargo bike developed by British manufacturer Electric Assisted Vehicles Ltd. (EAV).

Engineering nature to need

Although it hasn’t captured as much press attention as other natural fibers, bamboo is not only abundantly available but its mechanically extracted, low-density fibers also come with features unique among bio-based reinforcements: Its mechanical properties, particularly modulus and tensile strength, are superior to other bio-fibers. Further, because bamboo is cultivated in a tropical mono-climate with little seasonal variation, its properties show much greater consistency than those of other natural fibers.

Designer-friendly fiber reinforcements: In addition to better damping properties than carbon fiber, natural fibers also are more easily and less expensively colored than glass fibers, making them attractive for highly decorated products such as snowboards, surfboards and skis. Pictured here are dyed bamboo fibers. Source | Sunstrand

A consortium that includes Bangalore, India-based Spectrus, its U.S. partner, Innovium LLC (Dublin, Ohio, U.S.), and strongly supportive European and Asian customers, is in the advanced stages of developmental work, intended to capitalize on bamboo’s properties.

Developmentally complete, the consortium’s fiber-processing method converts bamboo chips into a variety of forms and fiber lengths: powder for resin additive/fillers, short-fiber (2-5 mm) reinforcements for injection molding applications and long fibers (6-12 mm) that are used for long-fiber pellets and semi-finished mats for press moldings. The company says it is very close to using these products to manufacture a variety of automotive and commercial vehicle parts for “leading global firms.” Presently, the parts are anticipated mainly for semi-structural interior applications, such as door and seat-back panels, parcel trays and floor panels. In these test and prototype applications, bamboo fibers have significantly reduced weight and damped noise and vibration, and done so better than other natural fibers at a lower part cost. Although natural fibers are usually produced in lengths no greater than 100-120 mm, bamboo can yield continuous fiber filaments, which can be processed into yarns, fabrics and preforms similar to those manufactured with glass and carbon fiber.

These fiber forms can then be mass produced into thermoset parts via injection molding, resin transfer molding (RTM) and high-pressure compression RTM (HP-C-RTM), also known as gap injection or wet compression molding. Kylee Guenther, owner and operations manager of Innovium, reports, “We are very close to bringing continuous-fiber bamboo composites technology into the automotive industry, as well as mass transportation and other industries.”

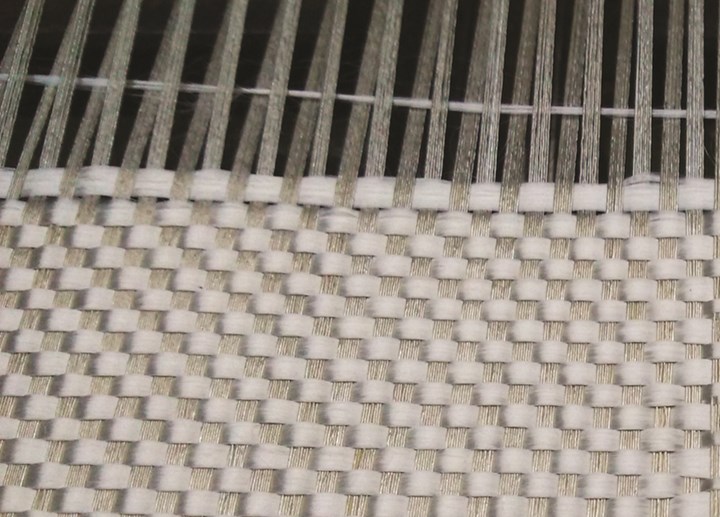

Continuous-fiber woven natural fabrics: Unlike other natural fibers, bamboo can yield continuous filaments that can be processed into yarns and fabrics, much like glass and carbon fibers. Pictured here is a woven bamboo mat fabric. Such fabrics can be infused with thermosets or thermoplastics in relatively high-volume processes, such as resin transfer molding (RTM) or HP-C-RTM. Spectrus (Bangalore, India) and US partner Innovium (Dublin, OH) intend to capitalize on this and other properties of bamboo fiber for composite parts targeted to the automotive and transportation industries. Source | Innovium

“It has taken years of intensive development to reach this phase and, we believe, to set another key milestone in the composites industry,” says Spectrus CEO Mahadev Chikkanna. He reports that Spectrus is still working on further improving and fully commercializing a complete bamboo product line, ranging from powder to fabrics.

