Small wind gets big

Massive growth, complex blade designs reopen challenging market in wind energy niche.

Because today’s commercial wind industry landscape is overshadowed by multimegawatt, utility-scale wind turbines with rotor diameters as large as 126m/413 ft, it is easy to forget that wind energy was pioneered by builders of small wind turbines (SWTs). But “small wind,” the marketing moniker for the very low end of the wind turbine size scale, never went away. In fact, SWTs — with a rated capacity of 100 kW or less and rotor diameters under 63 ft/19m — are making a strong comeback.

How strong? Here’s some interesting anecdotal evidence: In the U.S., for residents of California, Hawaii and North Carolina, Bergey 10-kW wind turbines are now available at Lowe’s home improvement centers. And at stores in the Ace Hardware chain, do-it-yourselfers can order the WindTronics WT6500, a compact, 185-lb/84 kg rooftop turbine.

Although it might be unrealistic to think in terms of a turbine on every roof, there is convincing statistical evidence that SWTs will play a key role in how countries will meet their goals for renewable energy and reduced fossil fuel dependence by target years that range from 2015 to 2030. As the small wind market expands, the implications for the composites industry could be big.

How big is big?

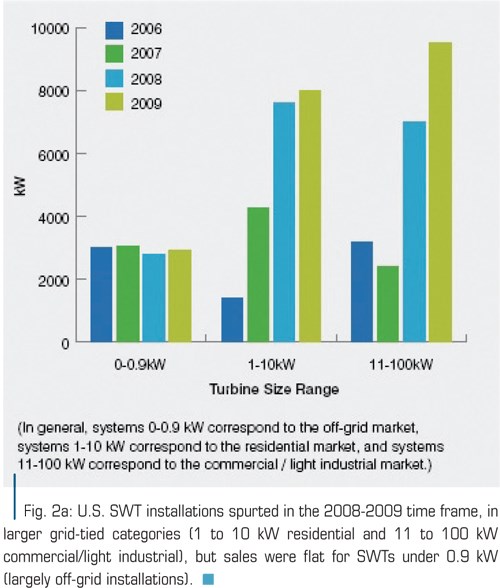

The often-cited report by the American Wind Energy Assn. (AWEA, Washington, D.C.), AWEA Small Wind Turbine Global Market Study, issued a clarion call for SWTs as a serious market. Of the total 100,000-MW of SWT capacity established thus far in the U.S. wind market’s 80-year history, half of that capacity was installed in the three-year period from 2007 to 2009. AWEA reports that in 2009, the recession notwithstanding, 9,800 SWTs were sold in the U.S. — a 15 percent jump from 2008, with approximately 11,200 sold in the rest of the world.

However, Nick Blitterswyk, CEO and cofounder of SWT manufacturer Urban Green Energy (UGE, New York, N.Y.), believes AWEA’s figure for overseas sales was grossly underestimated. “China alone produced 100,000 small wind turbines in 2010,” he claims. “The actual global market was probably closer to 150,000 units.” Blitterswyk is in a position to know. His two cofounders are Chinese citizens who enabled UGE to own a factory in Beijing and, with the help of its local sales office, to make China one of its largest markets, projected to contribute roughly half of the company’s sales by 2013.

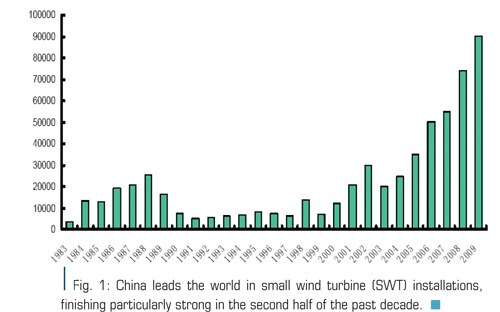

Professor Shen Dechang, of the Chinese Wind Energy Equipment Assn. (CWEEA, Beijing), presented figures for yearly SWT production in China from 1983 to 2009 at the Second World Summit on Small Wind Turbines (March 2011, Husum, Germany). He reported production levels of approximately 75,000 units in 2008 and 90,000 units in 2009 (see Fig. 1, at right). He also noted that 120,000 turbines have been exported from China between 2005 and 2009, with many 5-kW, 10-kW and 20-kW Chinese SWTs installed in the U.S. and a smaller number of 5-kW and 20-kW units delivered to Europe. Dechang estimated the cumulative total of small wind installations in China at more than 400,000 units. AWEA listed the cumulative SWT installations in the U.S. at roughly 100,000 units (see year/size breakdown in Fig. 2a, at right).

China’s sizable SWT production was reported early on by the REN21 global energy policy network (Paris, France) in its Renewables Global Status Report 2009 Update as “80,000 turbines (80 MW) in 2008.” REN21 agrees, roughly, with CWEEA’s estimate of China’s cumulative SWT installations (400,000) in its 2010 global status report, but it claims that 50,000 new Chinese units were produced in 2009, as opposed to Dechang’s claim of 90,000 units.

However, CWEEA’s larger production volumes are supported by Jacken Zheng, CEO of Beijing-based ATKEPP International Consulting Ltd., which cosponsored the China International Forum on Small Wind Turbines (CSWT 2011) held February 2011 in Beijing. ATKEPP is compiling a comprehensive database of Chinese SWTs as a reference for foreign buyers, and Zheng is a partner in a vertical-axis wind turbine (VAWT) project initiated by Beihang University. ATKEPP and Zheng, therefore, have studied the SWT market thoroughly. He states that in 2010, 40 percent of the 100,000 Chinese-made SWTs were exported. Dechang noted 80 SWT manufacturers in China — with five having an annual production capacity of more than 5,000 kW and 15 exceeding 1,000 kW annually — while Zheng counted 108 manufacturers, “34 of which are major ones.”

Despite widely accepted reports in the West that the U.S. comprises half of the global SWT market, it might actually account for a smaller fraction of a much larger global volume, with China being the overwhelming leader in production, sales and installations. In any case, UGE’s Blitterswyk speaks for most observers when he says, “The two biggest markets for small wind are China and the U.S.”

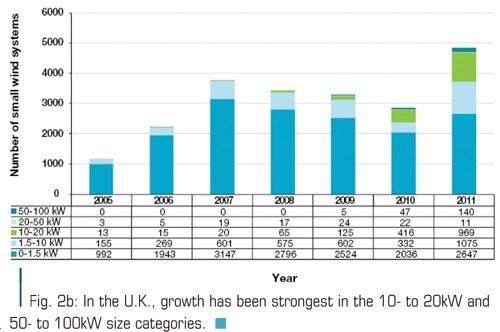

Apart from China and the U.S., the available evidence indicates that the number three small-wind market is the U.K. RenewableUK’s (London, U.K.) April 2011 Small Wind Systems UK Market Report says the U.K.’s SWT market is driven by the government’s legally binding commitment to produce 15 percent of its energy from renewables by 2020. The U.K. feed-in tariff (FIT) is aimed to help achieve this by paying up to 41.3 pence per kilowatt hour (p/kW-hr), to those who own renewable electricity systems for every kilowatt-hour they generate, plus an additional 3 p/kW-hr when surplus power is exported to the grid. This stimulus is on top of the inherent benefit of reducing purchased electricity at the typical 12 to 15 p/kW-hr retail rate via a consumer’s own renewable energy efforts.

“The feed-in tariff introduced in April has increased demand,” says Steve McMahon, director of sales and marketing for Proven Energy (Glasgow, Scotland, U.K.). “Our units are now being sold mostly to farmers due to a very pragmatic economic driver: they get an annuity for installing wind turbines.”

RenewableUK’s report is one of the most useful SWT market analyses, because it shows the source raw data (which informs “How big are composites?” in the next section), but such detailed surveys for the rest of Europe are not readily available. Paris-based REN21, however, describes “rising interest in Italy, where small turbines are seen as offering ‘made in Italy’ potential.” This was confirmed by SWT manufacturer Ropatec (Bolzano, Italy), which has installed nearly 1,000 VAWTs since 1997. Also, the World Wind Energy Assn. (WWEA, Bonn, Germany) reports that the German Wind Energy Assn. (BWE, Berlin, Germany) launched studies on SWT technical standards and profitability and also presented its new small-wind-turbine database of more than 200 models at the New Energy Husum trade event in March. More detailed data also is needed for growth in Asia apart from China, including India.

In sum, financial, wind and energy experts disagree about the numbers, but they do agree that production of SWTs is poised to skyrocket if consumer demand increases. That will depend significantly on whether government incentives in the U.S. and abroad are extended. Further, fossil-fuel prices must continue their upward trend, and high interest and commitment among private equity investors must stay strong. Conservative projections include 40 to 50 percent annual growth in Chinese domestic sales and 11 to 48 percent annual growth in the U.S., depending on the size and type of installation, with a similar outlook for U.K. sales.