One critical need yet to be addressed in the commercialization effort is optimizing the bond between bamboo fiber and matrix resin (see “Sizing up natural fibers” at the end of the article). Mahadev predicts end products with properties somewhere between glass and carbon composites, with lower costs and potential weight savings up to 50%.

Another consortium working to create bio-sourced, bamboo long fiber-reinforced matrix composites aims to launch its first prototype components by 2021.

Stocking raw feedstock for reinforcements: Sunstrand (Louisville, KY, US) claims to be the only US-based supplier of natural fibers and fillers to use and exclusively distribute domestic feedstock. Bales of flax, kenaf, bamboo, cane and other plant materials are delivered directly to its Kentucky facility. Source | Sunstrand

Taking a slightly different tack in the natural fibers arena, Sunstrand (Louisville, KY, US) services the nonwovens market with short and long fibers made from a variety of natural fibers, including hemp, flax, kenaf and bamboo. The company also custom manufactures chopped strand mat (CSM), which is made with randomly oriented fibers. The mat fibers are held together with a resin-specific binder (that is, one with a formulation identical to or compatible with the matrix resin, so it won’t interfere with resin/ fiber bonding) or fiber lignin itself (lignin in liquid form, derived from the same plant asthe fiber) used as a binder. Supplied in rolls, the mats can be used as single-reinforcement material, or in combination with multiple layers of woven or unidirectional fabrics in wet layup and infusion processes. Dr. Trey Riddle, Sunstrand CEO, says long fibers, typically 38-115 mm, are also compatible with sheet molding compound (SMC), using either a thermoset or thermoplastic resin, to produce a formable sheet. Riddle reports that the long-fiber mats have an aesthetic, translucent quality that customers find ideal for architectural applications.

In addition to supplying the nonwovens industry, Sunstrand also processes and sells bulk raw fibers to a variety of customers, including materials suppliers (e.g., injection and bulk molding compounders and fabricators), who use or sell the products to manufacture a variety of composite end-use parts. The company also sells fillers and additives made from natural sources — the reason the company bills itself as a bio-materials supplier rather than a bio-fibers supplier. Its bio-particulate fillers are made from bamboo and hurd, the inner, woody core of hemp, kenaf and flax plants, and range from 5 up to several hundred microns in length. The fillers are in the same price range as existing conventional products (talc, for example), but offer potential weight-savings opportunities, and in some cases can impart performance enhancements, such as improved impact strength.

Although other US-based companies supply bio-materials that have been grown in and then imported from other countries, Sunstrand uses an exclusively domestic feedstock and, Riddle claims, is currently the only US manufacturer of bio-materials for the composites industry to do so. The company has contracts with farmers to purchase agricultural feedstocks in raw format. Bales of hemp, flax and kenaf and, in the case of bamboo, complete canes, are delivered directly to its processing facility.

“We use our own, in-house processing technologies to extract the natural fibers and convert them to forms compatible with composites,” Riddle says. While variability is always a concern with natural materials, Riddle reports they are able to minimize the effects of variation by means of blending and strict quality-control procedures, producing products with properties that can be quantified within statistical limits. With such measures in place, Riddle says, “We have seen minimal variation in the composite response when manufactured from our materials.”

Natural is not equal

Lighter than glass, with competitive specific stiffness and strength,

Processing variation out, consistency in: A variety of in-house processing technologies are used at Sunstrand to cut, separate and extract the fibers and convert raw plant materials into forms compatible with composites. Source | Sunstrand

natural fibers also are less abrasive than glass, which prolongs tool life, and are easier and less expensive to dye than glass, providing fabricators with an aesthetic perk for end-use customers. Further, all natural fibers are essentially complex linear structures formed from ligno-cellulose polymers. However, despite the similarity, differences in the chemistries and functional groups that comprise the polymers dictate differences in mechanical, performance and processing properties. “Every natural fiber has differences in the ratio of lignin, cellulose, hemi-cellulose, etc.,” says Riddle. These nuances play a critical role in determining which fiber or fiber system is best for a given application. And knowledge of these differences helps engineers understand and optimize the performance of the fibers in the final composite part.