How big are composites?

Given these growth figures, the outlook for composites in SWTs is generally good, but for those who desire more specific data, small wind is a complex and rapidly moving target. Unlike 100-kW and larger turbines (for purposes of this discussion, large wind turbines or LWTs), which are roughly similar in design and operation, SWTs vary significantly in design and can be classified in two broad and distinctly different categories. The first and oldest comprises small, propeller-like horizontal-axis wind turbines (HAWTs), which have two or three rotor blades, like their LWT cousins. The second and more variegated category consists of vertical-axis wind turbines (VAWTs), some of which feature unusual blade configurations.

The distinction is an important one for the composites market. Composites are the material of choice for HAWT blades, but small wind builders who employ VAWT designs use a variety of materials to craft their sometimes complex blade shapes and vanes. Although there are some small units that feature composite blades, many SWT builders prefer, for economy’s sake, steel or aluminum. Yet a recent trend toward larger, grid-connected SWTs could increase the use of composites in VAWTs. (There also is some debate about the relative merits of HAWTs and VAWTs, a discussion summarized in the sidebar titled "HAWTs vs. VAWTs," appended to the end of this story, or click on its title under "Editor's Picks" at top right.) This much is certain: The demand for lower-cost units that nonetheless yield higher power output with greater efficiency is prompting SWT manufacturers to use a variety of composite materials and molding processes that are not viable in LWTs due to scale. As a result, thermoplastic and nano-enhanced composites, and compression molding and pultrusion processes, will likely gain wind energy market share via small-wind applications.

SWT growth: on-grid vs. off-grid

SWTs differ from their larger cousins in one other significant respect. LWTs are almost universally tied to the public power grid. Those not directly owned by utility companies are typically owned by public corporations with contractual obligations to supply power for public use. Small wind differs in that it makes wind power practical for private (individual or collective) ownership and use. Further, owners of small wind systems have the option to plug in or not plug in to the public grid.

As a result, SWTs can be classed as on-grid or off-grid. Owners of on-grid SWTs take advantage of the opportunity to sell power to a utility company, mitigating their power cost or even permitting them to turn a profit. As noted earlier, some governments now require that utilities buy that power at a premium to encourage private investment. On-grid SWTs are more common close to urban areas and more likely to be installed in developed countries. Off-grid systems are typically coupled with batteries that permit storage of generated electricity. Power is used where it is created. Off-grid SWTs, therefore, can provide local solutions to power needs in remote locations and in countries without a developed electrical network. Both on-grid and off-grid SWTs offer attractive features that have spurred public interest.

RenewableUK predicts that off-grid SWTs will retain the major share of the U.K. market. However, both RenewableUK and AWEA note that growth of larger grid-tied SWTs began in 2007-2008 (see Fig. 2b, at right). The average size of a U.K. SWT almost doubled from 2.6 kW in 2009 to 4.9 kW in 2010, thanks to growth in 10- to 20-kW and 50- to 100-kW units. AWEA shows significant growth in the U.S. in the 1- to 10-kW (residential) and 11- to 100-kW (commercial/light industrial) categories, with essentially flat sales in off-grid SWTs with capacities of up to 0.9 kW.

AWEA recognizes the federal investment tax credit (ITC) for expanding the 20-kW and smaller SWT market in the U.S. The ITC allows consumers to take 30 percent of their total SWT system cost as a federal income tax credit. AWEA also points approvingly to local net metering for increasing demand in units of 10 kW and larger. Net metering programs, offered by public utilities or required by law, compensate customers for the energy they produce (thus the popular phrase, “the meter runs backward”), and might include a requirement tht the utilities purchase the excess energy at the retail rate. Southwest Windpower (Flagstaff, Ariz.), cited as the world’s largest small wind turbine producer, sees growth in the residential grid-connected market as the technology becomes more efficient, reliable and easy to use. Even though it recommends at least a half-acre of land and 10 mph/16 kmh average annual wind speed for its HAWTs, it still sees potential for more residential installations.

In China, ATKEPP’s Zheng says that off-grid units comprise 97 percent of the market, with most less than 10 kW, and these units will continue to play a major role. Dechang noted two compelling reasons in his presentation at New Energy Husum: Two-thirds of China’s total area is suitable for small wind, and 2.4 million households (12 million people) still lacked electricity in 2006. This combination has driven widespread use of hybrid small wind/solar photovoltaic (PV) systems. Zheng adds that on-grid applications can have good growth if there is a state subsidy policy for distributed generation (power produced where it is used without transmission lines). Indeed, China’s energy policy has produced its SWT market leadership, a result of the government’s large rural electrification projects, combined with integrated funding programs for renewable energy development. The funding includes vital investment capital for Chinese technology manufacturers. (Read “China invested to become world SWT leader,” under "Editor's Picks"). Dechang sees a trend in China toward increased SWT size, similar to that observed in the U.K. and the U.S. He predicts that China’s dominant 200W and 300W units will soon be overtaken by 500W and 1-kW turbines.

Another factor in the continued global growth of off-grid units is the demand for cheaper and more environmentally friendly alternatives to the diesel generators that power telecommunication installations. Proven Energy’s McMahon explains, “Right now, diesel generators are common, but the freight of the diesel into remote locations outweighs every other economic concern.” In an interview on Jetson Green (www.jetsongreen.com), Miriam Robbins, marketing director for Southwest Windpower, agreed: “The growing cost of diesel is creating a higher demand for wind turbines in applications such as Telecom and rural electrification.” GSMA (London, U.K.), which represents the interests of mobile communications operators worldwide, has established the Green Power for Mobile program to help deploy wind, solar and sustainable bio-fuel power sources in 118,000 new and existing off-grid base stations in developing countries by 2012. An effort to sustainably power cell phone service for the 1.6 billion people currently without electricity, and another 1 billion without reliable access to power, could itself give a significant boost to SWTs. The effect could be especially strong in the next two years because only 10,000 of these base stations were renewably powered in 2010. GSMA also helped launch the Community Power from Mobile initiative in November 2010 to help mobile operators provide excess power generated at local base stations (typically greater than 5 kW) to surrounding off-grid communities. Similar programs are being funded by the World Bank to install SWT-powered pumping systems for irrigation that would then make excess power available to the local off-grid populations. The long-term opportunity for SWTs could be huge if competitive SWT products are available. The 2012 goal of 118,000 units is a portion of the 640,000 off-grid base stations GSMA members plan to build in developing countries in the same time period.

Composites landscape in HAWTs

The majority of small HAWT producers are using fiberglass blades, with some specifying epoxy resin while the rest are using polyester or vinyl ester. Carbon fiber blades are used by less than 20 percent of HAWT manufacturers outside of China, mostly in smaller-sized turbines. Zephyr Corp. (Tokyo, Japan) uses a carbon fiber laminate over foam core to produce extremely light blades (380g/13 oz) for its small yet comparatively powerful Airdolphin units, rated at 1.1 kW with a 1.8m/5.9-ft diameter rotor. Zytech Aerodyne (Zaragoza, Spain) also uses carbon fiber in its 900W Lakota (2.1m/6.9-ft rotor diameter) and 1-kW Long-Bow (2.3m/7.5-ft rotor diameter) turbines, both made in China.

At the other end of the spectrum, Wind Energy Solutions’ (Opmeer, The Netherlands) WES18, an 80-kW turbine, is equipped with two 7.8m/25.6-ft long blades made from glass and carbon fiber-reinforced epoxy. Each blade weighs less than 100 kg/220 lb, but these longer blades provide 30 kW more power than ReDriven Power’s (Iroquois, Ontario, Canada) 50-kW turbine, which uses three 6m/20-ft long infused fiberglass composite blades that each weigh 94.3 kg (208 lb). On the WES18, carbon fiber likely provides needed additional stiffness because the blades are hinged to the hub and flap with variations in wind speed. Gaia-Wind Ltd. (Glasgow, Scotland, U.K.) also uses a two-bladed rotor with a similar length blade (6.5m/21.3 ft) but has a rated output of only 11 kW.

A number of Chinese HAWT manufacturers use carbon fiber composite blades exclusively in turbines rated 700W or less. Models rated 1 kW and larger employ only fiberglass, if composite blades are used at all. Shanghai Ghrepower Green Energy Co. Ltd. (Shanghai, China) is using wood epoxy blades for its 5-, 10-, 50- and 100-kW machines, and four different manufacturers of 300W to 2-kW turbines are using injection molded glass fiber-reinforced polypro-pylene (PP) or nylon.