Within a composite matrix, the natural fiber is not typically a single fiber, but a fiber bundle that comprises multiple fiber chains held together by lignin. Riddle says this structure almost resembles and behaves like “a composite within a composite.” The different fiber extraction processes used by fiber suppliers also can contribute to variation. For example, hemp, flax, jute and kenaf, a group collectively termed bast fibers, all have similar fiber structures and, therefore, process similarly; but bamboo and agave fibers have unique fiber-bundle morphologies that require the use of dramatically different extraction processes. A typical hemp fiber bundle has a diameter of 70 to 80 microns. A bamboo fiber bundle can be up to 180 microns in diameter, or larger. These structural differences, in turn, determine mechanical properties. Riddle notes that kenaf might have a tensile strength of around 200 MPa vs. 500 MPa for bamboo. “In general, bast fibers do really well in nonwovens, but bamboo can outperform them in short-fiber compounding applications,” Riddle contends.

All of this fiber chemistry has some practical consequences. Although natural fibers, for the most part, are less expensive than glass fibers, when they are used to replace glass reinforcement, Riddle cautions, the replacement ratio might not be one-to-one. In other words, raw natural fibers might cost less per kilogram than raw glass fibers, but a composites fabricator might need more natural fibers in a particular application to achieve equivalent performance. The potential cost savings against glass, then, is application-dependent. Another limiting factor, he says, is that bio-materials generally have lower processing temperature limits than glass and may not be suitable as a replacement for glass in matrices that must be processed at very high temperatures.

Expanding the fiber palette

Fiber variation is minimized by blending and quality-control procedures, yielding a product which, when manufactured into composite parts, provides consistent mechanical properties. Source | Sunstrand

Germany-based Frimo Inc., a manufacturer of complete production-line machinery and tooling, recently introduced a new forming technology, Organo Sheet Injection (OSI), which combines forming and back injection of resin in a single step, with resulting improved efficiency. In one iteration of the process, parts can be molded from a sheet-reinforcing material called Natural Fiber Polypropylene (NFPP), which is a combination of compacted wood fiber/cellulose combined with polypropylene fibers. The material can be back injected with either polyurethane or epoxy. The company’s equipment is employed to make a variety of automotive interior parts from NFPP/polyurethane, such as door liners, which are approximately 50% lighter than the same parts made from glass fiber-reinforced ABS. Composites Evolution Ltd. (Chesterfield, UK) has developed a line of carbon/ flax fiber hybrid materials primarily for the automotive and sporting goods industries. The fabrics, which include hybrid woven yarns and hybrid spread-tow fabrics, are suitable for creating micro-sandwich laminates, which, according to the company, offer modulus equal to all-carbon laminates, but at reduced cost, lower weight and with increased damping properties. The hybrid yarns, targeted to automotive noise/vibration/harshness (NVH) applications, can be used to create one- or two-layer laminates in which the carbon and flax are “tuned” to work synergistically to damp vibration. The hybrid spread-tow fabrics are manufactured with a high degree of fiber alignment and low crimp. Brendon Weager, technical director, says a number of sports equipment companies are considering the tow fabrics in the design of new skis, snowboards and hockey sticks.

A natural progression

The performance and cost benefits of natural fibers are proving to be a powerful combination. Given the successes that have accumulated over the past decade, it’s a combination almost certain to attract wider attention and new development work aimed at better quantifying properties and qualifying the reinforcements for a wider range of composites applications.

Related Content

KCARBON and KIST develop lyocell/PLA/wood biocomposites

Initial demonstration in furniture shows properties two to nine times higher than plywood, OOA molding for uniquely shaped components.

Read MoreSuper Resin Inc. highlights plant-based epoxy resin, foam core

Eco-friendly resin system using glycol lignin offers an eco-friendly option for CFRP structures and components, and core materials.

Read MoreBiDebA project supports bio-based adhesives development for composites

Five European project partners are to engineer novel bio-based adhesives, derived from renewable resources, to facilitate composites debonding, circularity in transportation markets.

Read MoreDuplicor biocomposite cladding aids redevelopment of ABN AMRO office building in Amsterdam

Chosen for low CO2 footprint, RC value >9, fire resistance, light weight and high strength, Duplicor façade structures are key to two-story extension.

Read MoreRead Next

Natural fiber enables e-bike for package delivery

New parcel delivery vehicle concept employs a natural fiber prepreg for low weight, vibration dampening, non-conductivity and flame retardancy.

Read MoreNatural fiber composites: What’s holding them back?

Natural fiber reinforcements have been available for some time, but factors such as compatibility with current processes and geographic availability continue to limit widespread use.

Read MoreConsortium works to develop biosourced composites from bamboo fiber

The BAMCO collaborative project aims to develop new biocomposites created from long bamboo fibres.

Read More