Proven Energy also employs thermoplastic composites, but its wind turbines are much larger: 2.5 kW, 5.2 kW and 12.1 kW, with rotor diameters of 3.5m/11.5 ft, 5.5m/18 ft and 8.5m/27.9 ft, respectively. Founder Gordon Proven’s previous experience in the automotive industry led him to TWINTEX T PP fabric (OCV Chambéry International, Chambéry, France), made from TWINTEX roving (commingled E-glass and polypropylene filaments). The hollow blades are vacuum-formed in one piece at 200°C/392°F, eliminating the typical bondlines between blade halves that result from other processes. At 18 to 19 kg (40 to 42 lb) for the largest blade, Proven Energy believes the process results in a reasonably lightweight blade with good impact resistance. They do see leading-edge erosion but are working with 3M Performance Materials Div. (St. Paul, Minn.) on an erosion-resistant tape that reduces damage to helicopter blades.

Southwest Windpower recently moved away from hand layup to compression molding, explaining that despite the spike in cost for the matched metal tooling ($600,000 vs. $75,000 for composite tools), the drastic reduction in labor and cycle time results in a finished blade that is 70 percent less expensive. Using mostly chopped fiberglass-reinforced polyester resin, the company mints blades at weights ranging from 400g to 7,300g (0.9 lb to 16 lb) for 3.8-ft to 15.4-ft (1.2m to 4.7m) diameter rotors. This process allows the company to produce a larger blade at the previous cost level. The result is a greater swept area, resulting in greater output with greater efficiency at no additional cost. The soon-to-be-released Skystream 600 turbine, for example, will use three fiberglass composite blades in a 15.4-ft diameter rotor and will increase the swept area by 61 percent over the 12-ft Skystream 3.7, improving power generation by 77 percent and reducing energy cost by 35 percent.

Instead of changing its production process, Eagle Windpower Ltd. (Lahti, Finland) elected to increase blade performance by using an epoxy resin reinforced with carbon nanotubes (CNTs). Hybtonite, developed by Amroy Europe Oy (Herrala, Finland), uses Baytube CNTs from Bayer MaterialScience AG (Leverkusen, Germany). Bayer already helped develop the material with a customer in China that makes 40m to 50m (131 ft to 164 ft) blades. Amroy also worked with blade maker LM Wind Power (Lundeskov, Denmark) from 2002 to 2007 to tailor a resin system for the latter’s 61.5m/202-ft blades. Eagle uses Hybtonite in all of its three-bladed HAWT models: 2 kW (4.4m/14-ft diameter), 5 kW (6.7m/22-ft diameter), 10 kW (9.7m/32-ft diameter) and 20 kW (13.7m/45-ft diameter). The company claims that with Hybtonite the weight of its smallest blade (2.5m/8.2-ft long) is half that of a comparable fiberglass blade. This permits increased surface area and an aerodynamic design that achieves a coefficient of power (Cp) of 0.47 to 0.50, the highest possible with current turbine designs. CNTs also impart electrical conductivity, which might prove useful for lightning strike protection.

VAWTs: Composites or ....

As with HAWTs, the material choice for VAWT blades depends on size and shape; however, composites in VAWTs are by no means a given. Coated steel and aluminum are favored for smaller VAWTs, including the most common design for combined Savonius/Darrieus generators, which tend to use arched sheet-metal ribbons.

Composites get greater use in helical Darrieus turbines, such as the carbon fiber epoxy foils in quietrevolution’s (London, U.K.) qr5 (see “Tidal turbines to mine marine megawatts,” under "Editor's Picks") and the carbon fiber and fiberglass blades for SEaB Energy Ltd.’s (Southampton, U.K.) WindBuster, which uses five elliptical blades, each measuring 6m/20.1 ft in height and less than 300 mm/11.8 inches in width. The company was unwilling to divulge its manufacturing method but did say it explored many processes in its quest for cost-effective production of the patented bent, elliptical foils. COO Nick Sassow comments, “Both the aluminum cross-arms and composite blades make our turbines low maintenance and lightweight for easy installation.”

UGE’s helical Darrieus VAWTs also use an epoxy matrix with a mix of carbon and glass fiber, supplied by Shenyang Zhongheng New Materials Co. Ltd. (Shenyang, Liaoning Province, China) and Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd. (Lianyungang, Jiangsu Province, China). UGE’s Blitterswyk relates, “One of our key features is our blade shape, which is only possible in composites.” UGE designed both the turbines and blades in-house using computational fluid dynamics (CFD). Blades are made by a patent-pending semiautomatic process. The smallest blades used in UGE’s eddyGT 600W model are 6-ft/1.8m long and 12-inches/305-mm wide, and the UGE-4K uses the largest blades, with an 18-ft/5.5m length and 22-inch/559-mm width. Both models are in the midst of durability testing for the Small Wind Certification Council (SWCC, Clifton Park, N.Y.) and should be the first VAWTs to obtain certification by end of this year.

Composites are favored in many straight vertical Darrieus turbines. Because these foils have constant cross-sections, they can be pultruded. Ropatec uses carbon and glass fiber in the 2m/6.5-ft high, 400-mm/15.8-inch wide blades for its 3-kW VAWT. It has moved to pultrusion, using fiberglass in a special form for its 6-kW and 20-kW turbines, the latter employing blades that measure 4.3m/14 ft high by 750 mm/29.5 inches wide.

“Pultrusion affords us the capacity to make about 10 turbines per week,” Ropatec project manager Alessandro Bortolotti emphasizes, noting that foam core is necessary in all models sized 1 kW and larger to avoid deformation due to centrifugal forces and bending moments at the extruded aluminum arm attachments. Bortolotti notes that such concern for structural integrity is critical for safety because VAWTs are often used in urban settings. “The turbines must be tested in high winds and cannot break because it could cause serious personal injury and damage to property in these locations.” To avoid structural damage caused by harmonic frequency vibration, Ropatec offers a vibration sensor, which slows the turbine via a specially developed brake system when vibration exceeds the safe range. Ropatec is certifying its third generation of products to IEC 64100 standards.

Out from the shadows

The world is likely to source SWT components and whole turbines from China in pursuit of lower cost and shorter consumer payback, but composites will have the opportunity — via new turbine designs, manufacturing methods and materials — to boost efficiency and reduce the purchase price and maintenance costs via higher durability and reliability. Renowned SWT expert Trudy Forsyth, project manager at the National Renewable Energy Laboratory (NREL, Golden, Colo.), projected in the 2007 Distributed Wind Market Applications report that 680,000 small wind turbines would be installed by 2020. With 400,000 to 450,000 already in place in China, another 100,000 in the U.S. and expected annual production of 120,000 to 150,000 units worldwide, that goal is well within reach. The question now is the small-wind growth rate in the next few years. That will depend mostly on government and other market incentives and, to a lesser extent, on increased competition among developing SWT technologies. This is a market poised for substantial expansion, and composites are well positioned to be a major contributor.

Owens Corning Composite Solutions Business

Editor's Note: Savonius and Darrieus turbine types are described, respectively, at http://en.wikipedia.org/wiki/Savonius_wind_turbine and http://en.wikipedia.org/wiki/Darrieus_wind_turbine.

Related Content

Pultrusion, pull-winding showcase high-volume composites production

JEC World 2024: Exel Composites offers attendees a chance to engage with company experts and learn more about continuous composite manufacturing processes across various industries.

Read MoreBiocomposite for mobile architecture, low load-bearing applications

The German Institutes of Textile and Fiber Research and partners have developed a biocomposite well suited for support profiles and connecting nodes in construction applications.

Read MorePulFlex introduces pultruded Flex Connect

Fiberglass T-slot, primarily used for automation, framing and other quick setup systems, competes with aluminum alternatives.

Read MorePultruded CFRP chassis enables 36% payload increase for specialized commercial vehicles

CarbonTT’s quadraxial NCF composite chassis adds 185-kilogram capacity to Borco Höhns’ 3.5-ton Fiat Ducato market vehicle.

Read MoreRead Next

HAWTs vs. VAWTs

Horizontal-axis wind turbines (HAWTs) command the small wind turbine (SWT) market, led by a handful of companies that have been in production for 20 to 30 years, while vertical-axis wind turbine (VAWT) manufacturers, with the exception of Ropatec (Bolzano, Italy), have mostly developed within the past five years.

Read MoreTidal Turbines to Mine Marine Megawatts

Composites help subsea turbines harvest electrical energy from ocean currents.

Read More“Structured air” TPS safeguards composite structures

Powered by an 85% air/15% pure polyimide aerogel, Blueshift’s novel material system protects structures during transient thermal events from -200°C to beyond 2400°C for rockets, battery boxes and more.

Read More